- Home

- »

- Next Generation Technologies

- »

-

Insurtech Market Size, Industry Report, 2023-2030GVR Report cover

![Insurtech Market Size, Share & Trends Report]()

Insurtech Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Auto, Business, Health, Home, Specialty, Travel), By Service (Consulting, Support & Maintenance, Managed Services), By Technology, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-093-4

- Number of Report Pages: 161

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Insurtech Market Summary

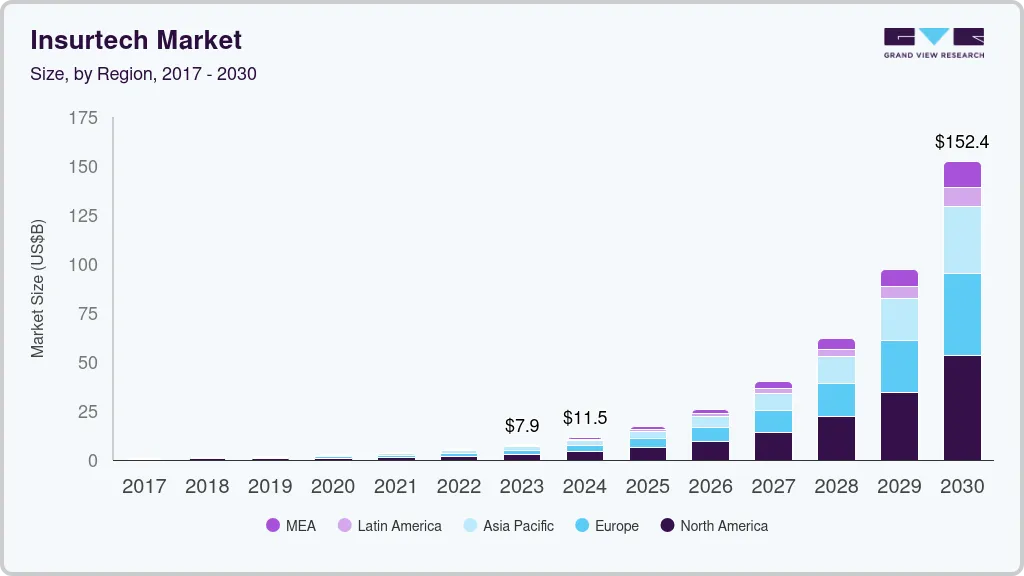

The global insurtech market size was estimated at USD 5.45 billion in 2022 and is projected to reach USD 152.43 billion by 2030, growing at a CAGR of 52.7% from 2023 to 2030. The increasing number of insurance claims worldwide is one of the major factors accentuating the market growth.

Key Market Trends & Insights

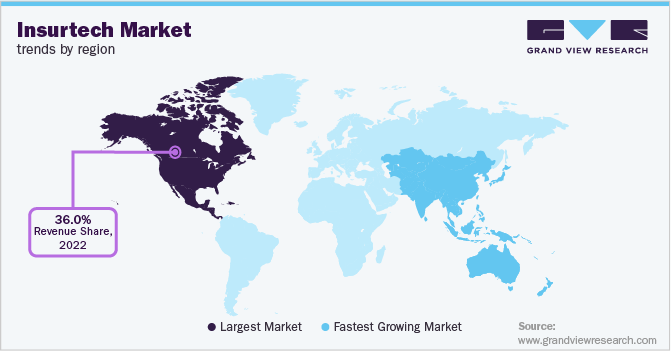

- North America dominated the market for insurtech in 2022 and accounted for more than a 36.0% share of the global revenue.

- By type, the health segment dominated the market in 2022 and accounted for more than 24.0% share of the global revenue.

- By service, the managed services segment held the leading revenue share of more than 42.0% in 2022.

- By technology, the cloud computing segment led the market with a revenue share of over 24.0% in 2022.

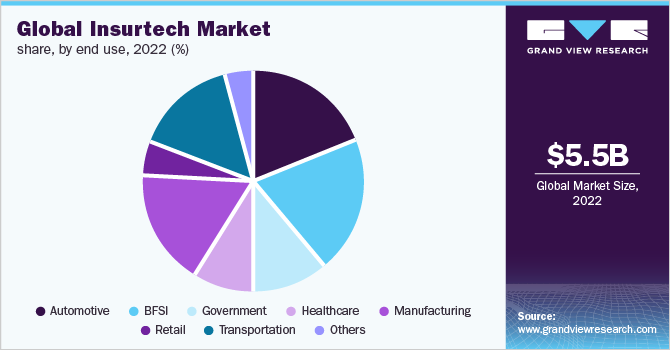

- By end-use, the BFSI segment dominated the market and accounted for more than 20.0% share of the global revenue in 2022.

Market Size & Forecast

- 2022 Market Size: USD 5.45 Billion

- 2030 Projected Market Size: USD 152.43 Billion

- CAGR (2023-2030): 52.7%

- North America: Largest market in 2022

Auto, life, and home are the most common insurance claims secured by people worldwide. According to a 2021 study by the Insurance Barometer, 36% of American respondents planned to purchase life insurance in 2021. Insurance companies are increasingly investing in digital technologies to reduce operational costs and to improve operational efficiency and the entire customer experience.

Digital technologies are used to understand customer needs and to enhance their offerings based on the changing customer needs. According to a survey conducted by EIS Group, a software company, 59% of the insurance companies surveyed increased their investment in digital infrastructure in 2021. Benefits offered by blockchain technology, such as cost savings, faster payments, and fraud mitigation, are driving its demand among insurance companies worldwide. Blockchain technology is used in insurance companies for applications such as Know Your Customer (KYC), Anti-money Laundering (AML) procedures, claim handling, and creating peer-to-peer models.

Several insurtech companies are entering into partnerships with insurance companies to offer blockchain technology-based solutions. For instance, in December 2020, Amodo, an insurtech company, announced its partnership with Galileo Platforms Limited, a technology company. Through this partnership, the companies would use blockchain technologies to help insurance companies offer new insurance solutions and transform their customer experience. Insurance companies are increasingly accepting cryptocurrency-based payments. For instance, in December 2021, Metromile, an auto insurance company, announced its plan to allow policyholders to pay premiums and claim payments using cryptocurrency. This initiative is expected to help the company strengthen its market position.

Additionally, in June 2021, Universal Fire & Casualty Insurance Company focused on offering traditional property and casualty insurance to small businesses started accepting cryptocurrency for premium payments. This trend is expected to favor the growth of the insurtech market. The demand for on-demand insurance is growing among consumers as it enables them to purchase insurance coverage on their smartphones at their convenience. Businesses in the on-demand insurance space are increasingly using innovative technologies such as the internet of things, artificial intelligence, big data, and predictive maintenance to reinvent the way on-demand insurance products are underwritten, created, and distributed.

COVID-19 Impact Analysis

The COVID-19 pandemic is anticipated to have a positive impact on market growth in 2022. Numerous insurance companies are reconsidering their long-term strategies and short-term needs as the COVID-19 and its impacts have accelerated the implementation of online platforms and new mobile applications to meet consumer needs. Several insurance companies are entering into partnerships with digital solution providers to enhance their offerings. For instance, in December 2021, Duck Creek Technologies, a core system provider for Property and Casualty (P&C) insurers, announced that SECURA Insurance, a P&C insurance carrier, selected Duck Creek Rating, Claims, Policy, and Insights to streamline its P&C business.

Type Insights

The health segment dominated the market in 2022 and accounted for more than 24.0% share of the global revenue. The increasing demand for digital platforms, which connect exchanges, brokers, providers, and carriers in health insurance, is anticipated to fuel the demand for the health segment. Life and health insurers are focusing on using advanced analytics to better serve and understand their customers. Numerous health insurance companies are adopting insurtech solutions to streamline claims processing procedures. Insurers are also focusing on combining their health insurance services with mobility features for added convenience.

The home segment is anticipated to register the highest growth over the forecast period. Numerous home insurance companies are seeking to create innovative products for commercial and residential real estate professionals and their respective tenants and residents. These companies are adopting insurtech solutions for faster list-to-lease time. These solutions use AI technology to create and deliver personalized insurance policies and efficiently handle claims for customers without needing insurance brokers. For instance, in June 2021, Farmers Insurance integrated Zesty.ai’s wildfire risk scoring model into its homeowner insurance underwriting processes. Through this partnership, the former company aims to adopt an innovative approach for managing its wildfire exposure by evaluating individual wildfire risks to homeowners.

Service Insights

The managed services segment held the leading revenue share of more than 42.0% in 2022. Managed services providers can provide insurers a measured gateway to transformation by incorporating expertise and talent with new technologies. Managed services providers also offer best processes, practices, and regulatory considerations to insurers. At the same time, managed services enable insurers to address challenges and opportunities in insurance IT and operations. Insurers have started acknowledging and embracing the value of improved business models, thereby creating growth opportunities for the managed services segment.

The support and maintenance segment is anticipated to register the highest growth over the forecast period. The growth of the support and maintenance segment can be attributed to the increasing adoption of advanced technologies and distribution channels by insurance companies. Numerous insurance companies across the globe are focusing on deploying advanced technology and customizing legacy software products to specific needs. This is expected to drive the demand for support and maintenance services across the globe.

Technology Insights

The cloud computing segment led the market with a revenue share of over 24.0% in 2022. Cloud computing has transformed the insurance industry with its resourcefulness, ease of deployment, and flexibility. Widespread acceptance of Bring Your Own Device (BYOD) policies, coupled with the growing amount of data insurance companies collect, is expected to drive the growth. Insurance companies are adopting cloud computing solutions owing to benefits, such as rapid deployment, cost-effectiveness, and scalability.

At the same time, partnerships between cloud computing solution providers and insurance companies are helping companies to enhance their insurtech products, which is expected to drive market growth. For instance, in November 2021, Amazon Web Services Inc. announced that American International Group, Inc., an insurance company, has selected it as a preferred public cloud provider. Through this initiative, American International Group aims to deliver better services to its customers.

The blockchain segment is anticipated to register the highest growth over the forecast period. Blockchain technology enables insurance companies to cut down on operational costs and drive operational efficiencies. This technology can be used to drive growth, integrate varied insurtech platforms, and enable new services to come to market, particularly for those who could not access insurance previously. Insurtech companies are expected to aggressively opt for blockchain technology owing to its features such as smart contracts, advanced automation, and strong cybersecurity.

End-use Insights

The BFSI segment dominated the market and accounted for more than 20.0% share of the global revenue in 2022.BFSI businesses are widely adopting insurtech solutions for improving business efficiency. The increase in the number of connected devices in the BFSI sector is leading to the generation of a huge amount of data. Moreover, insurance companies have realized that they can use such data to deliver better services, optimize costs, gain insights, and boost revenues. At the same time, the growing penetration of smartphones worldwide is also expected to drive the demand for insurtech solutions across the BFSI sector.

The healthcare segment is expected to register the fastest growth over the forecast period. The rising digitization in the insurance sector is expected to drive the adoption of insurtech solutions in the healthcare industry. The growing number of devices has created a need for effective monitoring, management, and maintenance of data across healthcare organizations. The growing digitization among customers has amplified the demand for easier and better access to insurance technology services. Furthermore, the rise in the use of blockchain-based technology among health and life insurance companies is also expected to drive the segment growth.

Regional Insights

North America dominated the market for insurtech in 2022 and accounted for more than a 36.0% share of the global revenue. The region is witnessing an increased adoption of insurtech solutions owing to the increasing spending of customers for insurance-related products. Moreover, these solutions offer customizable and flexible plans for property and health insurance. The growing number of insurtech startups across the region is also driving the market growth in the region.

Asia Pacific is anticipated to emerge as the fastest-growing regional market over the forecast period. The region is expected to witness significant growth due to the presence of numerous emerging economies and financial hubs in Singapore, India, and Hong Kong. Insurance service providers in the region are aiming to offer affordable insurance premium plans. The growing penetration of smartphones across Asia Pacific countries is also expected to drive the growth of the regional market.

Key Companies & Market Share Insights

The market is highly fragmented and is characterized by the presence of a large number of small players, which cater to the requirements of life- and non-life insurance sectors. Market players are focused on strategies such as partnerships to help them strengthen their market positions. For instance, in November 2021, Heritage Insurance Holdings Inc., a property and casualty insurance company, announced its partnership with Slide, an insurtech P&C carrier. Through this partnership, the former company would leverage Slide’s capabilities to improve underwriting and rating decisions.

A variety of regulations have curbed vendors’ ability to experiment in the market. However, high competition has given them no particular reason to do so. Advancements in the field of data communication and the rising adoption of digitization have enabled market players to build global supply chains. The capability of the insurtech businesses to drive innovation in the insurance industry by developing new products and solutions could help insurance firms meet dynamic customer requirements. Some of the prominent players operating in the global insurtech market are:

-

Damco Group

-

DXC Technology Company

-

Insurance Technology Services

-

Majesco

-

Oscar Insurance

-

Quantemplate

-

Shift Technology

-

TrÅv, Inc.

-

Wipro Limited

-

ZhongAn Insurance

Insurtech Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.87 billion

Revenue forecast in 2030

USD 152.43 billion

Growth rate

CAGR of 52.7% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, service, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; China; India; Japan; Brazil

Key companies profiled

Damco Group; DXC Technology Company; Insurance Technology Services; Majesco; Oscar Insurance; Quantemplate; Shift Technology; TrÅv, Inc.; Wipro Limited; ZhongAnInsurance

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Insurtech Market SegmentationThe report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global insurtech market report based on type, service, technology, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Auto

-

Business

-

Health

-

Home

-

Specialty

-

Travel

-

Others

-

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

Consulting

-

Support & Maintenance

-

Managed Services

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Blockchain

-

Cloud Computing

-

IoT

-

Machine Learning

-

Robo Advisory

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

BFSI

-

Government

-

Healthcare

-

Manufacturing

-

Retail

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global insurtech market size was estimated at USD 5.45 billion in 2022 and is expected to reach USD 7.87 billion in 2023.

b. The global insurtech market is expected to grow at a compound annual growth rate of 52.7% from 2023 to 2030 to reach USD 152.43 billion by 2030.

b. North America dominated the insurtech market with a share of 36.65% in 2022. This is attributable to the rising demand for end-to-end digital financial solutions and the significant presence of technology providers.

b. Some key players operating in the insurtech market include Damco Group; DXC Technology Company; Majesco; Oscar Insurance; Quantemplate; Shift Technology; Trōv, Inc.; Wipro Limited; and Zhongan Insurance.

b. Key factors that are driving the insurtech market growth include the growing adoption of predictive analytics and the increasing shift toward cloud computing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.