- Home

- »

- Homecare & Decor

- »

-

Laundry Care Market Size And Share, Industry Report, 2030GVR Report cover

![Laundry Care Market Size, Share & Trends Report]()

Laundry Care Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Laundry Sanitizer, Laundry Detergent, Fabric Softeners & Conditioners), By Application (Residential, Commercial), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-925-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Laundry Care Market Summary

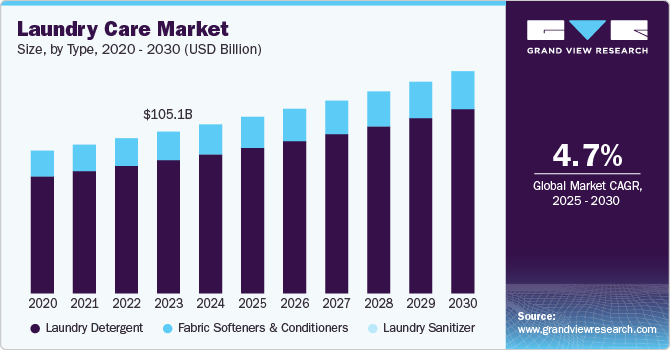

The global laundry care market size was estimated at USD 109.7 billion in 2024 and is projected to reach USD 144.30 billion by 2030, growing at a CAGR of 4.7% from 2025 to 2030. As disposable incomes rise, consumers are increasingly willing to invest in premium laundry care products that promise enhanced performance and added benefits.

Key Market Trends & Insights

- The laundry care market in North America accounted for a market share of around 24% in 2024 in the global market.

- The laundry care market in the U.S. accounted for a market share of around 70% in 2024.

- By type, laundry detergent segment accounted for a market share of around 82% in 2024.

- By application, residential application segment accounted for a share of around 58% in 2024.

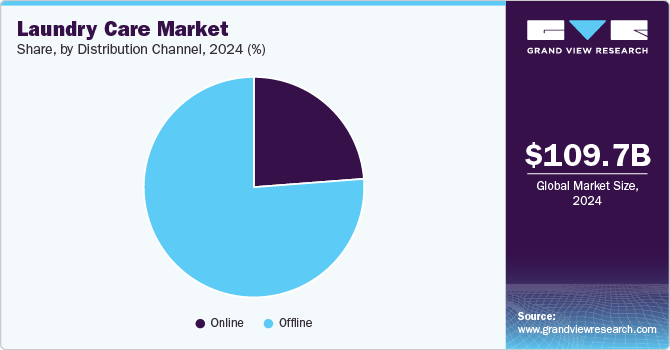

- By distribution channel, offline sales accounted for a market share of around 76% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 109.7 Billion

- 2030 Projected Market Size: USD 144.30 Billion

- CAGR (2025-2030): 4.7%

- Asia Pacific: Largest market in 2024

This trend is particularly evident in the growing demand for eco-friendly detergents, which offer sustainability, as well as specialized fabric softeners that provide added softness and freshness. Consumers are also gravitating toward products that cater to specific needs, such as hypoallergenic or stain-fighting formulations, reflecting a shift towards higher-quality, more personalized laundry care solutions.

The increased awareness of hygiene and sanitation, particularly following the COVID-19 pandemic, has significantly boosted the demand for laundry sanitizers, disinfectants, and other cleaning products in institutional settings. This trend stems from a heightened focus on maintaining stringent cleanliness standards in environments where infection control is critical, such as hospitals, nursing homes, and fitness centers. According to the Centers for Disease Control and Prevention (CDC), proper laundry hygiene in hospitals can reduce the risk of cross-contamination and infection outbreaks. As a result, hospitals and long-term care facilities have increased their use of EPA-registered disinfectants and sanitizers that meet healthcare-grade standards to clean linens, gowns, and uniforms.

Innovation and product differentiation are key drivers of the laundry care market, where brands strive to meet the evolving demands from sectors such as hospitality, healthcare, and institutional services. Companies are focusing on creating products that offer superior cleaning power but also address the growing need for sustainability, efficiency, and tailored solutions. For example, Ecolab, a leading player in laundry solutions, has developed innovative laundry detergents and fabric softeners that are formulated for industrial-scale washing while minimizing water and energy consumption. Their OxyGuard technology uses oxygen-based cleaning to reduce chemical usage, offering an eco-friendly and effective alternative.

Type Insights

Laundry detergent accounted for a market share of around 82% in 2024. Laundry detergent continues to dominate the laundry care market, fueled by consistent consumer demand for effective and convenient cleaning solutions that cater to a wide range of fabrics and stains. The evolution of laundry detergents, with innovations such as concentrated formulas, pods, and eco-friendly variants, has made it easier for consumers to use and achieve superior cleaning results with minimal effort. The availability of a wide variety of detergent types, from budget-friendly to premium options, ensures that they meet the diverse needs of different consumer segments, favoring the market growth.

The demand for fabric softeners & conditioners is expected to grow at a CAGR of 4.1 % from 2025 to 2030. The trend is particularly notable among consumers looking for premium products that improve the texture of fabrics and offer specialized benefits, such as hypoallergenic formulas for sensitive skin or eco-friendly options with biodegradable ingredients and recyclable packaging. Additionally, the growing awareness of personal care and hygiene, combined with the increasing focus on sustainability, has increased demand for natural and plant-based fabric softeners. With innovations in product formulations, such as concentrated and multi-functional conditioners that combine fabric softening with odor control or wrinkle reduction, the market for these products is expected to continue expanding.

Application Insights

Residential application accounted for a share of around 58% in 2024. Consumers increasingly seek products that offer superior cleaning power, stain removal, and fabric care, while also addressing specific needs like sensitive skin or allergy-friendly formulations. The convenience of pre-measured, concentrated detergents and eco-friendly packaging, such as refillable bottles and biodegradable products, is also appealing to environmentally-conscious consumers. Additionally, the rise in household incomes and busy lifestyles has led to more frequent laundry cycles, further boosting demand for high-quality and innovative laundry products. As consumers become more educated about the environmental impact of their purchases, the trend toward plant-based, cruelty-free, and sustainable laundry solutions continues to shape the demand in residential applications.

The demand for laundry care products in commercial application is expected to grow at a CAGR of 5.0% from 2025 to 2030. An increase in number of commercial establishments such as hotels, hospitals, and education facilities among others drive the market growth. The hotel industry has seen a steady increase in the number of establishments over the past decade. The U.S. hotel construction pipeline hit a record high with 6,095 projects and 713,151 rooms in Q2 2023, marking a 9% and 8% year-over-year increase, respectively, according to Lodging Econometrics. This expansion creates a higher demand for various services, including laundry. Guests now prioritize hygiene and cleanliness more than ever before when choosing accommodation. A survey conducted by TripAdvisor indicated that cleanliness is one of the top factors influencing hotel selection among travelers.

Distribution Channel Insights

Offline sales accounted for a market share of around 76% in 2024. Major offline stores such as Walmart, Target, Costco, and Kroger are key players, offering a wide selection of laundry care brands and products, from budget-friendly options to premium offerings. These stores benefit from in-store promotions, bulk purchasing options, and the immediate availability of products, which appeal to a large number of consumers who prefer to shop in person. Additionally, local grocery stores and pharmacies, like Walgreens and CVS, also contribute to offline sales by offering convenient access to smaller quantities of laundry care essentials. Despite the growth of online sales, offline channels remain a vital part of the market, especially for consumers who prioritize in-store shopping experiences or need products quickly.

Laundry care online sales is expected to grow at a CAGR of 5.6% from 2025 to 2030. Online platforms provide consumers with easy access to a wide range of laundry products, from detergents and fabric softeners to stain removers and specialized laundry solutions, often with the added benefit of competitive pricing and exclusive deals. The rise of subscription services, personalized product recommendations, and direct-to-consumer brands has further fueled this trend, offering tailored experiences and convenience for busy households. This shift toward online shopping has also been accelerated by the ongoing digitalization of retail, with key players investing in robust online presence and seamless delivery services to meet evolving consumer demands.

Regional Insights

The laundry care market in North America accounted for a market share of around 24% in 2024 in the global market. Consumer demand for effective and eco-friendly laundry solutions is driving innovations in product formulations and packaging, including more sustainable options like refillable containers and eco-conscious detergents. Additionally, the expansion of commercial establishments, such as laundromats, hotels, and fitness centers, is further boosting the demand for laundry care products tailored for high-volume use.

U.S. Laundry Care Market Trends

The laundry care market in the U.S. accounted for a market share of around 70% in 2024 in the North American market. Americans are increasingly opting for products that offer superior performance, such as high-efficiency detergents, fabric softeners, and stain removers, while also prioritizing eco-friendly options, including plant-based, biodegradable, and cruelty-free formulations. The demand for premium laundry products is growing, with consumers willing to invest in high-quality and specialized items that meet their specific needs, such as sensitive skin formulas or fragrances. The market is also bolstered by the rising adoption of smart appliances, such as washing machines with energy-saving features, and the continued growth of e-commerce, which makes laundry care products more accessible to a wider audience.

Europe Laundry Care Market Trends

The laundry care market in Europe accounted for a revenue share of around 28% of global revenue in 2024. As environmental concerns rise, European consumers are increasingly favoring detergents, fabric softeners, and stain removers made from natural ingredients or offering reduced environmental impact, such as biodegradable formulas and recyclable packaging. The market is also influenced by the shift towards premium and innovative laundry solutions, including high-efficiency detergents and smart washing machines that promote energy savings. Additionally, growing urbanization, changing lifestyles, and increasing disposable incomes are encouraging more frequent laundry cycles and higher product consumption.

Asia Pacific Laundry Care Market Trends

The Asia Pacific laundry care market is expected to grow at a CAGR of 5.6% from 2025 to 2030. The growth is driven by a shift toward premium laundry products, including detergents, fabric softeners, and stain removers, as well as the growing popularity of washing machines and smart laundry solutions. Consumers in the region are increasingly opting for environmentally-friendly products, reflecting the rising awareness of sustainability. Furthermore, innovations such as concentrated formulas and plant-based ingredients are gaining traction, with major players like Unilever, Procter & Gamble, and Henkel investing in regional expansions and product innovations to cater to evolving consumer preferences. The market's expansion is also fueled by e-commerce, making laundry care products more accessible to a broader consumer base across the region.

Key Laundry Care Company Insights

The competitive landscape in the laundry care market is marked by a diverse range of global and regional players vying for market share through product innovation, brand loyalty, and sustainability efforts. Leading brands such as Procter & Gamble (Tide), Unilever (Persil), and Henkel (Persil, Purex) dominate the market with strong distribution networks and a wide variety of products catering to different consumer needs, including detergents, fabric softeners, stain removers, and laundry boosters. In recent years, there has been an increasing emphasis on eco-friendly and sustainable laundry care solutions, with brands developing biodegradable, concentrated, and energy-efficient products that appeal to environmentally conscious consumers. Additionally, emerging players and niche brands are differentiating themselves by offering specialized products for sensitive skin, hypoallergenic formulations, and advanced stain-fighting technologies. As sustainability, convenience, and innovation continue to drive consumer preferences, competition remains fierce in this dynamic market.

Key Laundry Care Companies:

The following are the leading companies in the laundry care market. These companies collectively hold the largest market share and dictate industry trends.

- The Procter & Gamble Company (P&G)

- Unilever

- Henkel AG & Co. KGaA (Pril)

- Reckitt Benckiser Group PLC (Finish)

- Colgate-Palmolive Company

- SC Johnson and Son Inc.

- The Clorox Company

- ITC Ltd.

- Church & Dwight Co. Inc.

- Spectrum Brands Inc.

Recent Developments

-

In August 2024, Reckitt Benckiser Group PLC brand Finish has partnered with Flume to launch the "Finish Water Challenge," an initiative aimed at encouraging consumers to reduce water usage while doing dishes. By tracking water consumption through Flume's smart water monitoring system, participants can learn how to cut back on unnecessary water waste. The collaboration underscores Finish's commitment to sustainability and aims to help consumers make more environmentally responsible choices while maintaining high-quality dishwashing performance.

-

In May 2024, Procter & Gamble line P&G Professional has expanded its laundry care product line with Tide Professional Commercial Laundry Detergent and Downy Professional Fabric Softener, designed to help businesses such as hotels, healthcare facilities, and restaurants improve laundry efficiency. Tide Professional targets tough stains in one wash, while Downy Professional enhances fabric softness and freshness. These products are available in various sizes and formats, including liquid, powder, and PODS, providing versatile solutions for commercial use. P&G offers a money-back guarantee to ensure satisfaction with the new offerings

Laundry Care Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 114.59 billion

Revenue forecast in 2030

USD 144.30 billion

Growth rate (Revenue)

CAGR of 4.7% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, distribution channel, and region.

Regional scope

North America; Europe; Asia Pacific; Central & South America; & Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; and South Africa

Key companies profiled

The Procter & Gamble Company (P&G); Unilever; Henkel AG & Co. KGaA (Pril); Reckitt Benckiser Group PLC (Finish); Colgate-Palmolive Company; SC Johnson and Son Inc.; The Clorox Company; ITC Ltd.; Church & Dwight Co. Inc.; and Spectrum Brands Inc.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Laundry Care Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the laundry care market report based on type, application, distribution channel, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Laundry Sanitizer

-

Laundry Detergent

-

Fabric Softeners & Conditioners

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global laundry care market size was estimated at USD 109.71 billion in 2024 and is expected to reach USD 114.59 billion in 2025.

b. The global laundry care market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2030 to reach USD 144.30 billion by 2030.

b. Asia Pacific dominated the laundry care market with a share of 38% in 2024. This is attributable to the increased expenditure on cleaning and laundry products backed by the presence of a large-scale population searching for quick dry-cleaning and laundry care products.

b. Some key players operating in the laundry care market include Procter & Gamble (Cascade); Unilever; Henkel AG & Co. KGaA (Pril); Reckitt Benckiser Group PLC (Finish); Colgate-Palmolive Company; Kao Corporation; SC Johnson and Son Inc.; and The Clorox Company.

b. Key factors that are driving the laundry care market growth include the rising demand for laundry care products owing to the increasing population in developing regions, consumers' inclination toward eco-friendly cleansing products, and rising research and development in the chemical and detergent cleansing industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.