- Home

- »

- IT Services & Applications

- »

-

IT Service Management Market Size, Industry Report, 2030GVR Report cover

![Information Technology Service Management Market Size, Share & Trends Report]()

Information Technology Service Management Market (2025 - 2030) Size, Share & Trends Analysis Report By Component, By Technology, By Deployment (Cloud, On-premises), By Enterprise Size, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-130-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Information Technology Service Management (itsm) Market Summary

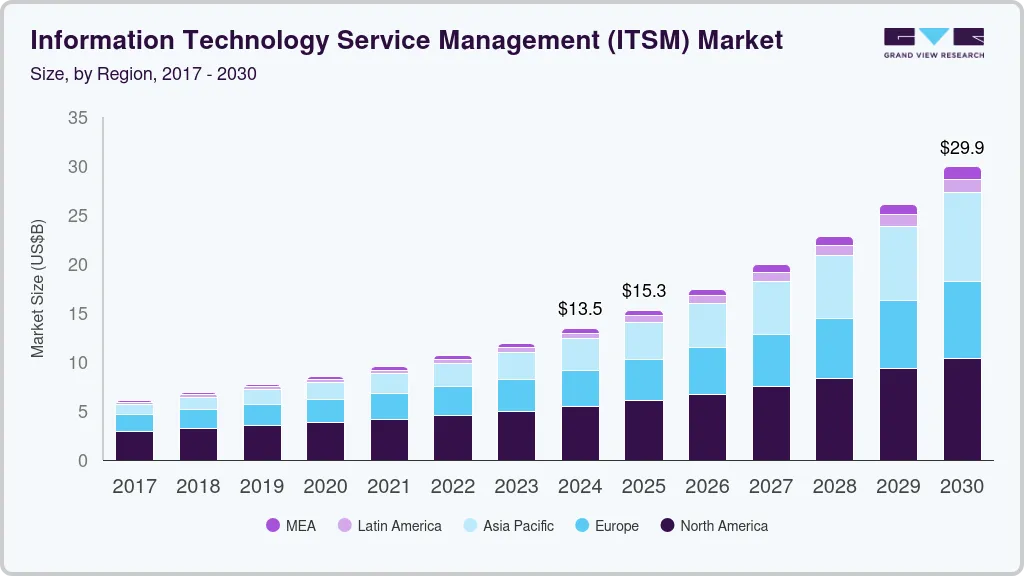

The global information technology service management (itsm) market size was estimated at USD 13,456.7 million in 2024 and is projected to reach USD 29,927.0 million by 2030, growing at a CAGR of 14.4% from 2025 to 2030. This growth is driven by the rising adoption of cloud computing and emerging technologies, necessitating information technology service management (ITSM) solutions for managing complex IT environments.

Key Market Trends & Insights

- North America information technology service management market dominated with a revenue share of over 40% in 2024.

- The ITSM market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030.

- By component, the solution segment led the market in 2024, accounting for over 76% share of the global revenue.

- By deployment, the cloud segment accounted for the largest revenue share in 2024.

- By vertical, the IT & telecom segment accounted for the largest revenue share in 2024 due to the sector's intricate IT infrastructure demands.

Market Size & Forecast

- 2024 Market Size: USD 13,456.7 Million

- 2030 Projected Market Size: USD 29,927.0 Million

- CAGR (2025-2030): 14.4%

- North America: Largest market in 2024

Organizations are also investing in ITSM solutions to enhance IT service quality and customer satisfaction, while regulatory compliance requirements are prompting further adoption to ensure adherence to these standards. Furthermore, industry regulatory requirements drive organizations to implement ITSM solutions to ensure compliance. These solutions aid in tracking and documenting IT processes, facilitating audits, and demonstrating adherence to industry-specific standards and data protection regulations.

The demand for ITSM is rising, fueled by several key factors. These include the growing complexity of IT systems and infrastructure, necessitating effective management solutions. Organizations also seek to enhance their agility to adapt swiftly to the ever-changing tech landscape. Moreover, there's an increased emphasis on prioritizing customer satisfaction and a heightened awareness of IT security's crucial role in safeguarding sensitive data. ITSM has become integral for efficiently managing IT resources, delivering top-notch services, and ensuring robust cybersecurity practices in today's dynamic business environment.

ITSM is a vital framework for organizations to manage their IT services efficiently, ensuring high-quality service delivery, cost reduction, risk mitigation, and alignment with business objectives. As businesses increasingly embrace digitalization and complex technologies such as cloud computing and AI, ITSM plays a crucial role in enabling organizations to optimize these technologies, enhance user experiences, and drive digital transformation progress. ITSM serves as a multifaceted tool for organizations, aiding in the adoption of new technologies by managing associated risks and dependencies, enhancing the customer experience through streamlined IT support, boosting operational efficiency via process automation and performance insights, reducing costs by eliminating waste, and optimizing resources, and fortifying security by providing a structured approach to IT risk management.

ITSM tools are experiencing increased adoption as they empower IT operations, particularly infrastructure and operations (I&O) managers, to better support the production environment by streamlining the delivery of high-quality IT services. These tools are most commonly utilized within IT service desks and delivery functions but are adaptable for non-I&O departments. These tools offer a range of benefits, including task automation, improved communication, incident and problem management, IT asset tracking, enforced change procedures, compliance adherence, and user self-service capabilities. Thus, ITSM tools enhance organizational efficiency and service quality across various departments, aligning IT practices with business goals.

Component Insights

The solution segment led the market in 2024, accounting for over 76% share of the global revenue. As technology reliance grows, there's a heightened demand for robust ITSM solutions that streamline operations, often incorporating automation for cost savings and quicker service delivery. Automation enhances efficiency and improves the accuracy and consistency of IT service delivery, resulting in reduced downtime and heightened customer satisfaction. Cloud-based ITSM solutions, offered by vendors such as ServiceNow, BMC, Cherwell Software, Ivanti, Broadcom, and IBM Corporation, are gaining traction due to their integrated capabilities and benefits for enterprises of varying sizes.

The service segment is predicted to foresee significant growth in the forecast years, driven by a rising demand for consulting, implementation, customization, training, and support services. These services play a pivotal role in assisting businesses as they transition to and optimize their utilization of new technologies and business models. Consulting services help assess needs and develop transformation plans, while implementation services facilitate the integration of new technologies. Customization services tailor solutions to specific requirements, and training/support services ensure employees are well-equipped to utilize new tools and models effectively. This growth underscores the crucial role of services in enabling organizations to navigate and thrive in an evolving technological landscape.

Deployment Insights

The cloud segment accounted for the largest revenue share in 2024. The growth is attributed to cloud-based ITSM solutions offering compelling advantages, including scalability, flexibility, and cost-effectiveness, making them highly attractive to organizations of all sizes. Additionally, the widespread adoption of cloud computing across businesses has fueled the demand for cloud-based ITSM solutions. Furthermore, the growing popularity of DevOps and agile development methodologies have played a significant role in driving the growth of the cloud ITSM market, given their requirement for more adaptable and scalable ITSM solutions.

The on-premises segment is anticipated to witness significant growth in the coming years.Security concerns remain a significant deterrent to cloud migration for many organizations, driven by apprehensions about data and application security in the cloud. The lower initial cost of implementing and maintaining on-premises ITSM solutions particularly appeals to organizations with limited budgets. Organizations with specific custom IT requirements also favor on-premises solutions for greater control. Moreover, some organizations must adhere to HIPAA or PCI DSS regulations, which are more manageable with on-premises ITSM solutions.

Enterprise Size Insights

The large enterprises segment accounted for the largest market revenue share in 2024.The segment's rise can be attributable to their intricate IT infrastructures necessitating robust ITSM solutions, alongside their substantial resources for investment. Furthermore, there's a heightened demand among large enterprises for automating IT services, optimizing efficiency, and reducing costs, tasks that ITSM solutions excel at, including incident and problem management. Compliance with HIPAA and PCI DSS regulations is increasingly critical for these enterprises, with ITSM solutions offering valuable incident tracking and reporting features. Thus, enhancing customer service through self-service options and real-time IT operation visibility is a priority, and ITSM solutions facilitate this with knowledge bases, service catalogs, and dashboards.

The SMEs segment is anticipated to exhibit the fastest CAGR over the forecast period. SMEs increasingly depend on IT to efficiently run their operations, encompassing customer relationship management and production automation tasks. This growing reliance on IT services is fueling a heightened demand for ITSM solutions tailored to the specific needs of SMEs. Moreover, the cost-effectiveness of ITSM solutions suits the budget constraints frequently associated with SMEs. Thus, these solutions are renowned for their ease of use, requiring minimal IT expertise for management for SMEs with restricted IT resources.

Vertical Insights

The IT & telecom segment accounted for the largest revenue share in 2024 due to the sector's intricate IT infrastructure demands. IT & telecom companies rely on ITSM tools and services to enhance service delivery, cut costs, and boost customer satisfaction. This dominance can be attributed to factors such as the rising adoption of cloud technology and digital advancements, a growing inclination towards IT service management outsourcing, heightened emphasis on IT security and compliance, and the continuous pursuit of efficiency and effectiveness in IT service delivery. Thus, the increasing complexity of IT operations and the need for streamlined management solutions to handle diverse IT functions efficiently.

The healthcare segment is anticipated to exhibit the fastest CAGR over the forecast period. This growth is driven by several key factors, including the increasing adoption of digital health technologies such as electronic health records (EHRs), telemedicine, and wearable devices. Healthcare organizations also prioritize enhancing patient care, compliance with stringent healthcare regulations such as HIPAA, and cost reduction. ITSM solutions play a pivotal role in assisting healthcare entities by tracking and managing IT assets, auditing IT activities, and safeguarding patient data, thus contributing to the sector's growth and efficiency.

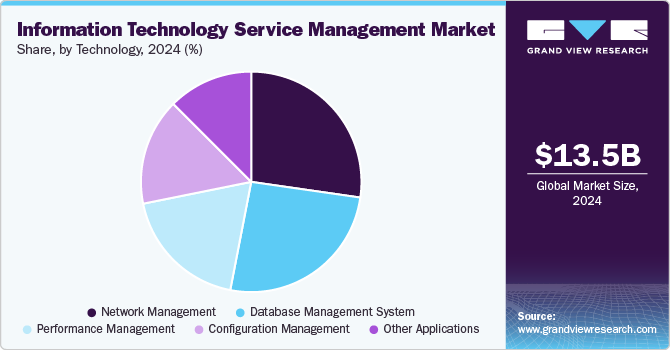

Technology Insights

The network management segment accounted for the largest revenue share in 2024. The high share can be attributed to the growing complexity of IT networks, which necessitates effective monitoring and management. Network management solutions play a vital role in helping organizations identify and resolve network issues, optimize performance, and bolster security. These solutions provide essential network visibility, allowing for problem diagnosis and mitigation while addressing the increasing need for network security in the face of evolving cyber threats. Network management solutions are instrumental in identifying and mitigating security threats, ensuring organizations can safeguard their digital infrastructure effectively. As IT networks evolve, network management solutions remain essential for optimizing performance, enhancing security, and ensuring seamless operations in an ever-changing technological landscape.

The Database Management System (DBMS) segment is predicted to foresee significant growth in the coming years, primarily driven by the surging demand for ITSM solutions that enhance IT infrastructure management. DBMSs play a pivotal role in storing and managing extensive data volumes, a critical requirement for ITSM solutions. The escalating adoption of cloud computing further fuels the segment's growth, offering scalability, flexibility, and cost-effectiveness advantages. Additionally, the increasing need for real-time data insights propels the DBMS segment. DBMSs enable organizations to collect, store, and analyze large volumes of data in real time, enhancing decision-making capabilities. Thus, the growing complexity of IT systems emphasizes the importance of DBMSs, as they provide a centralized data repository to manage IT system intricacies efficiently.

Regional Insights

North America information technology service management market dominated with a revenue share of over 40% in 2024. This regional leadership is driven by developed countries like Canada and the U.S., which have pioneered ITSM practices with a continuous investment in ITSM solutions. North American organizations are increasingly compelled to enhance IT service delivery and cost-effectiveness, making ITSM solutions a vital asset. Furthermore, the presence of leading ITSM vendors headquartered in North America further solidifies the region's advantageous position in the market.

U.S. Information Technology Service Management Market Trends

The ITSM market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030, driven by the increasing digital transformation across various industries. As organizations continue to adopt cloud computing, AI, and automation, the demand for efficient ITSM solutions to manage IT services, infrastructure, and workflows is rising. The shift towards remote work and hybrid models has further amplified the need for robust ITSM frameworks to ensure seamless IT operations, service delivery, and customer support. Additionally, the growing emphasis on data security, compliance, and integration of advanced technologies like AI and machine learning is expected to fuel market growth.

Europe Information Technology Service Management Market Trends

The ITSM market in the Europe region is expected to witness significant growth over the forecast period, driven by increased digitalization across sectors such as healthcare, manufacturing, and finance. The adoption of cloud services, AI, and automation is encouraging companies to implement ITSM solutions for improved IT infrastructure management and service delivery. Furthermore, the shift towards remote and hybrid work models has heightened the need for robust ITSM frameworks to ensure efficient IT support and seamless user experiences. Rising regulatory requirements, data privacy concerns, and the integration of AI and analytics for enhanced IT service optimization are also key factors propelling market growth.

Asia Pacific Information Technology Service Management Market Trends

The ITSM market in the Asia Pacific region is anticipated to register the fastest CAGR over the forecast period, driven by rapid digital transformation and the expansion of IT infrastructure across emerging economies like India, China, and Southeast Asia. The increasing adoption of cloud computing, AI, and automation is prompting businesses to implement ITSM solutions for better IT service delivery and operational efficiency. The region’s growing tech-savvy workforce and the shift towards remote work have further boosted the demand for effective ITSM frameworks. Additionally, rising investments in digital infrastructure, along with the need for enhanced cybersecurity and compliance, are key factors contributing to market growth.

Key Information Technology Service Management Company Insights

Some key players in the ITSM market, such as Atlassian; BMC Software, Inc.; Broadcom; and Cloud Software Group, Inc are actively working to expand their customer base and gain a competitive advantage. To achieve this, they are pursuing various strategic initiatives, including partnerships, mergers and acquisitions, collaborations, and the development of new products and technologies. This proactive approach allows them to enhance their market presence and innovate in response to evolving security needs.

-

Broadcom Inc. is a global technology company that develops, designs, and supplies a broad range of infrastructure software and semiconductor solutions. Broadcom is known for its software division, which offers solutions like Automic, CA Service Management, and DX Operational Intelligence. These tools provide comprehensive ITSM capabilities, including IT service automation, monitoring, and management. Broadcom's ITSM products are designed to enhance service delivery, streamline IT operations, and improve end-user experiences. The company serves various sectors, including telecommunications, financial services, and manufacturing, leveraging its expertise in software and hardware integration to deliver robust IT solutions.

-

BMC Software, Inc. is a foremost provider of IT solutions specializing in ITSM software. Its flagship ITSM platform, BMC Helix, offers comprehensive capabilities for IT service automation, incident management, asset management, and workflow optimization. BMC Helix leverages AI, machine learning, and cloud technology to provide intelligent, predictive, and user-centric IT services. The company’s solutions are widely used across various industries, including healthcare, finance, and retail, to improve IT operations, enhance service delivery, and drive digital transformation. With decades of expertise, BMC Software, Inc. is recognized for helping organizations modernize their IT infrastructure and streamline complex IT environments.

Key Information Technology Service Management Companies:

The following are the leading companies in the information technology service management (ITSM) market. These companies collectively hold the largest market share and dictate industry trends.

- Atlassian

- BMC Software, Inc.

- Broadcom

- Cloud Software Group, Inc

- Freshworks Inc.

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Ivanti.

- Open Text

- ServiceNow.

Recent Developments

-

In September 2024, BearingPoint partnered with Swish AI to enhance ITSM through the integration of AI technologies. This collaboration aims to transform the ITSM landscape by leveraging AI to automate service workflows, improve efficiency, and enhance user experiences. BearingPoint, a management and technology consultancy, focuses on delivering digital transformation solutions across various industries, including IT. With this partnership, they intend to streamline IT operations, reduce manual processes, and help clients adapt to an increasingly digital world by embedding intelligent automation into service management functions.

-

In May 2024, SolarWinds Worldwide, LLC. launched "SolarWinds AI," a generative AI engine integrated into its IT Service Management solution, SolarWinds Service Desk. Developed under the "AI by Design" framework, it aims to enhance IT operations by streamlining agent workflows, resolving issues faster, and minimizing downtime. The AI utilizes large language models (LLMs) to summarize ticket histories, suggest responses, and provide real-time solutions, ensuring privacy and security. SolarWinds plans to extend this AI across its observability and IT management solutions to support DevOps, SecOps, and more.

-

In March 2024, The Washington D.C. release of ServiceNow ITSM introduces new features to enhance digital product release management, streamline workforce optimization, and leverage AI. Key updates include the Digital Product Release (DPR) tool for coordinated product delivery, enhanced capabilities in "Now Assist" for AI-powered ITSM, and improved workforce optimization with peer recognition and better work assignment tools. Additional improvements cover service operations, process mining, and knowledge management aimed at boosting efficiency and user experience.

Information Technology Service Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.30 billion

Revenue forecast in 2030

USD 29.93 billion

Growth rate

CAGR of 14.4% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, deployment, enterprise size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Atlassian; BMC Software, Inc.; Broadcom; Cloud Software Group, Inc.; Freshworks Inc.; Hewlett Packard Enterprise Development LP; IBM Corporation; Ivanti.; Open Text; ServiceNow

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Information Technology Service Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global information technology service management (ITSM) market report based on component, technology, deployment, enterprise size, vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solution

-

Services

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Configuration Management

-

Performance Management

-

Network Management

-

Database Management System

-

Other Applications

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-Premises

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

SMEs

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Healthcare

-

Retail & E-commerce

-

IT & Telecom

-

Energy & Utilities

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global information technology service management market size was estimated at USD 13.46 billion in 2024 and is expected to reach USD 15.30 billion in 2025.

b. The global information technology service management (ITSM) market is expected to grow at a compound annual growth rate of 14.4% from 2025 to 2030 to reach USD 29.93 billion by 2030.

b. North America dominated the market in 2024, accounting for over 40% share of the global revenue. This regional leadership is driven by developed countries like Canada and the U.S., which have pioneered ITSM practices with continuous investment in ITSM solutions.

b. Some key players operating in the information technology service management (ITSM) market include Atlassian; BMC Software, Inc.; Broadcom; Cloud Software Group, Inc.; Freshworks Inc.; Hewlett Packard Enterprise Development LP; IBM Corporation; Ivanti.; Open Text; ServiceNow

b. Key factors driving the information technology service management market growth include the shift towards cloud-based ITSM solutions and the need for improved IT service delivery.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.