- Home

- »

- Medical Devices

- »

-

Intravenous Infusion Pumps Market, Industry Report, 2030GVR Report cover

![Intravenous Infusion Pumps Market Size, Share & Trends Report]()

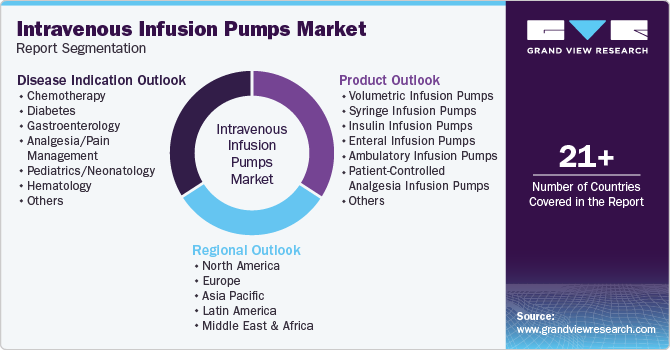

Intravenous Infusion Pumps Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Volumetric Infusion Pumps, Syringe Infusion Pumps), By Disease Indication (Chemotherapy, Diabetes, Gastroenterology), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-560-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Intravenous Infusion Pumps Market Summary

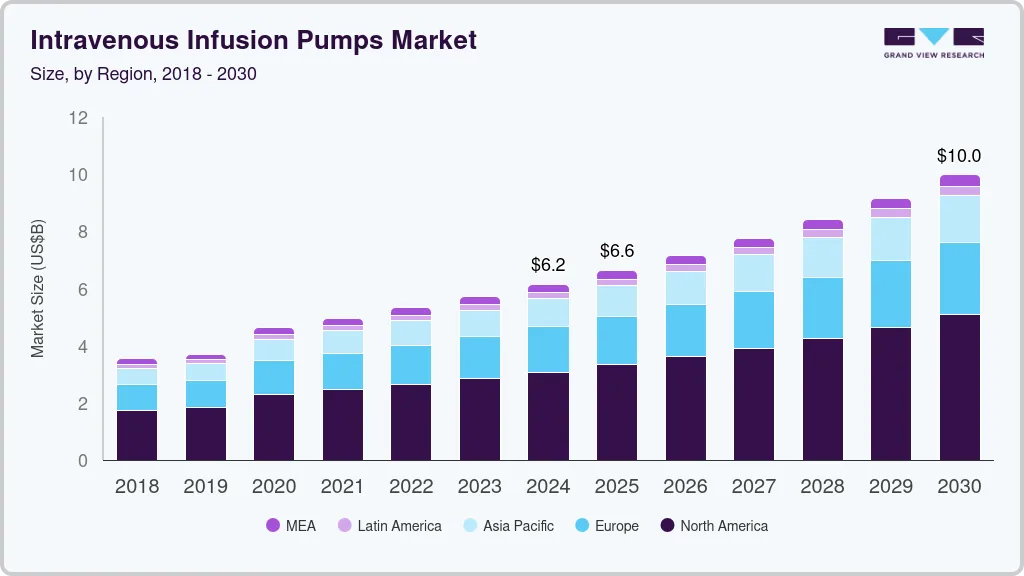

The global intravenous infusion pumps market size was estimated at USD 6,151.7 million in 2024 and is projected to reach USD 9,976.7 million by 2030, growing at a CAGR of 8.5% from 2025 to 2030. The increasing incidence of conditions such as cancer, diabetes, cardiovascular diseases, and respiratory illnesses necessitates the accurate administration of medications and therapies.

Key Market Trends & Insights

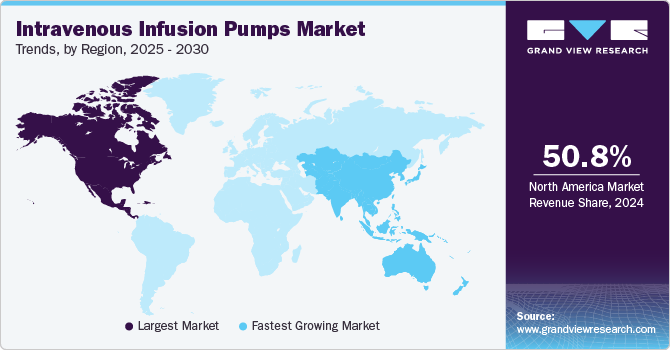

- North America intravenous infusion pumps market dominated the global market with a revenue share of 50.8% in 2024.

- Asia Pacific intravenous infusion pumps market is expected to register the fastest CAGR of 9.0% in the forecast period.

- Based on product, the volumetric infusion pumps segment dominated the market and accounted for a share of 16.8% in 2024.

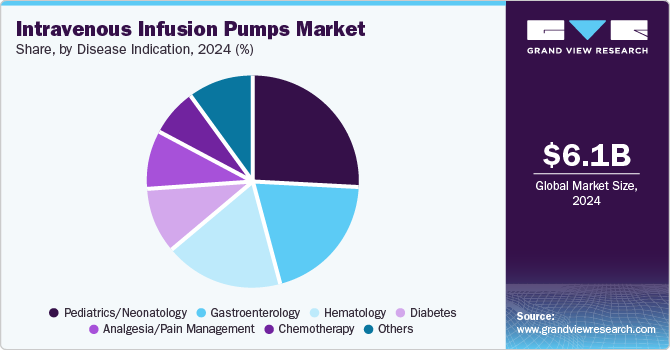

- Based on disease indication, the Pediatrics/neonatology segment led the market with a revenue share of 26.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6,151.7 Million

- 2030 Projected Market Size: USD 9,976.7 Million

- CAGR (2025-2030): 8.5%

- North America: Largest market in 2024

Infusion pumps are indispensable in this context, delivering precise dosages of vital treatments such as chemotherapy, antibiotics, and nutritional fluids. As these chronic conditions rise, the demand for infusion pumps continues to expand, highlighting their critical role in effective disease management.

Intravenous infusion pumps are used to administer medications, hormones, and nutritional fluids into the circulatory system through veins in controlled amounts. They are extensively used in clinical settings such as hospitals, nursing homes, and homes. A trained operator operates the pump by programming the rate and duration of fluid delivery using built-in software. Intravenous infusion pumps can deliver nutrients, hormones, antibiotics, chemotherapy drugs, and pain relievers.

The key factors driving the market's growth include increased incidences of chronic diseases, rapid escalation in the geriatric population, rising demand for ambulatory infusion pumps, and the burgeoning number of people undergoing surgical procedures. Intravenous infusion pumps are mainly used to administer critical fluids, including high-risk medication. Most infusion pumps are equipped with safety features and in-built alarms for operator alerts intended to activate in the event of a problem. Many conditions, such as immune deficiencies, cancer, and congestive heart failure, cannot be treated with oral medications and require infusion therapy.

As individuals age, they are more susceptible to chronic illnesses that require complex medication regimens. Infusion pumps are particularly beneficial in outpatient and home care settings, enabling safe and accurate drug delivery to elderly patients. The demographic shift towards an older population amplifies the adoption of infusion pumps, ensuring that healthcare providers can effectively meet this vulnerable group's specific needs. According to the World Health Organization, life expectancy at birth increased to 73.3 years in 2024, up by 8.4 years since 1995. Moreover, the global population aged 60 and older is projected to rise from 1.1 billion in 2023 to 1.4 billion by 2030.

Technological advancements in infusion pump capabilities further bolster market demand. The emergence of smart infusion pumps equipped with wireless connectivity, electronic health record (EHR) integration, and automated programming enhances patient safety and operational efficiency. These innovations minimize medication errors, streamline workflows, and promote adherence to treatment protocols, encouraging healthcare facilities to invest in these advanced devices. Consequently, the integration of cutting-edge technology into infusion pumps is paving the way for wider adoption in clinical practice.

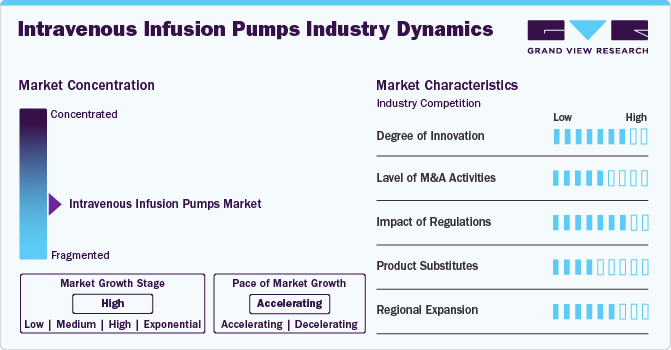

Market Concentration & Characteristics

The industry growth stage is high, and the pace of the market growth is accelerating. The emergence of smart infusion pumps equipped with advanced software minimizes medication errors through features such as drug libraries and wireless connectivity, thus enhancing workflow efficiency and safety in clinical settings.

Mergers and acquisitions are significantly prevalent within the parent market as companies strive to enhance their technological capabilities and market presence. Major industry players such as ICU Medical and Baxter International engage in strategic partnerships and acquisitions, facilitating innovation, accelerated product development, and enhanced distribution channels to meet rising market demands.

Regulatory frameworks play a crucial role in the intravenous infusion pump market by ensuring the safety and efficacy of products. Stringent, timely approvals from entities such as the U.S. Food and Drug Administration (FDA) enhance market acceptance and product development, thereby influencing innovation trajectories within the industry. In August 2024, the FDA expanded the Insulet SmartAdjust technology’s indications, enabling automated insulin dosing for adults with type 2 diabetes in the U.S.

Though intravenous infusion pumps are essential for accurate drug delivery, alternatives such as manual infusion techniques, syringe pumps, and wearable delivery systems exist. However, manual methods lack the precision of smart pumps, leading to their decline in favor of advanced solutions, which remain vital for continuous therapy in home healthcare settings.

Demographic shifts, healthcare investments, technological progress, and facilitative regulatory frameworks determine regional expansion in the market. North America and Europe currently exhibit market dominance in innovation, whereas the Asia Pacific region demonstrates the most rapid growth, attributed to its dynamic healthcare evolution and demographic transformations. Emerging markets are anticipated to experience future market expansion with improvements in infrastructure and access to sophisticated therapeutic modalities.

Product Insights

Volumetric infusion pumps dominated the market and accounted for a share of 16.8% in 2024. Volumetric infusion pumps, utilizing electronic peristaltic pressure for accurate and continuous fluid delivery, are crucial in various healthcare settings for administering medications, nutrients, and pain relievers. Their efficacy in delivering large volumes precisely is vital in managing chronic diseases such as cancer and diabetes and in surgical procedures. The integration of advanced technologies and drug libraries by key players further enhances their utility.

Insulin infusion pumps are expected to grow at the fastest CAGR of 9.1% over the forecast period.The global rise in diabetes prevalence, primarily due to aging populations, unhealthy lifestyles, and increasing obesity rates, has driven insulin pump demand. WHO data published in March 2024 indicated that, in 2022, approximately 43.0% of adults were overweight, with 16.0% classified as obese, both significant risk factors for type 2 diabetes. Insulin pumps offer advantages over traditional delivery methods, providing continuous subcutaneous insulin infusion (CSII) that enhances glycemic control. Furthermore, next-generation pumps featuring continuous glucose monitoring and AI-driven adjustments further improve patient outcomes, fueling the growth of home-based diabetes management solutions.

The ambulatory infusion pumps, which are used to deliver liquid nutrients and medications to a patient in emergencies and chronic conditions, contributed a significant market share in 2024. These pumps are widely favored for the delivery of nutrients and medications. The availability of other pumps such as patient-controlled analgesia (PCA) pumps, insulin pumps, and smart pumps will contribute to the supplementary growth of this segment. The rising demand for enteral and syringe pumps contributes to the burgeoning preference for the intravenous infusion pump, leading to segment growth.

Disease Indication Insights

Pediatrics/neonatology led the market with a revenue share of 26.4% in 2024. The market has been segmented based on disease indication into chemotherapy, diabetes, gastroenterology, analgesia/pain management, pediatrics/neonatology, hematology, and others. According to the CDC, 1 in every 33 babies born in the U.S. is diagnosed with a congenital disability each year. Neonatology focuses on acute conditions in newborns, such as prematurity and congenital malformations. Effective, cost-efficient care and proper nutrition post-birth can reduce preterm births by nearly three-quarters. Moreover, older children face diseases such as neuroblastoma and Gaucher disease, which necessitate advanced infusion pumps for accurate medication delivery and to reduce overdose risks.

Chemotherapy is projected to grow at the fastest CAGR of 9.7% over the forecast period. In 2024, the American Cancer Society projected over 2 million new cancer cases and 611,720 cancer deaths in the U.S. While 30%-50 % of cancers can be prevented through risk mitigation and early diagnosis, treatment for malignant tumors often requires chemotherapy, administered intravenously or via capsules. In November 2024, a randomized phase 2 clinical trial by the University of Iowa Health Care demonstrated that adding high-dose intravenous vitamin C to chemotherapy doubled the overall survival of late-stage metastatic pancreatic cancer patients from eight months to 16 months. Such developments necessitate precise drug delivery through intravenous infusion pumps, driving market growth due to the increasing cancer prevalence.

The hematology segment is estimated to grow significantly over the forecast period. With the rising incidences of surgeries and blood cancer (hemophilia), the demand for intravenous infusion pumps has surged in hematology. These pumps are used for treatments such as blood transfusion, which is expected to increase in the coming years. Intravenous pumps are used for hematology as they are the only way blood can be transfused into a patient’s body in a precise, compact, and continuous manner. Moreover, it can regulate manual control or in an automated manner, avoiding the risk of failure during the treatment.

Regional Insights

North America intravenous infusion pumps market dominated the global market with a revenue share of 50.8% in 2024. The increasing Incidence of chronic diseases, an increasing number of surgical procedures performed, well-developed & increasing R&D, and escalating adoption of advanced technology in infusion pumps contributed to the growth the of intravenous pumps industry in this region.

In April 2024, Mackenzie Health (Canada) launched BD Alaris EMR Interoperability, a first-of-its-kind technology in Canada. This system facilitates two-way communication between IV pumps and patient EMRs, aiming to reduce medication errors and streamline workflows.

U.S. Intravenous Infusion Pumps Market Trends

The intravenous infusion pumps market in the U.S. dominated the North America market with a revenue share of 87.6% in 2024, fueled by the high prevalence of chronic diseases, including cancer and diabetes. The country’s significant diabetes rates are linked to poor lifestyle choices and a stressful work environment. According to the Heart Failure Society of America’s (HFSA) Heart Failure Epidemiology and Outcomes Statistics report 2024, approximately 6.7 million Americans over the age of 20 are currently living with heart failure and is projected to rise to 8.7 million by 2030. Consequently, rising cardiovascular and chronic respiratory diseases, an aging population, and increasing surgical procedures are expected to boost demand for infusion pumps. Stricter government regulations and improved standards of care also contribute to market growth, alongside new product launches and FDA approvals.

Europe Intravenous Infusion Pumps Market Trends

Europe intravenous infusion pumps market held substantial market share in 2024. Most European countries boast well-developed healthcare infrastructures, facilitating the adoption of advanced patient care technologies. The market was driven by a growing burden of chronic diseases such as cancer and diabetes, an increasing number of surgical procedures, a rapid rise in the geriatric population, and significant government support.

Asia Pacific Intravenous Infusion Pumps Market Trends

Asia Pacific intravenous infusion pumps market is expected to register the fastest CAGR of 9.0% in the forecast period. Asian countries are population-dense with an elevated burden of chronic diseases such as diabetes, cardiovascular illnesses, and cancer. These countries are also popular for their low cost of treatment and surgeries, thus being a preferred market for medical tourism. Countries such as China, Japan, and India are emerging economies with well-developed healthcare infrastructure and facilities.

Japan's intravenous infusion pumps market is projected to grow at the fastest CAGR over the forecast period. The country is experiencing a rising median age due to declining mortality and increased life expectancy. This demographic shift has led to a growing prevalence of chronic diseases, highlighting the need for advanced infusion therapies.

Key Intravenous Infusion Pumps Company Insights

The market players are strategically utilizing drivers such as a shift in technology, automation, standardized dosing, and the extensive adoption of advanced healthcare technology for improved healthcare services. Moreover, major players often opt for geographical expansion to retain market share and adopt mergers, acquisitions, and new product launches to widen their portfolio.

-

Fresenius Kabi AG is a global manufacturer of intravenous infusion pumps, providing a comprehensive array of syringe and volumetric pumps designed for accurate drug and fluid delivery in hospital and ambulatory settings. Its systems incorporate safety technologies, medication error reduction software, and various IV disposables and accessories.

-

Tandem Diabetes Care, Inc. specializes in insulin infusion pumps for effective diabetes management. Its innovative t:slim X2 pump, featuring Control-IQ technology, offers user-friendly, connected insulin delivery systems that integrate continuous glucose monitoring and automated insulin dosing for individuals with diabetes.

Key Intravenous Infusion Pumps Companies:

The following are the leading companies in the intravenous infusion pumps market. These companies collectively hold the largest market share and dictate industry trends.

- Baxter

- B. Braun Medical Inc.

- Medtronic

- Micrel Medical Devices SA

- Boston Scientific Corporation

- Cardinal Health

- Fresenius Kabi AG

- ICU Medical, Inc.

- F. Hoffmann-La Roche Ltd

- Tandem Diabetes Care, Inc.

- Terumo Corporation

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Moog Inc.

- IRadimed Corporation

Recent Developments

-

In April 2025, Tandem Diabetes Care launched the Control-IQ+ insulin delivery technology in the U.S. This automated system expands accessibility to adults with type 2 diabetes and children aged two and older with type 1 diabetes.

-

In April 2025, ICU Medical received FDA 510(k) clearance for its new Plum Solo single-channel infusion pump and updated Plum Duo, expanding its IV Performance Platform with enhanced accuracy and data capabilities.

-

In November 2024, Boston Scientific announced an agreement to acquire Intera Oncology, aiming to broaden the company’s interventional oncology portfolio with Intera’s hepatic artery infusion pump technology for treating liver-dominant metastases.

-

In November 2024, ICU Medical, Inc. and Otsuka Pharmaceutical Factory (Japan) announced a joint venture to bolster IV solutions manufacturing and innovation within the North American market.

-

In October 2024, B. Braun Medical announced plans to increase its intravenous saline fluids production by 20% at its Irvine, California, and Daytona Beach, Florida facilities to address supply demands.

-

In April 2024, Baxter obtained FDA clearance for its Dose IQ Safety Software and Novum IQ large volume infusion pump, integrating both infusion modalities.

-

In January 2024, embecta Corp. announced the submission of a 510(k) premarket filing to the U.S. FDA for its proprietary disposable insulin delivery patch pump, designed to address the needs of individuals with type 2 diabetes.

Intravenous Infusion Pumps Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.64 billion

Revenue forecast in 2030

USD 9.98 billion

Growth rate

CAGR of 8.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, disease indication, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Baxter; B. Braun Medical Inc.; Medtronic; Micrel Medical Devices SA; Boston Scientific Corporation; Cardinal Health; Fresenius Kabi AG; ICU Medical, Inc.; F. Hoffmann-La Roche Ltd; Tandem Diabetes Care, Inc.; Terumo Corporation; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; Moog Inc.; IRadimed Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intravenous Infusion Pumps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global intravenous infusion pumps market report based on product, disease indication, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Volumetric Infusion Pumps

-

Syringe Infusion Pumps

-

Insulin Infusion Pumps

-

Enteral Infusion Pumps

-

Ambulatory Infusion Pumps

-

Patient-Controlled Analgesia Infusion Pumps

-

Implantable Infusion Pumps

-

Others

-

-

Disease Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemotherapy

-

Diabetes

-

Gastroenterology

-

Analgesia/Pain Management

-

Pediatrics/Neonatology

-

Hematology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.