- Home

- »

- IT Services & Applications

- »

-

Latin America Reverse Factoring Market Size Report, 2030GVR Report cover

![Latin America Reverse Factoring Market Size, Share & Trends Report]()

Latin America Reverse Factoring Market Size, Share & Trends Analysis Report By Category (Domestic, International), By Financial Institution, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-034-6

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

The Latin America reverse factoring market size was valued at USD 17,764.4 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 18.0% from 2023 to 2030. The market growth can be attributed to the shifting focus of micro, small, and medium-sized enterprises (MSMEs) toward supply chain financing, and the rising adoption of new technologies in the market. The stringent lockdown measures during the COVID-19 pandemic disrupted the whole supply chain process in Latin America, resulting in a massive slowdown of the manufacturing industry, reduced import-export operations, and an impact on the financial performance of industries.However, with the ease in lockdowns in early 2021, most of the MSMEs preferred reverse factoring services to optimize their supply chain and increase their working capital to accelerate their business growth, thereby driving the Latin American reverse factoring market growth during the forecast period.

Supply Chain Financing (SCF) or reverse factoring is emerging as a prominent alternative for accessing short-term credits in Latin America. Supply Chain Management (SCM) helps suppliers monetize their bill receivables without any financial liability, which is inevitable in the case of a loan. By monetizing suppliers’ receivables and offering immediate liquidity, reverse factoring also reduces the Cash Conversion Cycle (CCC) and Days of Sales Outstanding (DSO).

In addition, SCF enables the buyer to initiate faster payments to the supplier, which helps improve corporate liaisons with suppliers and significantly reduces the operational risk throughout the supply chain. Thus, the aforementioned factors are expected to drive the Latin American reverse factoring market during the forecast period.

The rising support from regional governments for creating smooth working capital solutions is driving the growth of the reverse factoring market in Latin America. Governments of various countries in the region, including Paraguay, Chile, Mexico, and Argentina, are announcing supportive initiatives for the promotion and development of reverse factoring. For instance, in 2018, the Government of Peru mandated e-invoice issuing for all companies from all end-use sectors. E-invoicing is assisting Peru-based MSMEs in obtaining instant cash payments from buyers through reverse factoring.

Advancements in digital technologies such as big data analytics, AI, NLP, Machine Learning (ML), Blockchain, IoT, and cloud computing are creating opportunities for the Latin American reverse factoring market. AI solution providers are investing heavily in R&D activities to offer improved AI tools for reverse factoring solutions. For instance, in September 2022, FactorFox Software launched FactorFox Mobile Optical Character Recognition (OCR), an AI application, for various factoring services. This OCR application optimizes an organization's ability to automate documentation and speed up operations for faster funding.

Market players are focusing on mergers, partnerships, and acquisitions to enhance their service offerings and brand value, creating a favorable environment for the reverse factoring services market. For instance, in May 2022, Galgo Capital’s subsidiary, Ancon SpA, a special purpose vehicle company, acquired a 40% stake in the factoring and account collection company Crece Capital, for an undisclosed amount in Peru.

Moreover, in March 2021, eFactor Network, a fintech company, extended its partnership with PrimeRevenue, Inc., a working capital solution provider, for four years. Owing to the partnership, eFactor Network would be able to provide PrimeRevenue, Inc.’s sustainable financial technology solutions to its clients across Latin America to improve their cash flows. Such factors are propelling the growth of Latin America’s reverse factoring market.

Category Insights

The domestic segment accounted for the largest market share of 92.2% in 2022. Developing economies are building comprehensive domestic supply chains for reducing their reliance on imported goods, thereby reducing cross-border trade flows. For instance, in December 2022, eFactor Network, a Mexican fintech company, and Trafigura Pte Ltd, a Singapore-based commodity trading company, collaborated with several financial institutions and piloted a sustainable supply chain finance initiative for mining companies in Mexico.

The program was aimed at strengthening mining companies’ working capital requirements and scaling out responsible sourcing options throughout the value chain. Such factors helped in strengthening the demand for reverse factoring in the segment during the forecast period.

The international segment is anticipated to progress at a CAGR of 21.5% during the forecast period. Some of the major benefits of international reverse factoring include trading with countries outside of the bank's jurisdiction; suppliers being able to receive the supplementary cash flow, allowing them to ensure steady supply and increase their volume of production; and suppliers benefitting from fast funding and high advance rates. These benefits will supplement the growth of the segment during the forecast period.

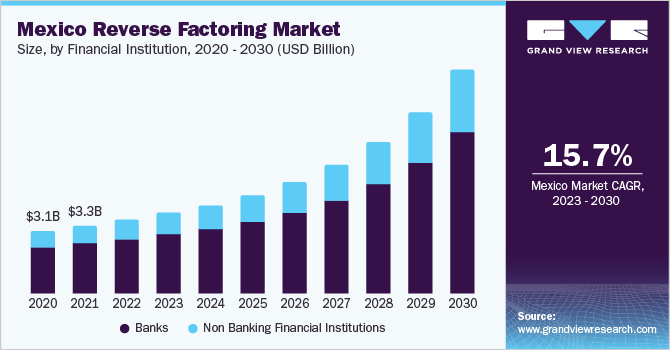

Financial Institution Insights

The banks segment accounted for the dominant market share of 78.5% in 2022. The segment growth can be attributed to the growth in digitization to bridge the current gaps in financial services and the need in the banking sector to provide improved customer experiences. Furthermore, the growing adoption of mobile-based payment channels and cross-border transactions is anticipated to propel the segment growth over the forecast period.

The non-banking financial institutions segment is anticipated to expand at a CAGR of 19.2% during the forecast period. NBFIs such as JP Morgan Chase and Wells Fargo use advanced technologies and leverage their partnership ecosystems across credit/loan disbursement& customer onboarding with the help of Artificial Intelligence (AI), machine learning, and blockchain.

The trade & working capital solutions offered by these organizations help businesses in dealing with an ever-changing geo-political and supply chain environment. Companies offer trade expertise with the help of digital solutions to their global clients. These offerings accelerate cash flow and optimize working capital in a business, improve operational efficiency, and streamline cross-border payments. These factors are expected to help in driving the segment growth during the forecast period.

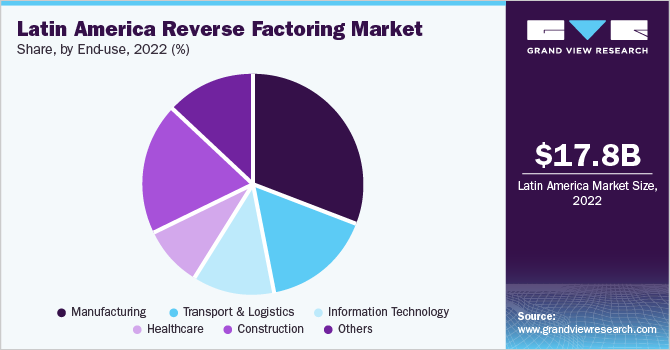

End-use Insights

The manufacturing segment accounted for the largest market share of 31.1% in 2022. Supply chain finance enhances cash flow by broadening the payment terms of the manufacturer’s supplier and providing suppliers with the option of receiving early payment for invoices. Supply chain finance, when combined with the right program partner, provides a multi-funder approach that enables companies to offer supply chain finance to a greater number of suppliers in different currencies and geographies.

This helps extend the benefits of early payment to more suppliers who need to support their customers' business transformations, which helps meet the buyer’s or customer’s working capital goals.It also provides manufacturers with visibility into payment processing and invoice status, enabling them to know the payment date.These benefits and capabilities provided by supply chain finance are expected to drive the demand of the segment during the forecast period.

The healthcare segment is expected to advance at the highest CAGR of 20.6% during the projection period. Manufacturers in the healthcare supply chain work on a variety of initiatives to grow, scale, and invest in themselves and others. They require easy access to readily available cash to scale and grow, through acquisitions or innovations.

Supply chain financing has the potential to improve a company's cash position. Better cash flow can lead to a broader product portfolio as the company invests in new technology or acquires other manufacturers with a diverse product offering. The benefits and capabilities provided by supply chain finance in the mentioned segment are expected to enable significant industry growth during the forecast period.

Regional Insights

Brazil held the majority share of 31.9% in the Latin America reverse factoring market in 2022, owing to the increasing manufacturing facilities in the country due to significant industrialization, which is encouraging global players to expand their business operations in Brazil. Client firms are focusing on maintaining consistency in their supply chain to reduce the product reach time to market by providing early payments to suppliers and establishing a long-term partnership, thus creating robust market opportunities. Thus, it is derived that market growth in the region will grow significantly.

Argentina is anticipated to emerge as the fastest-developing regional market with a CAGR of 26.7% during the assessment period. Argentina is home to various startups that offer reverse factoring, such as MR Presta SA de CV. Key market players across the region are offering customers easy access to working capital solutions with competitive lending rates. This, along with the presence of supply chain factoring service providers, has propelled the growth of the reverse factoring market in the country.

Key Companies & Market Share Insights

Market players are observed to invest resources in research & development activities to support growth and enhance their internal business operations. Companies can be seen engaging in mergers & acquisitions and partnerships to further upgrade their products and gain a competitive advantage in the market. They are effectively working on new product development, and enhancement of existing products to acquire new customers and capture higher market shares.

For instance, in September 2022, JP Morgan Chase & Co. announced the acquisition of Renovite Technologies, Inc., a provider of cloud-native payments technology. Following the acquisition, Renovite Technologies, Inc. would become part of JP Morgan Payments. The acquisition was aimed at helping JP Morgan Payments in building a next-generation merchant acquiring platform. Some of the Prominent players dominating the Latin America reverse factoring market include:

-

Credit Suisse Group AG

-

eFactor Network

-

Drip Capital Inc.

-

JP Morgan Chase & Co.

-

Monkey

-

Banco Bilbao Vizcaya Argentaria

-

Kyriba

-

Barclays Plc

-

Deutsche Factoring Bank

-

Accion International

-

TRADEWIND GMBH

-

HSBC Group

-

Societe Generale

-

Mitsubishi UFJ Financial Group, Inc.

-

SUMMA FACTORING

Latin America Reverse Factoring Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 19,727.4 million

Revenue forecast in 2030

USD 62,697.6 million

Growth rate

CAGR of 18.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Factoring volume in USD million and CAGR from 2023 to 2030

Report coverage

Factoring volume forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Category, financial institution, end-use, country

Regional scope

Latin America

Country scope

Brazil; Mexico; Chile; Peru; Argentina; Paraguay; Uruguay; Ecuador; Colombia; Bolivia; Rest of Latin America

Key companies profiled

Credit Suisse Group AG; eFactor Network; Drip Capital Inc.; JP Morgan Chase & Co.; Monkey; Banco Bilbao Vizcaya Argentaria; Kyriba; Barclays Plc; Deutsche Factoring Bank; Accion International; TRADEWIND GMBH; HSBC Group; Societe Generale; SUMMA FACTORING; Mitsubishi UFJ Financial Group, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Latin America Reverse Factoring Market Report Segmentation

This report forecasts factoring volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Latin America reverse factoring market report based on category, financial institution, end-use, and country:

-

Category Outlook (Factoring Volume, USD Million, 2018 - 2030)

-

Domestic

-

International

-

-

Financial Institution Outlook (Factoring Volume, USD Million, 2018 - 2030)

-

Banks

-

Non Banking Financial Institutions

-

-

End-use Outlook (Factoring Volume, USD Million, 2018 - 2030)

-

Manufacturing

-

Transport & Logistics

-

Information Technology

-

Healthcare

-

Construction

-

Others

-

-

Country Outlook (Factoring Volume, USD Million, 2018 - 2030)

-

Brazil

-

Mexico

-

Chile

-

Peru

-

Argentina

-

Paraguay

-

Uruguay

-

Ecuador

-

Colombia

-

Bolivia

-

Rest of Latin America

-

Frequently Asked Questions About This Report

b. The Latin America reverse factoring market size was estimated at USD 17,764.4 million in 2022 and is expected to reach USD 19,727.4 million in 2023.

b. The Latin America reverse factoring market is expected to grow at a compound annual growth rate of 18.0% from 2023 to 2030 to reach USD 62,697.6 million by 2030.

b. Domestic dominated the Latin America reverse factoring market with a share of around 92% in 2022. This is attributable to the the developing economies which are building comprehensive domestic supply chains for reducing their reliance on imported goods, thereby reducing cross-border trade flows.

b. Some key players operating in the Latin America reverse factoring market include Credit Suisse Group AG; eFactorNetwork; Drip Capital Inc.; JP Morgan Chase & Co.; Monkey; Banco Bilbao Vizcaya Argentaria; Kyriba; Barclays Plc; and Deutsche Factoring Bank.

b. The market growth can be attributed to the shifting focus of micro, small, and medium-sized enterprises (MSMEs) toward supply chain financing and the rising adoption of new technologies in the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."