- Home

- »

- Organic Chemicals

- »

-

Latin America Magnesium Nitrate Market Size, Industry Report, 2026GVR Report cover

![Latin America Magnesium Nitrate Market Size, Share & Trends Report]()

Latin America Magnesium Nitrate Market Size, Share & Trends Analysis Report By Application (Additives, Catalysts), By Country (Brazil, Argentina, Chile, Colombia), And Segment Forecasts, 2019 - 2026

- Report ID: GVR-3-68038-781-0

- Number of Report Pages: 73

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2017

- Forecast Period: 2019 - 2025

- Industry: Bulk Chemicals

Report Overview

The Latin America magnesium nitrate market size was estimated at USD 78.3 million in 2018 and is expected to grow at a CAGR of 4.5% over the forecast period. The significant growth in demand for fertilizer in the farming sector and increasing use of explosives in mining industries is expected to drive the demand.

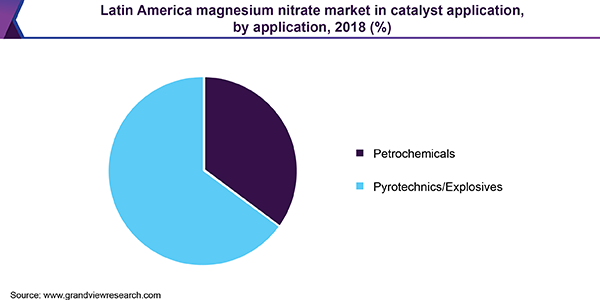

Magnesium nitrate is an odorless, crystalline, and colorless substance, which is primarily used as a catalyst for manufacturing fireworks and petrochemicals. It can be typically prepared by mixing calcium nitrate with magnesium sulfate, which is thereafter filtered to extract the insoluble calcium sulfate. In the explosives industry, it is used as an oxidizing agent to enhance the combustion of other substances used for producing explosives. In the fertilizers industry, magnesium nitrate acts as a source of magnesium ion and the nitrate ion, which stimulate the healthy growth of crops.

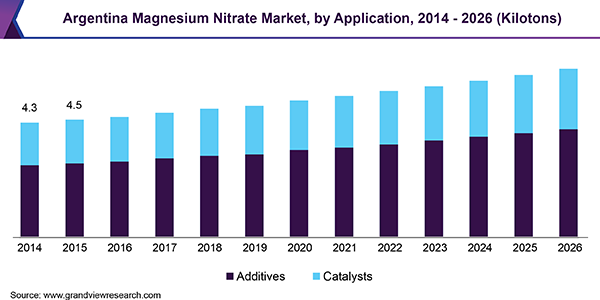

Argentina has been one of the crucial markets for explosives due to the growing mining activities in the country. Several companies have been broadening their presence in the country to captivate the untapped potential. Despite the country’s depressed prices of commodities, it is regarded as a mining destination with a multitude of new mining projects in the pipeline.

Latin America is considered as one of the prominent regions in terms of the production and export of crops. The region has witnessed robust growth in the production of crops over the last decade and this trend is expected to continue in the future. Magnesium nitrate is used in the formulation of various fertilizers, as it compensates for the deficiency of the nutrient in a plant. In addition, it contains nitrogen in the form of nitrate, which is the most efficient source of nitrogen for plant growth and yield.

The mining industry in Latin America has been thriving since the past few years and a plethora of metals such as copper, potash, lithium, iron ore, gold, and niobium have been unearthed. With a robust growth opportunity, several companies have made significant investments. In 2017, 305 companies invested a total amount of USD 2.38 billion in exploration activities, particularly in Mexico, Peru, Colombia, and Chile.

Application Insights

Magnesium nitrate is majorly used as an additive which is projected to grow at a CAGR of 3.8% from 2019 to 2025. Magnesium nitrate, as an additive, is further utilized in formulating nitric acid, fertilizers, and specialty chemicals. It is also used as a catalyst in the preparation of explosives and other petrochemical products. The demand for magnesium nitrate is majorly fueled by its utilization as a fertilizer in the agriculture-dependent economies in the region.

Nitric acid and fertilizer manufacturing are the major application areas for magnesium nitrate additives. The demand from the agriculture and mining industry is expected to drive the Latin America magnesium nitrate market. The easy availability of raw materials and the low cost of production has facilitated numerous fertilizer manufacturers to set up facilities in Brazil. This is likely to develop new opportunities for the utilization of magnesium nitrate in the region over the coming years.

The utilization of magnesium nitrate as a catalyst is growing rapidly in the petrochemicals and explosives industry. It is majorly used as a viscosity adjuster in the petrochemical industry. The favorable properties coupled with reduced risk of hazards associated with the product is anticipated to fuel its demand over the coming years. However, stringent government laws and regulations related to the use of explosives is likely to restrict product demand in the mining sector.

Country Insights

Mexico emerged as the largest consumer of magnesium nitrate whereas Chile is observed to be the fastest-growing consumer with a CAGR of 4.6% during the forecast period. Rapidly growing mining activities have boosted the overall demand for mining explosives in the country.

Mexico has been reforming their grounds of the energy sector which has reflected a substantial impact on the fertilizers industry. According to the International Association of Fertilizer Industry, companies operational in fertilizer business in the country are facing high cost of manufacturing provided the old infrastructure facilities and age-old technology in extracting raw materials. This has ultimately led to lower country-level production and high dependency on imports. With the advancement in the energy sector, the natural gas industry shall witness investment from regional and foreign multinationals, thereby leading to the introduction of the latest technologies. These advancements are likely to lower production and distribution cost of natural gas, eventually leading to decreased cost of fertilizer production.

Chile is a growing market in terms of explosives industry due to high mining activities supported by the government. Chile and Peru are among the two foreign investment open markets concerning mining operations that are aided by the government to subsequently increase the economic conditions of these countries. Companies such as Enaex which are among the top mining and blasting industries since the past 98 years have been observed to expand their business operations in Chile, which in turn shall pave way for magnesium nitrate demand over the forecast period.

Key Companies & Market Share Insights

The market is highly competitive. The industry comprises prominent and well-established players such as Avantor Performance Materials, Haifa Mexico, Sigma Aldrich, American Elements, Van Iperen International, Yara International, Neochim PLC, AKO Kasei Co. Ltd., Rongyu Chemical Co. Ltd, DowDuPont.

Companies are undertaking several initiatives including frequent mergers, acquisitions, capital expansion, and strategic alliances. In March 2018 Van Iperen International announced a new subsidiary named Van Iperen America, located in Florida to strengthen its position in North as well as Latin America. In 2017, Yara acquired Vale Cubatao Fertilizantes complex, Brazil to strengthen its position in the local market.

Latin America Magnesium Nitrate Report Scope

Report Attribute

Details

Market size value in 2019

USD 83.6 million

Revenue forecast in 2026

USD 113.5 million

Growth Rate

CAGR of 4.9% from 2019 to 2026

Base year for estimation

2018

Historical data

2014 - 2017

Forecast period

2019 - 2026

Quantitative units

Revenue in USD million and CAGR from 2019 to 2026

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

Latin America

Country scope

Argentina, Brazil, Chile, Colombia, Ecuador, Mexico, Peru

Key companies profiled

Avantor Performance Materials, Haifa Mexico, Sigma Aldrich, American Elements, Van Iperen International, Yara International, Neochim PLC, AKO Kasei Co. Ltd., and Rongyu Chemical Co. Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments covered in the reportThis report forecasts revenue growth at a regional & country level and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2026. For the purpose of this study, Grand View Research, Inc. has segmented the report on the basis of application and country:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2014 - 2026)

-

Additives

-

Nitric Acid

-

Specialty Chemicals

-

Fertilizers

-

Others

-

-

Catalysts

-

Petrochemicals

-

Pyrotechnics/Explosives

-

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million; 2014 - 2026)

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

Mexico

-

Peru

-

Ecuador

-

Frequently Asked Questions About This Report

b. The Latin America magnesium nitrate market size was estimated at USD 83.6 million in 2019 and is expected to reach USD 86.9 million in 2020.

b. The Latin America magnesium nitrate market is expected to grow at a compound annual growth rate of 4.5% from 2019 to 2026 to reach USD 113.5 million by 2026.

b. Additives application dominated the Latin America magnesium nitrate market with a share of 61.7% in 2019. This is attributable to utilization of the product in formulation of nitric acid, fertilizers, and specialty chemicals.

b. Some key players operating in the Latin America magnesium nitrate market include Avantor Performance Materials, Haifa Mexico, Sigma Aldrich, American Elements, Van Iperen International, Yara International, Neochim PLC, AKO Kasei Co. Ltd., and Rongyu Chemical Co. Ltd.

b. Key factors that are driving the market growth include significant growth in demand for fertilizer in the farming sector and increasing use of explosives in mining industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."