- Home

- »

- Clothing, Footwear & Accessories

- »

-

Licensed Sports Merchandise Market, Industry Report, 2030GVR Report cover

![Licensed Sports Merchandise Market Size, Share & Trends Report]()

Licensed Sports Merchandise Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Sports Apparel, Sports Footwear, Toys & Games), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-017-1

- Number of Report Pages: 136

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Licensed Sports Merchandise Market Summary

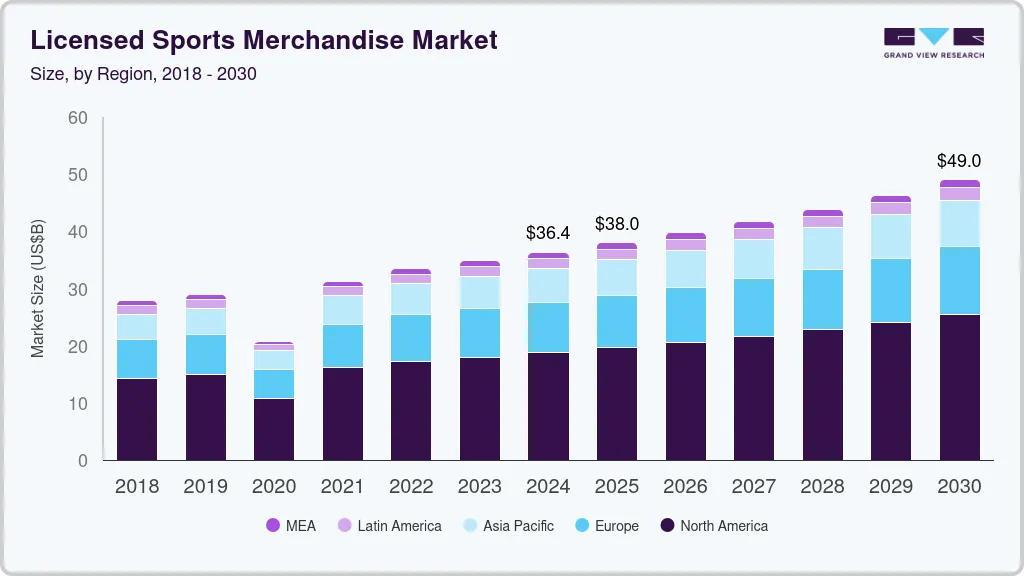

The global licensed sports merchandise market size was estimated at USD 36.36 billion in 2024 and is projected to reach USD 49.00 billion by 2030, growing at a CAGR of 5.2% from 2025 to 2030. One of the major factors driving the market's expansion is the growing population of sports enthusiasts, together with increased urbanization and the expansion of the online retail industry.

Key Market Trends & Insights

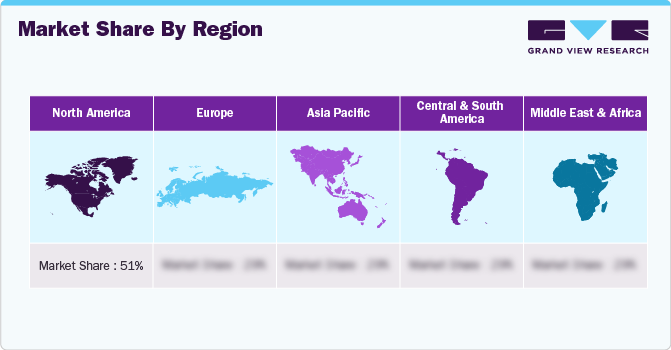

- North America dominated the licensed sports merchandise market with the largest revenue share of 51.7% in 2024.

- The licensed sports merchandise market in the U.S. is expected to grow at the fastest CAGR of 5.4% during the projected period.

- Based on product, the toys and games segment led the market with the largest revenue share of 30.4% in 2024.

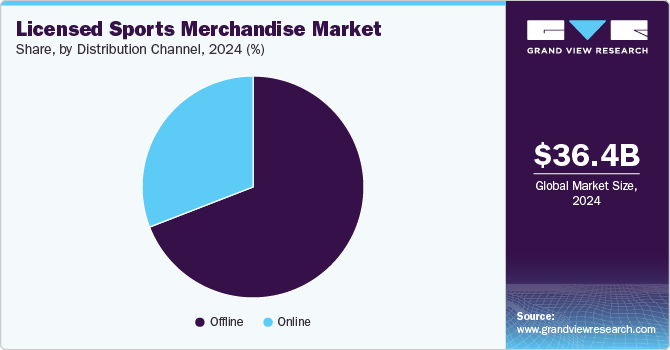

- Based on distribution channel, the offline distribution channel segment led the market with the largest revenue share of 66.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 36.36 Billion

- 2030 Projected Market Size: USD 49.00 Billion

- CAGR (2025-2030): 5.2%

- North America: Largest market in 2024

The market growth is also being aided by a notable rise in the number of regional and worldwide sports leagues. Consumer preference is constantly shifting away from traditional retailing channels and towards online platforms that provide a large selection of products and a convenient shopping experience for buying genuine, premium-quality goods at reasonable costs. Licensed sports products such as t-shirts & tops, sweatshirts & hoodies, jackets, bottom wear, caps, and hats, etc., featuring logos of famous sports teams, are gaining popularity among sports enthusiastic. Also, rising consumer spending power and increased investment in sports licensing fuel the market growth.

The market growth is also being aided by a notable rise in the number of regional and worldwide sports leagues. Consumer preference is constantly shifting away from traditional retailing channels and towards online platforms that provide a large selection of products and a convenient shopping experience for buying genuine, premium-quality goods at reasonable costs. Licensed sports products such as t-shirts & tops, sweatshirts & hoodies, jackets, bottom wear, caps, and hats, etc., featuring logos of famous sports teams, are gaining popularity among sports enthusiastic. Also, rising consumer spending power and increased investment in sports licensing fuel the market growth.

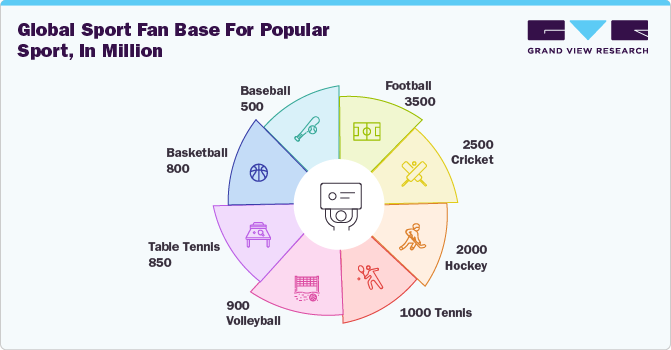

Various sports have gained immense popularity globally, with major leagues and tournaments attracting a large viewership. As sports gain more fans and followers, the demand for licensed merchandise associated with these sports increases. The popularity of sports such as football (soccer), American football, basketball, cricket, and others contributes to the growth of the licensed sports merchandise industry.

Sports fans are passionate and emotionally connected to their favorite teams and players. Licensed sports merchandise allows fans to express their support and loyalty by wearing apparel, using accessories, or displaying collectibles related to their favorite teams. The emotional connection between fans and their teams drives the demand for licensed merchandise. In addition, star athletes have a significant impact on the licensed sports merchandise industry. Fans idolize and admire their favorite athletes, often emulating their style and buying products they endorse.

In addition, sports teams often become integral parts of the community and local culture. Fans embrace their favorite teams as a source of pride and unity. Licensed sports merchandise allows fans to showcase their team spirit and identity. This sense of community and pride motivates fans to purchase merchandise, supporting the industry’s growth.

Major sporting events, such as championship series, playoffs, or tournaments, generate a surge in fan engagement and excitement. During these events, fans are more inclined to purchase licensed sports merchandise to celebrate their team's participation or victory. Seasonal fluctuations, such as the start of a new season or playoffs, drive sales as fans gear up for upcoming games and events.

Consumer Insights

The licensed sports merchandise industry is characterized by innovation, with continuous advancements in product design, technology, and customization options. Manufacturers strive to deliver high-quality products that align with the style preferences of fans. The market is consistently evolving to meet consumer demand, from advanced materials that enhance comfort and performance to personalized customization options that add a unique touch.

The perception of licensed sports merchandise has changed drastically over the past few years across regions. Rapid globalization, coupled with growing sports celebrity endorsements, has resulted in an increased demand for licensed sports merchandise globally. For instance, in May 2023, Adidas AG and Arsenal unveiled the 2023/2024 season Arsenal home jersey to mark the 20th anniversary of the ‘Invincibles’ season.

Moreover, licensed sports merchandise manufacturers also embrace the digital age, leveraging ecommerce platforms and digital marketing strategies to connect with fans globally. Online retail channels provide fans easy access to a wide range of licensed products, allowing them to browse, purchase, and engage with their favorite teams and athletes from their homes.

Brand partnerships and sponsorships allow sports organizations to showcase their logos, names, and products through licensed merchandise. By associating their brand with popular sports teams, leagues, or athletes, companies gain significant exposure to a wide fan base. This increases brand visibility and helps them reach new consumers, resulting in higher sales of licensed sports merchandise, thus driving market growth. Some of the sponsorships and brand partnership initiatives are as follows:

Furthermore, the demand for personalized products is on the rise, and therefore, offering customization and personalization options for licensed sports merchandise presents a significant opportunity for players. Allowing consumers to customize items with their preferred names, numbers, or designs creates a unique and personalized connection with their favorite teams or athletes.

In addition, sustainability is becoming increasingly important, especially among environment-conscious consumers. The growing presence of ethical consumers is boosting the demand for sustainable products, which is also likely to strengthen the demand for vegan and eco-friendly sporting merchandise. This opens up significant growth opportunities for players in the market.

Product Insights

The toys and games segment led the market with the largest revenue share of 30.4% in 2024. The demand for licensed toys and games is rising due to strong brand loyalty, popular entertainment franchises, and increasing consumer spending on collectibles. Collectors seek products featuring beloved characters from movies, TV shows, and video games. E-commerce expansion and collaborations between toy manufacturers and entertainment companies further fuel market growth.

The sportswear segment is projected to register at the fastest CAGR of 6.5% from 2025 to 2030. Growing fitness concerns among consumers due to sedentary lifestyles and health problems have increased demand for the segment. People are also increasingly realizing the importance of using the appropriate type of shoes for sports activities to prevent muscle injuries, leg injuries, knee pain, hip pain, and back pain. As a result, the demand for sports footwear is expected to register a sharp rise during the coming years.

Distribution Channel Insights

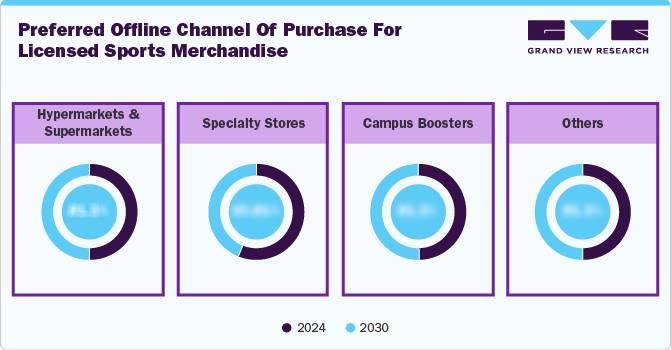

The offline distribution channel segment led the market with the largest revenue share of 66.9% in 2024. Supermarkets and hypermarkets have become key distribution channels for licensed sports merchandise, especially during major sporting events and peak seasons. These mass-market retailers offer a wide range of officially licensed apparel, accessories, and memorabilia at accessible price points, attracting a broad customer base. The primary appeal of these stores is convenience, allowing consumers to purchase sports merchandise while completing their regular shopping. Positioned as cost-effective and readily available, these products cater to casual fans and families who want to show team support without needing to visit specialty sports stores.

The online distribution channel is expected to grow at the fastest CAGR of 7.7% from 2025 to 2030. The online channel has emerged as a key driver in the distribution of licensed sports merchandise. Consumers increasingly prefer the convenience of e-commerce, where they can explore a wide range of officially licensed products from the comfort of their homes. Online platforms such as Amazon, eBay, and dedicated sports retailers offer seamless shopping experiences, featuring global brands, detailed product descriptions, and customer reviews. The rise of mobile commerce (m-commerce) has further accelerated this trend, enabling fans to purchase their favorite team merchandise anytime, anywhere.

Regional Insights

North America dominated the licensed sports merchandise market with the largest revenue share of 51.7% in 2024. The North America sports industry is characterized by the presence of prominent sports leagues such as the National Football League (NFL), the National Basketball Association (NBA), Major League Baseball (MLB), and the National Hockey League (NHL). These leagues boast massive fan bases, and the popularity of their teams and players translates into a substantial demand for licensed merchandise. The intense desire to own apparel, accessories, and collectibles associated with these esteemed sports organizations is pivotal in driving the licensed sports merchandise industry.

U.S. Licensed Sports Merchandise Market Trends

The licensed sports merchandise market in the U.S. is expected to grow at the fastest CAGR of 5.4% during the projected period. The U.S. is one of the largest sports merchandise markets in the world. The country is home to major sports leagues like the NFL, the NBA, MLB, and the NHL, which have massive fan bases. The widespread popularity of these leagues drives the demand for licensed merchandise associated with the teams and players, including jerseys, caps, and other fan apparel. The rise of athleisure wear has significantly influenced the demand for sports apparel and footwear in the U.S. Athleisure combines athletic wear with everyday fashion, allowing people to sport a casual and comfortable style while incorporating elements of sports apparel into their daily wardrobe. This trend has made sports apparel and footwear more versatile and appealing beyond sports activities.

Europe Licensed Sports Merchandise Market Trends

The licensed sports merchandise market in Europe is expected to grow at a significant CAGR of 5.1% from 2025 to 2030. The licensed sports merchandise industry in Europe is primarily driven by several key factors. Primarily, the growing popularity and widespread appeal of sports across the region play a significant role. Sports such as football (soccer), rugby, basketball, and Formula 1 enjoy a massive fan base in Europe, leading to a high demand for licensed merchandise associated with these sports. Additionally, major sporting events hosted in Europe, such as the FIFA World Cup, UEFA European Championship, and various international tournaments, act as catalysts for the licensed sports merchandise industry. These events attract a massive global audience and generate tremendous excitement, creating a surge in demand for licensed products associated with the participating teams and players.

The UK licensed sports merchandisemarket is expected to grow at a substantial CAGR of 5.3% from 2025 to 2030. The market in the UK is increasing due to the growing popularity of sports leagues such as the Premier League, Formula 1, and the Six Nations Championship. In addition, collaborations between sports clubs and fashion brands are making sports merchandise more appealing to a broader audience. The rise of e-commerce and official online stores has also made it easier for consumers to purchase authentic products, further driving market growth.

Asia Pacific Licensed Sports Merchandise Market Trends

The licensed sports merchandise market in Asia Pacific is expected to grow at a significant CAGR of 5.7% from 2025 to 2030. The rise of sports leagues and tournaments in the region has created a substantial market for licensed sports merchandise. Leagues like the Indian Premier League (IPL) in cricket, the Chinese Super League (CSL) in football, and the Korean Basketball League (KBL) have gained immense popularity, attracting large audiences both locally and internationally. Fans eagerly purchase licensed merchandise, such as jerseys, caps, and accessories, to show loyalty and affiliation to their favorite teams. In February 2023, Mumbai Indians, the most successful team in the Indian Premier League (IPL), relaunched its merchandise shop, MI Shop. The new shop offers a wider range of products, including jerseys, backpacks, apparel, gaming chairs, and cricket gear. The products were made available from about ten licensing partners, including Indian and global partners.

The China licensed sports merchandise market is projected to grow at the fastest CAGR of 5.9% over the forecast period. The China market is being driven by several key factors. There is a growing fan base for various sports, both domestic and international, in the country. Chinese consumers are increasingly interested in sports such as basketball, soccer, tennis, and Formula 1. This rising interest has created a significant demand for licensed merchandise associated with these sports.

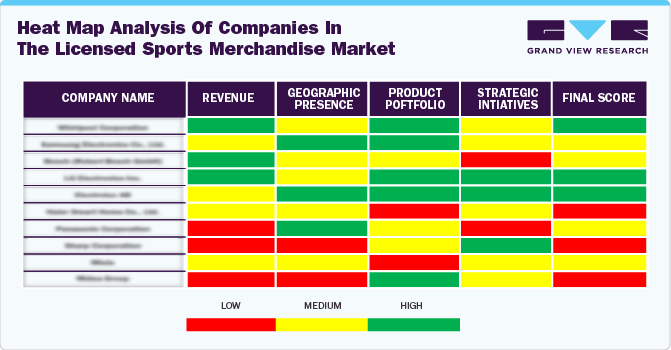

Key Licensed Sports Merchandise Company Insights

The major players in the licensed sports merchandise industry focus on diversifying and expanding the range of their product offerings. Mergers & acquisitions are the prominent strategies adopted by the key players. Manufacturers are providing robust services to gain a competitive advantage over others.

Key Licensed Sports Merchandise Companies:

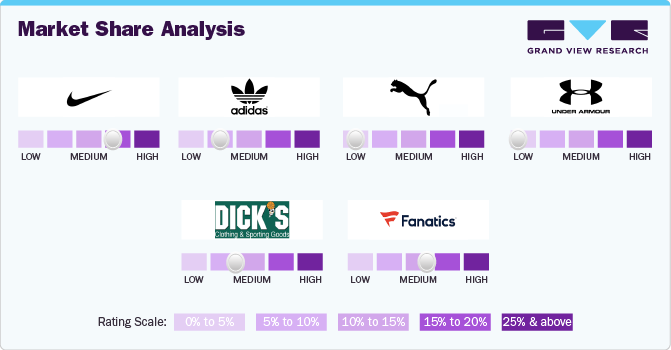

The following are the leading companies in the licensed sports merchandise market. These companies collectively hold the largest market share and dictate industry trends.

- VF Corporation

- Nike, Inc.

- Adidas AG

- Puma SE

- Under Armour, Inc.

- Hanesbrands Inc.

- DICK’S Sporting Goods Inc.

- Sports Direct International plc,

- G-III Apparel Group, Ltd.

- Fanatics Inc.

Recent Development

-

In March 2023, DICK'S Sporting Goods announced a corporate partnership with the National Collegiate Athletics Association (NCAA) to make DICK'S Sporting Goods the official and exclusive sporting merchandise retail partner. DICK'S Sporting Goods will have exclusive rights to provide sporting goods and merchandise related to NCAA championships. The partnership covers all 90 men's and women's championships organized by the NCAA.

-

In May 2023, Puma SE secured an exclusive multi-year licensing agreement with one of the highest classes of international racing, Formula 1, to provide a newly designed collection of fan wear and supply uniforms to all the Formula 1 racers and staff at the circuit.

-

In February 2023, Adidas AG partnered with Major League Soccer (MLS) as the league-wide kit supplier. The company is involved in a six-year agreement worth USD 830 million with MLS and will continue to supply team jerseys, kits, and official match balls for all 29 teams.

-

In September 2022, Nike, Inc. entered into a licensing agreement with the South Africa Rugby Union (SARU) to become its official apparel provider. This six-year licensing agreement will involve the design of Nike's Springboks jerseys for the South African rugby team and covers the 2023 and 2027 men's Rugby World Cups. The Springboks jerseys are expected to launch in July 2023.

Licensed Sports Merchandise Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 37.97 billion

Revenue forecast in 2030

USD 49.00 billion

Growth rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD million/billion, Thousand Units, Volume in Thousand Units, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Distribution Channel

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

VF Corporation; Nike Inc.; Adidas AG; Puma SE; Under Armour, Inc.; Hanes brands Inc.; DICK’S Sporting Goods Inc.; Sports Direct International plc; G-III Apparel Group, Ltd.; Fanatics Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global Licensed Sports Merchandise Market Report Segmentation

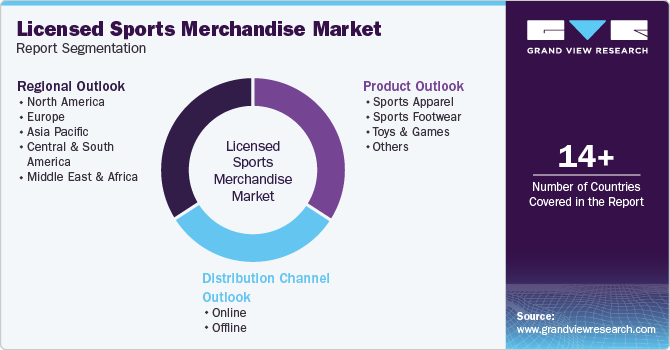

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global licensed sports merchandise market report based on the product, distribution channel, and region:

-

Product Outlook (Thousand Units; Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Sports Apparel

-

T-Shirts and Tops

-

Collegiate Sports Apparel

-

Non-Collegiate Sports Apparel

-

-

Sweatshirts and Hoodies

-

Collegiate Sports Apparel

-

Non-Collegiate Sports Apparel

-

-

Jackets

-

Collegiate Sports Apparel

-

Non-Collegiate Sports Apparel

-

-

Bottom wear

- Collegiate Sports Apparel

-

Non-Collegiate Sports Apparel

-

Others (caps, hats, etc.)

-

Collegiate Sports Apparel

-

Non-Collegiate Sports Apparel

-

-

-

Sports Footwear

-

Toys and Games

-

Others

-

- Distribution Channel Outlook (Thousand Units; Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Others

-

-

-

Regional Outlook (Thousand Units; Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global licensed sports merchandise market size was estimated at USD 36.36 billion in 2024 and is expected to reach USD 37.97 billion in 2025

b. The global licensed sports merchandise market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2030 to reach USD 49.00 billion by 2030.

b. Licensed toys and games segment held the largest market share of more than 30.4% in 2024. The demand for licensed toys and games is rising due to strong brand loyalty, popular entertainment franchises, and increasing consumer spending on collectibles.

b. Some of the major players operating in the global market are VF Corporation, Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Hanesbrands Inc., DICK’S Sporting Goods Inc., Sports Direct International plc, G-III Apparel Group, Ltd., Fanatics Inc.

b. Key factors that are driving the licensed sports merchandise market growth include the growing population of sports enthusiasts and increasing disposable income among consumers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.