- Home

- »

- Agrochemicals & Fertilizers

- »

-

Integrated Pest Management Pheromones Market Report, 2030GVR Report cover

![Integrated Pest Management Pheromones Market Size, Share & Trends Report]()

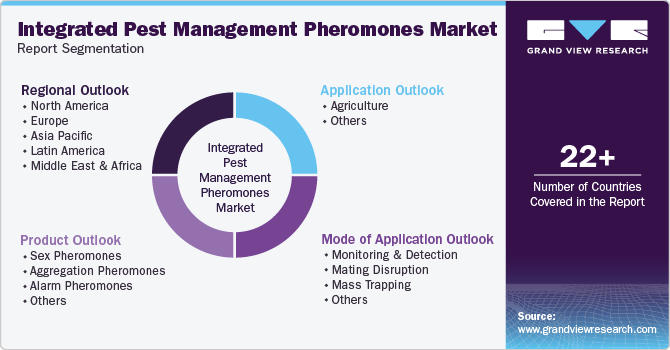

Integrated Pest Management Pheromones Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Sex Pheromones), By Mode Of Application (Monitoring), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-323-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Integrated Pest Management Pheromones Market Summary

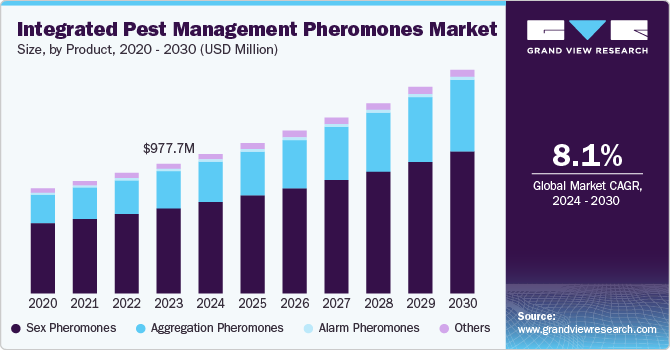

The global integrated pest management pheromones market size was valued at USD 977.7 million in 2023 and is projected to reach USD 1.68 billion by 2030, growing at a CAGR of 8.1% from 2024 to 2030. The market growth is driven by the rising awareness regarding food security and concerns about the ill effects of synthetic crop protection chemicals.

Key Market Trends & Insights

- The North America dominated the global market and accounted for the largest revenue share of 40.9% in 2023.

- U.S. dominated North America and accounted for the largest revenue share of 82.7% in 2023.

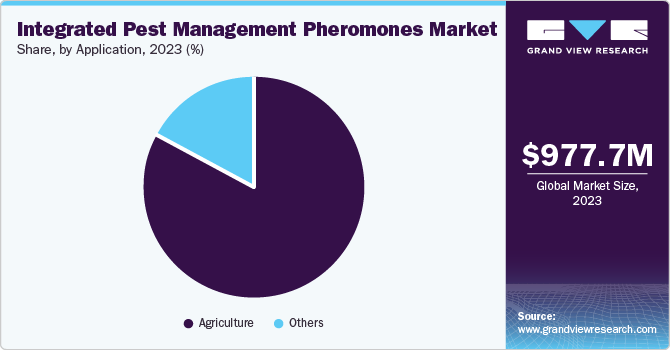

- By application, agriculture segment dominated the market and held the largest revenue share of 82.7% in 2023.

- By product, sex pheromones segment dominated the market and accounted for the largest revenue share of 66.0% in 2023

- By mode of application, mating disruption segment led the market and accounted for the largest revenue share of 41.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 977.7 Million

- 2030 Projected Market Size: USD 1.68 Billion

- CAGR (2024-2030): 8.1%

- North America: Largest market in 2023

In addition, integrated pest management (IPM) pheromones are considered clean and eco-friendly as compared to pesticides and are used to trap, catch, or kill pesticides, mainly during agricultural activities, which further drives market growth.

The U.S. government has taken proactive steps to support and enhance the country's agriculture industry, which is expected to drive the demand for IPM pheromones in the coming years. The USDA has launched an initiative to promote integrated pest management (IPM) practices across various settings, including farms, homes, landscapes, and structures. As a major exporter of agricultural products, the U.S. is encouraging sustainable farming methods, and the incorporation of IPM in crop protection offers numerous advantages. IPM reduces economic risks for farmers while providing cost-effective pest control solutions.

IPM also minimizes health hazards for field workers by promoting best management practices. The decreased crop and land damage is expected to drive the demand for IPM pheromones. In crop protection, insecticide application is known to impact non-targeted species extensively. To target a wider range of species, IPM pheromone suppliers need to invest heavily in R&D to identify and control various pests.

Product Insights

Sex Pheromones dominated the market and accounted for the largest revenue share of 66.0% in 2023 driven by their extensive usage in managing insect populations in the field. Pest management pheromones are highly effective for controlling pests by disrupting mating and preventing larvae from multiplying on crops and trees. Sex pheromones, primarily extracted from female insects, attract males for mating. The eggs laid by these insects on crops hatch into larvae that feed on the crops, leading to reduced yield.

Aggregation pheromones are anticipated to grow at a CAGR of 10.0% over the forecast period attributed to the increasing adoption of sustainable agricultural practices. These pheromones enhance pest control by attracting insects to specific locations, facilitating mass trapping, and effectively reducing pest populations. In addition, rising awareness of the environmental benefits of using pheromones over traditional pesticides is contributing to their popularity. Furthermore, the demand for safer, non-toxic pest management options further supports the growth of aggregation pheromones in modern agriculture.

Mode Of Application Insights

Mating disruption led the market and accounted for the largest revenue share of 41.5% in 2023. By creating artificial dispensers, the integrated pest management technique confuses male insects, delaying mating and pest reproduction. Sex pheromones are widely employed in mating disruption because they can stop male insects from acting in a way that affects moth development. However, mating disruption is a targeted pest management technique and can only be used for certain species of moths.

Mass trapping is expected to grow at a CAGR of 9.0% over the forecast period. The integrated pest management pheromones imitate insect pheromones for attracting, capturing, and disrupting mating patterns. IPM pheromones are available in various types, including sex pheromones, aggregation pheromones, and alarm pheromones. However, the global IPM pheromones market is growing, augmenting the rise of mass trapping, which utilizes insect sex pheromones and positively impacts natural enemies and the environment.

Application Insights

Agriculture dominated the market and held the largest revenue share of 82.7% in 2023 owing to the rising trend of ecological farming and stringent regulations on the usage of pesticides worldwide. In addition, government initiatives promoting the use of eco-friendly pest control methods enhance adoption among farmers. Furthermore, the rising global population and demand for high-quality crops further propel the market. Innovations in pheromone technology and improved formulations also contribute to their effectiveness and cost-efficiency, boosting market growth.

Regional Insights

The North America integrated pest management pheromones market dominated the global market and accounted for the largest revenue share of 40.9% in 2023 pertaining to the rising demand for IPM pheromones in the agricultural sector, which has become mechanized and heavily dependent upon an integrated system for supporting agribusinesses. Farmers in North America have started adopting improved technologies, such as IPM, chemical and bio-fertilizers, and grain elevators. The growing need for effective pest management techniques to develop specialized crops has compelled many farmers to adopt integrated pest management programs for crop protection.

U.S. Integrated Pest Management Pheromones Market Trends

The integrated pest management pheromones market in the U.S. dominated North America and accounted for the largest revenue share of 82.7% in 2023 owing to the technological advancements, and the market shows promising regional variations in customer preferences and market dynamics.In addition, the demand for effective pest management strategies to improve specialty crops resulted in many farmers practicing integrated pest management systems to protect their farms. The country's market is characterized by a strong demand for innovative integrated pest management (IPM) pheromones products and finds a broad market. The country exhibits an escalating market with increasing customer awareness and its advantages of integrated pest management pheromones.

Europe Integrated Pest Management Pheromones Market Trends

Europe integrated pest management pheromones market is expected to experience significant growth over the forecast period. In the present agriculture sector, there are multiple challenges including the requirement to ensure food security and food safety and to address increasing concerns related to the negative effects of pesticides in agriculture. Many European countries have strengthened their IPM research and development (R&D). Simultaneously, IPM R&D practices are often executed across Europe with the assistance of government initiatives.

The integrated pest management pheromones marketin the UK is expected to grow significantly owing to the sustainable and durable crop protection strategies that need to be altered. Integrated pest management (IPM) can prevent crop losses and ensure high-quality production to minimize food security and safety problems. At the same time, it can reduce reliance on conventional pesticides, further boosting the demand for integrated pest management pheromones.

Asia Pacific Integrated Pest Management Pheromones Market Trends

The Asia Pacific region integrated pest management pheromones market is expected to grow at a CAGR of 9.3% over the forecast period. The negative environmental impact of pesticide use, combined with growing concern about pesticides and their negative consequences, has led to the rise in the implementation of IPM pheromones. Many manufacturers and distributors are engaged in the wide-ranging integrated pest management (IPM) pheromone industry in the Asia Pacific region.

The China integrated pest management pheromones market is expected to grow significantly over the forecast period owing to factors such as a huge population and increasing food and vegetable demand. Moreover, farmers in agriculture are using integrated pest management pheromones in crucial ways, further widening the market opportunities.

The integrated pest management pheromones market in India witnessed the negative impacts of conventional pesticides on health, the environment, and living beings, resulting in the strong development of integrated pest management pheromones market utilization on a large scale in agriculture.

Key Integrated Pest Management Pheromones Company Insights

Some of the key companies in the integrated pest management (IPM) pheromones market include Harmony Ecotech Pvt. Ltd., Rovensa Next., AgriSense-BCS Ltd., Laboratorio Agrochem S.L., ATGC, Atlas Agro, Russell IPM Ltd.;in the market focusing on development & to gain a competitive edge in the industry.

- Sumiagro specializes in developing and distributing technically advanced products and offers fertilizers, crop protection goods, biostimulants, biocides, and cupric fungicides. The company’s offerings include herbicides, insecticides, and fungicides.

-

Trécé, Inc. is an agricultural chemical company that offers insect and kairomone-based products to protect food production and preserve the environment. The company’s product portfolio includes over 100 species-specific kits, attractants, and lures under brands including PHEROCON, CIDETRAK, and STORGARD.

Key Integrated Pest Management (IPM) Pheromones Companies:

The following are the leading companies in the integrated pest management pheromones market. These companies collectively hold the largest market share and dictate industry trends.

- Harmony Ecotech Pvt. Ltd.

- Rovensa Next.

- Syngenta

- AgriSense-BCS Ltd.

- Laboratorio Agrochem S.L.

- ATGC

- Atlas Agro

- Russell IPM Ltd

- Hercon Environmental.

- Semios.

- Shin-Etsu Chemical Co., Ltd.

- Sumiagro

- Bioline Agrosciences Ltd.

- Trécé, Inc.

Recent Developments:

- In February 2024, Syngenta and Lavie Bio Ltd. announced a partnership focused on discovering and developing novel bio-insecticides. This partnership was expected to use Lavie Bio's technology platform to identify and improve bio-insecticide candidates with Syngenta's widespread research and commercialization experiences. The partnership addresses the significant global challenge posed by insect pests, which cause crop losses.

Integrated Pest Management Pheromones Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.05 billion

Revenue forecast in 2030

USD 1.68 billion

Growth Rate

CAGR of 8.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 – 2022

Forecast period

2024 – 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Mode of Application, Application, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Indonesia, Brazil, Argentina, Saudi Arabia, Egypt

Key companies profiled

Harmony Ecotech Pvt. Ltd.; Rovensa Next.; Syngenta; AgriSense-BCS Ltd.; Laboratorio Agrochem S.L.; ATGC; Atlas Agro; Russell IPM Ltd; Hercon Environmental.; Semios.; Shin-Etsu Chemical Co., Ltd.; Sumiagro; Bioline Agrosciences ltd.; Trécé, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global integrated pest management pheromones market report based on product, mode of application, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sex Pheromones

-

Aggregation Pheromones

-

Alarm Pheromones

-

Others

-

-

Mode of Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Monitoring & Detection

-

Mating Disruption

-

Mass Trapping

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global integrated pest management pheromones market size was estimated at USD 910.7 million in 2022 and is expected to reach USD 977.7 million in 2023.

b. The global integrated pest management pheromones market is expected to grow at a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 1,682.1 million by 2030

b. North America dominated the IPM pheromones market with a share of 40.77% in 2022. This is attributable to high dependence on an integrated system for supporting agribusinesses.

b. Some key players operating in the integrated pest management pheromones market include Active IPM, Russell IPM, AgrichemBio, AgriSense-BCS Ltd., Laboratorio Agrochem, S.L., ATGC Biotech, Hercon Environmental Corporation, SemiosBIO Technologies, Shin-Etsu, Sumi Agro France, Syngenta Bioline Ltd., Trécé, Inc., and AgbiTech.

b. Key factors that are driving the market growth include rising awareness about benefits of IPM Pheromones and growth in commercial agriculture across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.