Interior Doors Market Size & Trends

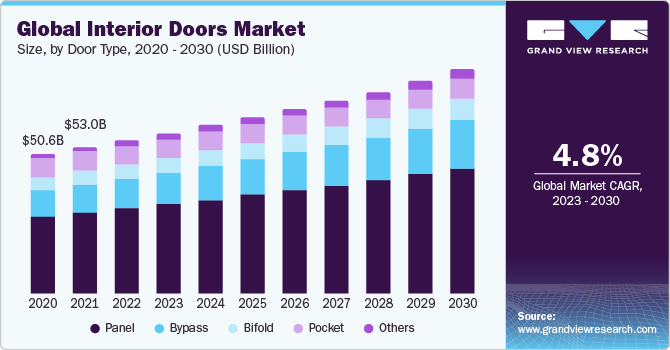

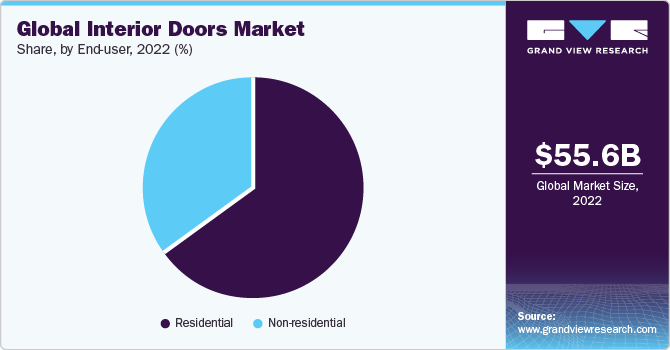

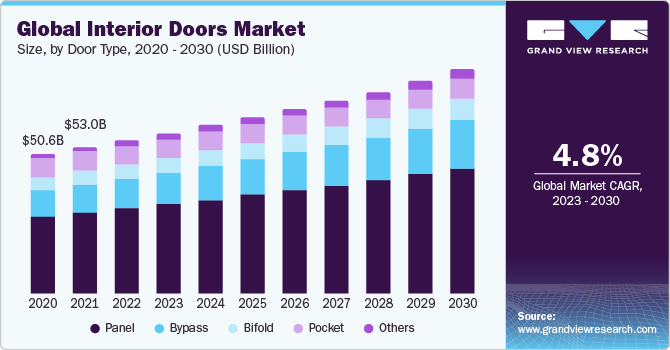

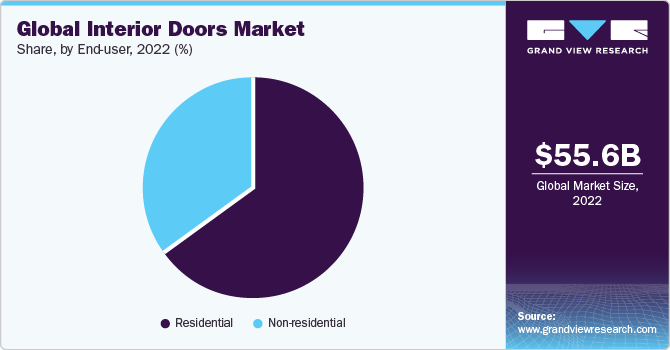

The global interior doors market was valued at USD 55.59 billion in 2022 and is expected to grow at a CAGR of 4.8% over the forecast period. This is attributed to the rapid growth in the construction market around the world creating a significant demand for interior doors. The economic growth in developing economies such as China and India has contributed to growth in the consumption of interior doors. It has been fueled by the growing needs of a sizeable middle class residing in these countries as well as around the world.

An interior door serves as a partition between various rooms and areas within a dwelling or structure. These are typically lightweight, slim, and often feature a hollow core. They primarily function to demarcate spaces within a building, in contrast to exterior ones, which are positioned at entrances and designed to withstand severe weather conditions and resist unauthorized access with their robust construction.

The Covid-19 pandemic significantly impacted various industries, including the construction and home improvement sectors, which, in turn, affected the interior door market. Many construction projects were temporarily halted or delayed due to lockdowns and supply chain disruptions. This caused a drastic reduction in demand for house interiors. Also the contraction of economy due to the shutting down of businesses and widespread layoffs led to a negative impact on buying power of consumers and their inclination to invest in home improvement decreased to a large extent due to financial constraints.

The rise of online retail and e-commerce has been a significant driving factor behind the growth of the market. This trend has revolutionized the way consumers shop, providing numerous benefits and opportunities for both buyers and sellers.Online retailers offer a vast selection ranging from various styles, materials, finishes, and sizes. This extensive variety allows customers to find products that precisely match their design and functional requirements. E-commerce also allows customers to shop from the comfort of their homes, eliminating the need for physical visits to multiple stores, saving time and money for them.

The construction market's growth is a major driving factor behind the expansion of the interior doors market. New residential and commercial construction projects have created substantial demand for the market. When there is an increase in the number of buildings being constructed, it naturally leads to a higher requirement for interior doors. Government housing schemes such as Pradhan Mantri Awas Yojna in India, aiming to provide ‘housing for all’, have contributed to the growth of the market in the country.

Door Type Insights

Based on the door type, the market is divided into panel, bypass, bifold, pocket, and others. The panel doors segment held the largest market share in 2022. These are known for their versatility and classic appearance. They consist of framed panels, which can be made from a variety of materials, including wood, MDF (Medium-Density Fiberboard), and composite materials. They are favored for their ability to complement different architectural styles and interior aesthetics. In recent years, panel doors have seen a resurgence in popularity due to the trend towards traditional and transitional home designs.

Material Insights

On the basis of material, the market is divided into wood, metal, glass, fiberboard, fiberglass, vinyl, and others. Wood held the largest material segment market share in 2022. Wooden products are highly valued for their natural beauty, durability, and traditional appeal. These are typically crafted from solid wood or wood veneer, and they offer a warm and timeless aesthetic. The wooden products includes a wide range of wood species, including oak, cherry, maple, and mahogany. Sustainability is an emerging factor in the wood doors market. Consumers are increasingly interested in products made from sustainably sourced materials. This has led to an increase in demand for FSC (Forest Stewardship Council) certified wooden doors.

End-User Insights

Based on end-user, the market is segmented into residential and non-residential buildings. Residential buildings were the largest end-users of interior doors in 2022. A crucial aspect regarding residential interior doors is that they are closely tied to housing trends and consumer preferences. During the COVID-19 pandemic, the demand for home office spaces and remote work led to an increased interest in home office or study doors that offer privacy and sound insulation. Another significant trend in this market is the integration of technology. Smart interior doors, equipped with features like keyless entry, remote locking, and touchless operation, have gained popularity.

Regional Insights

Asia Pacific dominated the market share in 2022, driven by several key factors such as a large and growing population, rapid urbanization, and a rising middle class. As more people move into urban areas, the demand for housing and, consequently, interior doors has surged. The growth in the tourism and business sectors has also led to a burgeoning demand for commercial spaces, hotels, and resorts. The products in this segment are often chosen for their durability, fire-resistant properties, and aesthetic appeal. Fire-rated and acoustic doors are particularly important in commercial settings, ensuring safety and privacy.

Key Companies & Market Share Insights

Key players operating in the market are Contractors Wardrobe, Inc., Masonite, Jeld-Wen Holdings Inc., Marvin, Concept SGA, Artisan Hardware, Bayer Built Woodworks Inc., Rustica, JB Kind Doors and Hume Doors & Timber. These companies are venturing into emerging markets characterized by growing interior designing expenditures and an expanding middle class around the globe. This strategic expansion serves as a risk mitigation strategy to reduce reliance on well-established markets.

In November 2022, Masonite announced the acquisition of Endura Products, a high-performance door systems and frames manufacturer. The deal costing around USD 375 million to Masonite will help the company expand its product portfolio with weather sealings, multi-point locks used in repair and remodeling applications.

In August 2022, Jeld-Wen Holding, Inc., a leading global manufacturer in construction products announced the initiation of a comprehensive review of strategic alternatives for its leading designer, manufacturer and distributor of doors & windows, The Australasia business. The well performing business has market leading positions and the review is expected to explore new options to unlock value for the stakeholders involved in it.