- Home

- »

- Pharmaceuticals

- »

-

Lactation Support Supplements Market Size & Share, ReportGVR Report cover

![Lactation Support Supplements Market Size, Share & Trends Report]()

Lactation Support Supplements Market (2023 - 2030) Size, Share & Trends Analysis Report By Ingredient Type (Fenugreek, Moringa, Milk Thistle, Fennel, Oatmeal), By Formulation, By Sales Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-055-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global lactation support supplements market size was valued at USD 569.8 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030. The growth can be attributed to the increasing childbirth rate coupled with the growing prevalence of insufficient milk supply in lactating women. According to the United Nations, World Population Prospects 2022, around 45.37 million childbirths were reported in Africa in 2021, higher than compared to 44.81 million childbirth in 2020. Lactation support supplements are the kind of galactagogue that supports improving or increasing the milk supply in lactating mothers.

With the increasing infant mortality rate primarily due to insufficient breastfeeding, the demand for these supplements is rising. According to the WHO statistics of June 2021, around 44% of infants aged 0 to 6 months were exclusively breastfed. Moreover, optimal breastfeeding could improve the well-being of children and could save the lives of more than 820,000 children aged five years and below globally.

Human milk insufficiency is a major concern globally, specifically in low- and middle-income countries (LMICs), and can lead to hypernatremia, hypoglycemia, and nutritional deficiencies in infants and newborns, and subsequently into infant death. According to the article published in International Breastfeeding Journal in February 2022, human milk insufficiency is the major concern in the LMICs and is prevalent in around 60-90% of women in the region. This is expected to boost the demand for lactation support supplements as it could aid in improving human milk insufficiency conditions.

Many government, non-profit, and social development organizations are promoting awareness regarding breastfeeding in lactating mothers through several campaigns. This has contributed to the demand for lactating support supplements and reduced the demand for human milk substitutes. For instance, Smile Foundation organizes various sessions and campaigns under the Swabhiman program in India to promote awareness regarding health and nutrition among lactating mothers and children and educate the mother regarding the benefits of breastfeeding.

The COVID-19 pandemic negatively impacted the lactation support supplements market owing to the risk associated with the transmission of the virus through human milk. Hence, the lactating mother opted for human milk substitutes. Moreover, with the closure of offline retail stores during the initial period of the pandemic, the demand for these supplements was low. With the launch of the products at e-commerce platforms and movement restrictions to curb the spread of the virus, the demand for these products through online sales channels is expected to increase and thus, contribute to the growth of the market post-pandemic.

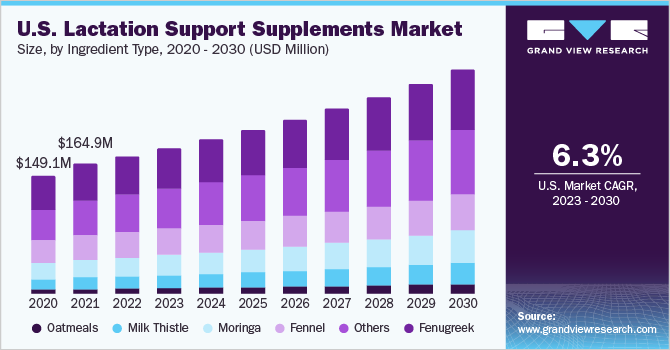

Ingredient Type Insights

The fenugreek segment held the largest revenue share of 28.7% in 2022. This can be attributed to the benefits associated with fenugreek with no or minimal side effects and the availability of the number of products containing fenugreek as an ingredient. Fenugreek seeds are traditionally used in the Middle East, the Indian subcontinent, and China as a condiment and to enhance the milk supply in lactating women. It is now increasingly adopted in the Western region for various ailments, including enhancing lactation in breastfeeding mothers.

However, the oatmeal segment is expected to witness the fastest growth over the forecast period. The high growth rate of the segment could be attributed to the benefits associated with oatmeal products in lactation. Hence, many companies are launching several products, including oatmeal cookies that do not have a pungent taste and smell as that of other herbal lactating supplements, which is expected to boost the demand for these products over the forecast period. Moreover, organizations such as the U.S. Department of Health and Human Services recommend oatmeal as a whole grain for breastfeeding women.

Formulation Insights

The capsules/tablets segment dominated the industry with a revenue share of 52.4% in 2022. Most of the galactagogues are available as capsules or tablets as it masks the pungent smell and taste of the herbal ingredients. Furthermore, these formulations are made with a precise dose that could be administered by breastfeeding women to get better results and reduce the chances of overdose and side effects associated with it. These factors are expected to contribute to the large share of the market.

The liquid segment is expected to grow at the fastest CAGR over the forecast period owing to the launch of several liquid formulations and the availability of many flavored products to mask the taste and smell of the ingredients. These products are easy to administer and have high concentrations of active ingredients that aid in boosting the milk supply in lactating women.

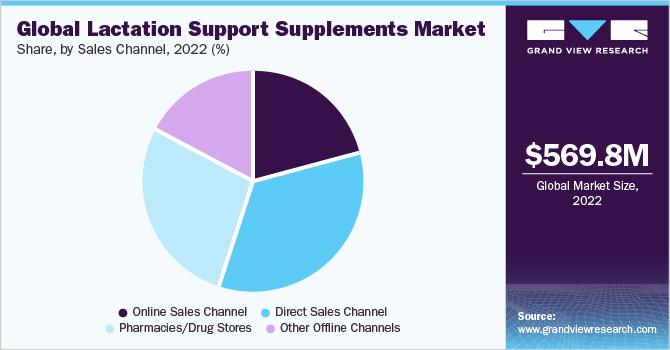

Sales Channel Insights

The direct sales channel segment dominated the market with 34.0% of the revenue share in 2022. This can be attributed to the higher preference of the customers to buy these products through direct sales channels. These products are intended for medicinal purposes and have herbal content and yet do not have any stringent regulations. This is expected to contribute to the growth of the segment.

However, the online sales segment is expected to grow with the fastest CAGR over the forecast period. The growing availability of these products at e-commerce platforms and the convenience of choosing the product from a wide range of portfolios that fulfills the demand of the customer are expected to drive the growth of the market during the forecast period. The online sales channel offers a wide range of products at a discounted price and reduces the efforts to travel to the onsite store.

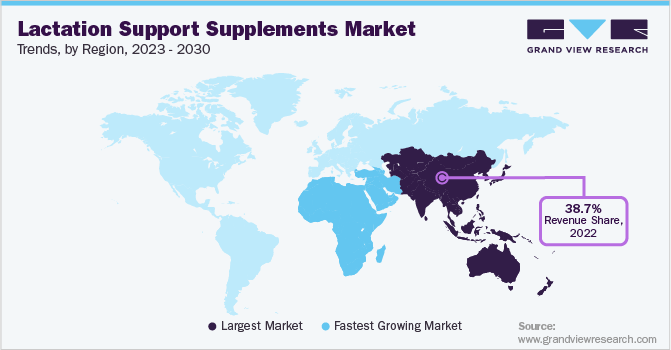

Regional Insights

Asia Pacific held the largest revenue share of 38.7% as of 2022. The availability of lactation support supplements and the high adoption of these supplements traditionally contribute to the high share of the market in the region. According to the research article published in the PLOS ONE Journal in July 2021, around 60% of breastfeeding mothers in Australia reported the use of one or more galactagogues. Around 47% of them reported the use of lactation cookies, 32% reported the use of brewer’s yeast, and around 22% reported the use of fenugreek.

The MEA region is projected to witness the fastest CAGR over the forecast period. The rising prevalence of milk supply insufficiency and increased infant mortality rate in the region is expected to contribute to the growth during the forecast period. According to World Bank data, the infant mortality rate in South Africa in 2021 was around 26 per 1,000 live births. This is majorly due to the undernutrition and low breastfeeding rates in the country.

Key Companies & Market Share Insight

The lactation support supplements industry is moderately fragmented, with the presence of a few major players and local players holding a majority of the share. The major players are adopting several strategies, including the launch of different products in different formulations to gain a high market share. For instance, in June 2019, Nestlé launched MATERNA Opti-Lac for lactating women. It is the probiotic solution with patented probiotic L. fermentum LC40 to support breastfeeding. The product is available in drugstores, pharmacies, retail shops, and others. Some prominent players in the global lactation support supplements market include:

-

Pink Stork

-

New Chapter

-

Mama's Select

-

ACTIF USA

-

Anya

-

Mommy’s Bliss Inc.

-

Nestle

-

Mother Love

-

Mommy Knows Best

-

Rumina Naturals

Lactation Support Supplements Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 605.2 million

Revenue forecast in 2030

USD 949.7 million

Growth rate

CAGR of 6.6% from 2023 to 2030

The base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segment Covered

Ingredient type, formulation, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; Norway, Sweden, Denmark, China; Japan; India; Kuwait; Australia; Thailand, South Korea, Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia

Key companies profiled

Pink Stork; New Chapter; Mama's Select; ACTIF USA; Anya; Mommy’s Bliss Inc.; Nestle; Mother Love; Mommy Knows Best; Rumina Naturals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

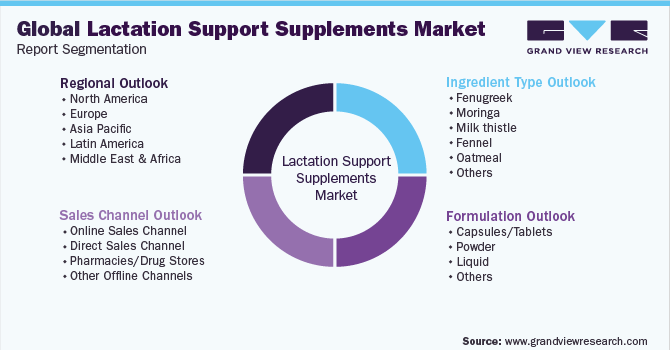

Global Lactation Support Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global lactation support supplements market report based on ingredient type, formulation, sales channel, and region:

-

Ingredient Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fenugreek

-

Moringa

-

Milk thistle

-

Fennel

-

Oatmeal

-

Others

-

-

Formulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Capsules/Tablets

-

Powder

-

Liquid

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online Sales Channel

-

Direct Sales Channel

-

Pharmacies/Drug Stores

-

Other Offline Channels

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global lactation support supplements market size was estimated at USD 569.8 million in 2022 and is expected to reach USD 605.2 million in 2023.

b. The global lactation support supplements market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 949.7 million by 2030.

b. North America dominated the lactation support supplements market with a share of 33.9% in 2022. The availability of lactation support supplements and the high adoption of these supplements traditionally contribute to the high share of the market in the region.

b. Some prominent players in the global lactation support supplements market include Pink Stork; New Chapter; Mama's Select; ACTIF USA; Anya; Mommy’s Bliss Inc.; Nestle; Mother Love; Mommy Knows Best; Rumina Naturals

b. Key factors that are driving the market growth include increasing childbirth rate coupled with the growing prevalence of insufficient milk supply in lactating women. According to the article published in International Breastfeeding Journal in February 2022, human milk insufficiency is the major concern in the LMICs and is prevalent in around 60-90% of women in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.