Intent-based Networking Market Size, Share, & Trends Analysis Report By Component, By Function, By Deployment, By Enterprise Size, By Vertical, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-113-8

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global intent-based networking market size was valued at USD 1.66 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 24.1% from 2023 to 2030. The primary driver contributing to the growth of the market is the transition from traditional network security and management modes to a more modern approach to network configuration and management. Automation in network operations leads to enhanced performance and scalability. Intent-based networking incorporates technologies such as network automation software. Moreover, routine functions across the network can be automated using machine learning, artificial intelligence, and network orchestration.

The telecommunications industry is undergoing a major transformation with emerging trends such as 5G. While it brings a great opportunity for telecommunication companies to win new customers, they must differentiate from the competition and adapt to changing customer needs. Telecommunication operators can use the policy-driven approach and automation capabilities of intent-based networking to expedite the configuration and deployment of network services. Automation using intent-based networking can also help reduce service activation time from days to minutes. Moreover, the ability of intent-based networking to dynamically adjust the network based on intent ensures seamless network operations and reduced downtime.

Using cloud computing to make data centers more intelligent and secure further drives the adoption of intent-based networking. Intent-based networks enable end-to-end automation using algorithms. It allows for scalability at a lower cost and is vital for large-scale telecommunication and data center operations. As companies seek to overcome traditional network operational limitations, market growth is expected to surge over the forecast period.

Furthermore, intent-based networking can help improve the overall IT enterprise. Intent-based networking architecture is guided by a high-level business policy defined by the network administrator. The software automatically identifies the best resources to implement the business policy across the network. Using intent-based networking thus eliminates the need for manual intervention, except for authorization purposes.

While intent-based networking offers numerous advantages, its implementation is burdened by several challenges. Adopting intent-based networking results in a significant shift in skill sets. IT personnel may need to learn new technologies, understand policy-driven networking concepts, and be proficient in managing and troubleshooting intent-based networking. To overcome these challenges, companies provide adequate training and upskilling opportunities to maximize the benefits of intent-based networking.

COVID-19 Impact Analysis

The COVID-19 pandemic resulted in a sudden shift to remote work and increased reliance on digital operations during the pandemic. Organizations faced a surge in network traffic and changing usage patterns. Several companies were taken aback and reacted to the situation over time by enhancing technology for core operations. Intent-based networking's agility and automation capabilities would have been advantageous in quickly adapting to these fluctuations and ensuring a seamless user experience, due to which its adoption is garnering attention to ensure business continuity in unforeseen situations such as the pandemic.

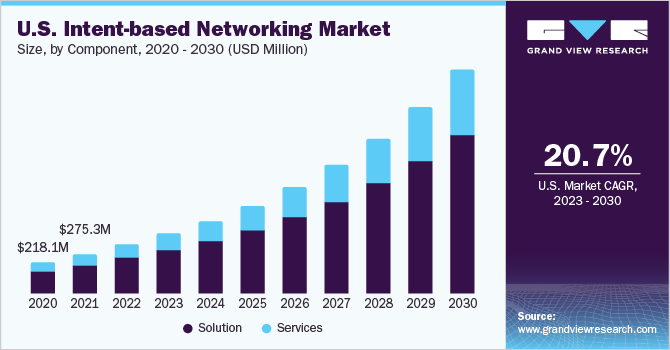

Component Insights

The solution segment dominated the market in 2022 and accounted for a revenue share of more than 72.0%. The growth of intent-based networking solutions can be attributed to the growing use of software-defined networking. Intent-based networking enhances the capabilities of software-defined networking by autonomously running and monitoring network performance. Moreover, it helps build a controller-led network to translate business objectives into policies across various domains.

The services segment is anticipated to register significant growth over the forecast period. Consulting services offered by intent-based networking companies help understand an organization's unique requirements, business goals, and existing network infrastructure. Intent-based networking providers also assist with designing and configuring intent-based networking solutions tailored to the organization's needs. Thus, the need for integration and deployment services will witness significant growth over the forecast period.

Function Insights

The network automation & analytics segment dominated the market in 2022 and accounted for a revenue share over 42.0%. The segment’s growth can be attributed to the increasing adoption of intent-based networking to align network functions with overall business goals and improve operational efficiency. Moreover, automation helps reduce complexity in operations by bringing about consistency across the network and eliminating the need for each device to be configured to the network for smooth operations. Moreover, leveraging artificial intelligence and machine learning, intent-based networking software provides real-time analytics and troubleshooting, thus reducing downtime.

The workflow integration segment is anticipated to grow significantly over the forecast period. The rising adoption of technology for streamlining workflows is the primary growth factor. Intent-based networking can automate the workflow of large-scale enterprise networks without compromising efficiency. The software can run either customer-defined or pre-defined workflows, reduce human errors, and lead to cost savings, which is expected to drive growth.

Deployment Insights

The on-premise segment dominated the market for intent-based networking in 2022 and accounted for a revenue share of over 39.0%. On-premise deployment enables companies to retain control over the physical infrastructure and control the frequency and pace of software updates. Moreover, it helps maintain the privacy of critical operations such as aerospace and defense, as operations can be monitored. Familiarity with existing on-premise infrastructure also helps organizations reduce latency and downtime.

The cloud segment is projected to register significant growth from 2023 to 2030. The growth of the cloud segment can be attributed to the rising transition from on-premise to cloud-based deployment. Cloud-based solutions include built-in data backup and disaster recovery capabilities, ensuring that network data remains protected and can be recovered during data loss or disruptions. Moreover, cloud-based intent-based networking can easily scale up or down based on the organization's requirements.

Enterprise Size Insights

The large enterprises segment dominated the market in 2022 and accounted for a revenue share of over 65.0%. By gaining network agility and automation, large enterprises benefit from intent-based networking. With the ability to define intent-based policies aligned with complex business objectives, large enterprises can ensure consistent network performance. Moreover, it helps enhance security and compliance across their extensive and diverse network infrastructures.

The SME segment is anticipated to register significant growth over the forecast period. SMEs can quickly adapt to changing business requirements and scale their networks. The cost-effectiveness of automated solutions provides SMEs with access to advanced networking capabilities without heavy upfront investments. Thus, intent-based networking capabilities are becoming attractive for SMEs to support their business growth and competitiveness.

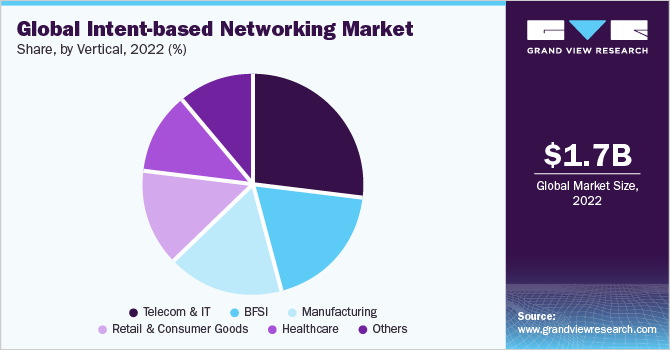

Vertical Insights

The telecom & IT segment dominated the market in 2022 and accounted for a global revenue share of over 26.0%. Intent-based networking enables intelligent traffic steering and bandwidth allocation based on business intent policies. This feature optimizes network performance, ensuring critical services, such as voice and video, receive appropriate prioritization. Furthermore, telecommunication networks handle vast amounts of data, and intent-based networking facilitates real-time analytics to gain insights into network behavior.

The BFSI segment is anticipated to register significant growth over the forecast period. Intent-based networking allows BFSI companies to prioritize core business applications like online banking and transaction systems. Operational efficiency using technology ensures that essential services receive the necessary network resources and deliver an uninterrupted user experience. Intent-based networking also assists in compliance reporting helping BFSI firms navigate the complexities of the financial industry regulatory landscape.

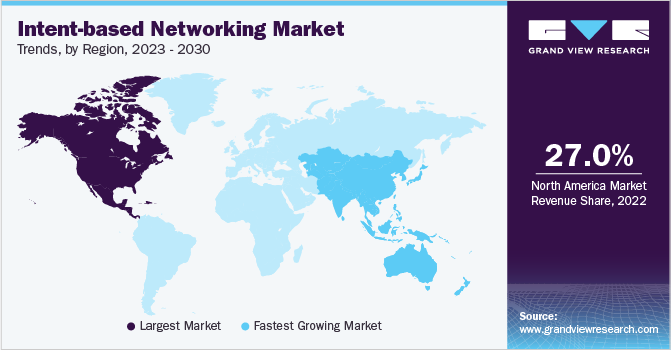

Regional Insights

North America dominated the market for intent-based networking in 2022, accounting for a more than 27.0% revenue share. Intent-based networking is increasingly being incorporated by large enterprises present across the region. Moreover, Software Defined Wide Area Networking (SD-WAN) solutions are becoming increasingly popular in the North American region. Integrating SD-WAN with intent-based networking allows organizations to create more intelligent, secure, and flexible WAN environments.

The Asia Pacific regional market is anticipated to emerge as the fastest-growing market from 2023 to 2030. The Asia Pacific region is witnessing a surge in connected devices and has a rapidly growing population. Telecommunication operators in the region are expanding network infrastructure to meet the increasing connectivity demands of consumers and businesses. Moreover, a push towards digital transformation across industries is leading to the use of technologies such as cloud computing and the Internet of Things which is expected to bode well for the growth of the intent-based networking industry.

Key Companies & Market Share Insights

The intent-based networking market is an emerging market with lucrative growth opportunities. Prominent companies are actively engaging in strategic initiatives to gain a competitive edge. Partnerships and collaborations, mergers and acquisitions, and new product and feature launches are some of the most common strategic initiatives. Moreover, companies also collaborate on pilot projects to test operations on a small scale and drive innovation through shared expertise.

In January 2023, Juniper Networks, Inc. launched a new version of Apstra intent-based networking. The new version would enable companies to leverage Apstra’s automation capabilities to ensure consistent security and network policies across virtual and physical infrastructures. Moreover, Apstra’s new version is characterized by improved analytical and configuration capabilities, supplemented by multivendor support. Some of the prominent players in the global intent-based networking market include:

-

Cisco Systems, Inc.

-

Juniper Networks, Inc.

-

IBM Corporation

-

Hewlett Packard Enterprise

-

Nokia

-

Gluware

-

Forward Networks, Inc.

-

NetBrain Technologies, Inc.

-

ERICSSON GROUP

-

Huawei Technologies Co., Ltd.

Intent-based Networking Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 2.05 billion |

|

Revenue forecast in 2030 |

USD 9.30 billion |

|

Growth rate |

CAGR of 24.1% from 2023 to 2030 |

|

Base year of estimation |

2022 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, function, deployment, enterprise size, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Cisco Systems, Inc.; Juniper Networks, Inc.; IBM Corporation; Hewlett Packard Enterprise; Nokia; Gluware; Forward Networks, Inc.; NetBrain Technologies, Inc.; ERICSSON GROUP; Huawei Technologies Co., Ltd. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Intent-based Networking Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global intent-based networking market report based on component, function, deployment, enterprise size, vertical, and region.

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solution

-

Services

-

-

Function Outlook (Revenue, USD Billion, 2017 - 2030)

-

Network Automation & Analytics

-

Workflow Integration

-

Business Policy Management

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premise

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

SME

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Telecom & IT

-

Retail & Consumer Goods

-

Manufacturing

-

BFSI

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global intent-based networking market size was estimated at USD 1.66 billion in 2022 and is expected to reach USD 2.05 billion in 2023.

b. The global intent-based networking market is expected to grow at a compound annual growth rate of 24.1% from 2023 to 2030 to reach USD 9.30 billion by 2030.

b. North America dominated the intent-based networking market with a share of 27.03% in 2022. Intent-based networking is increasingly being incorporated by large enterprises present across the region.

b. Some key players operating in the intent-based networking market include Cisco Systems, Inc.; Juniper Networks, Inc.; IBM Corporation; Hewlett Packard Enterprise; Nokia; Gluware; Forward Networks, Inc.; NetBrain Technologies, Inc.; ERICSSON GROUP; Huawei Technologies Co., Ltd.

b. Key factors that are driving the market growth include emerging trends in telecommunications and technological advancements.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."