- Home

- »

- Plastics, Polymers & Resins

- »

-

Laminated Labels Market Size, Share & Growth Report, 2030GVR Report cover

![Laminated Labels Market Size, Share & Trends Report]()

Laminated Labels Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Polyester, Vinyl), By Form (Rolls, Sheets), By Type (Adhesive), By Application (Food And Beverages), By Region, And Segment Forecasts

- Report ID: 978-1-68038-858-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Laminated Labels Market Size & Trends

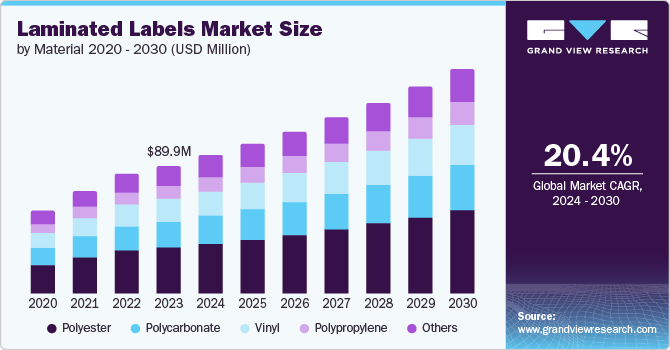

The global laminated labels market was valued at USD 89.9 million in 2023 and is projected to grow at a CAGR of 8.4% from 2024 to 2030. Increased demand for packages of products from industries such as food and beverages, pharmaceuticals, and others has contributed to the upward growth of this market. The rise in awareness about the information labels printed on the products has also helped the market grow. Companies are focusing on creating attractive, laminated labels, as it is likely to help them in the marketing of the product. Better quality and attractive labels attract more customers. Therefore, these factors are responsible for the upward growth of this market.

Laminated labels help improve the visual quality of the product by providing a better and more polished look. The labels are employed with various signs and information, helping to increase customer engagement. A better-laminated label can be a distinguishing factor of a product in the market as it can help attract customers' attention. Hence, these factors contribute to the upward growth of this market.

Furthermore, the market growth is attributed to increased demand for pharmaceutical products, personal care and home care products, food and beverages, and many more. This has resulted in an increase in the demand for printing laminated labels. Moreover, there is an increase in awareness about reading the content printed on the packages of the products. Therefore, companies are printing labels in an innovative manner by providing important information that, in return, helps in attracting customers.

The increased industrial use of laminated labels has also contributed to the market growth, as industries require labels that are long-lasting and readable. Because laminated labels have protective layers, they can withstand conditions such as dampness, sunlight exposure, and other factors. Therefore, the preference for using laminated labels has increased significantly, which has resulted in the upward market growth of laminated labels.

Material Insights

The polyester segment dominated the market in 2023 with a share of 36.0% in 2023. This is due to the increase in the use of polyester in manufacturing laminated labels. Polyester offers qualities such as heat resistance, chemical resistance, long durability, and more; therefore, it is widely used in manufacturing laminated labels. Polyester areas on the packages are usually used to print critical information about the product. Moreover, the temperature tolerance of polyester allows laminated labels to remain intact and endure hot or cold environments. Polyester's printable ability and clarity enable companies to print high-quality texts and images, ensuring better print quality. Therefore, these factors have resulted in the upward market growth of this segment.

The vinyl segment had a significant market share in 2023 attributed to vinyl's durable and versatile properties. Vinyl can withstand chemical exposure, moisture exposure, and abrasion when the package is in transit or stored. These properties have resulted in the increased demand for vinyl in the shipping and logistics industries. Furthermore, the rise of e-commerce has also increased demand for laminated labels.

Form Insights

The roll segment dominated the market in 2023 with a share of 63.9% in 2023. This growth was attributed to the use of laminated label rolls in the production of product labels. Rolls can accommodate a higher number of labels, enabling higher label production than sheets. Utilization of rolls ensures less downtime, more production efficiency, and less wastage. Rolls also offer flexibility with label lengths that allow the companies to manufacture labels according to the needs of the products. Therefore, these factors have resulted in the growth of this segment.

The sheets segment had a significant market share in 2023 due to its practicality and versatility in labeling operations. Sheets allow efficient labeling of items in small quantities and are a convenient option for labeling items in homes, offices, and personal products. Hence, these factors are responsible for the market growth of this segment.

Type Insights

The face stock segment dominated the market in 2023 with a share of 45.5% in 2023 due to the increased demand of face stock material. The demand for facestock material is increasing in industries such as food and beverages, pharmaceuticals, personal care which give importance to the branding of their products in terms of information printed and visual appearance. Furthermore, the durability and versatility properties of face stock material have also resulted in the market growth of this segment.

The adhesive segment is expected to witness a significant growth rate over the forecast period. The growth was attributed to the growth in industries such as food and beverages, personal care, and pharmaceuticals, which has resulted in the increased demand for adhesive labels. Adhesive labels provide durability and protection against abrasion, moisture, and sunlight, ensuring the longevity of labels in harsh environments. Therefore, these factors have resulted in the market growth of this segment.

Application Insights

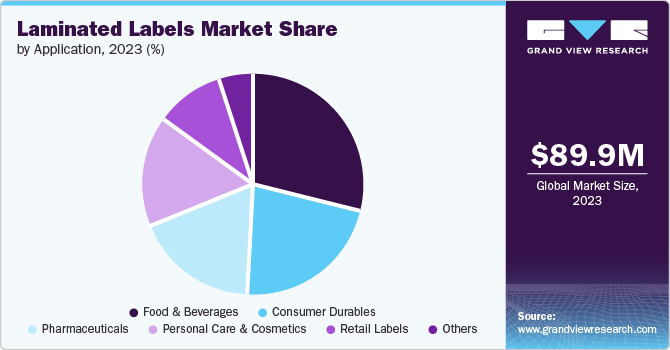

The food and beverages segment dominated the market in 2023, with a share of 28.6 % in 2023. This market growth is attributed to the rise in the production of products in the food and beverages industry. Laminated labels provide the necessary protection of products, which is mandated by government regulations. Companies in this industry focus on packaging their products in a distinctive manner, which is possible with the versatility of laminated labels. Furthermore, due to the rise in e-commerce, the food and beverage industry has increased the production of its products, resulting in an increased requirement for laminated labels.

The retail labels segment is expected to grow at a CAGR of 8.5% over the forecast period. Increases in the sale of products from industries such as personal care, food and beverages, home care, and many more have resulted in market growth in this segment. Products sold in retail outlets are labeled with laminated labels to ensure proper information visibility and long shelf life. Retail stores are labeling products in innovative designs, which enables them to increase the distinctiveness of the products.

Regional Insights

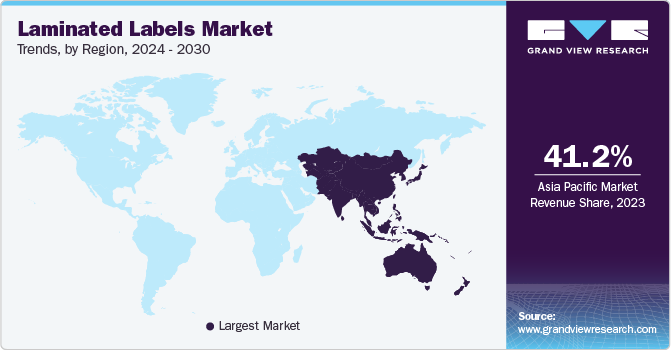

The North American market is anticipated to grow with a CAGR of 8.3% during the forecast period. The growth in the market is attributed to the rise in the production of food and beverage products, personal and home care products, pharmaceutical products, and more. Growing awareness about product labels has educated customers about the information printed on the products. Therefore, companies are implementing innovative labeling and packaging methods to improve their products' visual aspects. These factors have resulted in the positive growth of the market.

U.S. Laminated Labels Market Trends

The market in the U.S. is projected to grow substantially due to the presence of key market players in industries such as consumer goods, food and beverages, retail, and more. Companies are targeting customer attention by improving the packaging quality and design, which helps them improve the presence of their products in the country's supermarkets. These factors are, therefore, attributed to the increase in laminated labeling of products, as the labeling allows manufacturers to package products according to market demands and trends.

Asia Pacific Laminated Labels Market Trends

Asia Pacific dominated the laminated labels market with a market share of 41.2% in 2023 due to rapid urbanization and growth in consumer durables, food and beverages, pharmaceuticals, and more markets. There is an increased demand for products with high-quality labeling in these industries. Better labeling allows companies to improve their brand awareness and shelf presentation. Government regulations regarding packaging and labeling of products have also contributed to the market growth of this region. Furthermore, economic growth in countries such as China and India has further contributed to the market growth in this region.

China dominated the Asia Pacific market in 2023 with a market share of 41.5% due to growth in the retail industry, which sells consumable durables, food, beverages, and more. Companies are investing in innovative laminated labeling to improve their product presentation on the shelf. Increased awareness about reading the information printed on product labels has also contributed to the market growth in this country.

Europe Laminated Labels Market Trends

Europe was identified as a lucrative region in this industry, as it had a market share of 22.1% in 2023. Companies that want to improve the quality of their products attribute the market growth to the increased use of laminated labels. These companies focus on readable labels with longer durability. Government regulations regarding the packaging and information labeling of products also help in the upward growth of this market.

Key Laminated Labels Company Insights

Some of the key companies in the global laminated labels market are Avery Dennison Corporation, CCL Industries, Constantia Flexibles, Coveris, R.R. Donnelley & Sons Company, Lecta Adestor, 3M Company, and more. Companies are focusing on investing in innovation and research in order to cater the trend in the market.

-

Avery Dennison Corporation is a manufacturer of pressure-sensitive adhesive material such as self-adhesive label, apparel-branding labels, tags, medical products and RFID inlays.

-

3M Company operates in field of consumer goods, worker safety, and healthcare. The company produces adhesives, laminates, abrasives, and other equipment.

Key Laminated Labels Companies:

The following are the leading companies in the laminated labels market. These companies collectively hold the largest market share and dictate industry trends.

- Avery Dennison Corporation

- CCL Industries

- Constantia Flexibles

- Coveris

- R.R. Donnelley & Sons Company

- Lecta Adestor

- 3M Company

- Bemis Manufacturing Company

- Flexcon Company, Inc.

- Sticky things Limited

- Amtico International

- AHF, LLC.

- Congoleum

- Flowcrete Group Ltd.

- Forbo International SA

- Gerflor

- Interface, Inc.

- IVC Group

- James Halstead Plc.

- Mannington Mills, Inc.

- NOX Corp.

- Tkflor

- Nora

- Toli Floor

Recent Developments

-

In June 2024, Constantia Flexibles launched a new product for packaging industry named EcoTwistPaper, a wax-free twist wrap made from paper. The product is manufactured focusing on recyclability and company’s shift towards sustainability.

-

In October 2023, Coveris, a medical packaging manufacturing announced a launch of recyclable thermoforming film Formpeel P. It was a latest addition to the company’s portfolio of sustainable material.

Laminated Labels Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 97.1 million

Revenue forecast in 2030

USD 157.7 million

Growth rate

CAGR of 8.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, type, form, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Avery Dennison Corporation, CCL Industries, Constantia Flexibles, Coveris, R.R. Donnelley & Sons Company, Lecta Adestor, 3M Company, Bemis Manufacturing Company, Flexcon Company, Inc., Sticky things Limited, Amtico International, AHF, LLC., Congoleum, Flowcrete Group Ltd., Forbo International SA, Gerflor,Interface, Inc., IVC Group, James Halstead Plc., Mannington Mills, Inc., NOX Corp., Tkflor, Nora, Toli Floor

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laminated Labels Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Global Laminated Labels Market report based on material, form, type, application, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyester

-

Vinyl

-

Polycarbonate

-

Polypropylene

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Rolls

-

Sheets

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Adhesive

-

Facestock

-

Release Liner

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food and Beverages

-

Pharmaceuticals

-

Personal Care and Cosmetics

-

Consumer Durables

-

Retail Labels

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.