- Home

- »

- Pharmaceuticals

- »

-

Iron Deficiency Anemia Therapy Market Size Report, 2030GVR Report cover

![Iron Deficiency Anemia Therapy Market Size, Share & Trends Report]()

Iron Deficiency Anemia Therapy Market Size, Share & Trends Analysis Report By Therapy Type (Oral Iron Therapy, Parenteral Iron Therapy), By Age Group, By End-user, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-124-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global iron deficiency anemia therapy market size was valued at USD 4.49 billion in 2022 and is estimated to grow at a compound annual growth rate (CAGR) of 7.6% from 2023 to 2030. The growth of the market can be attributed to the increasing prevalence of iron deficiency anemia (IDA) due to insufficient iron consumption, an inability of the patient's body to absorb iron, and a growing aging population. Moreover, the increasing global awareness about the importance of early diagnosis & treatment for IDA, increasing healthcare expenditure, growing focus on improving healthcare infrastructure, and various government initiatives & programs aimed at reducing the burden of IDA are further driving market growth.

According to the WHO, anemia is a serious health problem and affects 571 million women and 269 million children globally. Hospitalized seniors are more affected with a prevalence of 40% while nursing home residents experience an even higher prevalence of 47%. The global prevalence of 17% suggests that around 15 million old-age individuals in the European Union and North America may suffer from anemia. The prevalence increases with age, reaching nearly 50% in men above 80 years of age. As the population ages in Western societies, the number of anemic patients is expected to rise considerably in the coming years.

In addition, IDA remains a significant global public health challenge, with a particular impact on adolescent girls and women of reproductive age, including pregnant women. Women of reproductive age are especially susceptible to anemia, and severe or moderate anemia can lead to adverse outcomes during pregnancy. Despite ongoing efforts by governments, the burden of anemia persists as a serious issue worldwide.

According to the World Health Organization (WHO), over half a billion women, or approximately 29.9% of reproductive women aged 15-49 years, suffered from anemia in 2019, with the majority experiencing IDA. Women in their reproductive and adolescent years are particularly susceptible to anemia due to inadequate dietary intake and iron loss during menstruation and pregnancy.

The increasing frequency of government initiatives to control the widespread prevalence of the condition is further driving market growth. For instance, in May 2023, the World Health Organization (WHO) unveiled its comprehensive framework to combat anemia globally, aiming to reduce its prevalence by 50% in women of reproductive age by 2025. Although progress in addressing IDA has been slow, the new framework calls on countries to accelerate action and take a multi-sectoral approach to tackle the root causes and risk factors of anemia.

The framework outlines key action areas to improve intervention coverage and uptake, involving various stakeholders such as governments, civil society, academia, researchers, funding agencies, international organizations, and media. By collaboration, these stakeholders can play a crucial role in minimizing the increasing burden of anemia and promoting overall health. The launch of this new framework took place during the International Maternal Newborn Health Conference.

Therapy Type Insights

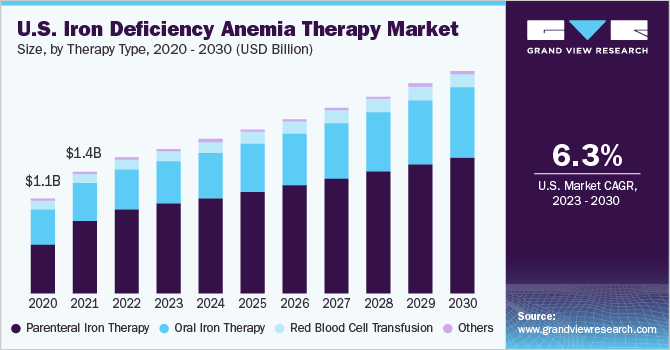

The parenteral iron therapy segment held the largest revenue share of 60.81% in the market for iron deficiency anemia therapy in 2022. This form of therapy plays a critical role in treating IDA, especially for patients who are intolerant or unresponsive to oral iron supplements. It is also necessary for individuals receiving recombinant erythropoietin therapy or suffering from chronic diseases that hinder iron absorption through oral means.

Moreover, advancements in parenteral formulations and new product launches by key companies have improved patient convenience and safety, making it a preferred choice for healthcare providers and patients alike. For instance, in May 2023, Emcure Pharmaceuticals introduced the Orofer FCM 750, an extension of its parenteral iron brand that contains ferric carboxymaltose (FCM). This new dosage variant aims to offer a more effective and convenient solution for patients suffering from IDA. The DCGI-approved FCM is specifically indicated for treating iron deficiency when oral preparations prove ineffective or unsuitable for use.

The oral iron therapy segment is poised to witness the fastest CAGR over the forecast period. The growth of the segment in the IDA therapy market is driven by its convenience, patient preference, effectiveness, wide availability, and increasing cost-effective product launches by key companies. For instance, in March 2023, BioSyent Pharma Inc. launched FeraMAX Pd Maintenance 45 in the Canadian market. This is the company's third offering that utilizes the patented Polydextrose-Iron Complex as an oral iron supplement delivery system.

The product is strategically designed to prevent iron deficiency, maintain optimal levels, and address a specific gap in iron health therapy. By offering such products, market players are catering to the needs of patients seeking effective and convenient treatments for absolute iron deficiency with safe and easy-to-administer oral formulations.

Age Group Insights

The adult age group segment accounted for the largest revenue share of 63.87% in the iron deficiency anemia therapy market in 2022. The presence of a stressful & busy lifestyle and increasing incidence of anemia in women of reproductive age contribute to the growth in prevalence of IDA. Moreover, high levels of stress may reduce the absorption of dietary iron in the gut, even if iron-rich food items are consumed. Additionally, for young women, stress & busy lifestyles can worsen menstrual irregularities, causing heavier blood loss and raising the risk of iron deficiency anemia.

The above-mentioned factors can collectively contribute to the higher susceptibility of IDA in the adult age group. Moreover, healthcare providers and government bodies are actively engaging in awareness campaigns to educate young- and mid-adults about the importance of balanced diets, stress management, and regular health checkups to detect and manage IDA at an early stage, thereby driving the segment’s growth.

The pediatric segment is expected to witness the fastest CAGR over the forecast period. Children are more susceptible to iron deficiency anemia due to rapid growth, insufficient intake, and sometimes inadequate iron absorption from their diet. Moreover, favorable government initiatives are further anticipated to support segment growth in the forecast period. For instance, in 2018, the Indian government introduced the National Nutrition Mission (Poshan Abhiyaan) to reduce anemia prevalence in women and children by 3% annually.

End-user Insights

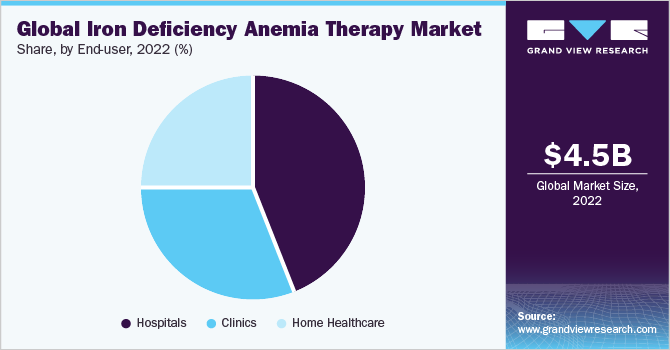

The hospitals segment dominated the market for iron deficiency anemia therapy and held the largest revenue share of 43.67% in 2022. Hospitals are often the primary location for administering intravenous therapy, a common method for treating severe cases of IDA. Intravenous administration of drugs allows for precise dosage and monitoring, which is important for patients with severe anemia or those who cannot tolerate oral supplements. In addition, hospital premises are equipped to handle complex cases and have the necessary facilities, medical staff, and expertise to manage patients with severe conditions, making them the preferred option for treating acute and critical cases of IDA.

Moreover, hospitalized patients already receiving treatment for other conditions may require concurrent iron therapy. Hospitals can easily integrate IDA therapy into their overall treatment plans, ensuring comprehensive care for patients, and have access to a wide range of intravenous formulations, including newer and more advanced products, giving healthcare providers more options to tailor treatments according to individual patient needs.

The home healthcare segment is expected to witness the fastest growth rate from 2023 to 2030. Home healthcare can be more cost-effective than hospitalization, particularly for patients who require long-term or sustained iron therapy. It reduces the financial burden on both patients and healthcare systems. Moreover, the increasing introduction of oral iron drugs will further drive segment growth over the forecast period. Home healthcare allows patients to receive therapy in the comfort of their homes, which is especially appealing for those with chronic or less severe cases of IDA.

Many patients prefer the convenience of home treatment, avoiding the need for frequent hospital visits. Moreover, advancements in telehealth and remote monitoring technologies enable healthcare providers to monitor and manage patients' conditions remotely, making home healthcare a viable and efficient option for many patients. Additionally, the development of user-friendly and safe home administration methods, such as subcutaneous iron infusion systems, has facilitated the growth of home health care in the IDA therapy market.

Regional Insights

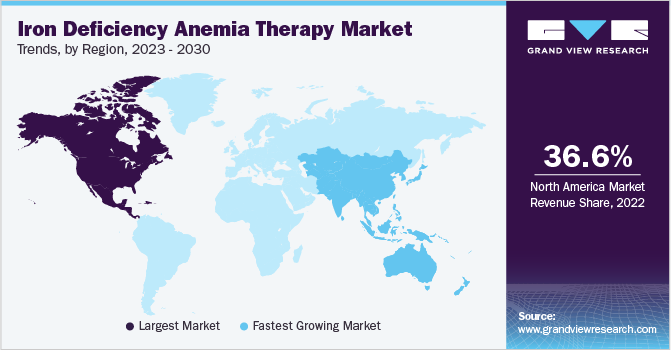

North America dominated the market with a revenue share of 36.56% in 2022. Increasing R&D activities with improved research facilities, the presence of key competitors, and new product launches are the major factors driving regional market growth. For instance, in June 2023, the U.S. FDA approved Daiichi Sankyo’s INJECTAFER for the treatment of iron deficiency in adult patients with heart failure, classified as New York Heart Association class II/III, to enhance exercise capacity. The company stated that this is the first and only FDA approval for an intravenous iron replacement therapy designed specifically for the treatment of progressive and chronic heart failure in adult patients.

The Asia Pacific market for iron deficiency anemia therapy is expected to expand at the fastest CAGR of 9.6% over the forecast period. The increasing incidence of the disease, a large target population, the increasing awareness among people, and favorable strategic initiatives undertaken by local and international market players are driving market growth significantly. In addition, increasing efforts by regional governments to overcome this burden is driving the growth of the IDA therapy market in the APAC region.

For instance, India is actively working towards the ambitious goal of the World Health Organization to reduce anemia by 50% by 2025. To achieve this, a multi-faceted approach is being adopted, with a strong focus on increasing anemia testing and treatment rates from a young age. The ‘Anemia Mukt Bharat’ initiative, launched in 2018, plays a pivotal role in this effort, aiming to address anemia across all stages of life through a comprehensive strategy. Moreover, initiatives like the Ayushman Bharat School Health and Wellness Program actively target preventive measures for anemia among school-going children and adolescents in government and government-aided schools.

Key Companies & Market Share Insights

Key players operating in the market focus on partnerships, strategic collaborations, and geographical expansions in emerging and economically favorable regions. For instance, in March 2023, Nippon Shinyaku Co., Ltd. introduced MonoVer, a new intravenous preparation, to treat iron deficiency anemia in Japan. The formulation contains ferric derisomaltose, which features a high-stability matrix structure binding with iron and a low immunogenicity linear oligosaccharide (derisomaltose) as the API. This new product offers an effective and reliable solution for managing IDA through intravenous injection, catering to the specific needs of patients in the Japanese market. Some of the major players in the global iron deficiency anemia therapy market are:

-

Akebia Therapeutics, Inc.

-

Bayer AG

-

Sanofi

-

Johnson & Johnson Services, Inc.

-

CSL Vifor

-

AbbVie Inc. (Allergan)

-

Teoxane

-

Zydus Group

-

GSK plc

-

Novartis AG

-

AdvaCare Pharma

-

Apotex Inc.

-

Covis Pharma GmbH

-

PHARMACOSMOS A/S

Iron Deficiency Anemia Therapy Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.84 billion

Revenue forecast in 2030

USD 8.06 billion

Growth rate

CAGR of 7.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapy type, age group, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Akebia Therapeutics, Inc.; Bayer AG; PHARMACOSMOS A/S; Sanofi; Johnson & Johnson Services, Inc.; CSL Vifor; AbbVie Inc. (Allergan); Teoxane; Zydus Group; GSK plc; Novartis AG; AdvaCare Pharma; Apotex Inc.; Covis Pharma GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Iron Deficiency Anemia Therapy Market Report Segmentation

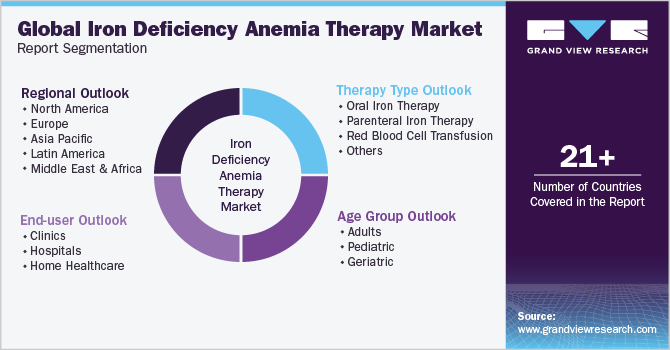

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global iron deficiency anemia therapy market report based on therapy type, age group, end-user, and region:

-

Therapy Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral Iron Therapy

-

Parenteral Iron Therapy

-

Red Blood Cell Transfusion

-

Others

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Pediatric

-

Geriatric

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinics

-

Hospitals

-

Home Healthcare

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global iron deficiency anemia therapy market size was estimated at USD 4.49 billion in 2022 and is expected to reach USD 4.84 billion in 2023.

b. The global iron deficiency anemia therapy market is expected to grow at a compound annual growth rate of 7.6% from 2023 to 2030 and is expected to reach USD 8.06 billion by 2030.

b. The parenteral iron therapy segment is expected to dominate the iron deficiency anemia therapy market with a share of 60.81% in 2022 due to the advancements in parenteral iron formulations and new product launches by the key companies operating in the market.

b. Some key players operating in the iron deficiency anemia therapy market include Akebia Therapeutics, Inc., Bayer AG, Sanofi, Johnson & Johnson Services, Inc., CSL Vifor, and AbbVie Inc. among others.

b. The increasing prevalence of iron deficiency anemia (IDA) due to insufficient iron consumption, an inability of the patient's body to absorb iron, and a growing aging population, increasing global awareness, and favorable government initiatives are the major factors driving the iron deficiency anemia therapy market growth over the forecast period.

b. North America held the largest share of 36.56% in 2022 and is expected to register a lucrative growth rate over the forecast period. It is attributable to the increasing R&D activities with improved research facilities, the presence of key competitors, and new product launches.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."