- Home

- »

- Medical Devices

- »

-

Laparotomy Sponge Market Size, Industry Report 2033GVR Report cover

![Laparotomy Sponge Market Size, Share & Trends Report]()

Laparotomy Sponge Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Radiopaque, RFID, Traditional, RFID), By End-use (Hospitals & Clinics), By Region (North America, Europe, Asia Pacific, Latin America, MEA) And Segment Forecasts

- Report ID: GVR-2-68038-316-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Laparotomy Sponge Market Summary

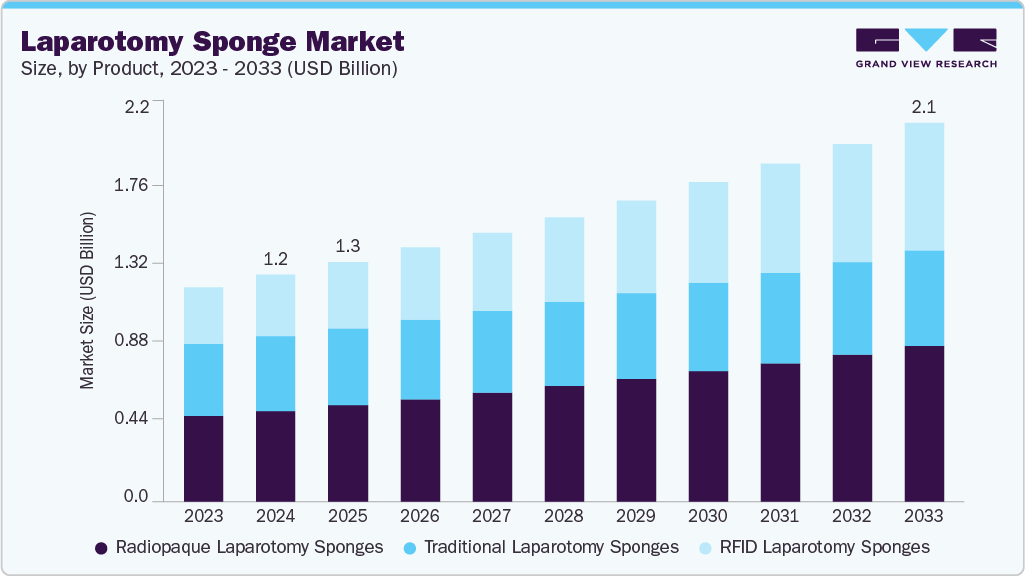

The global laparotomy sponge market size was estimated at USD 1.23 billion in 2024 and is projected to reach USD 2.06 billion by 2033, growing at a CAGR of 5.9% from 2025 to 2033. This reflects the growing elderly population, resulting in more abdominal diseases that need surgical treatment.

Key Market Trends & Insights

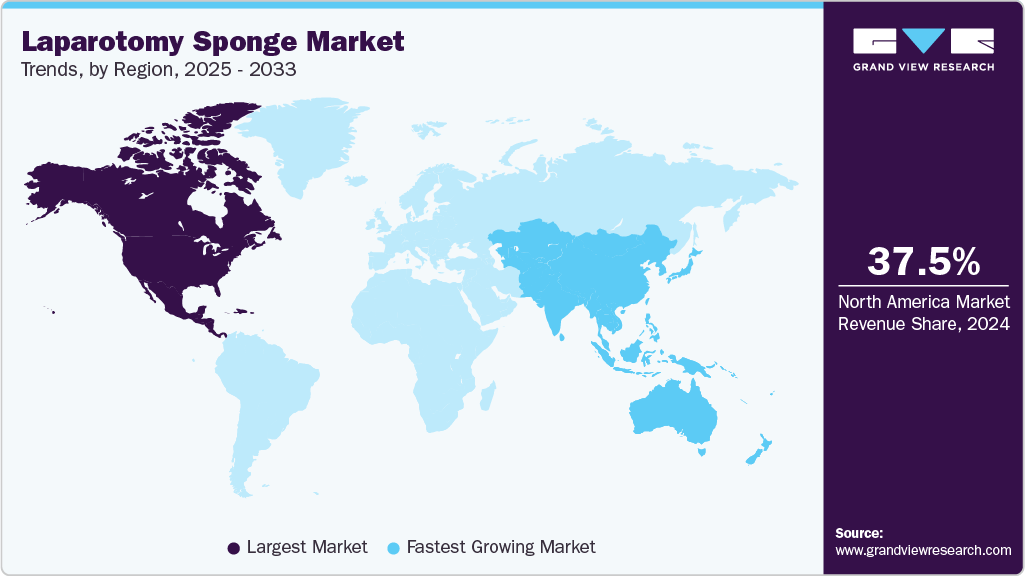

- The North America laparotomy sponge market held the largest share of 37.5% of the global market in 2024.

- The laparotomy sponge industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the radiopaque laparotomy sponges segment held the highest market share of 39.9% in 2024.

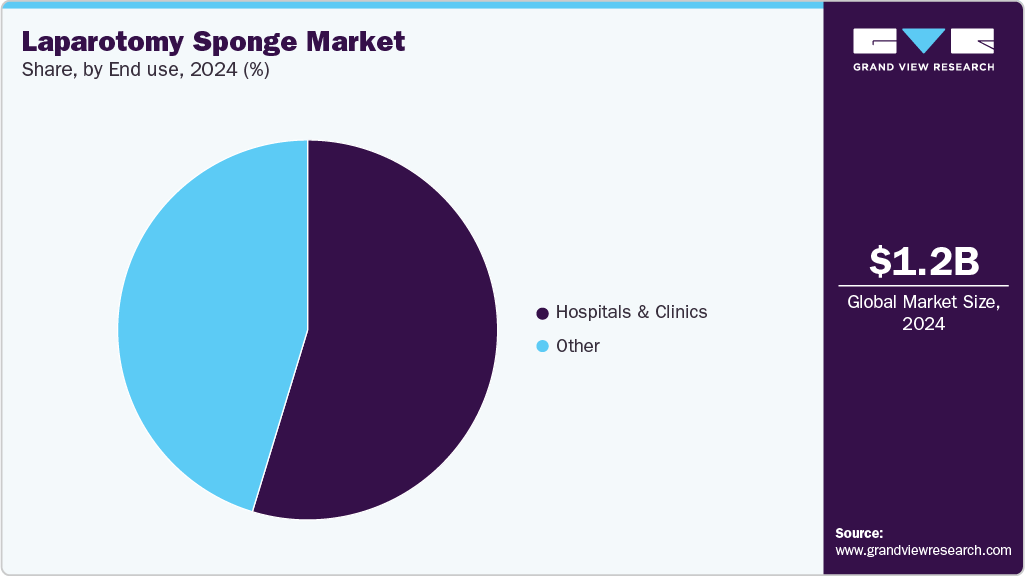

- Based on end use, the hospitals & clinics segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.23 Billion

- 2033 Projected Market Size: USD 2.06 Billion

- CAGR (2025-2033): 5.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Innovations such as radiopaque materials and RFID-enabled sponges improve detection and lower the chances of retained surgical items. Furthermore, the global rise in surgical procedures, driven by chronic illnesses such as cancer and heart conditions, boosts demand. Growing healthcare facilities and using single-use, environmentally friendly sponges also support market expansion.The laparotomy sponge market is witnessing significant growth driven by advancements in surgical safety protocols and the increasing prevalence of abdominal surgeries. For instance, according to the American College of Surgeons, around 4 million abdominal operations are performed yearly in the U.S. Laparotomy sponges are essential tools used to absorb fluids and prevent retained surgical items (RSIs) during procedures, increasing their demand in operating rooms. The rising incidence of abdominal disorders, cancer, and cesarean deliveries has contributed to a rise in laparotomy procedures globally, thereby boosting demand for these sponges.

The market is also witnessing a shift toward sustainable practices, with manufacturers focusing on eco-friendly materials and packaging to meet environmental standards. Innovations in sponge design, such as improved adhesive properties and ergonomic configurations, aim to enhance usability and comfort for surgical teams. Moreover, antimicrobial coatings on laparotomy sponges are becoming increasingly popular to minimize infection risks during surgeries. These advancements align with stringent healthcare regulations and address growing concerns about surgical safety and operational efficiency, further contributing to market growth.

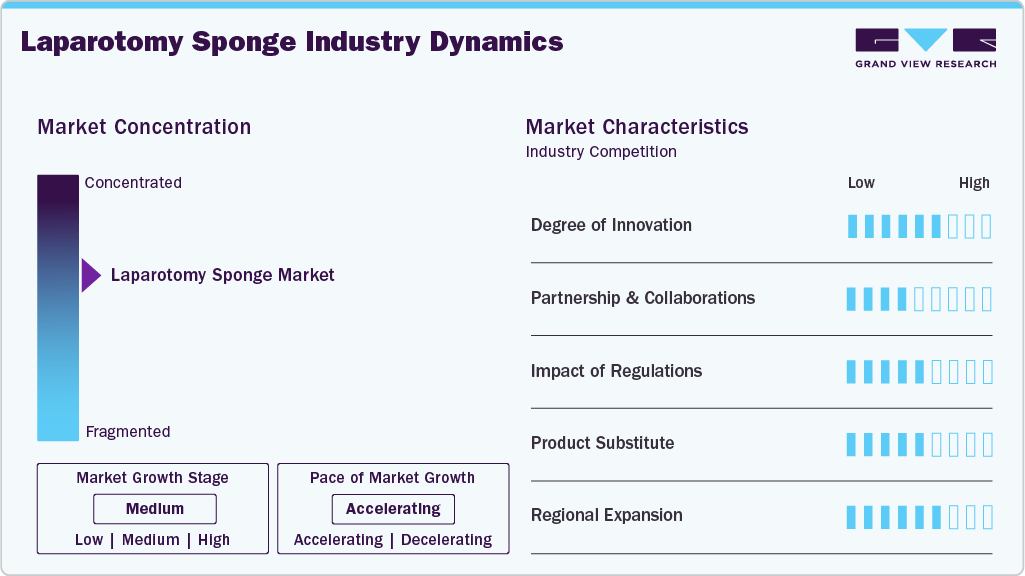

Market Concentration & Characteristics

The laparotomy sponge market witness’s significant industry concentration, with key players focusing on expansion and product differentiation. Companies such as Integra LifeSciences, Stryker, and Cardinal Health hold significant market share. The market is characterized by steady growth driven by increasing surgical procedures, technological advancements, and a focus on patient safety. Key market drivers include the rising prevalence of abdominal disorders, cancer, and cesarean deliveries, coupled with advancements such as RFID-enabled sponges for improved safety and sponge detection systems, as well as growing awareness of surgical safety and infection control measures.

The laparotomy sponge industry experiences a moderate to high degree of innovation, primarily driven by the need for improvements and error reduction in surgical procedures. Advancements such as radio-frequency identification (RFID) and barcode-enabled sponges are gaining demand, addressing the critical issue of retained surgical items (RSIs). These innovations can help prevent adverse events and enhance surgical outcomes. However, the integration of such advanced solutions remains uneven globally, especially in low- to mid-income settings due to cost constraints.

Although partnerships and collaborations in the laparotomy sponge industry are currently limited, the potential for future collaborations is high. Most manufacturers operate independently, focusing on organic growth strategies such as product enhancements and direct engagement with hospitals and surgical centers. Furthermore, collaborative efforts with academic institutions or regulatory bodies to standardize safety protocols are also expected to witness a rise over the forecast period.

Regulations play a crucial role in shaping the laparotomy sponge industry. Regulatory bodies such as the U.S. FDA and European CE authorities enforce stringent guidelines for sterility, safety, and traceability of surgical sponges. This regulatory framework encourages manufacturers to prioritize compliance and quality assurance, ensuring the safety of use for laparotomy sponges in healthcare facilities. As surgical safety gains more attention globally, future regulations may become stricter, further encouraging innovation and potentially differentiating market players with better regulatory compliance.

The threat of direct product substitutes in the laparotomy sponge industry is relatively low. However, functional substitutes in the form of advanced hemostatic agents and absorbable surgical pads are also witnessing demand. These alternatives may be preferred in complex or minimally invasive procedures where reduced foreign body presence is prioritized. However, laparotomy sponges remain the standard of care due to their high absorbency, versatility, and ease of use. Their role in maintaining clear surgical fields and managing blood loss is crucial in several open surgeries.

The laparotomy sponge industry is witnessing significant regional expansion, particularly in emerging economies where surgical volumes are rising and healthcare infrastructure is improving. Similarly, increasing regulatory compliance and hospital facility requirements are expected to drive demand. Government-backed healthcare programs and foreign investments in hospital infrastructure further support the regional expansion.

Product Insights

The radiopaque laparotomy sponge segment accounted for the largest revenue share in 2024, due to increasing emphasis on surgical safety and post-operative accountability. Radiopaque laparotomy sponges are implanted with a detectable marker visible under X-ray imaging. This allows for quick identification of retained surgical items (RSIs), significantly reducing the risk of complications such as infections, adhesions, or re-operation. Hospitals and surgical centers increasingly adopt radiopaque sponges to comply with regulatory guidelines and improve surgical outcomes.

The adoption of Radio-Frequency Identification (RFID) sponge in the laparotomy sponge market is witnessing significant growth due to its ability to enhance surgical safety and prevent surgical items retained (RSIs). RFID-tagged laparotomy sponges contain chips that allow real-time tracking and detection through specialized scanners, reducing reliance on manual counting and significantly minimizing human error. In addition, RFID product offers traceability and automatic documentation, streamlining post-operative audits and litigation defense, further fueling their demand in healthcare facilities.

End Use Insights

The hospital & clinics segment accounted for the largest revenue share in 2024. This growth is driven by the high volume of surgical procedures conducted in these settings. Hospitals are the primary adopter of laparotomy sponges due to their extensive surgical departments handling abdominal, gynecological, and trauma-related surgeries. The rising incidence of complex surgeries and emergency interventions in hospitals has encouraged the consistent demand for sterile, radiopaque sponges to manage blood absorption and prevent retained surgical items. The expansion of hospital infrastructure in emerging markets and the steady increase in surgical admissions in developed regions have further supported segment growth.

The others segment is experiencing significant growth and is driven by the rising number of outpatient surgical procedures and the increasing shift of complex surgeries to ambulatory settings. Others are rapidly adopting laparotomy sponges due to their cost-effectiveness, shorter patient recovery times, and lower infection rates compared to traditional hospitals. These centers are performing a growing volume of minimally invasive and open abdominal surgeries such as cholecystectomies, hernia repairs, and gynecological procedures that require efficient sponge tracking systems to reduce the risk of retained surgical items.

Regional Insights

The North America laparotomy sponge marketwith the largest revenue share of 37.5% in 2024, driven by a rise in surgical procedures, increased awareness around retained surgical items (RSIs), and the increasing adoption of radiofrequency identification (RFID) and barcode-based tracking systems. Furthermore, the presence of key players in the region, such as Integra LifeSciences, Stryker, and Cardinal Health further increases the access of wide range of laparotomy sponges to healthcare facilities, thereby fueling the market growth in the region.

U.S. Laparotomy Sponge Market Trends

The laparotomy sponge market in U.S. is expected to witness growth, driven by increasing focus of healthcare facilities on regulatory compliance. In addition, the increasing volume of surgical procedures, particularly abdominal surgeries, has increased the demand for high-quality laparotomy sponges. The emphasis on patient safety and adherence to stringent regulatory standards further propels the adoption of advanced sponges with radiopaque and RFID features.

Europe Laparotomy Sponge Market Trends

The European market for laparotomy sponges is witnessing significant growth driven by advancements in surgical procedures and increasing awareness around surgical safety protocols. Technologies such as radiofrequency identification (RFID) and barcode systems are gaining demand in hospitals and surgical centers across Europe. Countries such as Germany, France, and the UK are emphasizing hospital hygiene and patient safety, further encouraging the adoption of high-quality laparotomy sponges. The growth is also supported by the increasing number of complex surgical procedures among the aging population, creating significant demand.

The laparotomy sponge market in the UK is driven primarily by advancements in surgical safety protocols and a rising volume of abdominal surgeries across NHS and private healthcare settings. Moreover, the demand for laparotomy sponges is also driven by increasing hospital emphasis on surgical count accuracy and the prevention of retained surgical items (RSIs), aligning with current patient safety regulations and CQC standards.

The laparotomy sponge market in Germany is driven by advancements in surgical technologies and an increasing number of complex abdominal procedures. German healthcare facilities are adopting innovative sponge designs, including radiopaque and RFID-enabled sponges, to enhance surgical safety and efficiency. These factors collectively contribute to the expansion of the laparotomy sponge market in Germany.

Asia Pacific Laparotomy Sponge Market Trends

The laparotomy sponge market in Asia Pacific is driven by a combination of rising surgical volumes, expanding healthcare infrastructure, and increasing adoption of safety-enhancing surgical products. Countries such as China, India, and Thailand are witnessing a surge in both government and private investments in the improvement of healthcare infrastructure to improve the quality of the healthcare sector, which is boosting the demand for high-quality surgical consumables such as radiopaque laparotomy sponges. In addition, awareness initiatives by regional healthcare bodies are leading to more standardized surgical protocols, further contributing to the increasing adoption of these products in the region.

The laparotomy sponge market in Japan is witnessing significant growth, driven primarily by the rising surgical volumes, increased awareness of retained surgical items (RSIs), and ongoing efforts to improve operating room safety protocols. Moreover, Japan’s aging population, which fuels the demand for abdominal and complex surgeries, further contributes to the market growth in the country.

The laparotomy sponge market in China is driven by the expansion of surgical procedures and increased focus on patient safety in operating rooms. In addition, the developing healthcare infrastructure and healthcare quality in the country’s hospitals further contribute to demand. Furthermore, the government's emphasis on quality care under the Healthy China 2030 agenda is further encouraging hospitals to invest in reliable surgical consumables.

The laparotomy sponge market in India is witnessing significant growth, driven by rising surgical volumes, improving hospital infrastructure, and increased emphasis on surgical safety protocols. Moreover, government initiatives to expand access to healthcare under programs such as Ayushman Bharat are increasing the adoption of healthcare consumables in the country. Furthermore, the demand is also driven by the private sector’s growing investment in multispecialty and super-specialty facilities, which require reliable surgical consumables.

Latin America Laparotomy Sponge Market Trends

The laparotomy sponge market in Latin America is driven by the rising surgical volumes, expanding healthcare infrastructure, and increasing awareness around surgical safety. Moreover, the market also benefits from a regional push toward improving perioperative care and reducing the incidence of retained surgical items. Countries such as Brazil, and Argentina are investing in modernizing public hospitals, which is fueling demand for high-quality surgical consumables, including radiopaque and RFID-tagged laparotomy sponges.

The laparotomy sponge market in Brazil is witnessing significant growth, supported by rising surgical procedures across both public and private healthcare sectors. Advances in surgical protocols and an increased focus on patient safety further fuel the demand for laparotomy sponges. In addition, the expansion of hospital infrastructure, including new surgical centers, is increasing the utilization of surgical consumables, thereby driving the country's market growth.

Middle East & Africa Laparotomy Sponge Market Trends

The laparotomy sponge market in the Middle East and Africa (MEA) is driven by the rising surgical procedure volumes, improvements in hospital infrastructure, and increasing awareness of surgical safety standards. Adopting advanced surgical protocols and emphasizing reducing retained surgical items fuel demand for radiopaque and RFID-tagged laparotomy sponges. In addition, the expansion of medical tourism across the Gulf region supports the adoption of high-quality surgical consumables, thereby fueling the market growth in the region.

The laparotomy sponge market in Saudi Arabia is witnessing steady growth, driven by the expanding surgical volume across both public and private healthcare institutions. Moreover, the market is also driven by the Kingdom’s healthcare infrastructure developments under the Vision 2030 initiative, which emphasizes surgical safety and advanced operating room practices. The increasing adoption of surgical safety protocols, including sponge tracking technologies such as RFID and barcoding, is also influencing purchasing decisions among hospitals, aiming to minimize retained surgical items (RSIs).

Key Laparotomy Sponge Company Insights

The laparotomy sponge market is highly competitive, with key players such as Integra LifeSciences, Stryker, and Cardinal Health holding significant positions. The major companies undertake various organic and inorganic strategies such as product introduction, collaborations, and regional expansion to serve the unmet needs of their customers.

Key Laparotomy Sponge Companies:

The following are the leading companies in the laparotomy sponge market. These companies collectively hold the largest market share and dictate industry trends.

- Integra LifeSciences

- Medical Action Industries Inc.

- SDP Inc.

- Dukal, LLC

- Stryker

- Cardinal Health

- AllCare

- DeRoyal Industries Inc.

- Allmed Medical Products Co.,Ltd.

- Premier Enterprises

Recent Developments

-

In November 2024, Stryker launched its next-generation SurgiCount+ system, integrating sponge tracking and blood loss estimation into a single platform to improve surgical safety and workflow efficiency. Combining SurgiCount’s RFID-enabled sponge tracking with the Triton system’s real-time blood loss analysis helps reduce surgical count errors-one of the most time-consuming safety tasks-by up to 10 minutes per procedure.

-

In October 2023, a U.S. patent (20240136700, April 2024) details a surgical sponge with a laminated RFID tag featuring flexible tabs and an etched metal foil antenna. The tag enhances durability, signal strength, and X-ray visibility, improving tracking and reducing the risk of retained surgical items.

Laparotomy Sponge Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.31 million

Revenue forecast in 2033

USD 2.06 million

Growth rate

CAGR of 5.9% from 2025 to 2033

Actual period

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Integra LifeSciences; Medical Action Industries Inc.; SDP Inc.; Dukal, LLC; Stryker; Cardinal Health; AllCare; DeRoyal Industries Inc.; Allmed Medical Products Co.,Ltd.; Premier Enterprises

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laparotomy Sponge Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global laparotomy sponge market report on the basis of product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Radiopaque Laparotomy Sponge

-

Traditional Laparotomy Sponge

-

RFID Laparotomy Sponge

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global laparotomy sponge market size was estimated at USD 1.23 billion in 2024 and is expected to reach USD 1.31 billion in 2025.

b. The global laparotomy sponge market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2033 to reach USD 20.06 billion by 2033.

b. North America dominated the laparotomy sponge market with a share of 37.5% in 2024. This is attributable to the increasing geriatric population, rising incidence of abdominal disorders, and the growing number of abdominal surgeries.

b. Some key players operating in the laparotomy sponge market include Medtronic; Derma Sciences, Inc.; Medical Action Industries, Inc.; Medline Industries, Inc.; Stryker; Premier Enterprises; ACTIMED; A Plus International, Inc.; Cardinal Health; and AllCare.

b. Key factors that are driving the market growth include increasing incidence of abdominal disorders, technological advancements, and surging geriatric population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.