- Home

- »

- Renewable Chemicals

- »

-

Global Isosorbide Market Size & Share Report, 2022-2030GVR Report cover

![Isosorbide Market Size, Share & Trends Report]()

Isosorbide Market (2022 - 2030) Size, Share & Trends Analysis Report By End Use (Resins & Polymers, Additives), By Application (PEIT, Polycarbonate), By Region, And Segment Forecasts

- Report ID: 978-1-68038-029-3

- Number of Report Pages: 153

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

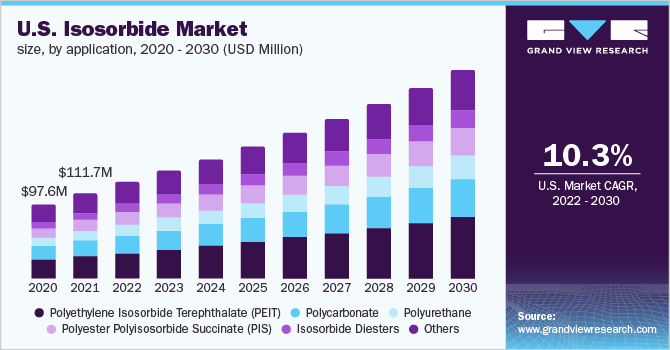

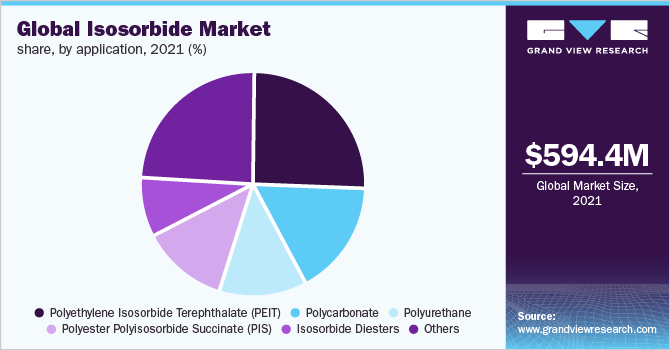

The global isosorbide market size was valued at USD 594.4 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 9.1% from 2022 to 2030. The market growth is attributed to the growing demand for isosorbide bioplastic production. The global market is impacted by multiple factors such as increasing focus on a high-quality product depending on its applications in emerging markets and increasing legislation concerning the sustainability of chemicals. Moreover, sustainability has emerged as one of the prominent trends among manufacturers as it positively impacts their brand image among well-aware consumers across developed countries such as the U.S. and the U.K.

The U.S. EPA has implemented rigorous laws in North America on account of growing environmental concerns regarding the usage of synthetic polymers, which has encouraged the biotechnology and polymer industry players to develop new technologies using eco-friendly ingredients. Isosorbide derived from starch is an environmentally friendly alternative to synthetic polymers. This factor is expected to have a positive impact on product demand in the region.

The growing demand for bioplastics is likely to drive the North American market. Furthermore, the regional market is characterized by strong demand for sustainability, which has resulted in a significant demand for sustainable ingredients in packaging applications. The U.S. Department of Agriculture's measures to promote environmentally friendly products is likely to promote the overall demand for bioplastics in North America.

Various government initiatives and regulatory support are likely to foster green chemical manufacturing. For instance, in Europe, Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) supports manufacturers of bio-based/green products by providing them with opportunities to develop and market sustainable bio-based/green alternatives. However, manufacturers must comply with certain registration exemptions implemented by REACH.

End-use Insights

Resin and polymers dominated the market with a revenue share of more than 50.0% in 2021. This can be attributed to the increasing product significance in the bio-refining industry for the development of novel bio-based polymers and resins. For instance, isosorbide-methacrylate is a low-viscosity cross-linking polymer used for the production of thermoset polymers having enhanced mechanical and thermal properties.

Increasing product demand as a key platform chemical for developing various cyclic molecules and polymers along with its versatile chemical characteristics is expected to boost the product application in a host of polyesters for various end-use industries such as packaging, durable goods, and optical media.

Isosorbide, either as a monomer or as a component of macromonomers for curable resins, has the ability to improve the qualities of coatings, particularly optics and scratch resistance. In thermosetting resins, the use of isosorbide can have a positive impact on coating qualities including gloss and hardness. In foam applications, its usage in PUs has been shown to boost the transition temperature (Tg) and compression strength.

Synthetic isosorbide finds application as a fuel additive in diesel and as an electrolyte additive in lithium-ion accumulators. The demand for bio-based fuel additives is rapidly expanding. Because of strict environmental protection legislation and increased awareness among regional consumers, North America and Europe have emerged as major consumers of bio-based fuel additives.

Application Insights

Polyethylene Isosorbide Terephthalate (PEIT) dominated the market with a revenue share of more than 25.0% in 2021. This large share is attributed to the mounting consumption of the product in thermoplastics and packaging applications such as hot-fill containers, jars, and bottles.

PEIT polymer comprises enhanced material properties compared to polyethylene terephthalates (PET), such as higher glass transition temperature, rigidity, and UV resistance. Such properties make PEIT ideal for thermoplastics and packaging applications. PEIT is the most widely used application of isosorbide. For instance, using it as a chain extender for thermoplastic polyurethanes has a significant effect on the mechanical and thermal properties of the material compared to traditional petroleum-sourced polymers, while also increasing the biologically-sourced composition of these polymers simultaneously.

Polycarbonates are highly regarded as engineering plastics because they combine good mechanical and thermal qualities with transparency and other optical benefits. These properties allow for a wide range of applications, including food & beverage containers, optical displays, protective barriers, and lenses. Traditional polycarbonate is derived from bisphenol A, a petrochemical feedstock that has been linked to reproductive, developmental, and other health problems. As a result, BPA-free polycarbonates are highly demanded.

In recent years, in the search for sustainable alternatives, isosorbide has gained popularity as an excellent substitute for isocyanates in polyurethane production. Isosorbide-based polyurethane products display properties such as high thermal stability and low polydispersity. Consequently, they are used in the production of coatings, foams, and elastomers. Furthermore, based on the enhanced insulation characteristics of PU foam, isosorbide-based polyurethane finds significant use in a broad range of applications including packaging, automotive, and construction.

Growing concerns over environmental degradation have compelled automotive companies to switch to bio-based components with enhanced thermal stability and chemical resistance. In addition, the high glass transition temperature and chemical versatility of these isosorbide derivatives are expected to drive the demand for the product in the aforementioned applications over the forecast period. The sustainability and eco-friendly characteristics of the product are the key factors propelling its demand in the global market.

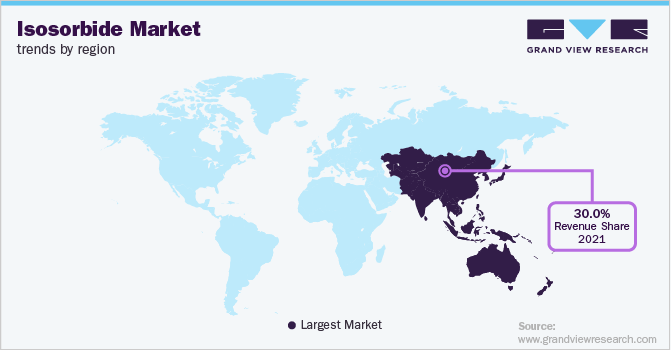

Regional Insights

Asia Pacific dominated the market with a revenue share of over 30.0% in 2021. This high is attributed to the easy availability of raw materials, cheap labor, and the expansion of end-use industries such as pharmaceutical, personal care, nutraceutical, and cosmetics. All the prominent players in the market are situated in the Asia Pacific.

Asia Pacific is anticipated to dominate the global market owing to the presence of some of the largest polymer manufacturers as well as a large clientele base. Owing to significant factors such as a shortage of fossil fuel resources, rising product demand from developing nations such as Indonesia, Thailand, and Malaysia, and fluctuating petroleum prices, the Asia Pacific market is likely to grow at a fast pace.

Furthermore, government regulations to reduce VOC content in paints and coatings are projected to drive the bio-based coatings market in North America. Bio-based coatings demand in the region is predicted to be driven by the emergence of green construction norms. Increasing automobile demand combined with the emergence of industrial development is likely to drive the demand for bio-based coatings in North America, in turn, boosting the consumption of isosorbide in coating applications over the forecast period.

Bio-based materials such as bio-based thermosets and bioplastics are increasingly being used in the automotive industry. The growing popularity of bio-concept cars is expected to boost the demand for isosorbide-based thermoplastics. Constant efforts by the European Authorities to establish a bio-based sector and numerous plans and policies aimed at achieving long-term economic growth are expected to drive isosorbide demand in the region.

Key Companies & Market Share Insights

Leading companies are focusing on expanding their operations globally in order to acquire a large market share. Roquette is the world's largest manufacturer of isosorbide present across the value chain and is involved in the manufacturing of products such as starch, isosorbide, and biopolymers. Polysorb is a brand of bio-based isosorbide derivatives offered by Roquette. Parchem Fine & Specialty Chemicals, for example, is a significant product distributor. Some prominent players in the global isosorbide market include:

-

J&K Scientific Ltd.

-

Jinan Hongbaifeng Industry & Trade Co., Ltd.

-

Novaphene

-

Roquette Frères

-

MANUS AKTTEVA BIOPHARMA LLP

Isosorbide Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 663.6 million

Revenue forecast in 2030

USD 1.30 billion

Growth Rate

CAGR of 9.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million, volume in tons, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; China; India; Japan

Key companies profiled

J&K Scientific Ltd.; Jinan Hongbaifeng Industry & Trade Co., Ltd.; Novaphene; Roquette Frères; MANUS AKTTEVA BIOPHARMA LLP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Isosorbide Market Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global isosorbide market report on the basis of end-use, application, and region:

-

End-use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Resins & Polymers

-

Additives

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene Isosorbide Terephthalate (PEIT)

-

Polycarbonate

-

Polyurethane

-

Polyester Polyisosorbide Succinate (PIS)

-

Isosorbide Diesters

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global isosorbide market size was estimated at USD 594.4 million in 2021 and is expected to reach USD 663.6 million in 2022.

b. The global isosorbide market is expected to grow at a compound annual growth rate of 9.1% from 2022 to 2030 to reach USD 1.30 billion by 2030.

b. Resins & polymers dominated the isosorbide market with a share of 53% in 2021. This is attributable to the increasing significance in the bio-refining industry for the development of novel bio-based polymers and resins.

b. Some key players operating in the isosorbide market include Roquette Frères, and Novaphene.

b. Key factors that are driving the market growth include increasing demand for isosorbide derivatives in medical applications and growth in the bioplastic sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.