- Home

- »

- Clothing, Footwear & Accessories

- »

-

Islamic Clothing Market Size, Share, Industry Report, 2033GVR Report cover

![Islamic Clothing Market Size, Share & Trends Report]()

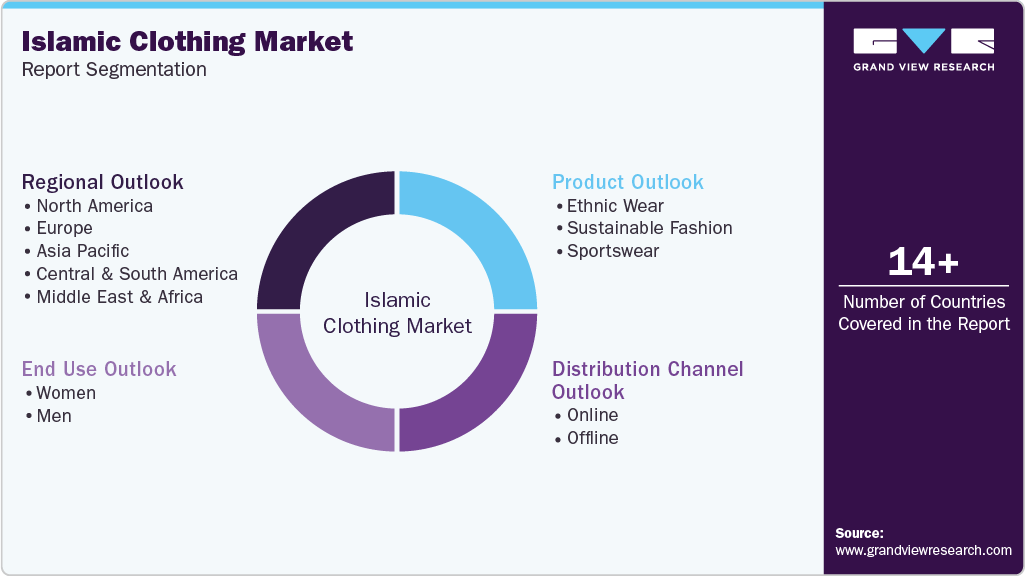

Islamic Clothing Market (2025 - 2033) Size, Share & Trends Analysis Report By End Use (Women, Men), By Product (Ethnic Wear, Sustainable Fashion, Sportswear), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-677-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Islamic Clothing Market Summary

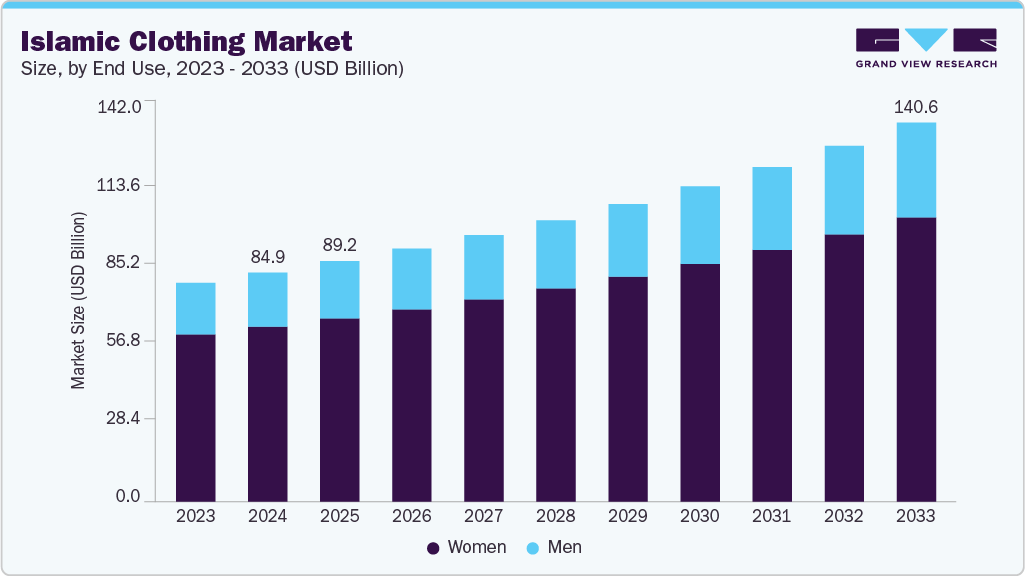

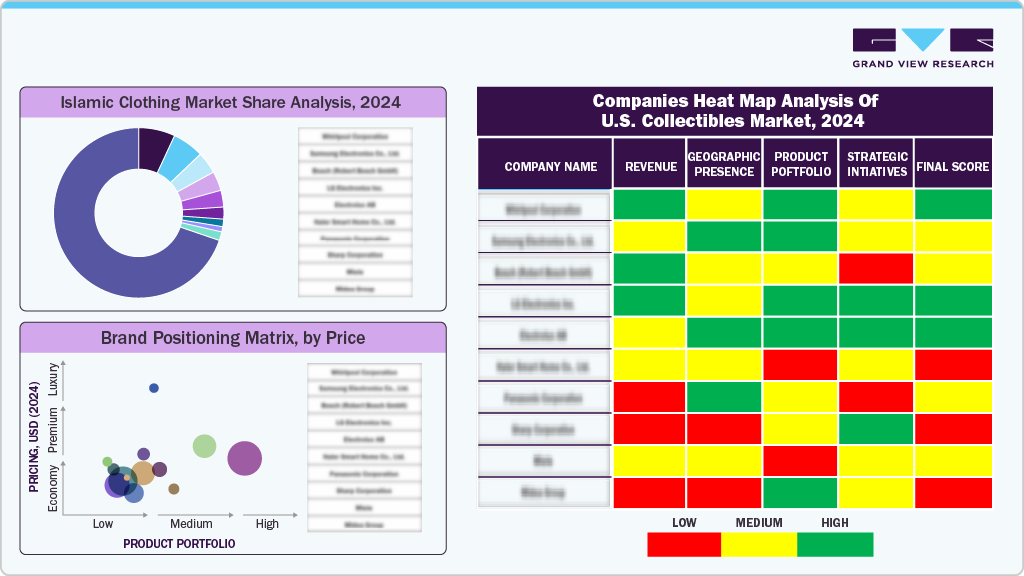

The global Islamic clothing market size was estimated at USD 84.98 billion in 2024 and is projected to reach USD 140.59 billion by 2033, growing at a CAGR of 5.9% from 2025 to 2033. One major driver of this market is the growing global demand for modest fashion, fueled by cultural and religious preferences.

Key Market Trends & Insights

- By region, the Middle East and Africa led the global market with a share of 48.25% in 2024.

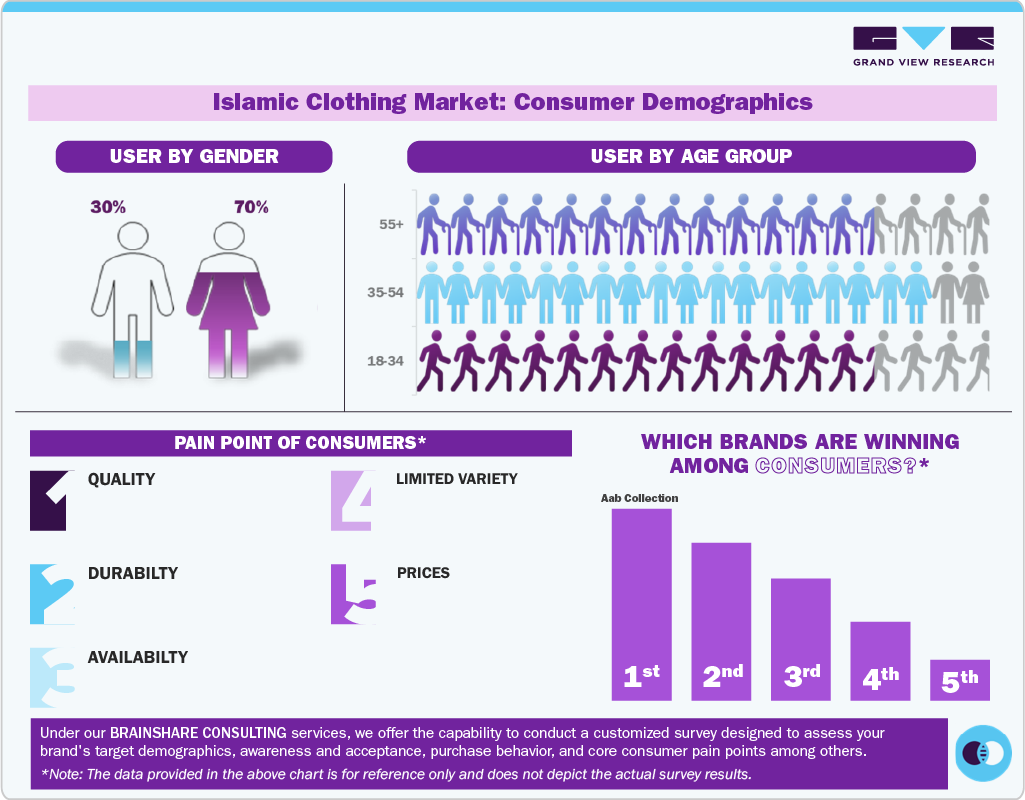

- By end use, the women segment led the market and accounted for a share of 76.41% in 2024.

- By product, the ethnic wear segment led the market and accounted for a share of 78.83% in 2024.

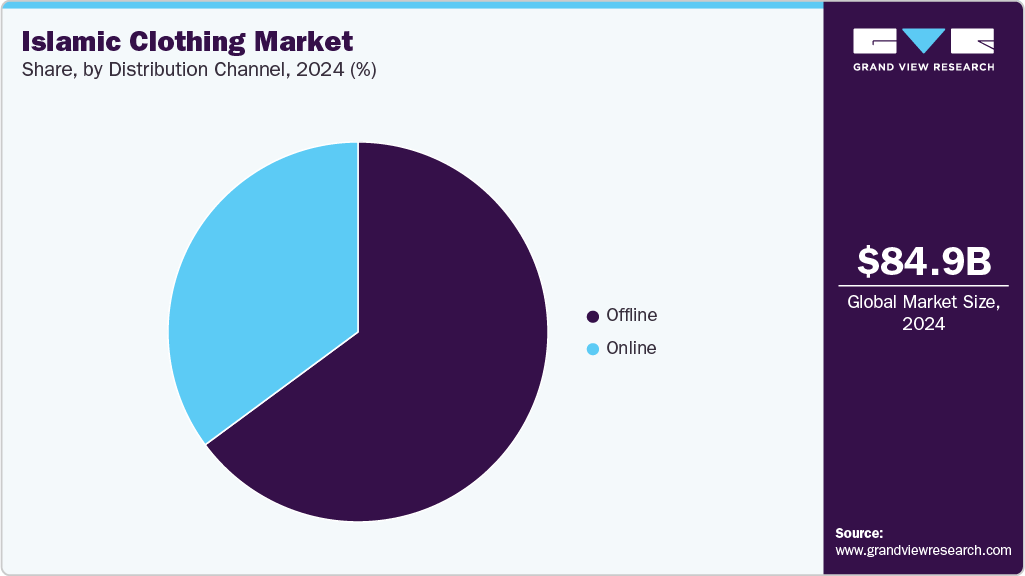

- By distribution channel, the offline segment led the market and accounted for a share of 64.88% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 84.98 Billion

- 2033 Projected Market Size: USD 140.59 Billion

- CAGR (2025-2033): 5.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, the rise of e-commerce and social media has broadened access and visibility, supporting market expansion. The Islamic clothing industry is witnessing steady growth driven by rising demand for modest fashion, fueled by increasing Muslim populations and greater cultural awareness globally. Consumers are seeking stylish yet faith-compliant apparel, encouraging brands to offer modern designs that align with Islamic values. The growing influence of Muslim fashion influencers and social media has also played a key role in shaping preferences and expanding market reach. In addition, the rise of e-commerce platforms has improved accessibility to a wide range of modest wear across regions. Efforts toward inclusive fashion and innovations in fabric and design are further propelling the market forward. According to the data published in April 2025, Qom, Iran, is becoming a hub for modest fashion and attracts millions of pilgrims, both domestic and international, annually, making it a suitable marketplace for Islamic clothing and modest fashion.

There has been a significant rise in awareness and appreciation of modest fashion in Islamic communities and globally in recent years. This trend is driven by a growing desire among consumers to embrace clothing that aligns with their cultural and religious values while still being stylish and contemporary. According to data published in December 2024, the UAE government promotes the inclusion and cultural representation of hijabs.

The rise of social media platforms and fashion influencers plays a crucial role in popularizing modest fashion trends. Many Muslim fashion bloggers, designers, and celebrities showcase creative and modern ways to wear traditional Islamic garments, making modest fashion more accessible and appealing to younger generations. This increased visibility has helped break stereotypes about Islamic clothing being old-fashioned or restrictive, encouraging more consumers to explore and invest in modest apparel. According to the data published in December 2024, popular hijab influencers-based in Dubai include Nourhan Elgouhary with 802k followers, Rasha Albeik with 750k followers, and Yusra Alsayed with 739k followers on social media.

Consumer Insights

End Use Insights

The women segment was the largest segment in terms of revenue in 2024, accounting for a share of 76.41%. The women segment is driven by their increasing desire to balance religious modesty with contemporary fashion trends. Muslim women are seeking clothing that reflects their cultural and religious values while also offering style, comfort, and versatility for everyday wear and social occasions. The rising participation of women in education, the workforce, and social activities has expanded their need for diverse, functional, and fashionable modest apparel such as hijabs, abayas, and kaftans. Moreover, social media platforms have empowered Muslim women to express their fashion sense publicly, inspiring others and shaping global modest fashion trends.

The men segment is anticipated to witness a CAGR of 6.5% from 2025 to 2033 due to the growing global Muslim population, rising cultural pride, and the broader popularity of modest fashion. Younger generations are embracing traditional attire as a means of expressing their identity, while modern designs and e-commerce have made Islamic wear more accessible and stylish. The comfort and versatility of garments like thobes and kurtas, combined with rising disposable incomes in Muslim-majority nations and the entry of mainstream brands into the modest fashion segment, are further fueling the global growth of this market.

Product Insights

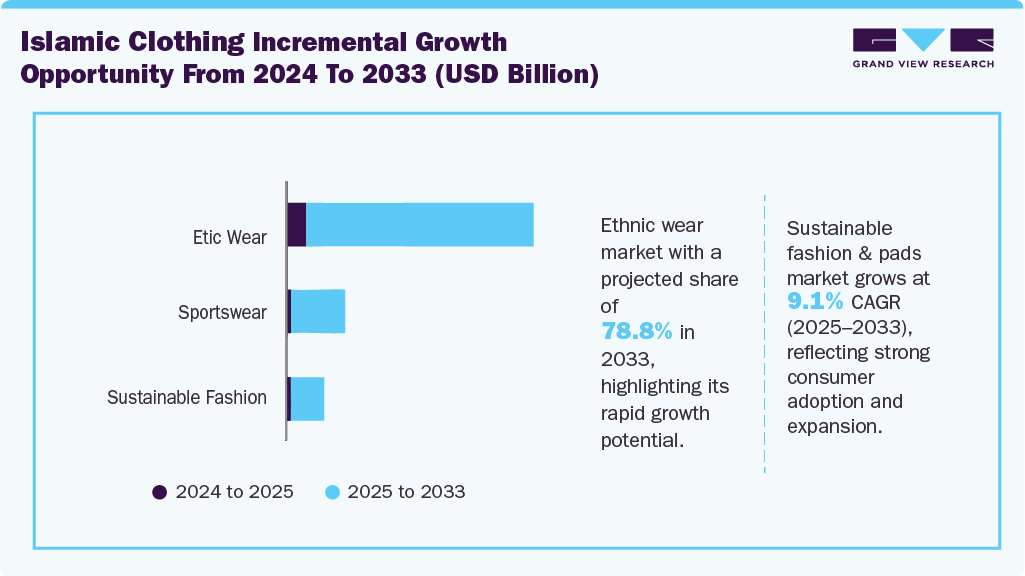

Ethnic wear is the largest segment, which accounted for a share of 78.83% in 2024. The ethnic wear segment is experiencing significant growth, driven by several key factors that reflect evolving consumer preferences and cultural dynamics. A prominent trend is the fusion of traditional garments, such as abayas, hijabs, prayer outfits, burkhas, and thobes, with contemporary fashion elements. Designers are incorporating modern fabrics, colors, and silhouettes into these pieces, making them more appealing to younger, fashion-conscious consumers while maintaining modesty standards.

Sustainable fashion is projected to witness a CAGR of 9.1% from 2025 to 2033. The sustainable fashion segment is primarily driven by a rising environmental consciousness among Muslim consumers who seek to align their clothing choices with both their faith and ethical values. Many Muslim consumers recognize that sustainability is deeply rooted in Islamic principles, such as modesty, resource conservation, and social responsibility, which discourage wastefulness and encourage mindful consumption. This awareness motivates them to prefer apparel made from eco-friendly materials, such as organic cotton and recycled fabrics, produced through fair labor practices and transparent supply chains. In addition, the increasing availability of stylish, modern modest wear that incorporates sustainable design innovations appeals to younger, fashion-forward Muslim consumers who want to express their identity without compromising environmental ethics. Social media and Muslim fashion influencers further amplify this trend by showcasing sustainable modest fashion, making it more visible and desirable.

Distribution Channel Insights

The offline distribution channel is the largest growing segment, which accounted for a share of 64.88% in 2024. Consumers often prefer to touch, feel, and try on garments before purchasing to ensure a proper fit, high-quality fabric, and adherence to modesty standards. Traditional and cultural attire usually involves tailoring, customization, and personal consultations, which are better facilitated in physical stores. Moreover, in many Muslim-majority regions, local boutiques, bazaars, and specialized retailers remain the primary shopping channels due to limited online penetration and a preference for face-to-face transactions. Festivals like Eid and Ramadan also drive heavy in-store shopping, as consumers value the social and experiential aspect of buying clothing in person.

The online distribution channel is expected to grow at a CAGR of 7.2% from 2025 to 2033. The sales of Islamic clothing through online distribution channels are expected to witness the highest growth in the coming years. The market is largely driven by the convenience and accessibility that e-commerce websites provide, allowing shoppers to browse extensive collections of modest wear anytime and anywhere. Consumers appreciate the wide variety of styles, sizes, and price points available on these platforms, which often include detailed product descriptions, size guides, and customer reviews that aid informed purchasing decisions.

Regional Insights

Middle East & Africa Islamic Clothing Market Trends

The Islamic clothing industry growth in the Middle East and Africa is deeply rooted in cultural, religious, and lifestyle factors that make modest wear an essential and everyday requirement. The region has a predominantly Muslim population, where spiritual practices and traditional norms strongly influence dress choices. Consumers across MEA view Islamic clothing as a fashion preference and a reflection of faith and identity. The region’s expanding Muslim population strongly adheres to Islamic values and traditions, which creates a consistent demand for modest and religiously appropriate attire. The daily use of garments such as abayas, hijabs, kaftans, thobes, and prayer outfits ensures consistent demand across all age groups and demographics.

Increasing urbanization and rising disposable income, especially in countries like the UAE, Saudi Arabia, and Nigeria, have shifted toward premium and designer Islamic fashion. Consumers are now looking for garments that blend tradition with modern aesthetics, which has created a robust market for innovative, stylish, and high-quality products. There is a growing demand for modest wear that can be worn at workplaces, educational institutions, social gatherings, and even in athletic settings. In addition, the increasing presence of Islamic fashion events and influencers in the region promotes awareness and interest in diverse Islamic clothing styles.

In May 2025, Aab Collection launched the first drop of its Eid al-Adha collection, designed for warm weather days, elegant evenings, and everything in between. The release reflects Aab’s continued commitment to blending traditional modest wear with contemporary elegance. The much-anticipated collection officially arrived on June 8, offering fresh styles just in time for Eid celebrations.

North America Islamic Clothing Market Trends

The North American Islamic clothing industry is driven by the region’s growing Muslim population, rising cultural diversity, and the mainstream acceptance of modest fashion. Consumers are increasingly seeking apparel that balances religious values with contemporary style, prompting both local designers and global brands to introduce modern modest collections. The surge of e-commerce and social media influencers has expanded market visibility, while sustainability and ethical fashion practices are becoming key factors in purchasing decisions. In addition, rising disposable incomes and inclusivity in fashion are encouraging more men and non-Muslim consumers to adopt modest wear, further fueling market growth.

U.S. Islamic Clothing Market Trends

The U.S. Islamic clothing industry is projected to grow at a CAGR of 6.5% from 2025 to 2033. In the U.S., modest fashion is increasingly characterized by blending modesty with contemporary style, moving beyond traditional silhouettes to include modern cuts, soft draping, layering, and trend-driven colors that allow women to express their personal style while maintaining coverage. At the same time, identity and cultural representation shape how Muslim consumers engage with clothing, as many use modest dress to affirm both their American and Muslim identities in diverse social spaces. For instance, Haute Hijab, a U.S.-based brand that designs stylish hijabs and modest dresses for modern Muslim women who want to balance faith-based modesty with everyday fashion, illustrates how modest wear has become both a cultural statement and a lifestyle fashion choice in the American market.

Asia Pacific Islamic Clothing Market Trends

The Asia Pacific Islamic clothing industry is experiencing robust growth, driven by its large Muslim population, rising disposable incomes, and increasing fashion consciousness across countries such as Indonesia, Malaysia, Pakistan, and Bangladesh. Consumers are embracing modern modest wear that combines traditional elements with contemporary design, while e-commerce and social media platforms are expanding access and brand visibility. The region’s strong textile manufacturing base supports both domestic demand and exports, and growing interest in sustainability and ethical fashion among younger consumers is shaping product innovation and design trends.

Key Islamic Clothing Company Insights

Leading players in the Islamic clothing industry include Aab Collection, Modanisa, and Haute Hijab. The global market for Islamic clothing remains highly competitive, with key players focusing on expanding production capabilities and strengthening distribution networks across both online and offline channels. Manufacturers are investing in design innovation, sustainable fabric sourcing, and advanced tailoring technologie to meet the growing demand for modest, stylish, and eco-friendly apparel. The rising global Muslim population further drives market growth, increasing cultural pride and the expression of identity, as well as the expanding adoption of modest fashion across mainstream and luxury segments.

Key Islamic Clothing Companies:

The following are the leading companies in the islamic clothing market. These companies collectively hold the largest market share and dictate industry trends.

- Aab Collection

- Modanisa

- Haute Hijab

- SUKAINA

- An-Nahar

- AbayaAddict

- Inayah

- SHUKR Islamic Clothing

- Haf & Haf

- The WRDS Clothing

Recent Developments

-

In July 2025, A UK-based couplelaunched a faith-inspired children's lifestyle brand called Once Upon a Dua, targeting the UAE market and broader Gulf region. Founded in 2022, the brand offers a range of baby essentials and toys, including keepsake hijabi dolls, Arabic-alphabet dinner sets, ride-on cars, and personalized items that combine Scandinavian-influenced design with Islamic cultural themes. They aim to fill a niche for stylish yet faith-forward children's products by blending modern aesthetics and value-driven design, noting that parents increasingly value culture and heritage in their children's toys and essentials.

Islamic Clothing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 89.20 billion

Revenue Forecast in 2033

USD 140.59 billion

Revenue Growth rate

CAGR of 5.9% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End use, product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East and Africa

Countries covered

U.S.; UK; Germany; Turkey; Russia; Indonesia; Malaysia; India; Egypt; Saudi Arabia; Nigeria; UAE

Key companies profiled

Aab Collection; Modanisa; Haute Hijab; SUKAINA; An-Nahar; AbayaAddict; Inayah; SHUKR Islamic Clothing; Haf & Haf; The WRDS Clothing

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Islamic Clothing Market Report Segmentation

This report forecasts revenue growth at regional levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global Islamic clothing market report by end use, product, distribution channel, and region:

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Women

-

Men

-

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Ethnic Wear

-

Abayas & Hijabs

-

Prayer Outfits

-

Burkha & Naqaab

-

Thobes & Jubbas

-

Others

-

-

Sustainable Fashion

-

Sportswear

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Online

-

E-commerce Website

-

Company-owned Website

-

-

Offline

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

Turkey

-

Russia

-

-

Asia Pacific

-

Indonesia

-

Malaysia

-

India

-

-

Middle East and Africa (MEA)

-

Egypt

-

Saudi Arabia

-

Nigeria

-

UAE

-

-

Central & South America

-

Frequently Asked Questions About This Report

b. The global active insulation market size was estimated at USD 84.98 billion in 2024 and is expected to reach USD 89.20 billion in 2025.

b. The global islamic clothing market is expected to grow at a compounded annual growth rate of 5.9% from 2025 to 2033 to reach USD 140.59 billion in 2033.

b. Middle East & Africa dominated the islamic clothing market with a share of 48.25% in 2024. High Islamic population coupled with rising adoption of innovative modest clothing in countries, such as UAE and Egypt is anticipated to drive the regional demand.

b. Some key players operating in the islamic clothing market include Hennes & Mauritz AB (H & M), Aab, Marks & Spenser (M & S), and Saqina.

b. Key factors driving the islamic clothing market growth include preferences for modest fashion wear coupled with increasing Islamic population

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.