- Home

- »

- Communication Services

- »

-

Legal Process Outsourcing Market Size, Share Report, 2030GVR Report cover

![Legal Process Outsourcing Market Size, Share & Trends Report]()

Legal Process Outsourcing Market Size, Share & Trends Analysis Report By Location (Offshore, On-shore), By Service (E-discovery, Patent Support, Litigation Support), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-109-2

- Number of Report Pages: 115

- Format: PDF, Horizon Databook

- Historical Range: 2018 – 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Legal Process Outsourcing Market Trends

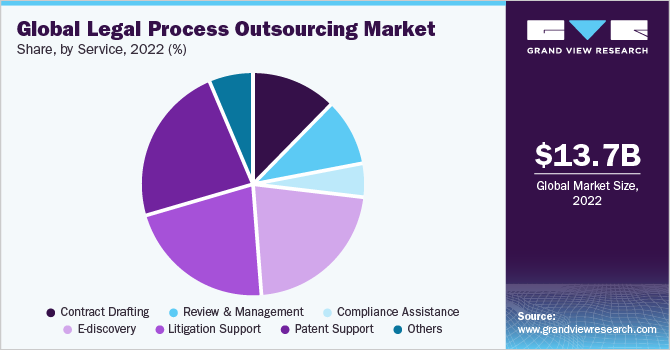

The global legal process outsourcing market size was valued at USD 13.67 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 31.4% from 2023 to 2030. The legal process outsourcing (LPO) providers, once acquainted with the organization’s business procedures, provide numerous services that include contract drafting and management, e-discovery, review and management, compliance assistance, litigation support, and patent support. LPOs have broad legal expertise and modern technologies that assist organizations in the objective coding of documents, gathering and synthesizing facts, negotiations, and objective legal research. Players such as Mindcrest Inc., QuisLex Inc., Pangea3 (E&Y), and UnitedLex have been expanding their offerings beyond litigation and regulatory investigation support services to contract management and other corporate services.

Vendor selection is one of the key deciding factors for the success of an LPO program. On-shore or offshore outsourcing can be selected based on the type of services to be outsourced. Companies such as Syntel support organizations that look for innovative services and solutions to achieve operational competitiveness. Reference checks include investigating and interviewing principal lawyers as well as non-lawyers; in addition, the hiring practices of the vendor are examined to identify the quality of employees. Maintaining security through the process involves inspecting the provider’s security network as well as premises, along with signing non-disclosure agreements and related contractual clauses.

LPO allows law firms to outsource low-value activities and focus their in-house workforce on higher-value activities. Concerns in LPO adoption include security and confidentiality risks, as well as ensuring high quality. These concerns have been overcome through approaches such as certifications and building Service-Level Agreements (SLAs). Signing Non-Disclosure Agreements (NDA), as well as maintaining physical security using effective access control, which helps ensure data security and confidentiality.

Cost-saving, scalability, and flexibility offered by outsourcing legal services are expected to be the key driving force for the market over the next six years. Overall saving depends on the type and degree of service provided. The cost of legal services in markets such as India is less than that in North America. Outsourcing costs per hour have been reported to be as low as USD 50, which is expected to boost savings considerably. Moreover, infrastructure costs in other overseas markets such as India and South Africa are less than those of developed countries such as the U.S. and the U.K.

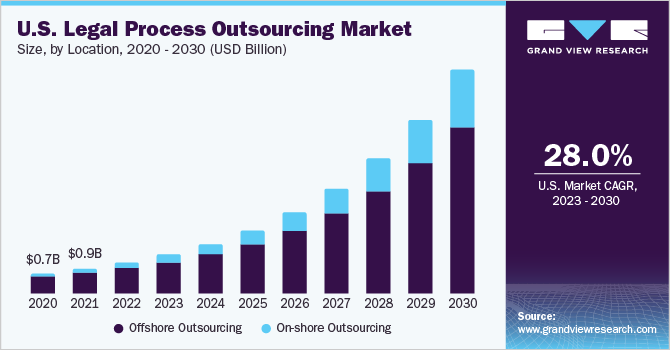

Location Insights

The offshore outsourcing segment led the market in 2022, accounting for more than 77.0% share of the global revenue. Outsourcing legal activities help organizations to manage time and workforce effectively. South Africa, India, and the Philippines are popular destinations for LPO, which have a considerable time difference from the U.S. and Europe. The time difference helps to provide an around-the-clock workforce, whenever required. Also, countries with common law systems in place would share the same basic legal framework. Thus, the Philippines and India have emerged as leading offshore LPO destinations.

The on-shore LPO market is expected to grow significantly at a CAGR of around 34.0% over the forecast period. On-shore outsourcing is expected to gain prominence on account of the growing perception among law firms that these service providers are better equipped than their offshore counterparts. Additional benefits such as better control over the operations, enhanced data security, shared regulatory framework, and sophisticated service delivery models are expected to impact the market for on-shore LPO providers favorably.

Service Insights

The e-discovery segment led the market in 2022, accounting for a global revenue share of around 22.0%. E-discovery is a time-consuming process that is best handled by a dedicated technical and legal expert. The total electronically stored information law firms need to handle in the upcoming years is expected to grow exponentially. Many firms try to manage e-discovery in-house or through third parties or through a combination of both.

Law firms have started outsourcing e-discovery for several reasons, including the benefit from legal technology expertise, lower expenses & recovered costs, data security, and faster & accurate data. For instance, the cost of ownership of an e-discovery function includes technology implementation, maintenance & employment training, salaries, and other overhead costs of the in-house support staff. The additional cost of deploying the software and hardware solutions alone costs around USD 200,000 annually. Thereby, LPO shall help in cutting down the high cost associated with the in-house e-Discovery solution.

Regional Insights

Asia Pacific led the market in 2022, accounting for more than 71.0% share of the global revenue. This high share can be attributed to the presence of key offshore locations in India and the Philippines. Asia Pacific LPO market is expected to expand at a CAGR of around 32.0% from 2023 to 2030. LPO in countries such as India provides quantifiable advantages; these include the availability of numerous English-speaking lawyers; whose pay rate is considerably lower than those of their U.S. counterparts. The high-level competency and experience of an LPO considerably improve the relationship with the client and enhance work output.

Latin America is expected to grow at a faster rate of around 31.0% from 2023 to 2030 thereby emerging as a nearshore alternative to services offered similar to that of India. Further, a large number of firms in the U.S. prefer to outsource repetitive legal activities, which is spurred by the growing legal industry in the North American region. Moreover, with the growing concerns regarding legal overheads in countries such as the U.K. and U.S., corporate firms aim to outsource specific legal proceedings through their legal representatives. However, legal regulations differ geographically, which is viewed as a barrier by cautious organizations considering the outsourcing of legal services.

Key Companies & Market Share Insights

Vendors active in the market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in January 2023, UnitedLex launched Vantage Intelligence Repository, the company’s latest investment in its digital litigation tools portfolio. The new solution is powered by knowledge management and enables the clients to use data and insights in their portfolio of litigation discovery. Its innovative architecture will also allow its clients to develop a repository of historic work-product, irrespective of data origination, which will curtail the discovery costs significantly. Some of the prominent players in the legal process outsourcing market include:

-

Clairvolex

-

Clutch Group

-

Cobra Legal Solutions LLC

-

CPA Global Ltd.

-

Evalueserve

-

Exigent

-

Infosys Ltd

-

Integreon Managed Solutions Inc.

-

Legal Advantage LLC

-

Lex Outsourcing

-

Lexplosion Solutions Pvt. Ltd.

-

Lexsphere Pvt. Ltd.

-

Mindcrest Inc.

-

Pangea3

-

QuisLex Inc.

-

UnitedLex

Legal Process Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 17.45 billion

Revenue forecast in 2030

USD 117.89 billion

Growth rate

CAGR of 31.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Location, service, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; China; India; Philippines; Brazil

Key companies profiled

Clairvolex; Clutch Group; Cobra Legal Solutions LLC; CPA Global Ltd.; Evalueserve; Exigent; Infosys Ltd; Integreon Managed Solutions Inc.; Legal Advantage LLC; Lex Outsourcing; Lexplosion Solutions Pvt. Ltd.; Lexsphere Pvt. Ltd.; Mindcrest Inc.; Pangea3; QuisLex Inc.; UnitedLex

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Legal Process Outsourcing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global legal process outsourcing market report based on location, service, and region.

-

Location Outlook (Revenue, USD Million, 2018 - 2030)

-

Offshore Outsourcing

-

On-shore Outsourcing

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Contract Drafting

-

Review and Management

-

Compliance Assistance

-

E-discovery

-

Litigation Support

-

Patent Support

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Philippines

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global legal process outsourcing market size was estimated at USD 13.67 billion in 2022 and is expected to reach USD 17.45 billion in 2023.

b. The global legal process outsourcing market is expected to grow at a compound annual growth rate of 31.4% from 2023 to 2030 to reach USD 117.89 billion by 2030.

b. The Asia Pacific region dominated the global legal process outsourcing market with a share of 71%. This is attributable to the generation of significant revenue in offshore sites in India and the Philippines.

b. Some of the key players in the global LPO market include UnitedLex Corporation; Integreon, Inc.; Elevate Services Inc.; Pangea3 LLC; QuisLex Inc.; Mindcrest Inc.; Clutch Group; and Axiom Law.

b. Key factors that are driving the legal process outsourcing market growth include cost efficiency and effective utilization of resources

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."