- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Japan Aqueous Polyurethane Dispersion Market Size Report, 2030GVR Report cover

![Japan Aqueous Polyurethane Dispersion Market Size, Share & Trends Report]()

Japan Aqueous Polyurethane Dispersion Market Size, Share & Trends Analysis Report By Product (Component Polyurethane), By Application (Leather Finishing, Coating Agents), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-399-7

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Report Overview

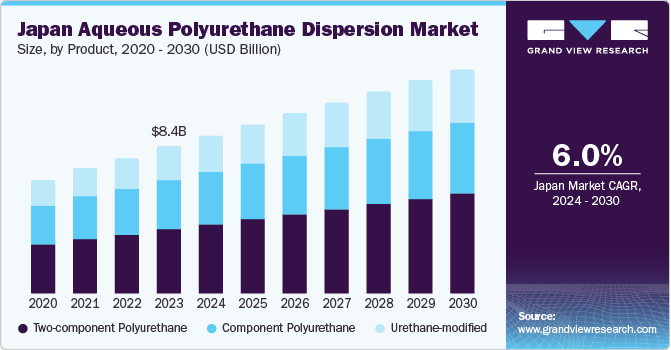

The Japan aqueous polyurethane dispersion market size was valued at USD 8.37 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.0% from 2024 to 2030. The market growth in Japan is driven by the development of the automobile and home furnishing industries, increasing demand from the synthetic leather manufacturing sector, and technological advancements.

The industry’s reliance on aqueous polyurethane dispersion (PUD) is attributed to its versatility in coatings, which offer exceptional durability, corrosion resistance, and aesthetic appeal. This is particularly evident in the use of aqueous PUD in automotive manufacturing, where it provides a convincing solution for coatings. Furthermore, technological advancements, environmental regulations, and shifting consumer preferences toward water-based coatings are driving the adoption of aqueous PUD.

Industrial and commercial fields are also witnessing growth due to the exceptional properties of aqueous PUD, including fast drying and resistance to temperature impact. Moreover, aqueous PUD is used as single-ion electrolytes in batteries and as a binding agent for various applications, including inks, ceramic powders, and semi-permeable membranes.

The shift from solvent-based polyurethane systems to aqueous PUDs across various applications is driven by government regulations mandating reduced total volatile organic compounds (VOCs) and increasing pressure to reduce system costs. The adaptable polymer design of aqueous PUD makes it suitable for diverse applications, contributing to the market’s expansion. As a result, the Japan aqueous PUD market is poised for continued growth, driven by its unique properties and applications.

Product Insights

Two-component polyurethane dominated the market and accounted for a share of 43.9% in 2023. The two-component PUD system offers a customizable and precise curing process, enabling manufacturers to tailor the dispersions for specific applications. This setup enhances the overall performance of the final product, providing robustness and adaptability in coatings and adhesives, ultimately improving product quality and efficiency.

Urethane-modified is expected to register the fastest CAGR of 6.7% during the forecast period. Modified urethanes, tailored with oil for the coatings industry, offer exceptional performance characteristics. They exhibit excellent abrasion and mar resistance, enhanced flexibility, toughness, and chemical resistance. Applications include industrial floors, gym floors, trim varnishes, timber floors, and other purposes, making them a versatile coating solution.

Application Insights

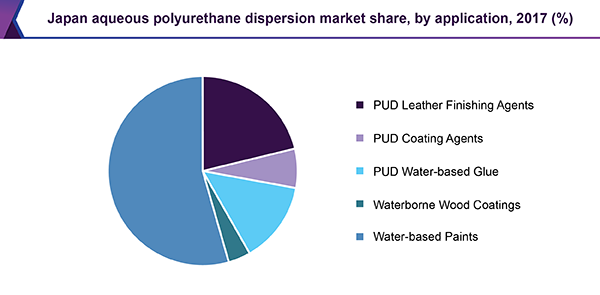

Water-based paints accounted for the largest market revenue share of 36.6% in 2023. Water-based paints with PUD offer a sustainable solution, boasting low VOC emissions, fast drying, and excellent color retention. Suitable for indoor and outdoor applications, these eco-friendly coatings support the green construction trend and contribute to a more environmentally responsible coatings industry.

Polyurethane dispersion (PUD) leather finishing agents is projected to grow at the fastest CAGR of 6.9% over the forecast period. PUDs offer unparalleled flexibility, enabling leather products to maintain their softness and comfort over time. With the ability to produce various finishes, including gloss, matte, and textured looks, PUDs facilitate customization to cater to diverse aesthetic preferences. Furthermore, manufacturers must adhere to environmental regulations, making PUDs a key compliance solution.

Key Companies & Market Share Insights

Some key companies in the Japan aqueous PUD market include BASF; The Lubrizol Corporation; Mitsui Chemicals, Inc.; Evonik Industries AG; and others. The market is competitive, featuring global and local players, with companies utilizing mergers and acquisitions to strengthen their positions.

-

Mitsui Chemicals, Inc. is a diversified chemicals company, offering a broad range of products including basic chemicals, petrochemicals, polyurethane, and functional materials, serving various industries including mobility, healthcare, food packaging, and basic materials.

-

Covestro AG is a provider of advanced polymers, specializing in the production of raw materials for polyurethanes, coatings, adhesives, and specialty products. Its portfolio includes polycarbonates, specialty chemicals, and byproducts such as styrene and chlorine, catering to various industries.

Key Aqueous Polyurethane Dispersion Companies:

The following are the leading companies in the Japan aqueous polyurethane dispersion market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- The Lubrizol Corporation

- Mitsui Chemicals, Inc.

- Evonik Industries AG

- DIC Corporation

- LANXESS

- Covestro AG

- UBE Corporation

- FUJI CHEMI TRADING CO., LTD.

- Kadotoku Corporation Co., Ltd.

Recent Developments

-

In July 2024, Lubrizol introduced Turboset 5000HS, a high-solids, self-crosslinking PUD, as the latest addition to its range of resin technologies for coatings, designed to protect heavily used wooden floors.

-

In November 2023, Covestro AG launched low-carbon-footprint PUD in the Asia Pacific market, starting from Q1 2024, sourced from its CISS site in China.

Japan Aqueous Polyurethane Dispersion Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.99 billion

Revenue forecast in 2030

USD 12.75 billion

Growth rate

CAGR of 5.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

Japan

Key companies profiled

BASF; The Lubrizol Corporation; Mitsui Chemicals, Inc.; Evonik Industries AG; DIC Corporation; LANXESS; Covestro AG; UBE Corporation; FUJI CHEMI TRADING CO.,LTD.; Kadotoku Corporation Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Japan Aqueous Polyurethane Dispersion Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Japan aqueous polyurethane dispersion market report based on product, and application.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Component Polyurethane

-

Two-component Polyurethane

-

Urethane-modified

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

PUD Leather Finishing Agents

-

PUD Coating Agents

-

PUD Water-based Glue

-

Waterborne Wood Coatings

-

Water-based Paints

-

Others

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."