- Home

- »

- Pharmaceuticals

- »

-

Insulin Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Insulin Market Size, Share & Trends Report]()

Insulin Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Rapid-Acting Insulin, Long-Acting Insulin, Combination Insulin, Biosimilar), By Application, By Type, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-951-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Insulin Market Summary

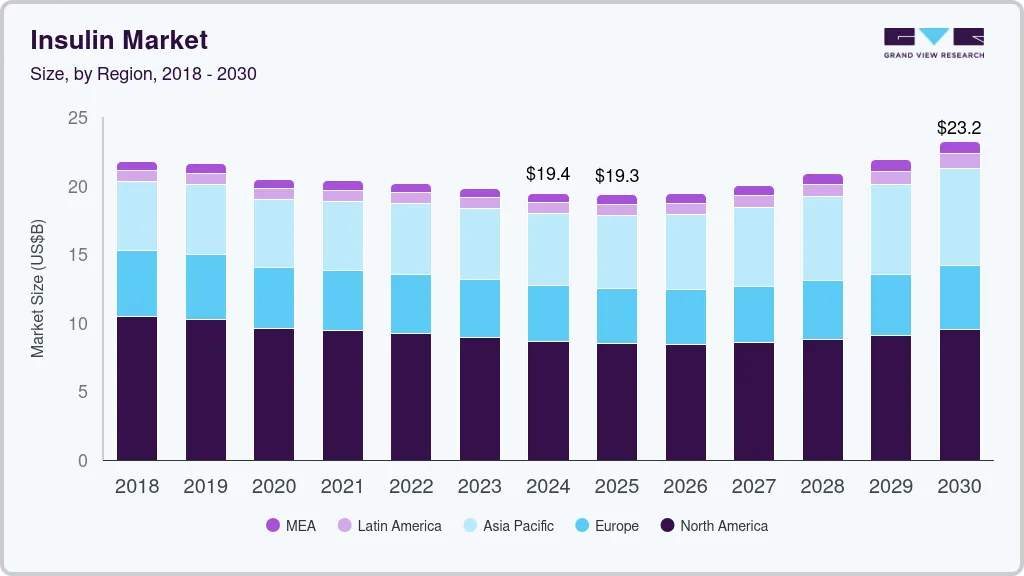

The global insulin market size was estimated at USD 19.32 billion in 2024 and is projected to reach USD 23.21 billion by 2030, growing at a CAGR of 3.7% from 2025 to 2030. Advances in formulations, such as rapid-acting and long-acting, enhance treatment options and patient adherence.

Key Market Trends & Insights

- North America insulin market dominated the overall global market and accounted for the 44.6% revenue share in 2024

- The U.S. insulin market held a significant share of the North American market in 2023.

- By product, the long-acting insulin segment dominated the market and accounted for the largest revenue share of 52.4% in 2024

- By application, the type 1 diabetes mellitus segment dominated the market and accounted for the largest revenue share of 78.8% in 2024

Market Size & Forecast

- 2024 Market Size: USD 19.32 Billion

- 2030 Projected Market Size: USD 23.21 Billion

- CAGR (2025-2030): 3.7%

- North America: Largest market in 2024

The expected commercialization of pipeline drugs and novel insulin combinations, such as once-weekly insulins like Efsitora alfa, Icodec and IcoSema propels the demand. These investigational therapies enhance diabetes management by offering improved glycemic control and reduced injection frequency with more convenient administration options. Their success in Phase 3 trials could lead to new treatment alternatives for diabetic patients.

The rising prevalence of diabetes, particularly type 2, drives demand for insulin therapies, expanding the market. Increased awareness, early diagnosis, and the need for lifelong treatment create a sustained need for various formulations and delivery systems. The International Diabetes Federation (IDF) highlights the growing global burden of the disease, with approximately 540 million adults aged 20-79 currently living with the condition. By 2045, this number is projected to rise to 783 million, accounting for 10.5% of the adult population. Over 90% of these individuals have type 2, driven by factors such as urbanization, aging populations, decreased physical activity, and rising obesity rates. Three-quarters of adults with diabetes reside in low- and middle-income countries, and 240 million remain undiagnosed. The IDF emphasizes the importance of preventive measures, early diagnosis, and proper care to mitigate disease complications. The IDF Diabetes Atlas serves as a key resource, providing vital statistics on diabetes prevalence, mortality, and healthcare costs globally, aiming to improve lives and prevent diabetes in at-risk populations.

The rising prevalence of obesity and related conditions like type 2 drives demand for products, fueling market growth as more individuals require effective diabetes management and treatment solutions. In 2022, 1 in 8 people globally were living with obesity, with adult obesity more than doubling since 1990. Approximately 2.5 billion adults were overweight, and 890 million lived with obesity. Childhood obesity is also rising, with 37 million children under 5 and 390 million aged 5-19 classified as overweight. Obesity results from an energy imbalance and is influenced by environmental, psychosocial, and genetic factors. It increases the risk of type 2, cardiovascular disease, and certain cancers, impacting quality of life. Preventive measures include promoting healthy diets and physical activity, with a focus on multisectoral actions to create supportive environments and enhance health systems to manage obesity effectively.

The study titled "Advances in Nanomedicine for Precision Insulin Delivery" published in July 2024 in the journal Pharmaceuticals. The article examines the advancements in nanomedicine aimed at improving delivery systems, focusing on enhancing drug stability, bioavailability, and precision targeting for disease management. Diabetes mellitus is a metabolic disorder characterized by improper glucose utilization and excessive production, leading to hyperglycemia. Its global prevalence is projected to rise to 783.2 million by 2045. Insulin therapy is essential for type 1 diabetes due to β-cell dysfunction, with intensive insulin regimens reducing microvascular complications but increasing the risk of severe hypoglycemia. Innovations in delivery, including nanomedicine approaches, enhance drug stability, bioavailability, and targeted delivery, addressing compliance issues. Future developments focus on creating advanced nanocarriers for improved management and patient outcomes. Advancements in nanomedicine for precision delivery enhance drug efficacy, improve patient adherence, and reduce complications, driving market growth by meeting increasing demand for effective management solutions.

Product Insights

The long-acting insulin segment dominated the market and accounted for the largest revenue share of 52.4% in 2024 due to its crucial role in managing diabetes. These products provide stable and prolonged glucose control, reducing the risk of hypoglycemia and enhancing patient adherence. The growing prevalence of Type 2, combined with an increasing preference for convenient dosing regimens, drives demand for long-acting formulations. Innovations in long-acting insulin products, including improved formulations that offer better pharmacokinetics and ease of use, further bolster this segment. As healthcare providers prioritize effective and reliable diabetes management, long-acting insulin continues to capture a substantial market share.

The biosimilar insulin segment is projected to expand at a lucrative CAGR during the forecast period, driven by increasing demand for cost-effective management solutions. As healthcare systems seek to reduce expenses, biosimilars offer a more affordable alternative to branded insulins while maintaining similar efficacy and safety profiles. The growing prevalence of diabetes, alongside the patent expirations of several major products, is facilitating the entry of biosimilars into the market. Additionally, supportive regulatory frameworks and increased awareness among healthcare providers and patients about biosimilars are expected to fuel this segment's growth, enhancing accessibility to therapies.

Application Insights

The type 1 diabetes mellitus segment dominated the market and accounted for the largest revenue share of 78.8% in 2024, driven by the rising incidence of this autoimmune condition among children and adults. As Type 1 requires lifelong therapy for blood glucose management, the demand for various formulations, including rapid-acting, long-acting, and combination insulins, continues to grow. Advances in delivery systems, such as pumps and pens, further support this segment's expansion. Increased awareness of diabetes management and improvements in healthcare access are also contributing to the rising adoption of these therapies among individuals with Type 1, solidifying its position as the largest application segment.

The Type 2 Diabetes Mellitus segment is projected to be the fastest-growing application area in the market, driven by the rising prevalence of this metabolic disorder globally. Factors contributing to this growth include increasing obesity rates, sedentary lifestyles, and an aging population. Unlike Type 1 diabetes, Type 2 can often be managed with lifestyle changes initially, but many patients eventually require these therapies. The growing awareness of diabetes management and advancements in formulations and delivery systems are expected to fuel demand. Additionally, government initiatives promoting education and treatment accessibility will further support the expansion of this segment.

Type Insights

The analog insulin segment dominated the market and accounted for the largest revenue share of 87.3% in 2024 due to its advantages over human insulin. Analog insulins, including rapid-acting and long-acting formulations, offer improved glycemic control and flexibility in managing blood sugar levels. Their pharmacokinetic profiles enable patients to tailor insulin administration around meal times, reducing the risk of hypoglycemia and enhancing overall treatment adherence. With the rising prevalence of diabetes and increasing patient awareness of effective management, the demand for analog is expected to grow. Additionally, ongoing innovations in formulation and delivery technologies are likely further to propel this segment's dominance in the market.

The human insulin segment is expected to experience the highest growth rate in the market due to several factors. As awareness of diabetes management increases, more patients and healthcare providers recognize the efficacy and affordability of human insulin. This segment is particularly appealing in emerging markets where cost constraints are significant. Additionally, introducing more convenient delivery methods, such as prefilled pens and pumps, enhances patient adherence. These elements combined are likely to drive a robust growth trajectory for the segment during the forecast period, catering to the rising demand for effective treatments.

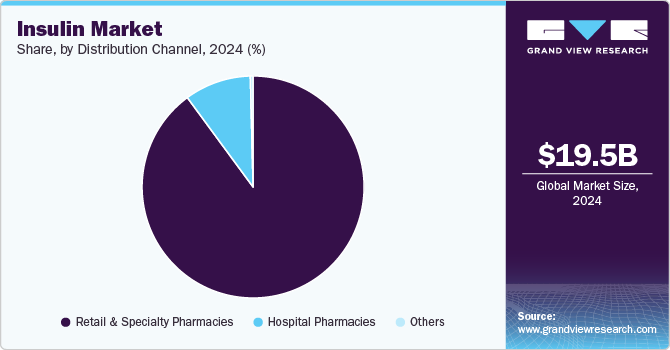

Distribution Channel Insights

The retail pharmacy segment dominated the market and accounted for the largest revenue share of 90.0% in 2024. This dominance is attributed to the widespread accessibility of products through retail channels, making it convenient for patients to obtain their medications. Retail pharmacies often offer a range of types, including rapid-acting, long-acting, and biosimilar options, catering to diverse patient needs. Furthermore, initiatives to improve affordability and awareness of diabetes management have led to increased foot traffic in retail pharmacies, solidifying their role as a primary source for insulin therapy among individuals with diabetes.

The others segment, encompassing online pharmacies, is anticipated to experience the fastest growth during the forecast period. The increasing adoption of e-commerce and telehealth services has made such products more accessible to patients who prefer the convenience of online shopping. This segment benefits from a growing trend of patients seeking affordable and discreet options for their diabetes management. Additionally, online pharmacies often provide competitive pricing, home delivery services, and extensive product offerings, further driving their popularity and growth in the market.

Regional Insights

North America insulin market dominated the overall global market and accounted for the 44.6% revenue share in 2024 due to several key factors. High prevalence rates of dry eye syndrome, driven by aging populations and increased screen time, contribute significantly to market growth. The region benefits from advanced healthcare infrastructure, which supports the rapid adoption of innovative treatments and advanced diagnostic tools. Additionally, the strong market presence of leading pharmaceutical companies and a high rate of consumer awareness further boost market expansion.

U.S. Insulin Market Trends

The U.S. insulin market held a significant share of the North American market in 2023 due to a high incidence of diabetes, particularly Type 2 diabetes, coupled with increasing demand for advanced therapies such as rapid-acting and long-acting insulin. The presence of leading pharmaceutical companies, extensive research, and innovation in analogs and biosimilars further strengthened the market. Additionally, favorable reimbursement policies, strong healthcare infrastructure, and the growing adoption of combination products contributed to the market’s growth.

Europe Insulin Market Trends

The insulin market in Europe is experiencing notable growth due to increasing awareness of diabetes management and the rising prevalence of both Type 1 and Type 2 diabetes. Enhanced healthcare infrastructure demand for advanced therapies such as long-acting and rapid-acting insulin. The market also benefits from the growing adoption of biosimilars, which offer cost-effective alternatives. Favourable reimbursement policies and a strong focus on innovation, particularly in delivery systems, contribute to this growth. Major distribution channels include hospitals, retail pharmacies, and other healthcare providers, ensuring widespread access.

The UK insulin market is a major player in the Europe region due to its well-established healthcare system, widespread diabetes screening programs, and strong government support for diabetes management. The National Health Service (NHS) provides broad access to both human insulin and insulin analogs, contributing to increased demand. Additionally, adopting biosimilar products, combined with favorable reimbursement structures, enhances affordability and accessibility.

Insulin market in Germany hold a significant market share due to its advanced healthcare infrastructure and increasing prevalence of diabetes, especially Type 2 diabetes. Strong government initiatives to promote diabetes awareness and early diagnosis have boosted the demand for rapid-acting and long-acting products. Germany’s focus on research and development in biosimilar and innovative delivery systems such as pens has further driven market growth.

Asia Pacific Insulin Market Trends

The Asia-Pacific insulin market is rapidly expanding, driven by rising diabetes prevalence across populous countries like India and China. Growing healthcare awareness, improving healthcare infrastructure, and increasing adoption of analogs are key drivers in the region. Many countries in Asia-Pacific are also focusing on cost-effective biosimilar options, making treatments more affordable. Additionally, increasing urbanization and sedentary lifestyles further fuel the regional demand for therapies.

China’s insulin market is experiencing significant growth due to the country’s large diabetic population, particularly those with Type 2 diabetes. Government health initiatives to improve diabetes care and a strong focus on expanding healthcare access in both urban and rural areas are key market drivers. The adoption of biosimilar has increased, making therapies more affordable. China also benefits from substantial investment in R&D and the local production, reducing import dependency.

Insulin market in Japan is well-established, with a high rate of diabetes awareness and management, especially for Type 1. The country’s aging population and high prevalence of diabetes-related complications have driven demand for advanced therapies, including long-acting and rapid-acting . Japan is also a leader in adopting innovative delivery systems, such as pumps and continuous glucose monitors.

Brazil Insulin Market Trends

The Brazil insulin market is expanding due to the rising prevalence of diabetes, particularly Type 2 diabetes, driven by lifestyle changes and increasing obesity rates. Government initiatives aimed at improving diabetes management, including distributing free insulin through public health programs, contribute to market growth. Brazil is also seeing a shift toward insulin analogs and biosimilars, providing more treatment options for patients.

MEA Insulin Market Trends

The MEA insulin market is growing steadily, fuelled by a rising incidence of diabetes, particularly in urban areas with increasing rates of obesity and sedentary lifestyles. Governments across the region are investing in diabetes awareness and management programs, leading to greater demand for insulin, including both human insulin and analogs.

Saudi Arabia insulin market is a major player in the region due to its high prevalence of diabetes and strong government efforts to address the growing health issue. The country has invested in improving diabetes care and expanding access to both human insulin and insulin analogs. Additionally, the adoption of advanced delivery systems and biosimilar has been on the rise, making treatment more accessible and affordable.

Key Insulin Company Insights

The competitive landscape of the insulin market is dominated by major global players such as Novo Nordisk, Sanofi, and Eli Lilly, who led in product innovation and market share. These companies continuously invest in research and development, focusing on next-generation therapies, such as biosimilars and analogs, to meet the growing demand. Emerging players in regions like Asia-Pacific are increasingly gaining traction by offering cost-effective biosimilar products, intensifying competition. Strategic partnerships, mergers, and acquisitions are common as companies aim to expand their product portfolios and global reach.

Additionally, advancements in delivery systems further intensify the competition within the market. Many companies opting for geographical expansion, strategic collaborations, and partnerships in emerging and economically favorable regions through mergers and acquisitions. For instance, in February 2022, Biocon announced the acquisition of Viatris’ biosimilar portfolio for USD 3.335 billion. This acquisition strengthened Biocon’s biosimilar product portfolio and improved its revenue generation.

Key Insulin Companies:

The following are the leading companies in the insulin market. These companies collectively hold the largest market share and dictate industry trends.

- Novo Nordisk A/S

- Eli Lilly and Company

- Sanofi

- Biocon Ltd

- Wockhardt

- Boehringer Ingelheim International GmbH

- Julphar

- United Laboratories International Holdings Limited

- Tonghua Dongbao Pharmaceutical Co. Ltd.

Recent Developments

-

In January 2024, Novo Nordisk concluded the COMBINE 3 phase 3a trial, evaluating IcoSema, a combination of basal insulin icodec and semaglutide administered once weekly. The study found that IcoSema effectively reduced HbA1c levels and was comparable to daily insulin glargine U100 and insulin aspart. The treatment also resulted in significant weight reduction and fewer hypoglycemia incidents. This suggests IcoSema could streamline diabetes management by replacing daily injections with a single weekly dose. Additional findings from the broader COMBINE program are expected later in the year.

-

In September 2023, Novo Nordisk partnered to boost human insulin production in South Africa, to provide affordable insulin throughout Africa. The initiative aims to reach 4.1 million individuals with Type 1 and Type 2 diabetes by 2026. This effort aligns with the African Union's Pharmaceutical Manufacturing Plan, addressing the rising need for diabetes care across a continent where 24 million adults are living with the condition. Through the iCARE program, insulin will be distributed to health authorities at a cost of USD 3 per vial, focusing on increasing local production, distribution, and equitable access to treatment.

-

In March 2023, Eli Lilly announced a 70% reduction in prices for its most commonly prescribed insulins and capped out-of-pocket costs for patients at USD 35 per month. Effective May 1, 2023, the list price of Insulin Lispro will be USD 25 per vial. These measures aim to improve insulin accessibility for people with diabetes amid rising costs in the healthcare system.

Insulin Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.32 billion

Revenue forecast in 2030

USD 23.21 billion

Growth rate

CAGR of 3.7% from 2025 to 2030

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Eli Lilly and Company; Sanofi; Novo Nordisk A/S; Biocon; Boehringer Ingelheim; Tonghua Dongbao Pharmaceutical Co. Ltd; Wockhardt; Julphar; United Laboratories International Holdings Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Insulin Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global insulin market report based on product, application, type, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Rapid-Acting Insulin

-

Long-Acting Insulin

-

Combination Insulin

-

Biosimilar

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Human Insulin

-

Insulin Analog

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Type 1 Diabetes Mellitus

-

Type 2 Diabetes Mellitus

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global insulin market size was valued at USD 19.45 billion in 2024 and is anticipated to reach USD 19.32 billion in 2025.

b. The global insulin market is expected to witness a compound annual growth rate of 3.74% from 2025 to 2030 to reach USD 23.21 billion by 2030.

b. Based on product type, the long-acting insulin segment accounted for a share of 52.36% in 2024 due to high prescription rate owing the longer duration of effect and lesser amount of injections required.

b. Some of the key players in the insulin market are Novo Nordisk A/S; Eli Lilly and Company; Sanofi; Biocon Ltd; Wockhardt; Boehringer Ingelheim International GmbH; Julphar; United Laboratories International Holdings Limited; and Tonghua Dongbao Pharmaceutical Co. Ltd.

b. The major factors driving market growth are the rising prevalence of diabetes, rising geriatric and obese population base, and advancements in insulin delivery.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.