- Home

- »

- IT Services & Applications

- »

-

IT Asset Disposition Market Size, Industry Report, 2030GVR Report cover

![IT Asset Disposition Market Size, Share & Trend Report]()

IT Asset Disposition Market (2025 - 2030) Size, Share & Trend Analysis By Asset Type (Computers/Laptops, Smartphones & Tablets, Peripherals), By End Use (BFSI, IT & Telecom, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-950-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

IT Asset Disposition Market Summary

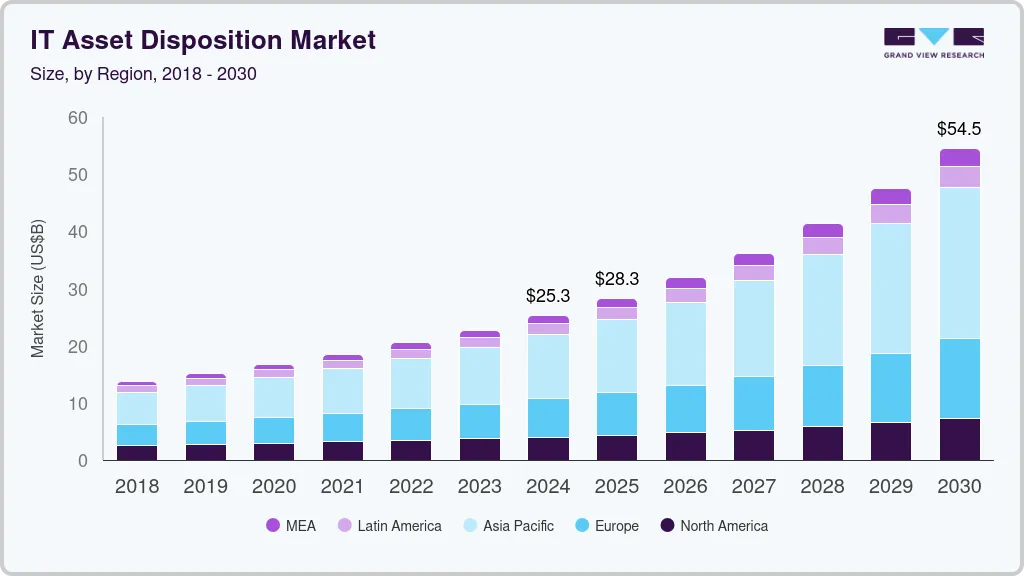

The global IT asset disposition market size was estimated at USD 25.31 billion in 2024 and is projected to reach USD 54.54 billion by 2030, growing at a CAGR of 14.0% from 2025 to 2030, driven by the rapid pace of technological advancements, leading to shorter device lifecycles.

Key Market Trends & Insights

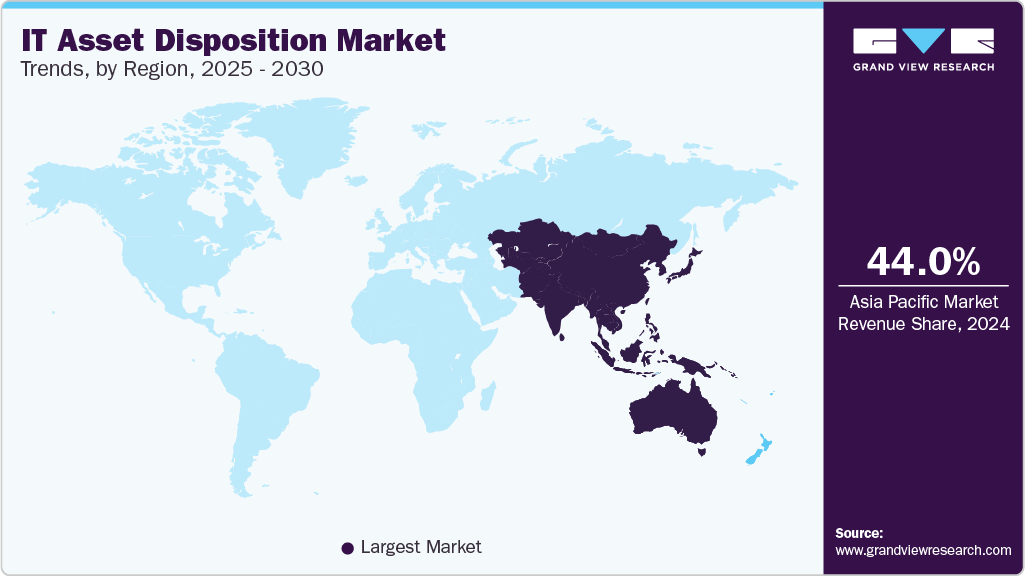

- Asia Pacific dominates the IT Asset Disposal market with the highest market share and is expected to register the highest CAGR of 15.8% from 2025 to 2030.

- The IT asset disposition market in the U.S. is expected to grow significantly at a CAGR of 11.4% from 2025 to 2030.

- By asset type, the computers/laptops segment dominated the market with revenue share of over 43.0% in 2024.

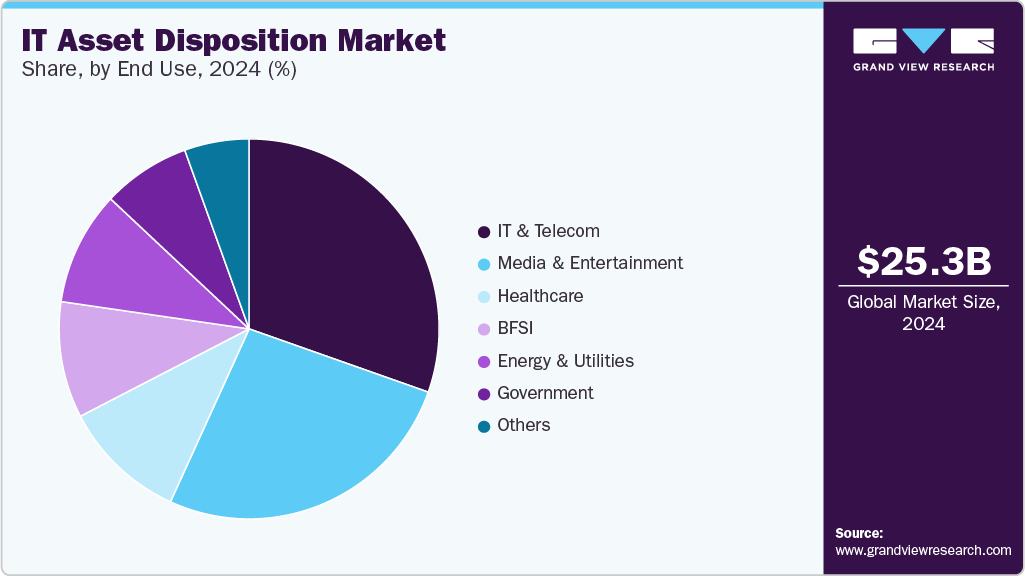

- By end use, the IT & telecom segment dominated the market and accounted for the revenue share of over 30.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 25.31 billion

- 2030 Projected Market Size: USD 54.54 Billion

- CAGR (2025-2030): 14.0%

- Asia Pacific: Largest market in 2024

As businesses and consumers frequently upgrade their IT equipment to keep up with evolving software and hardware requirements, the need for secure and sustainable disposal of outdated assets has surged. This trend is further amplified by the growing adoption of cloud computing, IoT devices, and 5G technology, accelerating hardware refresh cycles and increasing the volume of end-of-life IT assets requiring proper disposal.The increasing emphasis on data security and regulatory compliance also contributes to the growth of the IT asset disposition industry. With stringent data protection laws such as GDPR, HIPAA, and CCPA, organizations are under pressure to ensure that sensitive data stored on retired IT assets is destroyed. ITAD providers offer certified data destruction services, mitigating the risk of data breaches and ensuring compliance with legal requirements. The rising awareness of cybersecurity threats has pushed businesses to adopt professional ITAD services rather than relying on informal or unsecured disposal methods.

Environmental sustainability and corporate social responsibility (CSR) initiatives are also fueling the expansion of the ITAD market. Businesses increasingly prioritize eco-friendly disposal practices, including recycling and refurbishing IT assets to reduce electronic waste (e-waste). Governments and regulatory bodies worldwide are implementing stricter e-waste management policies, encouraging companies to partner with certified ITAD providers. Additionally, the circular economy model, which promotes reuse and resource recovery, is gaining traction, making ITAD an essential component of sustainable business operations. These factors collectively contribute to the robust growth of the ITAD market globally.

Asset Type Insights

The computers/laptops segment dominated the market. It accounted for the revenue share of over 43.0% in 2024, driven by the shortening lifespan of devices due to rapid advancements in hardware and software. Businesses and consumers frequently upgrade their PCs and laptops to keep up with performance demands, security updates, and new operating systems, leading to a steady influx of retired devices that require proper disposal. The shift to hybrid and remote work models has also accelerated device turnover, as companies refresh their fleets to ensure employees have modern, efficient, and secure machines.

The mobile devices segment is anticipated to grow at a CAGR of 15.3% during the forecast period, driven by the accelerated replacement cycle of smartphones and tablets, fueled by frequent technological advancements, shorter product lifespans, and consumer demand for newer models. Mobile device manufacturers release upgraded versions annually, pushing businesses and individuals to retire older devices faster. Additionally, the rise of 5G technology has further accelerated upgrades, as older devices often lack compatibility with new network standards, creating a surge in end-of-life mobile devices that require secure and sustainable disposal.

End Use Insights

The IT & telecom segment dominated the market and accounted for the revenue share of over 30.0% in 2024. The rise of network virtualization and Open RAN (O-RAN) deployments is another key growth catalyst, as telecom providers replace proprietary hardware with standardized, disaggregated solutions. This shift generates large volumes of decommissioned telecom gear, from base stations to switches, which require specialized ITAD handling due to their complex components and regulatory classifications (e.g., radiation safety in RF equipment). Meanwhile, IT leasing models and the as-a-service economy are increasing asset turnover rates, as businesses increasingly favor flexible OPEX-based hardware consumption over ownership, further expanding the ITAD opportunity.

The media and entertainment segment is expected to grow significantly over the forecast period due to digital transformation, content proliferation, and heightened data security needs. One of the primary drivers is the rapid obsolescence of production and post-production equipment, driven by relentless advancements in high-resolution formats (4K/8K, HDR), virtual production (LED volumes, AR/VR), and AI-powered editing tools. Studios, broadcasters, and streaming platforms frequently upgrade their IT infrastructure, including servers, storage arrays, and workstations, to handle larger file sizes and real-time rendering demands, generating a continuous stream of decommissioned assets that require secure, compliant disposal.

Regional Insights

North America's IT asset disposition market held a share of nearly 16.0% in 2024 due to strict e-waste regulations (e.g., U.S. state laws like California’s SB 20) and high corporate sustainability commitments. The region’s mature IT infrastructure, rapid tech refresh cycles, and strong emphasis on data security compliance (e.g., HIPAA, CCPA) drive demand for certified ITAD services. Additionally, the circular economy push and corporate ESG goals encourage businesses to adopt ITAD solutions that maximize asset recovery while minimizing environmental impact.

U.S. IT Asset Disposition Market Trends

The IT asset disposition market in the U.S. is expected to grow significantly at a CAGR of 11.4% from 2025 to 2030 due to frequent hardware upgrades in enterprises and data centers, alongside fragmented but stringent state-level e-waste laws. High cybersecurity awareness and litigation risks from data breaches push companies toward professional ITAD providers. The growing refurbished electronics market, supported by trade-in programs from Apple and Dell, further fuels demand for secure and value-driven disposition services.

Europe IT Asset Disposition Market Trends

The IT asset disposition market in Europe is anticipated to grow considerably from 2025 to 203.0. The Green Deal initiative promotes circular economy practices, pushing businesses to prioritize ITAD for compliance. High tech adoption rates in industries like automotive (IoT/5G) and finance (cloud migration) also contribute to increased ITAD demand as legacy systems are phased out.

The UK IT asset disposition market is expected to grow rapidly in the coming years. Strong financial and healthcare sectors, which handle sensitive data, require certified ITAD services for secure disposal. The government’s net-zero targets further incentivize businesses to adopt sustainable ITAD practices, including refurbishment and carbon-neutral recycling.

The Germany IT asset disposition market held a substantial market share in 2024. The country’s rigorous enforcement of WEEE and data protection laws ensures high demand for compliance. Additionally, a strong secondary market for refurbished enterprise hardware supports ITAD vendors specializing in remarketing.

Asia Pacific IT Asset Disposition Market Trends

Asia Pacific dominates the IT Asset Disposal market with the highest market share and is expected to register the highest CAGR of 15.8% from 2025 to 2030 due to rapid digital transformation in emerging economies and increasing e-waste regulation (e.g., India’s E-Waste Rules). The growing middle class drives electronics consumption, while manufacturing hubs like China and Vietnam produce surplus IT assets needing disposal. However, informal recycling remains a challenge, creating opportunities for formal ITAD providers.

The Japan IT asset disposition market is expected to grow rapidly in the coming years. The country’s aging IT infrastructure and shift to Society 5.0 (smart cities, IoT) accelerate hardware turnover. Additionally, high data security standards in automotive and electronics manufacturing industries drive demand for certified ITAD services.

The China IT asset disposition market held a substantial market share in 2024, driven by government policies promoting a circular economy and crackdowns on informal e-waste processing. The booming domestic tech sector (e.g., Huawei, Alibaba) generates massive volumes of retired IT assets, while data localization laws (e.g., Cybersecurity Law) mandate secure onshore disposal. However, cost sensitivity and a strong refurbishment market shape ITAD strategies toward value recovery over pure recycling.

Key IT Asset Disposition Company Insights

Key players operating in the IT asset disposition industry are CompuCom Systems, Inc., Sims Lifecycle Services, Inc., Iron Mountain, Dell Inc., and IBM Corporation. The companies are focusing on various strategic initiatives, including new product development, partnerships and collaborations, and agreements, to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In February 2025, CompuCom Systems, Inc. announced a strategic partnership with Verkada to enhance security solutions for businesses through advanced cloud-based technology. This collaboration merges Compucom’s deep IT service expertise with Verkada’s innovative physical security systems, offering organizations a streamlined, data-driven approach to safeguarding people, assets, and operations. By leveraging intelligent analytics and integrated security infrastructure, the partnership aims to deliver smarter, more efficient protection while unlocking valuable operational insights.

-

In September 2024, Iron Mountain acquired IT asset disposition (ITAD) firm Wisetek, a strategic move that enhances its capabilities in delivering comprehensive and innovative IT lifecycle solutions. With Wisetek's expertise, Iron Mountain aims to expand its service offerings and provide customers with more advanced, secure, and sustainable options for managing end-of-life IT assets.

-

In January 2024, Sims Lifecycle Services, Inc. and MOLG, a U.S.-based digital and automation tools entered into a collaboration focused on automating the repurposing of Open Compute Project (OCP) data center materials. The partnership aims to address growing demands in the reverse data center supply chain by combining technical capabilities to support scalable operations. The initiative is also expected to contribute to sustainability efforts within the sector.

Key IT Asset Disposition Companies:

The following are the leading companies in the IT asset disposition market. These companies collectively hold the largest market share and dictate industry trends.

- Apto Solutions Inc.

- CompuCom Systems, Inc.

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Ingram Micro Services

- Iron Mountain

- ITRenew

- LifeSpan International Inc.

- Sims Lifecycle Services, Inc.

IT Asset Disposition Market Report Scope

Report Attribute

Details

Market size in 2025

USD 28.32 billion

Revenue forecast in 2030

USD 54.54 billion

Growth Rate

CAGR of 14.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Asset Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Apto Solutions Inc.; CompuCom Systems, Inc.; Dell Inc.; Hewlett Packard Enterprise Development LP; IBM Corporation; Ingram Micro Services; Iron Mountain; ITRenew; LifeSpan International Inc.; Sims Lifecycle Services, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global IT Asset Disposition Market Report Segmentation

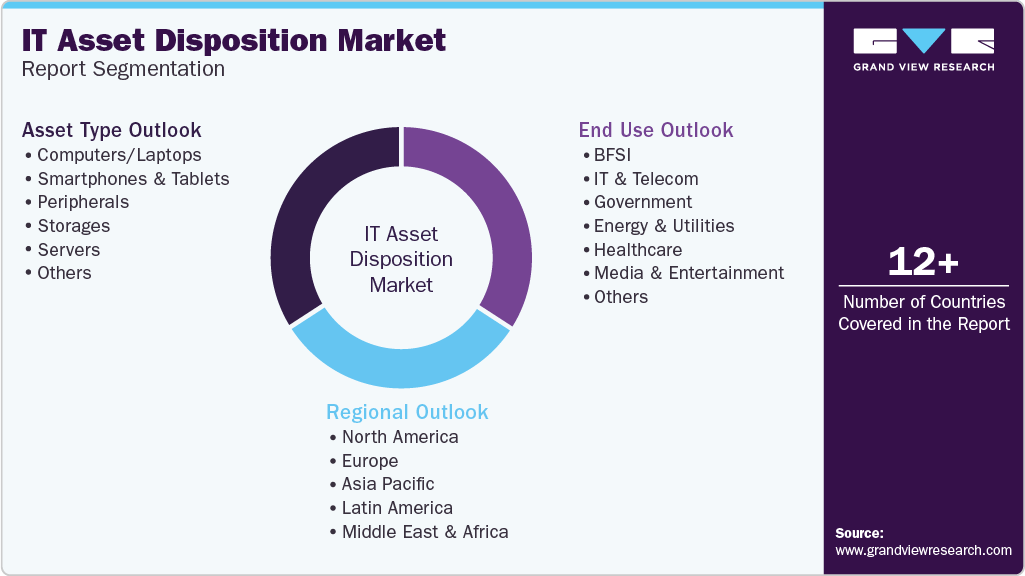

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the IT asset disposition market report based on asset type, end use, and region.

-

Asset Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Computers/Laptops

-

Smartphones and Tablets

-

Peripherals

-

Storages

-

Servers

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT & Telecom

-

Government

-

Energy and Utilities

-

Healthcare

-

Media and Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global IT asset disposition market size was estimated at USD 25.31 billion in 2024 and is expected to reach USD 28.32 billion in 2025.

b. The global IT asset disposition market is expected to grow at a compound annual growth rate of 14.0% from 2025 to 2030 to reach USD 54.54 billion by 2030.

b. Asia Pacific dominated the IT asset disposition market with a share of 42.05% in 2024. This is attributable to technology advancements, rapid digital transformation in emerging economies, and increasing e-waste regulation (e.g., India’s E-Waste Rules).

b. Some key players operating in the IT asset disposition market include Apto Solutions Inc., CompuCom Systems, Inc., Dell Inc., Hewlett Packard Enterprise Development LP, IBM Corporation, Ingram Micro Services, Iron Mountain, ITRenew, LifeSpan International Inc., Sims Lifecycle Services, Inc.

b. Key factors driving market growth include the rapid pace of technological advancements, which leads to shorter device lifecycles. As businesses and consumers frequently upgrade their IT equipment to keep up with evolving software and hardware requirements, the need for secure and sustainable disposal of outdated assets has surged.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.