Market Size & Trends

The global IVF time-lapse imaging devices market size was valued at USD 410.3 million in 2023 and is projected to grow at a CAGR of 23.7% from 2024 to 2030. The rising market growth is due to the growing need for IVF time-lapse imaging devices in hospitals, as well as fertility clinics applications on a global scale. The increase in infertility can be attributed to lifestyle choices and behavioural shifts, such as more stress due to work pressure, older parents, declining marriage rates, and delaying marriages. The increasing obesity rate significantly contributes to the rise in infertility cases, with obese women at higher risk for infertility and uterine problems.

Throughout the COVID-19 crisis, the IVF industry experienced a decline in individuals choosing to undergo IVF and IUI treatments. COVID-19 brought about major changes, leading to increased digital adoption in the sector. In order to succeed during difficult periods, the global IVF market was compelled to focus on operational efficiency and the adoption of telehealth services.

Although Artificial intelligence (AI) in IVF is still in the early phases is gaining more popularity and has potential to enhance results and increase treatment possibilities. AI has displayed positive outcomes by being able to process extensive data and recognize patterns that may not be visible to humans, making it useful for predicting pregnancy results and choosing the best embryos for transfer. From the moment of fertilization until the blastocyst stage, AI could assist in continuous predictions through its integration with time-lapse imaging (TLI) technologies. Recent research has shown that AI can enhance the effectiveness of IVF by supporting medical professionals in choosing the most suitable embryos for implantation and lowering the chances of miscarriage.

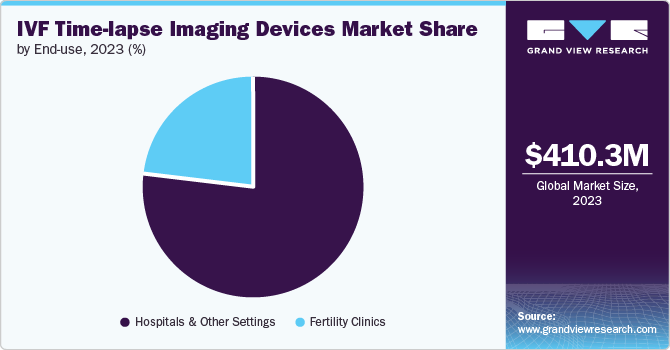

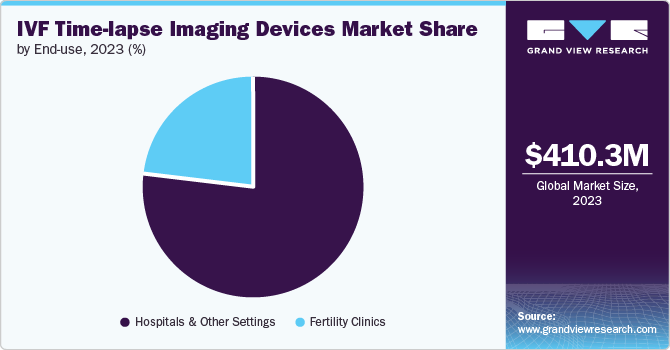

End Use Insights & Trends

Hospitals & other settings segment dominated the market and accounted for the highest revenue percentage of 77.0% in 2023. The key drivers for the segment growth are the increasing infertility rates, the quick adoption of assisted reproductive technologies in healthcare facilities, the continuous advancement of healthcare infrastructure, and the expanding access to well-equipped facilities.

The fertility clinics segment is expected to grow with the fastest CAGR in the forecast period as the preference of using clinics for treatments is increasing with couples failing to conceive. The success rate of this procedure is also high; hence, this market segment is poised to grow in the future.

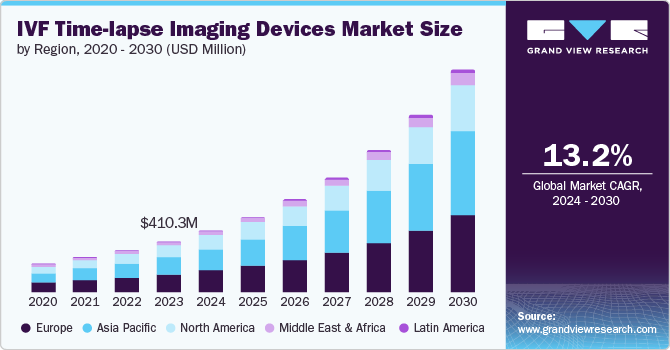

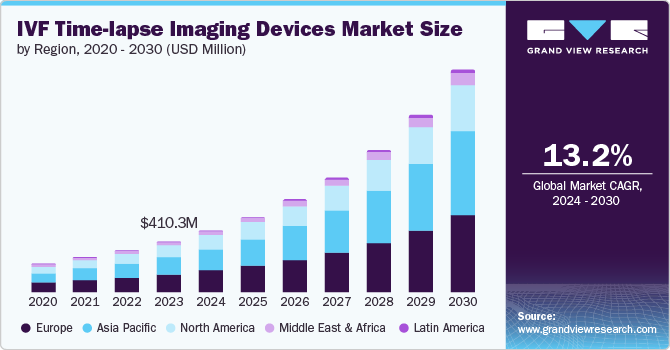

Regional Insights

Europe dominated the IVF time-lapse imaging devices market in 2023 with a market share of 36.1% due to increased infertility cases and fertility tourism, driving demand for IVF procedures. A growing number of individuals are travelling to various European countries, including Spain, the Czech Republic, and others, in order to undergo IVF procedures at a more affordable price. Regulations that are strictly regulating the IVF treatments is also a growth factor.

U.S. IVF Time-lapse Imaging Devices Market Trends

The U.S. accounted for a share of 92.9% in North America in 2023 and attributed to grow as many patients are now practicing the IVF treatment. It has become a more common first treatment option for infertility of any cause. Furthermore, there is growth in this market as population prefer this treatment in order to have children later in the future.

Asia Pacific IVF Time-lapse Imaging Devices Market Trends

Asia Pacific IVF time-lapse imaging devices market is anticipated to witness significant growth in the market with a CAGR of 25.9%. The increase is due to a rise in product knowledge, decreased costs, and a higher rate of infertility. The increase in disposable income has led to a higher utilization of IVF procedures. Couples who typically choose IVF treatment are generally in the middle age bracket and have secure financial circumstances.

Key IVF Time-lapse Imaging Devices Company Insights

Some of the major companies in the IVF Time-lapse Imaging Devices Market are Vitrolife, Esco Medical., Genea BIOMEDX, ASTEC CO., Ltd. Companies are expanding geographically and educating potential customers in order to grow in this market.

-

Vitrolife Sweden AB produces biomedical equipment. The Company manufactures items for fertility and transplantation such as needles, pipettes, and systems for storing human cells, tissue, and organs.

-

Esco Medical is a producer of medical equipment, including long-term embryo incubators, ART workstations, anti-vibration tables, and time-lapse incubators. The company’s products are used to assist clinical and industrial laboratories in achieving successful outcomes in research, development, quality control, and analysis.

Key IVF Time-lapse Imaging Devices Companies:

The following are the leading companies in the IVF time-lapse imaging devices market. These companies collectively hold the largest market share and dictate industry trends.

- Vitrolife

- Esco Medical

- Genea BIOMEDX

- ASTEC CO., Ltd.

Recent Developments

-

In May 2024, Vitrolife finalized the purchase of eFertility, a company that manages IVF clinics through its system and software solutions.

-

In May 2024, Gameto, revealed new research that details the cellular engineering and manufacturing methods behind Fertilo. Vitro maturation (IVM) solution includes engineered ovarian support cells (OSCs) designed to help eggs mature outside of the body. This information emphasized Gameto's quality by design approach to product development facilitates the production of OSC-IVM for both clinical and commercial purposes.

IVF Time-Lapse Imaging Devices Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 498.48 million

|

|

Revenue forecast in 2030

|

USD 1,787.8 million

|

|

Growth Rate

|

CAGR of 23.7% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

End Use, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

|

|

Key companies profiled

|

Vitrolife, Esco Medical., Genea BIOMEDX, ASTEC CO., Ltd., Gameto

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global IVF Time-Lapse Imaging Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Global Hospital Acquired Infection Control Market report based on end use and region.

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)