Latin America Detergent Market Trends

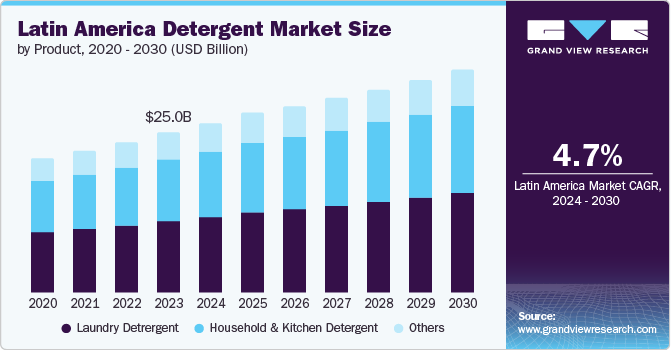

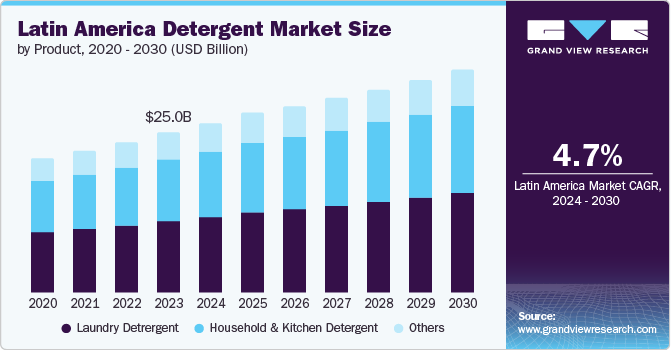

The Latin America detergent marketsize was valued at USD 25.0 billion in 2023 and is projected to grow at a CAGR of 4.7% from 2024 to 2030. This growth is attributed to rising population, lifestyle shifts, and rising hygiene, and cleanliness awareness. In addition, increasing consumer demand for eco-friendly personal care products is escalating the market growth. The increasing disposable income is changing consumer buying preference towards premium products. The multiple benefits of detergents, the growing usage of cleaning products, including laundry and dishwashing detergents, is boosting the market expansion.

With the increasing population and rising disposable income, consumers spend heavily on improving their lifestyles and changing their preferences towards consumer goods such as detergents. In addition, the usage of premium attires made from high-quality fabrics backs the demand for detergents to maintain the quality of the fabric. In addition, the growing popularity of smart homes and the rising adoption of washing machines, particularly in these regions, drive the detergent market.

Moreover, focusing on hygiene and cleanliness, consumers are more conscious of the importance of good hygiene, contributing to the rise in soft detergents on the skin and natural and chemical-free products. Moreover, the use of detergents made up of natural ingredients is rising due to increasing awareness about the benefits of organic and less toxic-based products. Furthermore, introducing new and innovative detergent products is driving the market. Companies are increasingly investing in research and development to meet consumer demand and develop new products in the detergent category.

Product Insights

The laundry detergent dominated the market and accounted for the largest revenue share of 45.0% in 2023. The shifting preferences among consumers towards eco-friendly and less chemical-containing formulations with added quality ingredients in detergent products offered by companies attain the customers' trust. Hence, laundry detergents are convenient alternatives for soaps as they reduce time and energy, leading to market growth. Moreover, laundry detergents provide easy and quick choice over traditional detergents, making them best for implementation in daily use.

The household and kitchen detergent is expected to grow at a CAGR of 5.1% over the forecast period driven by the shift of customers from synthetic and chemical products to natural and less harmful detergents. Purchasing the right washing liquid gel or detergent powder for household purposes ensures efficacy and cleanliness. As detergents are cleaning products for daily household chores and are significant for making utensils clean and hygienic, they further increase the demand for detergents.

Application Insights

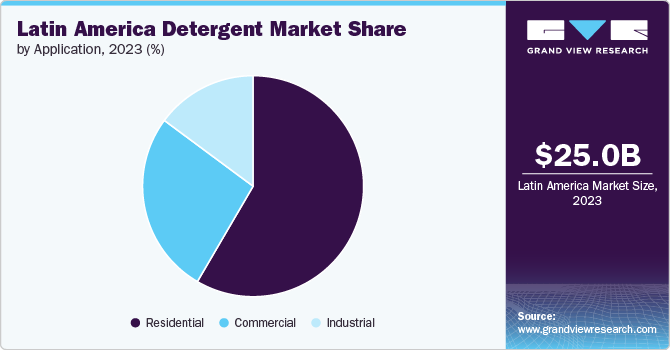

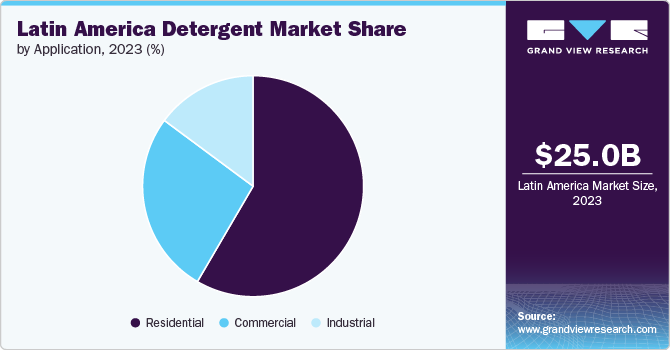

The residential segment dominated the market with a share of 58.7% in 2023. This growth is attributed to the increasing population in the region, due to which there is an increased demand for cheap residential-use detergent products that include properties of efficient stain-removing agent ingredients. In addition, adopting washing machines in regions fuels the demand for detergent products. Whereas growth in urbanization in countries augments the alignment for rising sales in powder or liquid detergents, aiming for cleanliness and effective results after washing.

The commercial segment is expected to grow at a CAGR of 5.2% over the forecast period. The rising need for proper cleanliness and hygiene in restaurants, hospitals, tourism industries, hospitality, and commercial spaces propels the demand for detergents. In addition, customers tend to buy products that are effective and super-quality. Hence, it is important to maintain proper cleanliness for the overall safety of the people.

Regional Insights

The detergent market in Latin America is witnessing substantial growth due to rising innovations in detergent formulations, such as the implementation of eco-friendly and anti-allergenic detergents, which propels the market expansion as consumers nowadays prioritize sustainability and health-conscious alternatives over chemicals and allergic detergent powders. Moreover, the rising adoption of eco-friendly and skin-friendly products, along with products made up of natural ingredients, is driving the market growth.

Brazil detergent market dominated the Latin America market, with a revenue share of 40.4% in 2023. This growth is attributed to the demand for less expensive products in some of the country's economically backward regions. Moreover, the choices for effective and cheap detergents. Further, the rising consumer and personality care led to the product market growth.

The detergent market in Argentina is witnessing significant growthdriven by continuous implementation and usage in executing daily household chores. It has been widely utilized in hospitality, travel and tourism, and hospitals. Furthermore, rising customer demand for organic and eco-friendly detergent powders and liquids propels the market growth. Hence, FMCG (Fast Moving Consumer Goods) companies focus on product differentiation and provide premium alternatives with added features such as enhanced formulations for different fabrics, odors, and stain-removing capabilities.

Key Latin America Detergent Market Company Insights

Some of the key companies in the Latin America detergent market include Unilever, Procter & Gamble, Colgate-Palmolive Company, Henkel AG & Co. KGaA, Amway Corp., Productos Químicos Panamericanos SA in the market are focusing on development & to gain a competitive edge in the industry.

-

Unilever produces, distributes, and markets fast-moving consumer goods. Its product line includes food items, beverages, medications, soaps, home care items, vitamins, minerals, supplements, and beauty and personal care items. It is well-established in more than 190 nations globally.

-

Procter & Gamble produces and distributes quick-moving consumer products, encompassing a variety of product categories, including baby wipes, conditioners, shampoos, dishwashing liquids, toothbrushes, toothpaste, and air fresheners. The company's well-known brands include Gillette, Head & Shoulders, Pampers, Olay, Tide, Ariel, and Pantene.

Key Latin America Detergent Companies:

- Unilever

- Procter & Gamble

- Colgate-Palmolive Company

- Henkel AG & Co. KGaA

- Amway Corp.

- Productos Químicos Panamericanos SA (PQP)

- Detergentes Y Jabones Sasil S.A.P.I de C.V.

- California Cleaning Supply LLC

- BioCloro S.R.L.

- Nacional de Detergentes S.A.

Recent Developments

-

In April 2024, Procter and Gamble launched Tide Evo, a new type of laundry clothing made of square-shaped six-layer tile. The Tide Evo is designed to be more convenient and eco-friendly, making washing clothes faster.

-

In April 2024, Unilever announced the launch of a new laundry detergent, Wonder Wash, designed specifically for short-cycle washes. With the help of technology and innovation, Wonder Wash is specifically formulated to deliver powerful clean water in less than 15 minutes. Wonder Wash comes in three variants: Speed Clean Bio, Odour Defy, and Ultra Care.

Latin America Detergent Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 26.5 billion

|

|

Revenue forecast in 2030

|

USD 34.8 billion

|

|

Growth Rate

|

CAGR of 4.7% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, application, region

|

|

Regional scope

|

Latin America

|

|

Country scope

|

Brazil, Argentina, Colombia

|

|

Key companies profiled

|

Unilever; Procter & Gamble; Colgate-Palmolive Company; Henkel AG & Co. KGaA; Amway Corp.; Productos Químicos Panamericanos SA; Detergentes Y Jabones Sasil S.A.P.I de C.V.; California Cleaning Supply LLC; BioCloro S.R.L.; Nacional de Detergentes S.A.

|

|

Customization scope

|

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Latin America Detergent Market Report Segmentation

This report forecasts revenue growth at regional and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Latin America detergent market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Latin America

-

Brazil

-

Argentina

-

Colombia