- Home

- »

- Display Technologies

- »

-

Interactive Video Wall Market Size, Industry Report, 2030GVR Report cover

![Interactive Video Wall Market Size, Share & Trends Report]()

Interactive Video Wall Market (2025 - 2030) Size, Share & Trends Analysis Report By Layout, By Display, By End-use (Retail, Corporate, Transportation, Healthcare, Hospitality, Museum, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-125-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Interactive Video Wall Market Size & Trends

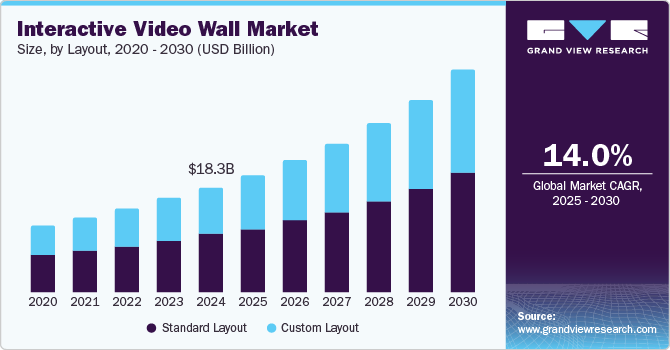

The global interactive video wall market size was valued at USD 18.33 billion in 2024 and is projected to grow at a CAGR of 14.0% from 2025 to 2030. The increasing adoption of digital signage across various sectors, such as retail and entertainment, has significantly contributed to this growth. Businesses are utilizing interactive video walls to enhance customer engagement and create immersive experiences, thereby attracting more consumers. Moreover, advancements in display technologies, including high-definition and touch-sensitive screens, have made these systems accessible.

The demand for interactive video walls is growing significantly due to the need for immersive customer experience across various sectors. Retailers use these walls to offer interactive product displays, to drive customer engagement, and to make shopping more engaging and enhanced for customers. For instance, L’Oréal, in its Paris flagship store, installed interactive video walls for customers to explore virtual makeup tutorials and augmented product trials; this helped with customer engagement, making it easier to try and buy products without physical samples.

Innovations in display technologies, such as LED and OLED panels with ultra-high-definition resolution, have enhanced these systems’ visual appeal and energy efficiency, making them cost-efficient. Furthermore, technological advancements in gesture-based interfaces and touch-sensitive surfaces allow users to interact more naturally and have fully interactive experiences. As businesses seek innovative ways to connect with customers, the demand for these interactive systems is expected to rise, driving further investment in the interactive video wall industry.

The continuous improvement in the software supporting interactive video walls is a major contributor to their adoption. Advanced content management systems (CMS) help organizations easily control and display diverse media types, from videos to live data, across multiple screens simultaneously. As entertainment, retail, and advertising companies increasingly view the interactive video wall industry as a powerful tool for enhancing customer engagement, the market is poised for further growth.

Layout Insights

The standard layout segment dominated the market with a revenue share of 54.6% in 2024, primarily due to ease of use, cost-effectiveness, and broad applicability in various industries. Standard layouts typically feature landscape and portrait orientations and are popular in retail, education, and corporate sectors, where high-quality displays can significantly enhance audience engagement. Their seamless integration and flexibility for different applications, such as trade shows and conference rooms, make them highly functional. Moreover, as the demand for digital signage and immersive experiences continues to grow, standard layout video walls are increasingly becoming the go to choice for businesses aiming to capture and hold the attention of their audiences effectively. The interactive video wall industry is benefiting from this trend as companies seek effective solutions for engaging customers.

The custom layout segment is projected to grow at the highest CAGR during the forecast period. Technological innovations have made implementing customized designs affordable and easier, providing enhanced flexibility and creative possibilities. Furthermore, the shift toward experiential marketing and interactive content drives businesses to adopt custom video walls to offer more engaging and personalized customer experiences. In 2024, ViewSonic introduced the LDC series, which features customizable, ultra-slim, and frameless designs that cater to a variety of needs. This series offers an extensive range of sizes, aspect ratios, and shapes. This allows the creation of unique configurations easily across various settings.

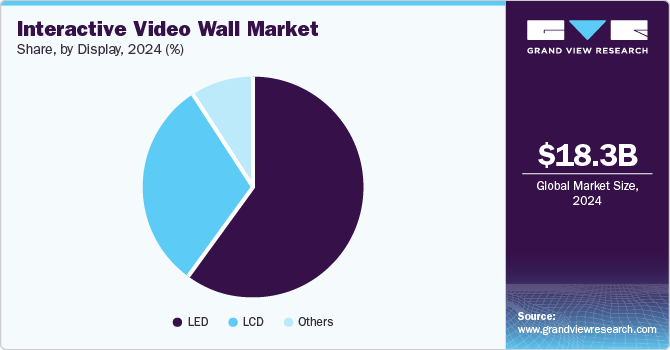

Display Insights

The LED segment dominated the market with the highest revenue share in 2024, owing to its superior image quality, which makes it ideal for indoor and outdoor large video walls. Its ability to provide seamless displays with minimal bezels ensures a more immersive viewing experience, which is particularly advantageous for industries such as advertising, entertainment, and corporate events. In addition, energy efficiency and longer lifespan of LED displays reduce operational costs, making them a cost-effective choice in the long term. The flexibility of LED panels also allows for custom shapes and sizes, enhancing their adaptability for different environments and design needs.

The LCD segment is expected to grow at a significant CAGR over the forecast period, driven by the rising need for immersive and engaging digital experiences across industries such as retail, education, and entertainment. Improvements in LCD technology, including better resolution, brightness, and touch functionality, enhance both visual appeal and interactivity. Businesses and educational institutions are increasingly implementing these solutions to increase engagement and promote collaboration, fueling the market's expansion. For instance, Pro Display's Interactive Video Walls integrate high-quality 24/7 LCD displays with Infrared Touch Overlays to create large-format interactive installations. These LCD screens feature narrow bezels, allowing for a sleek design with a minimal footprint. They offer various customization options, including tailored LCD screen sizes and non-touch alternatives, enhancing the overall aesthetic and functionality of the display. As the interactive video wall industry evolves, LCD technology plays a crucial role in meeting diverse user needs.

End-use Insights

The retail segment dominated the market with the highest revenue share in 2024. This is largely due to the sector's focus on enhancing customer engagement through visually captivating displays. Interactive video walls allow retailers to create immersive shopping experiences that draw customers in and encourage them to interact with products. For instance, John Lewis, a UK-based department store chain, has introduced interactive video walls that let customers see how products would look in their homes. This "try before you buy" experience helps shoppers make more informed decisions, resulting in higher customer satisfaction and fewer product returns.

The hospitality segment is expected to grow at a significant CAGR over the forecast period due to several driving factors. The revival of travel demand post-pandemic has led to increased consumer interest in both leisure and business travel, significantly boosting occupancy rates in hotels and other accommodations. In addition, rising disposable incomes and urbanization are contributing to a growing middle class that seeks diverse travel experiences and higher-quality services, further fueling demand in the hospitality sector. Moreover, the trend toward wellness tourism and personalized guest experiences aligns with evolving consumer preferences, making the hospitality industry more competitive. These factors collectively position the hospitality segment for robust growth in the coming years.

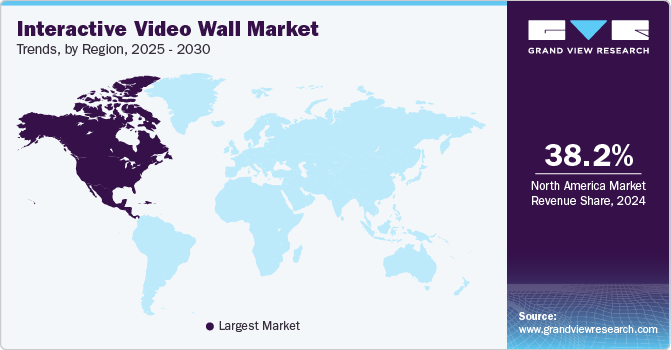

Regional Insights

The North America interactive video wall market dominated the global revenue with a revenue share of 38.2% in 2024. The region has a strong technological infrastructure and high adoption rates of advanced display technologies, which facilitate the deployment of interactive video walls in various sectors, including retail, corporate environments, and entertainment. The increasing demand for immersive advertising and digital signage solutions is another significant driver as businesses seek innovative ways to engage consumers.

U.S. Interactive Video Wall Market Trends

The U.S. interactive video wall market dominated the North America region in 2024, driven by increased demand for customization and personalization over the forecast period. This growth is fueled by increasing demand for large-format displays and digital signage across various sectors, including retail and entertainment. The integration of advanced technologies, such as LED displays and AI capabilities, enhances interactivity and personalization, making these installations more functional for consumers.

Europe Interactive Video Wall Market Trends

The interactive video wall market in Europe is experiencing substantial growth, driven by advancements and rising demand for immersive customer experiences across various sectors. Countries including Germany, the UK, and France are leading this trend. In Germany, significant investments in sectors such as hospitality and transportation are enhancing the adoption of interactive video walls, particularly in public spaces such as airports and train stations. The presence of major display solution providers, including Mitsubishi Electric Europe and NEC Display Solutions, is fostering innovation and expanding the interactive video wall industry.

Asia Pacific Interactive Video Wall Market Trends

The Asia Pacific (APAC) interactive video wall market is expected to grow at the highest CAGR over the forecast period, owing to factors such as rapid urbanization and increasing investment in digital signage. The region's diverse industries, including retail, hospitality, and transportation, are embracing interactive video walls to enhance customer engagement and create immersive experiences. The integration of advanced display technologies, such as LED and OLED panels, improves visual quality and offers energy efficiency, making these systems more functional to businesses looking to innovate and stand out in competitive markets.

China interactive video wall market is experiencing growth, fueled by rapid technological advancements and a strong focus on enhancing consumer experiences. Retailers are increasingly adopting interactive video walls to create engaging environments that captivate customers and drive sales. In addition, the Chinese government's initiatives to develop smart cities further boost the demand for advanced display solutions. As a result, China is emerging as a leading market for interactive video walls in the Asia Pacific region, with businesses leveraging these technologies to deliver unique and personalized experiences that resonate with consumers.

Key Interactive Video Wall Company Insights

Key players in this interactive video wall industry include LG Electronics, Samsung Electronics, NEC Corporation, Delta Electronics, Barco, and Panasonic. These companies are leading the way in technological advancements and product innovations that enhance user engagement through interactive displays.

-

Panasonic Corporation offers a variety of high-quality LED and LCD displays designed for various applications, including retail environments, corporate settings, and public spaces. Panasonic's commitment to innovation is evident in its development of interactive video wall systems that incorporate cutting-edge features such as 4K resolution, high brightness, and energy efficiency. Their displays are often used in immersive environments where visual clarity and reliability are paramount.

-

Christie Digital Systems Inc. is an audiovisual company specializing in digital projection and display technologies. Its product offerings include high-performance video wall processors and modular display solutions such as MicroTiles, which are designed to create large-scale video walls with exceptional image quality. These displays are widely used in various sectors, including entertainment, corporate environments, and command-and-control centers.

Key Interactive Video Wall Companies:

The following are the leading companies in the interactive video wall market. These companies collectively hold the largest market share and dictate industry trends.

- Christie Digital System USA, Inc.

- eyefactive GmbH

- Ideum Inc.

- Intermedia Touch

- Leyard

- MultiTaction Inc

- Panasonic Corporation of North America

- Planar Systems, Inc.

- Prestop B.V.

- SAMSUNG

Recent Development

-

In June 2023, Planar announced the launch of the Planar DirectLight Pro Series, a new LED video wall platform designed for versatility and enhanced lifetime value. This innovative platform features high brightness and outstanding image performance, with pixel pitches down to sub-1 mm. It supports various display configurations and is backed by the Planar EverCare Lifetime Limited Warranty, ensuring long-term reliability for diverse applications such as conference rooms and broadcast studios.

-

In November 2022, Samsung launched a premium direct-view display, The Wall All-in-One, a cutting-edge LED signage solution designed for versatile commercial applications. It is suitable for various environments, from retail spaces to corporate settings. The Wall All-in-One's exceptional picture quality is powered by microLED technology. In addition, the integrated design simplifies setup by eliminating the need for external devices, streamlining the user experience.

Interactive Video Wall Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.52 billion

Revenue forecast in 2030

USD 39.44 billion

Growth Rate

CAGR of 14.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Layout, display, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, Mexico, UAE, KSA, South Africa

Key companies profiled

Christie Digital System USA, Inc.; eyefactive GmbH; Ideum Inc.; Intermedia Touch; Leyard; MultiTaction Inc; Panasonic Corporation of North America; Planar Systems, Inc.; Prestop B.V.; SAMSUNG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

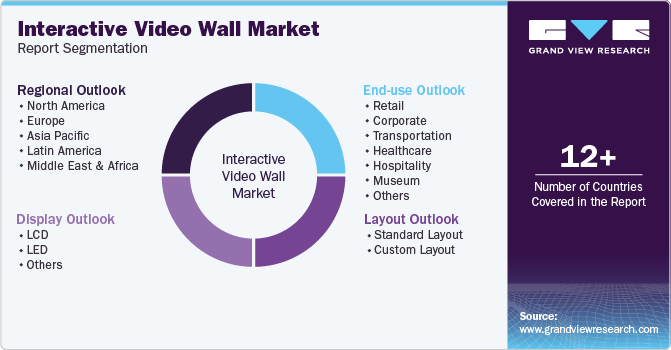

Global Interactive Video Wall Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Interactive video wall market report based on layout, display, end-use, and region.

-

Layout Outlook (Revenue, USD Million, 2018 - 2030)

-

Standard Layout

-

Custom Layout

-

-

Display Outlook (Revenue, USD Million, 2018 - 2030)

-

LCD

-

LED

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Retail

-

Corporate

-

Transportation

-

Healthcare

-

Hospitality

-

Museum

-

Others

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.