- Home

- »

- Organic Chemicals

- »

-

Isobutanol Market Size And Share, Industry Report, 2030GVR Report cover

![Isobutanol Market Size, Share & Trends Report]()

Isobutanol Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Synthetic, Biobased), By Application (Oil & Gas, Solvents & Coatings, Chemical Intermediate), By Region, And Segment Forecasts

- Report ID: 978-1-68038-577-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Isobutanol Market Size & Trends

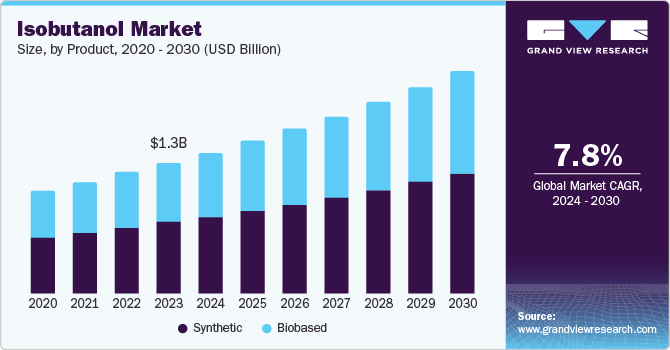

The global isobutanol market size was valued at USD 1.28 billion in 2023 and is projected to grow at a CAGR of 7.8% from 2024 to 2030. The market is poised for significant growth, driven by its multifaceted applications across industries, including automotive fuel, chemicals, personal care, and pharmaceuticals. With a focus on sustainability, technological advancements, and regulatory support for greener technologies, the market is expected to exhibit a steady growth trajectory in the coming years.

Market growth is significant due to the increasing adoption of isobutanol as a fuel replacement for gasoline, driven by its ability to boost octane numbers and reduce emissions. This trend is particularly appealing to automotive companies seeking to comply with stringent emissions standards. Furthermore, the rising demand for biofuels and the shift towards cleaner energy sources are fueling the use of isobutanol.

Isobutanol’s versatility is also driving its demand across various industries. As a chemical intermediate, it is used in the production of butyl acrylate, butyl acetate solvents, and other products. The growth in chemical production, particularly in developing nations, is a key driver of demand for isobutanol in the coatings, adhesives, and plastic products sectors. Moreover, the personal care industry leverages isobutanol as a solvent for cosmetics and fragrances in perfumes, lotions, hair products, and other products.

The ease of manufacturing isobutanol from renewable feedstocks such as corn or sugarcane via fermentation has made it an attractive option for manufacturers. Technological innovations have not only reduced production costs but also improved yield efficiency, making it a preferred choice among manufacturers. Major market players are collaborating and investing in research and development to enhance production processes and explore new end-use applications for isobutanol.

Product Insights

Synthetic isobutanol held the highest revenue share of 54.6% in 2023. Synthetic isobutanol is primarily produced through large-scale petrochemical processes, utilizing readily available raw materials such as propylene and butylene from crude oil refining or natural gas production. This method yields higher purity products, making it ideal for applications in pharmaceuticals and cosmetics where high-quality products are required.

Biobased isobutanol is expected to register the fastest CAGR of 8.0% during the forecast period. The growing concern about climate change and environmental degradation is driving demand for sustainable alternatives. Biobased isobutanol, produced from renewable biomass sources such as corn or sugarcane, offers a carbon-neutral solution. It can be used as a solvent, gasoline additive, or feedstock for other chemicals, promoting world sustainability and reducing petroleum-based emissions.

Application Insights

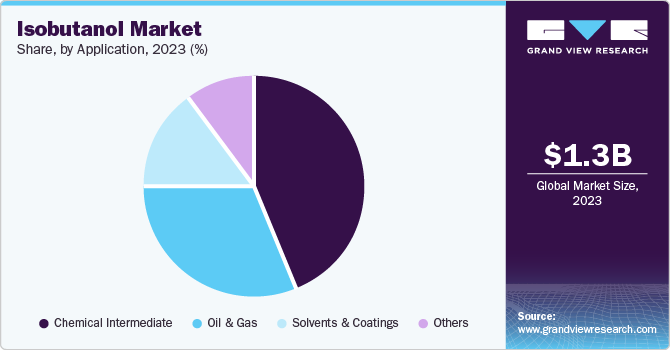

The chemical intermediate segment dominated the market with a revenue share of 44.4% in 2023. Isobutanol serves as a raw material for producing various chemicals, including Butyl Acrylate, Isobutyl Acetate, and Plasticizers. Its versatility allows for widespread adoption across industries, creating demand for it in the chemical intermediate segment. This versatility will enable manufacturers to capitalize on its diverse applications and drive growth.

The oil & gas segment is expected to register the fastest CAGR of 8.2% during the forecast period. Isobutanol plays a significant role in the oil and gas industry, particularly in fuel formulation, where it enhances gasoline octane numbers, improving engine performance and economic benefits. Moreover, government initiatives aimed at reducing fossil fuel reliance have driven the development of alternative fuel sources, ensuring isobutanol’s relevance in the sector.

Regional Insights

Asia Pacific isobutanol market dominated the global isobutanol market with a market share of 39.2% in 2023. The Asia Pacific region has experienced rapid economic growth, driving demand for chemicals such as isobutanol. Developing countries in the region industrialized, necessitating increased production of isobutanol. Advanced production techniques in countries such as China and Japan have enabled efficient synthesis from various sources.

China Isobutanol Market Trends

The isobutanol market in China dominated the Asia pacific isobutanol market with a revenue share of 70.9% in 2023. China has been actively investing in its chemical manufacturing sector, with a focus on isobutanol production. The country boasts multiple large-scale production facilities, leveraging advanced technologies to optimize output. This scale enables Chinese manufacturers to meet both domestic and international demand efficiently, solidifying their position as a major player in the industry.

Latin America Isobutanol Market Trends

Latin America isobutanol market is expected to register the fastest CAGR of 8.4% during the forecast period. Latin America offers several natural resources, including agricultural feedstock, suitable for synthesizing bio-based chemicals such as isobutanol. The region’s climate fosters the growth of crops such as sugarcane, corn, and cassava, which can be fermented to produce isobutanol. Brazil, in particular, has established itself as a leading producer of bioethanol, a key precursor to isobutanol through fermentation.

The isobutanol market in Brazil is expected to grow lucratively in the forecast period. Brazil, a leading sugarcane producer, leverages this feedstock to manufacture bio-based chemicals such as isobutanol. By modifying fermentation processes to yield isobutanol, Brazil can optimize production. Moreover, the country has implemented initiatives to promote renewable energy and reduce greenhouse gas emissions, solidifying its commitment to sustainability.

North America Isobutanol Market Trends

North America isobutanol market is expected to grow significantly over the forecast period. North America has taken a leading role in isobutanol production, driven by technological advancements. Government policies promoting renewable energy sources have increased demand for bio-based chemicals such as isobutanol. The Renewable Fuel Standard (RFS) mandates blending of renewable fuels with conventional gasoline, providing a framework for growth.

The isobutanol market in U.S. held a substantial market share in 2023. The U.S. benefits from an abundant feedstock for chemical production, particularly shale gas and natural gas liquids (NGLs), which are readily available and cost-effective for isobutanol production. The country has also invested in cutting-edge facilities to produce isobutanol, positioning itself as a leader in the industry.

Europe Isobutanol Market Trends

Europe isobutanol market held significant revenue share in 2023. Europe’s growing market share in isobutanol consumption is attributed to a combination of factors, including historical industrial policies, a favorable policy environment for sustainable processes, advancements in production technologies, and increasing demand for biofuels. Moreover, strategic partnerships between existing players have also contributed to the growth.

The isobutanol market in Germany is expected to grow rapidly over the forecast period. Germany’s robust research and development (R&D) infrastructure and skilled workforce provide a strong foundation for innovation. The country’s chemical industry has historically prioritized process development, resulting in efficiency gains across various sectors. This expertise is particularly evident in isobutanol production, where German companies have leveraged their know-how to achieve operational excellence.

Key Isobutanol Company Insights

Some key companies in the isobutanol market include Tokyo Chemical Industry Co., Ltd.; Mitsubishi Chemical Group Corporation.; Nexchem Ltd; KH Neochem Co., Ltd.; and others. Market participants have employed various strategies, including new product introductions, distribution enhancements, geographical expansion, and other initiatives to stay competitive.

-

Tokyo Chemical Industry Co., Ltd., Japan, is a manufacturer of specialty organic chemicals, offering a wide range of laboratory chemicals, pharmaceuticals, cosmetics, and functional materials. With over 70 years of experience, TCI provides over 30,000 products and custom synthesis services, supported by global facilities in North America, Europe, China, and India.

-

BASF offers a comprehensive portfolio in the isobutanol market. With a focus on synthetic processes, advanced technologies, and sustainability, BASF produces high-quality isobutanol for various industries, including automotive, coatings, and pharmaceuticals.

Key Isobutanol Companies:

The following are the leading companies in the isobutanol market. These companies collectively hold the largest market share and dictate industry trends.

- Tokyo Chemical Industry Co., Ltd.

- Mitsubishi Chemical Group Corporation.

- Nexchem Ltd

- KH Neochem Co., Ltd.

- BASF

- ChemBK.com

- Advanced Biotech

- Exxon Mobil Corporation

- SANKYO CHEMICAL CO.,LTD.

- KANTO KAGAKU

Recent Developments

-

In July 2024, OQ Chemicals announced a price increase of USD 110 per metric ton for Iso-Butanol and n-Butanol, driven by tight supply of feedstock Propylene. The move was attributed to market volatility, force majeure declarations, and power disruptions following Hurricane Beryl.

Isobutanol Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.38 billion

Revenue forecast in 2030

USD 2.16 billion

Growth Rate

CAGR of 7.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan

Key companies profiled

Tokyo Chemical Industry Co., Ltd.; Mitsubishi Chemical Group Corporation.; Nexchem Ltd; KH Neochem Co., Ltd.; BASF; ChemBK.com; Advanced Biotech; Exxon Mobil Corporation; SANKYO CHEMICAL CO.,LTD.; KANTO KAGAKU

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Isobutanol Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global isobutanol market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Synthetic

-

Biobased

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Solvents & Coatings

-

Chemical Intermediate

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.