- Home

- »

- Medical Devices

- »

-

Intraosseous Infusion Devices Market Size Report, 2030GVR Report cover

![Intraosseous Infusion Devices Market Size, Share & Trends Report]()

Intraosseous Infusion Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Manual IO Needles, Battery Powered Driver), By End-use (Hospitals and Clinics, Ambulatory Surgical Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-245-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Intraosseous Infusion Devices Market Trends

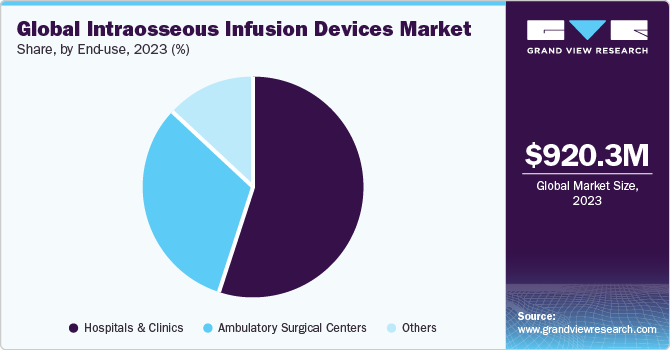

The global intraosseous infusion devices market size was estimated at USD 920.3 million in 2023 and is projected to grow at a CAGR of 6.2% from 2024 to 2030. Intraosseous infusion (IO) is the procedure of injecting fluids, blood products, and medications directly into the bone marrow. The intraosseous infusion devices allow for the administered fluids and medications to go completely into the vascular system. The IO route of medication and fluid is an alternative to the intravascular route. These devices are used when patient need urgent delivery of life-saving medications and fluids and has compromised intravenous access.

Factors that are driving the market growth are increase in prevalence of chronic diseases, rise in number of emergency care cases, and surge in incidence of conditions such as serious burns, severe accidents, cardiovascular ailments, which fuel the hospitalization chances.

Medical professionals are needed to utilize the intraosseous infusion devices as a trustworthy backup when intravenous device access is not possible. The intraosseous infusion devices have emerged as most preferred devices in pediatric resuscitation. The intraosseous infusion devices are inserted into bone’s medullary space, and flow of fluid into intraosseous device indicated accurate positioning. The manually inserted intraosseous infusion needles have been approved since 1940 in the U.S. There are various sites of intraosseous insertion available such as distal & proximal tibia, sternum, distal femur, and calcaneum. One of the reliable and fastest means of administrating the emergency medication fluids in the sternum is the sternal intraosseous infusion which allow easy vascular access.

Increase in prevalence of cardiovascular diseases, rapid escalation seen in the geriatric population, technological advancements in intraosseous infusion devices, and rise in number of cancer patients is expected to boost the market growth during the forecast period. For instance, According to WHO, cardiovascular diseases cause 17.9 million deaths every year across the globe. In addition, 4 out of 5 cardiovascular disease deaths are caused due to strokes and heart attacks, and around 30% of these deaths occur in the population under 70 years of age. Similarly, according to a study conducted by CDC, around 695,547 deaths were caused by heath disease in 2022, and every 1 in 20 adults of age 20 years or above have coronary artery disease in the U.S.

According to the Population Reference Bureau data, the number of Americans aged 65 is expected to increase from 58 million in 2022 to 82 million in 2050 and is projected to account for nearly 23% of the population in 2050, from 17% in 2022. Moreover, similar growth in the senior population across countries is expected to provide lucrative opportunities for the market growth.

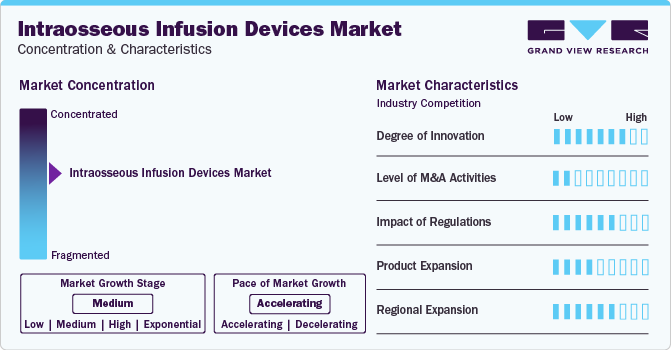

Market Concentration & Characteristics

The market has been experiencing many technological innovations, one such path-breaking innovation is in March 2022, PAVmed Inc. publicized that physician at Clinica Porto Azul in Columbia, effectively implanted the PORT IO Intraosseous Infusion Device in 3 patients, as part of its IRB approved first in human clinical study of 40 patients. Such innovations drive the market growth during the forecast period.

The market is characterized by a low level of M&A activities undertaken by leading players in the last three years.

Regulations significantly impact the market by ensuring stringent compliance standards for product safety, quality, and documentation. While promoting patient welfare, these regulations also necessitate rigorous tracking, reporting, and adherence to good clinical practice (GCP).

The expansion of the existing intraosseous infusion devices line with expanded indications drives the market growth. For instance, in October 2020, Teleflex Corporation announced 510(k) USFDA clearance for expanded indications for arrow EZ-IO intraosseous infusion system. The system may be given for up to 48 hours when alternative intravenous vascular access is not available.

Regional expansion involves establishing strategic distribution hubs and partnerships to efficiently navigate diverse regulatory landscapes.

Type Insights

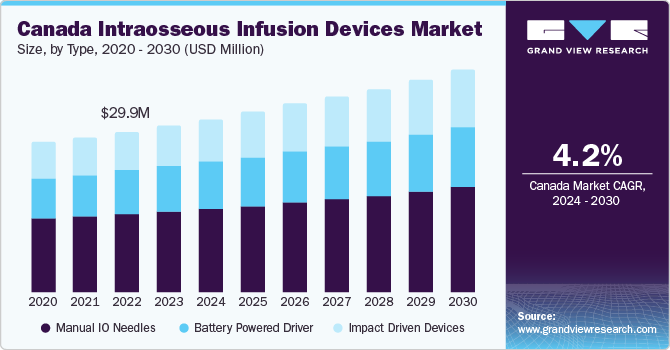

Based on type, the manual IO needles segment led the market with the largest revenue share of 49.4% in 2023, owing to rise in tibia and fibula fractures, increase in availability of manual IO needles, and increase in demand during emergency care procedures. Manual IO needles are generally used in children because of needles safety profile, and ease of usage, once instruction has taken place.Depending on the surgical procedure, a different types of manual IO needles are used for intraosseous infusion such as butterfly, spinal, standard steel hypodermic, sternal, and trephine. Most generally used manual IO needles are Cardinal Health Illinois /Jamishidi needle, and Cook critical care sur-fast needle, and Cook Dieckman modified needle.

The battery powered driver segment is projected to grow at the significant CAGR during the forecast period, owing to its capability to operate with extreme accuracy coupled with minimum operational time. In additions, the technological advancements in battery powered driver further boost demand during the forecast period.

End-use Insights

Based on end-use, the hospitals and clinics segment led the market with the largest revenue share of 54.9% in 2023. This segment is driven by the availability of developed & latest infrastructure, rise in investments to develop sophisticated healthcare infrastructure, increase in the number of skilled professionals, and easy accessibility. Also, these are well-equipped with technologically advanced treatment setups, providing services for several chronic diseases. In addition, hospitals and clinics lay greater emphasis on innovative modes of treatment and patient care, which is expected to lower costs and increase adoption of emergency care services across all sections of the society. On average, hospitalizations may last for 4-5 days, driving the need for supplying medications and fluids to patients through intraosseous infusion. Moreover, the market growth is attributed to increasing availability of intraosseous infusion in hospitals and clinics as procedure has gained immense popularity in recent times, owing to the advantages associated with it. Also, increase in emergency care patient admissions as well as heart attack cases treatment further boost the market growth.

The ambulatory surgical centers segment is projected to grow at the significant CAGR during the forecast period, owing to increase in preference for intraosseous infusion and increase in number of cardiology procedures in ambulatory surgical centers. For instance, according to an article by Becker's Healthcare in September 2022, it was projected that by mid-2020s, ambulatory surgical centers performed 33% of all cardiology procedures in the U.S., growing by nearly 23% from 2018.

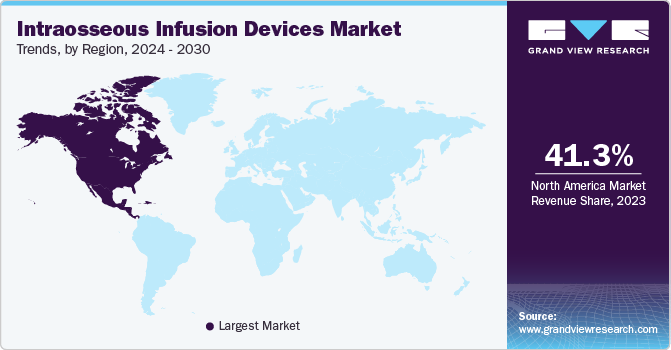

Regional Insights

North America dominated the intraosseous infusion devices market with the revenue share of 41.33% in 2023. The factors such as well-established reimbursement policies, strong medical infrastructure, the existence of key players such as Teleflex Incorporated, Becton Dickinson Company, Cardinal Health, Inc. and Cook Group, and technological advancement in intraosseous infusion devices drives market growth. The combination of all these significant factors will make North America the most promising regional market over the forecast period.

U.S. Intraosseous Infusion Devices Market Trends

The intraosseous infusion devices market in the U.S. held the largest share in North America in 2023, owing to factors such as increase in prevalence of cardiovascular diseases, surge in public awareness regarding intraosseous infusion, and rising R&D for novel treatments. For instance, according to the CDC, coronary artery disease accounts for 25% or 610,000 deaths annually in the U.S. The innovative landscape, coupled with a well-established regulatory framework, positions the U.S. as a leader in adopting and advancing intraosseous infusion devices, contributing significantly to its dominance in the North American market.

Europe Intraosseous Infusion Devices Market Trends

The intraosseous infusion devices market in Europe was identified as a lucrative region in this industry. The market remained unaffected by the economic downturn in European countries mainly due to the presence of sophisticated healthcare infrastructure, high awareness among patients & medical professionals, and growing cardiovascular diseases.

The Germany intraosseous infusion devices market held the largest share in 2023, due to the Germany's well-regulated reimbursement scheme plays a crucial role in driving market growth. Approximately 80.0% of the German population is covered by statutory health insurance policies, and the reimbursement system for medical devices is classified into inpatient and outpatient policies.

The intraosseous infusion devices market in UK is expected to grow at the fastest CAGR over the forecast period, due to several compelling factors that have fuelled the demand for these medical devices across diverse emergency care settings. The UK has a sizable healthcare system, creating a consistent demand for medical devices and a receptive attitude toward innovative technologies.

The France intraosseous infusion devices market is expected to grow at the fastest CAGR over the forecast period, due to the demand for intraosseous infusion devices is on the rise, driven by several key factors, including the increasing geriatric population and the growing burden of cardiovascular diseases. According to the World Bank, the geriatric population in France has risen from 18% in 2012 to 20.8% in 2020. This demographic shift has contributed to a significant prevalence of cardiovascular diseases in the country.

Asia Pacific Intraosseous Infusion Devices Market Trends

The intraosseous infusion devices market in Asia Pacific is expected to witness at the significant CAGR of 7.0% over the forecast period. Asian countries are population dense with an elevated burden of chronic diseases like diabetes, cardiovascular illnesses, and cancer. Asian countries like China, India, and Japan are emerging countries with well-developed healthcare infrastructure and facilities. Factors like high disease burden, low cost of treatments, adoption of advanced technology, and significant government reforms are paving way for the intraosseous infusion devices industry.

The Japan intraosseous infusion devices market held the largest share in 2023, due to favourable government initiatives, including increased awareness of cardiovascular diseases, and robust healthcare system, are contributing to the growth of the market. The Japanese government has initiated new healthcare measures, aiming to reduce expenditure and improve medical device and care standards, by revising its policies & introducing new programs, such as the Integrated Community Care System & Japan Health Care Vision.

The intraosseous infusion devices market in China is expected to grow at the fastest CAGR over the forecast period, owing to the strong support from government and substantial investments in R&D have played a pivotal role in advancing China's intraosseous infusion devices. Moreover, China’s population is aging, and, like many countries, its major disease burden is chronic illnesses. According to WHO, approximately 80% of deaths in China are due to chronic illnesses, including cardiovascular disease, stroke, cancer, COPD, and diabetes. This epidemiological transition has aided the growth of the country’s intraosseous infusion devices market.

Middle East & Africa Intraosseous Infusion Devices Market Trends

The intraosseous infusion devices market in Middle East & Africa is expected to grow at the fastest CAGR over the forecast period, due to rising prevalence of cardiovascular diseases, growing demand for effective treatment across the region drives market growth. In addition, economic development and the presence of high unmet healthcare needs are among the major drivers expected to boost the market growth in MEA.

The Saudi Arabia intraosseous infusion devices market is expected to grow at the fastest CAGR over the forecast period, due to presence of high-quality healthcare infrastructure with high accessibility to health facilities is likely to facilitate the market growth in the country. In 2022, Saudi Arabia spent an estimated USD 36.8 billion on healthcare & social development, accounting for 14.4% of its 2022 budget. The healthcare landscape in the country is expected to further advance as the government is trying to bring about reforms in the sector.

The intraosseous infusion devices market in Kuwait is expected to grow at the fastest CAGR over the forecast period, due to the rising prevalence of cardiovascular diseases and growing demand for effective treatment. Kuwait’s growing aging population contributes to market growth. As per the United Nations Population Fund’s World Population Dashboard data for 2021, around 3.4% of Kuwait’s population comprises individuals aged 65 and older.

Key Intraosseous Infusion Devices Company Insights

Argon Medical Devices, Inc., SAM Medical, and BIOPSYBELL S.R.L. are some of the emerging companies in the market.

Key Intraosseous Infusion Devices Companies:

The following are the leading companies in the intraosseous infusion devices market. These companies collectively hold the largest market share and dictate industry trends.

- Aero Healthcare AU Pty Ltd

- Teleflex Incorporated.

- Becton, Dickinson and Company.

- BIOPSYBELL S.R.L.

- Cook Group

- SAM Medical

- Argon Medical Devices, Inc.

- Cardinal Health, Inc.

- Medax SRL Unipersonle

- StarFish Medical

Recent Developments

-

In June 2023, Teleflex Incorporated received 510(k) U.S. FDA clearance for Arrow EZ-1O IO needle for MR conditional labelling. The EZ-IO needle is a critical component of Arrow EZ-IO intraosseous vascular access system. EZ-1O has a diamond tip for precise, fast, and steady insertion

-

In January 2022, Safeguard Medical launched NIO+ Adult, a ultra compact next generation intraosseous infusion device. The NIO+ Adult is a reliable durable, intraosseous device built to resist challenging environments and harsh conditions

-

In March 2020, SAM Medical announced the launch of SAM IO Intraosseous Access System which is a manually and multi-use IO device for hospital and pre-hospital healthcare providers in the military and civilian sectors

Intraosseous Infusion Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 974.5 million

Revenue forecast in 2030

USD 1,401.0 million

Growth rate

CAGR of 6.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Aero Healthcare AU Pty Ltd; Teleflex Incorporated.; Becton, Dickinson and Company.; BIOPSYBELL S.R.L.; Cook Group; SAM Medical; Argon Medical Devices, Inc.; Cardinal Health, Inc.; Medax SRL Unipersonle; StarFish Medical

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intraosseous Infusion Devices Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global intraosseous infusion devices market report based on type, end-use and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual IO Needles

-

Battery Powered Driver

-

Impact Driven Devices

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global intraosseous infusion devices market size was estimated at USD 920.3 million in 2023 and is expected to reach USD 974.5 million in 2024.

b. The global intraosseous infusion devices market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach USD 1,401.0 million by 2030.

b. North America dominated the intraosseous infusion devices market with a share of 41.3% in 2023. This is attributable to the region's advanced healthcare infrastructure, increased awareness about advanced treatment, and a growing aging population.

b. Some of the players operating in this market are Aero Healthcare AU Pty Ltd; Teleflex Incorporated.; Becton, Dickinson and Company.; BIOPSYBELL S.R.L.; Cook Group; SAM Medical; Argon Medical Devices, Inc.; Cardinal Health, Inc.; Medax SRL Unipersonle; and StarFish Medical

b. Key factors that are driving the intraosseous infusion devices market growth include the rise in demand for rapid administration of medications or fluids directly into vascular system, surge in number of surgeries, and development of technologically advanced intraosseous infusion devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.