- Home

- »

- Display Technologies

- »

-

Interactive Tables Market Size & Share, Industry Report, 2030GVR Report cover

![Interactive Tables Market Size, Share & Trends Report]()

Interactive Tables Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (LCD, LED, Capacitive, Others), By Screen Size (32-65 Inch, 65 Inch & Above), By Application (Exhibitions & Trade Shows, Education, Hospitality, Retail), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-188-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Interactive Tables Market Summary

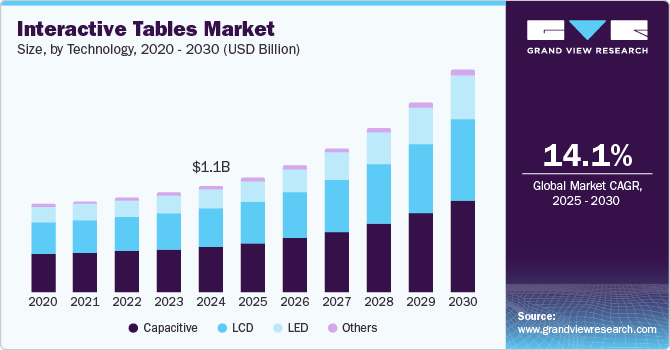

The global interactive tables market size was estimated at USD 1,119.0 million in 2024 and is projected to reach USD 2,341.2 million by 2030, growing at a CAGR of 14.1% from 2025 to 2030. Increasing digitization in the education sector to encourage a more conducive learning environment for students is the primary demand driver for interactive tables worldwide.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, capacitive accounted for a revenue of USD 513.0 million in 2024.

- LED is the most lucrative technology segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1,119.0 Million

- 2030 Projected Market Size: USD 2,341.2 Million

- CAGR (2025-2030): 14.1%

- North America: Largest market in 2024

Continued advancements in touchscreen and multi-touch technologies by display manufacturers have made such solutions more accessible and efficient for end-users. These improvements allow interactions with larger and more responsive screens, making the user experience smoother and more engaging.

Rising awareness regarding product benefits in verticals apart from education has helped companies in the interactive tables industry to boost the visibility and sales of their products. For instance, in the retail sector, interactive tables enable customers to browse products, check prices, and access detailed information without needing assistance from staff. This improves customer satisfaction and can lead to increased sales as well as repeated visits in the future while also freeing up the staff to carry out other important tasks. Furthermore, the technology can display 3D product models and allow customers to virtually try products, such as clothing, accessories, or furniture. This enhances the shopping experience and helps customers make better purchasing decisions. As the competition in the retail industry grows with the entry of new brands and the growing use of online platforms, physical stores have been compelled to use such interactive display technologies to increase customer traffic and drive sales through offline channels.

Interactive tables create engaging and immersive experiences by allowing users to interact actively with content, enhancing their engagement and participation. Their benefits are more visible in team settings, as the technology enables multiple users to interact with the screen simultaneously, making it ideal for group work and collaboration. This is particularly beneficial in classrooms, corporate settings, and creative environments where teamwork is crucial. These tables enable teams to share and manipulate real-time content, helping them brainstorm and collaborate more effectively. Such features are useful for meetings, workshops, and innovation sessions that help boost productivity. Interactive tables that support multi-touch capabilities are becoming more popular as they allow multiple users to interact with the screen simultaneously. Gesture recognition, including pinching, swiping, and rotating, improves the user experience by allowing for more natural and intuitive interactions.

The integration of artificial intelligence (AI) and machine learning technologies further provides notable growth avenues for this market. AI is being used to personalize user experiences on interactive tables. For instance, this technology can analyze user behavior to offer tailored recommendations or adjust content dynamically based on user preferences. This innovation can help transform retail, hospitality, and educational settings. Meanwhile, interactive tables with AI-powered natural language processing (NLP) allow users to interact with the system using voice commands. Users can search for information, request specific services, or ask questions in a conversational manner, which enhances the usability and accessibility of the table. Modern interactive tables are also being designed to be more adaptable and modular, allowing for customizable configurations based on the needs of different spaces and environments. For example, tables can be expanded to accommodate larger teams or split into smaller segments for more personalized discussions.

Screen Size Insights

The 32-65 inch segment accounted for a leading revenue share of 59.2% in the global interactive tables industry in 2024. Compared to video wall touchscreen displays, the smaller size of these displays makes them highly portable, as they can be easily unplugged and moved to different locations. The lower-sized models (32-inch) are widely used in compact workspaces such as personal offices and in the retail segment in the form of digital product catalogs or to display promotional content. Corporate spaces generally deploy higher-end solutions with the largest screen sizes, such as 65-inch models, which are ideal for larger teams or conference settings, where multiple people can interact simultaneously with the screen.

The interactive tables segment with a screen size of 65 inches and above is expected to grow at a substantial CAGR during the forecast period. These solutions are generally used in business settings, public spaces, exhibitions, and educational institutes to provide multiple users with a dynamic and impactful experience. For instance, in exhibitions, trade shows, and events, large interactive tables can be used to display digital signage, interactive product demonstrations, or company information visually compellingly. Attendees can interact with the displays, explore detailed product features, watch videos, and engage with interactive maps or content. Meanwhile, larger tables in public spaces such as airports, shopping malls, museums, and convention centers serve as digital directories or wayfinding tools. Users can search for specific locations, browse venue maps, or get information about the area's events, amenities, and services.

Technology Insights

The capacitive segment accounted for a leading revenue share in the global interactive tables industry in 2024. Capacitive touchscreens are well-known for their accuracy, responsiveness, and ability to simultaneously detect touch input with multiple fingers. These features make them an ideal technology for interactive tables in various use cases such as business meetings, education, retail, public information systems, and entertainment. Capacitive touchscreens are highly sensitive, providing precise touch recognition, which results in smooth and accurate interactions. Moreover, they are generally more durable than other types of touchscreens, as they do not rely on physical pressure, meaning they have fewer moving parts and tend to last longer without degradation in touch sensitivity.

The LED technology segment is anticipated to grow at the highest CAGR during the forecast period in this market. The need to ensure energy savings in display technologies among smaller enterprises and the cost-efficiency of LED-based interactive tables have helped drive segment expansion. Additionally, LED displays are known for their brightness capabilities, ensuring that the interactive table's content is clearly visible even in well-lit environments. This is crucial in public use cases such as malls, airports, museums, and exhibitions, where ambient light can greatly affect screen visibility. These displays are available in various sizes, allowing businesses and institutions to select the appropriate size based on available space and purpose.

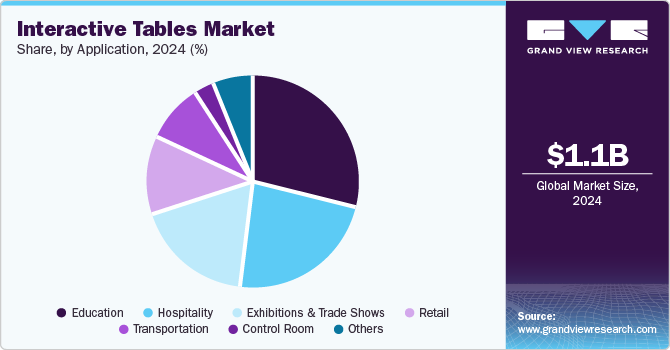

Application Insights

The education segment accounted for the largest revenue share in the global market in 2024 and is expected to maintain its position in the coming years. Interactive tables in educational institutions have become an important part of enhancing the learning experience, encouraging collaboration, and improving student engagement. These tables combine digital displays with touch technology, allowing students and educators to interact with content more proactively. The growing focus on STEM education among leading global institutions has created a high growth scope for this market. Interactive tables provide a platform for students to interact with simulations, especially in STEM subjects. For instance, students can explore 3D models of molecules, interact with geometric shapes in math lessons, or simulate physics experiments to understand complex concepts better. These tables can be leveraged in data science and statistics courses to visualize complex data, enabling better conceptual understanding.

The hospitality segment is anticipated to advance at the fastest CAGR from 2025 to 2030 in the interactive tables industry. These solutions can be used in a variety of ways that enhance customer experience, streamline operations, and improve engagement. Combining interactive digital displays with touch-based technology helps create a dynamic and personalized experience for guests. Interactive tables can be placed in hotel rooms that can serve as a platform for guests to browse menus, place room service orders, request amenities, or book additional services such as spa treatments or housekeeping. Guests can interact with a digital menu, customize their orders, and have their requests delivered without needing to avail themselves of the services of the front desk staff. Restaurants are also increasingly deploying such display solutions, as they provide guests with digital menus where they can browse food and beverage options, view images, read descriptions, and check nutritional information. Guests can then place orders directly from the table without waiting for a server. Thus, the high level of convenience and customization offered by interactive tables has helped boost market growth through this application area.

Regional Insights

The North America interactive tables market accounted for the largest revenue share of 43.2% globally in 2024, aided by an increasing awareness regarding this technology across various verticals. The education sector has been focusing on integrating different technologies to boost student participation in classroom activities and their understanding of various topics. Additionally, the rapid growth of the retail industry in regional economies such as the U.S. and Canada has created further growth opportunities for market players developing advanced display solutions. Retailers use such systems for product catalogs, interactive advertisements, or virtual try-ons, which ensures increased customer engagement.

U.S. Interactive Tables Market Trends

The U.S. accounted for a dominant revenue share in the regional market for interactive tables in 2024. Continued investments by state authorities to digitalize educational institutions and boost the success rate of students have helped drive market expansion in the economy. In January 2024, the U.S. Department of Education released the 2024 National Educational Technology Plan (NETP), titled ‘A Call to Action for Closing the Digital Access, Design and Use Divides.’ The NETP provides actionable recommendations for schools and districts to improve educational opportunities and outcomes while highlighting the importance of addressing disparities in educational technology access across the country. Such initiatives are expected to accelerate the adoption of interactive classroom tables, ensuring sustained market growth.

Asia Pacific Interactive Tables Market Trends

The Asia Pacific market accounted for the second-largest revenue share globally in 2024, owing to the increasing pace of digitization in regional economies such as China, India, and South Korea, coupled with the widespread use of technologies in educational institutions across developed economies such as Japan and Australia. The retail sector has witnessed significant regional advancements, allowing retailers to use interactive tables in stores to provide immersive and tech-savvy shopping experiences. Moreover, there has been a substantial rise in the number of exhibitions and trade shows in the region, spanning different domains such as chemicals, consumer goods, automotive, healthcare, and others. These events increasingly use advanced display technologies, such as interactive tables, to allow attendees to engage directly with products or services.

Latin America Interactive Tables Market Trends

The Latin American market for interactive tables is anticipated to advance at the highest CAGR from 2025 to 2030. The region has witnessed a significant number of technological advances in recent years, aided by the introduction of favorable government policies and the entry of multinational organizations in economies such as Brazil, Chile, and Argentina. Major business hubs such as São Paulo and Buenos Aires are experiencing substantial investments by companies in interactive tables for meeting rooms, innovation spaces, and collaborative work environments. Furthermore, fast-growing sectors in Latin America, such as finance, technology, and consulting, are increasingly seeking digital solutions to improve productivity and foster innovation. Interactive tables are effective tools that enhance meetings, creative sessions, and decision-making processes.

The demand for interactive tables has witnessed exponential growth in Brazil over the past few years. The economy is undergoing a significant digital transformation across multiple sectors, from education and healthcare to retail and public services. Interactive tables play an important role in this shift by enabling digital interaction, improving user engagement, and enhancing the overall experience. Additionally, the rising affordability and availability of touch-screen and sensor-based technologies have made interactive tables more accessible to businesses and institutions in Brazil. Cities such as São Paulo, Rio de Janeiro, and Belo Horizonte have witnessed a high rate of urbanization, driving the adoption of smart technologies in public spaces and businesses. Interactive tables are becoming an integral part of the country’s urban infrastructure, helping cities manage services and engage residents and visitors.

Key Interactive Tables Market Company Insights

Some of the major companies involved in the global interactive tables industry include Boxlight, DigaliX, and Ideum, among others.

-

Boxlight is an American organization that provides interactive technology solutions primarily for the education sector. The company designs, manufactures, and distributes a range of products, including interactive flat-panel displays, LED video walls, classroom audio systems, and educational software. Notable solutions offered by Boxlight include the ProColor Touch Screen Table, which supports up to 12 simultaneous touch points for cooperative learning, and the MimioFrame, a retrofit kit that transforms traditional whiteboards into interactive touch boards.

-

DigaliX is a Spanish company specializing in developing interactive technologies and multi-touch large format devices. Some notable products offered by the company include Simmersive (interactive immersive room), XTable (interactive multi-touch table), XFrame (interactive multi-touch screen), the XHolo holographic assistant, and the Magic Mirror (smart mirror). These products have applications in several major industries, including hospitality, education, exhibition, corporate, healthcare, and others.

Key Interactive Tables Companies:

The following are the leading companies in the interactive tables market. These companies collectively hold the largest market share and dictate industry trends.

- Boxlight

- DigaliX

- eyefactive GmbH

- Garamantis GmbH

- Ideum

- Intermedia Touch

- MARVEL TECHNOLOGY (CHINA) CO.,LTD

- TableConnect GmbH

- MMT GmbH & Co. KG

- Pro Display

- Shenzhen HDFocus Technology Co., Ltd.

Recent Developments

-

In September 2024, Ideum announced a collaboration with Clark Planetarium to showcase its innovative touch tables at the 2024 Association of Science and Technology Centers (ASTC) Conference in Chicago. Ideum displayed its 65-inch Platform II and the experimental OLED 65-inch Platform II, which ran software exhibits by Clark. These exhibits included Gravity Lab, Stellar Playground, and Colonize Mars, among others, which had been designed to work on various touch tables and kiosks developed by Ideum.

-

In July 2024, DigaliX provided its SIMMERSIVE Interactive Tasting Classroom solution to the CIFP Carlos Oroza, an educational institution that offers vocational training in the hospitality sector. The interactive classroom has been equipped with advanced technological solutions that facilitate dynamic and comprehensive training, enabling students to improve their knowledge and technique. These include the ‘XTable’ interactive tables, which allow students to practice and improve their skills with interactive tasting activities through custom-developed software, as well as virtual environments and virtual winery solutions.

Interactive Tables Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.21 billion

Revenue forecast in 2030

USD 2.34 billion

Growth rate

CAGR of 14.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Screen size, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Boxlight; DigaliX; eyefactive GmbH; Garamantis GmbH; Ideum; Intermedia Touch; MARVEL TECHNOLOGY (CHINA) CO.,LTD; TableConnect GmbH; MMT GmbH & Co. KG; Pro Display; Shenzhen HDFocus Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Interactive Tables Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global interactive tables market report based on screen size, technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

LCD

-

LED

-

Capacitive

-

Others

-

-

Screen Size Outlook (Revenue, USD Million, 2018 - 2030)

-

32-65 Inch

-

65 Inch & Above

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Exhibitions & Trade Shows

-

Education

-

Hospitality

-

Retail

-

Control Room

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.