- Home

- »

- Consumer F&B

- »

-

Kale Chips Market Size, Share, Growth, Industry Report 2030GVR Report cover

![Kale Chips Market Size, Share & Trends Report]()

Kale Chips Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Dehydrated Leaf Chips, Extruded Chips), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-503-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Kale Chips Market Summary

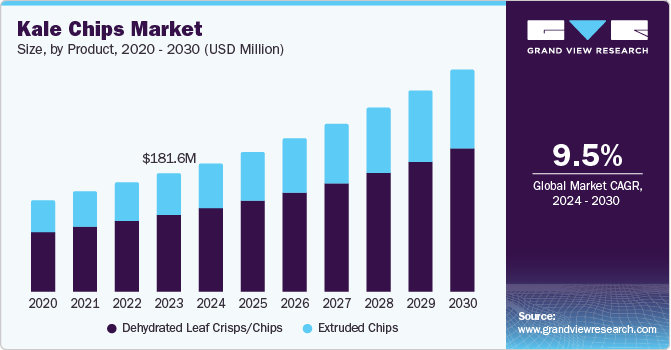

The global kale chips market size was valued at USD 181.6 million in 2023 and is projected to reach USD 339.4 million by 2030, growing at a CAGR of 9.5% from 2024 to 2030. Increasing consumer health consciousness, the rise of plant-based diets, and innovative flavors and varieties drive the market's growth.

Key Market Trends & Insights

- North America kale chips market held the highest revenue share of 35.1% 2023.

- The U.S. kale chips market held a significant market share in North America in 2023.

- By product, the dehydrated leaf crisps/chips segment dominated the market and accounted for a revenue share of 65.3% in 2023.

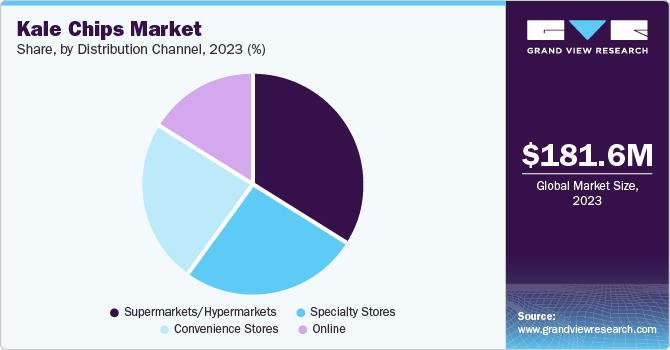

- By distribution channel, the supermarket/hypermarkets segment held the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 181.6 Million

- 2030 Projected Market Size: USD 339.4 Million

- CAGR (2024-2030): 9.5%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Consumers' continuing to prioritize healthy eating habits while seeking convenient snack options contributes to the demand for kale chips. In addition, the availability of kale chips in supermarkets, health food stores, and online platforms has expanded significantly. This increased accessibility makes it easier for consumers to purchase these products regularly.

Kale chips are a popular snack made from kale, a leafy green vegetable known for its high nutritional value. There is an increasing trend among consumers towards healthier eating habits. Kale is identified as rich in vitamins A, C, and K and minerals such as calcium and iron. The demand for nutritious snacks has led to the popularity of kale chips as a healthier alternative to traditional potato chips.

The rise of plant-based diets has contributed to the growth of the kale chips market. As more people adopt vegetarian or vegan lifestyles, they seek snacks that align with their preferences. Kale chips fit within these diets as they are made entirely from plants. Modern lifestyles often require convenient food options consumed on the go. Kale chips are lightweight, portable, and have a longer shelf life than fresh vegetables, making them an attractive option for busy consumers looking for healthy snacks.

Product Insights

The dehydrated leaf crisps/chips dominated the market and accounted for a revenue share of 65.3% in 2023. Dehydration is a gentle process that retains most of the kale's vitamins, minerals, and antioxidants. This aligns with the health-conscious consumers. Dehydration of kale leaves leads to the formation of a crispy surface, which is among the most desirable qualities of snacks. Dehydrated kale chips also have a longer shelf life than other processing methods, which benefits both the manufacturer and the consumer. In addition, it's a less expensive process, increasing the manufacturers' profit margin.

The extruded chips segment is expected to grow at the fastest CAGR from 2024 to 2030. This growth can be attributed to lighter and puffier texture, flavor infusion, shape versatility, additional nutrient enrichment, and child-friendly appeal. The texture of extruded chips is quite different from the regular texture of chips, making it attractive to a broader market, especially those who prefer less crunchy snacks. Also, the extrusion process of producing snacks allows for better incorporation of flavors, resulting in various tastes and flavors. Extruded chips can be shaped into different forms, making them visually appealing and offering a distinct eating experience. Incorporation of extra nutrients or fortified ingredients can be done through the extrusion process, thus increasing the product's nutritional value. The extruded form of kale chips is lighter in texture and comes in different shapes, which is more appealing to children, increasing the market base.

Distribution Channel Insights

The supermarket/hypermarkets held the largest revenue share in 2023. Broader consumer reach, physical product inspection by consumers, established distribution channels, and promotion activities are driving the segment's growth. Supermarkets and hypermarkets cater to a broad consumer base, including health-conscious individuals. Consumers can physically examine the product, including its texture, color, and packaging, before making a purchase decision, which is crucial for new product adoption. Moreover, supermarkets and hypermarkets have established distribution networks, ensuring efficient and widespread product availability.

The online segment is expected to grow at the fastest CAGR during the forecast period. The increasing popularity of online shopping across various product categories has created a favorable environment for the growth of online food sales, including kale chips. Online platforms offer convenience, allowing consumers to purchase kale chips from the comfort of their homes. The widespread use of smartphones has made online shopping more accessible, contributing to the growth of the online segment. Online platforms enable precise targeting of health-conscious consumers through personalized recommendations and advertising, increasing sales.

Regional Insights

North America kale chips market held the highest revenue share of 35.1% 2023. Increasing adoption of a healthy lifestyle, demand for health & wellness products, developed retail infrastructure, innovation & product development, and high disposable income are factors driving the market growth. A well-established retail network, including supermarkets, specialty stores, convenience stores, and online platforms ensures the widespread availability of kale chips. A higher disposable income in the region allows consumers to spend more on premium and health-oriented products propelling the market growth.

U.S. Kale Chips Market Trends

The U.S. kale chips market held a significant market share in North America in 2023 owing to developed retail infrastructure, a strong consumer base for healthy snacks, and strong marketing and branding. Targeted marketing through e-commerce and online shopping platforms increases the sale of healthy kale chips. The population of the U.S. has a large consumer base that is increasingly showing an interest in convenient and healthy snacks, driving the market growth.

Europe Kale Chips Market Trends

Europe's kale chips market held a significant market share in 2023 due to growing consumer awareness about health and nutrition and a well-developed regional distribution network, including supermarkets, convenience stores, and online platforms. Consumers are increasingly interested in transparency regarding food ingredients. The clean label movement emphasizes natural ingredients without artificial additives or preservatives, increasing the demand for healthy food products.

UK kale chips market held a substantial market share in 2023 owing to increasing health concerns due to modern lifestyle contributing to opting for healthy food products. The rise in veganism and vegetarianism in the UK has boosted the demand for plant-based snacks. Kale chips, being a plant-based product, align well with the dietary preferences of this growing consumer segment. As reported by finder, in 2024, the United Kingdom has an estimated 2.5 million vegans, which constitutes 4.7% of the adult population. This represents a significant increase of approximately 1.1 million vegans from 2023 to 2024. Additionally, in 2024, there are 3.1 million vegetarians in the UK, comprising 5.8% of the population. This notable rise in the numbers of both vegans and vegetarians underscores a growing trend towards plant-based diets, driven by factors such as increased health awareness, environmental sustainability, and concerns regarding animal welfare.

Asia Pacific Kale Chips Market Trends

Asia Pacific kale chips market is expected to grow at the fastest CAGR during the forecast period. This growth is attributed to Increasing awareness of health and wellness, the growing middle class in the region, and Western influence on the choices. Consumers are becoming more conscious about their diet and thus are looking for healthier options instead of regular fried snacks. Moreover, the growing middle class in countries like China, India, and Australia is fueling demand for premium and imported food products, including kale chips. The increasing influence of Western dietary habits and lifestyles drives the adoption of new food products.

The Indian kale chips market is expected to grow significantly due to rapid urbanization, changing lifestyles, the influence of Western culture, and the growing middle class. Rapid urbanization and changing lifestyles have increased packaged and convenient food product consumption, creating an opportunistic marketplace for kale chips. Moreover, the growing middle class with disposable income is driving demand for premium and imported food products, including kale chips.

Key Kale Chips Company Insights

Some of the key companies in the kale chips market include Nagano Prefecture., The Kale Factory., BRAD’S PLANT BASED, LLC, Vermont Kale Chips, Simply 7 Snacks.,Takebayashi WB Co., Ltd, and others. Organizations are focusing on innovative snacks with different flavours to increase the consumer base. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Simply 7 Snacks aims to cater to health-conscious consumers by providing snacks that are gluten-free, non-GMO, and free from artificial preservatives and additives. The company offers dehydrated kale leaves seasoned with various flavors. The chips are marketed as a healthy snack alternative.

-

The Kale Factory offers kale chips as a snack product. The company produces various kale chip flavors that are packaged for retail sale. The product line includes different options, such as kale cookies and kale Krackers.

Key Kale Chips Companies:

The following are the leading companies in the kale chips market. These companies collectively hold the largest market share and dictate industry trends.

- Nagano Prefecture.

- The Kale Factory

- BRAD’S PLANT BASED, LLC

- Vermont Kale Chips

- Simply 7 Snacks

- The Angel Kale Company

- Healthy Crunch.

- CHICAGO KALE CHIP CO.

- Takebayashi WB Co., Ltd.

Recent Developments

-

In April 2021, Brad's Plant Based, a company specializing in nutritious plant-based snacks, announced a strategic partnership with KEEN Growth Capital, an investment firm focused on health and wellness innovations. This collaboration aimed to leverage KEEN's expertise and resources to enhance Brad's Plant Based's market presence and product offerings. Concurrently, Brad's Plant Based introduced three new product lines, expanding its portfolio of healthy, plant-based snacks.

Kale Chips Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 197.3 million

Revenue forecast in 2030

USD 339.4 million

Growth rate

CAGR of 9.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; Brazil; South Africa Saudi Arabia; UAE

Key companies profiled

Nagano Prefecture; The Kale Factory; BRAD’S PLANT BASED, LLC; Vermont Kale Chips; Simply 7 Snacks; The Angel Kale Company; Healthy Crunch; CHICAGO KALE CHIP CO.; and Takebayashi WB Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Kale Chips Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global kale chips report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dehydrated Leaf Crisps/Chips

-

Extruded Chips

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Convenience Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.