- Home

- »

- Clothing, Footwear & Accessories

- »

-

Global Licensed Sports Merchandise Market Size Report, 2030GVR Report cover

![Licensed Sports Merchandise Market Size, Share & Trends Report]()

Licensed Sports Merchandise Market Size, Share & Trends Analysis Report By Products (Sports Apparel, Toys and Games, Others), By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-017-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

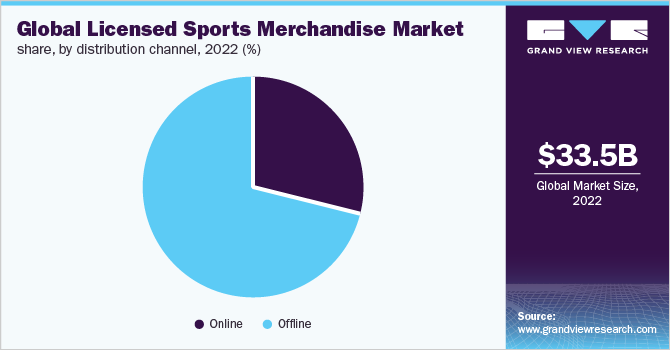

The global licensed sports merchandise market size was valued at USD 33.48 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030. One of the major factors driving the market's expansion is the growing population of sports enthusiasts, together with increased urbanization and the expansion of the online retail industry. The growth of the market is also being aided by a notable rise in the number of regional and worldwide sports leagues. Consumer preference is constantly shifting away from traditional retailing channels and towards online platforms that provide a large selection of products and a convenient shopping experience for buying genuine premium-quality goods at reasonable costs. Licensed sports products such as t-shirts & tops, sweatshirts & hoodies, jackets, bottom wear, caps, and hats, etc., featuring logos of famous sports teams, are gaining attraction among sports enthusiastic people. Also rising consumer spending power and increased investment in sports licensing fuel the market growth.

COVID-19 negatively impacted the global licensed sports merchandise market. Due to the strict government regulations and restrictions, outdoor activities and sports were affected during the pandemic. The sports clubs, gyms, and fitness studios were the first businesses to undergo shutdown as per the government norms to restrict the spreading of the COVID-19 virus.

Consumers, retailers, and licensees faced a scarcity of new entertainment content amidst pandemic related production shutdown. According to a report published by License Global in 2022, after suffering significant disruptions due to COVID-19, the sports industry saw a rebound in 2021, growing by 8% since 2019. Also, name, image and likeness agreements for college athletes became a reality, contributing to a growth in sports licensing opportunities as the collegiate category grew by 18.6%.

However, the market is expected to gradually return to pre-pandemic levels as people resume normal life and participate in various sports activities. This is anticipated to impact positively during the forecast period.

Products and goods that have the endorsement of a sports team or athlete are defined as licensed sports merchandise. It covers products like sporting goods, toys and accessories for sports, video games, clothes, and footwear. Sports entities receive a fixed amount of royalty payments from licensing organizations for goods sold with their trademarked logos, designs, and other branding. Fans of sports and video games alike enjoy wearing officially licensed sports gear and sports accessories. Sports apparel and accessories that are breathable, light, and waterproof are offered in the market at premium and reasonable price points. Customers are increasingly using online shops to purchase a variety of goods.

Significant investments in traditional and e-sports have resulted from the commercialization of athletic events, contests, and tournaments. The market for licensed outdoor and sports apparel is growing as endurance sports like running, swimming, and cycling are gaining enormous popularity. Public and private companies are investing heavily in sports events to promote sporting activities.

For instance, in November 2022, The Saudi Arabian Football Federation (SAFF) announced that German sportswear giant Adidas will replace Nike as the kit supplier of Saudi Arabia’s national soccer teams from 2023. The deal runs until 2026 and makes Adidas the exclusive supplier of all training and match wear for the SAFF, including the men’s, women’s and youth sides.

Moreover, the growing number of sports leagues globally has increased the sales of licensed sports merchandise. Alongside, female participation in sports has also further increased the scope of the market.

Product Insights

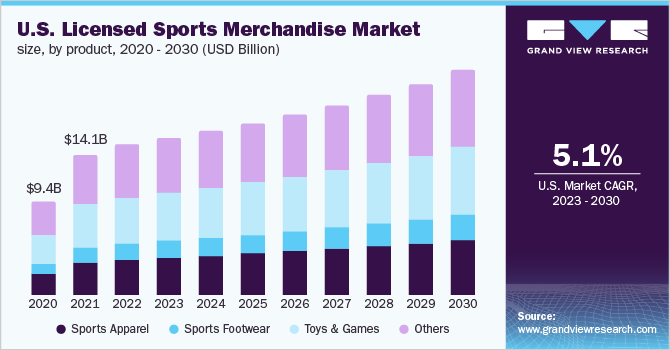

By product, others segment accounted for the largest share of more than 33.7% in 2022, due to the rising number of sports leagues and the growing global fan base of the sports events. Under the other segment, products include such as keychains, mugs, cups etc. An increase in the launch of trendy sports club key chains, mugs, cups and accessories is expected to augment the segment during the forecast period. Furthermore, the surge in online shopping for sporting goods is projected to create prospective opportunities for the growth of the segment in the near future.

Sports footwear segment such as running shoes, football shoes, sneakers, and lifestyle shoes are expected to witness the fastest growth during the coming years. Growing fitness concerns among consumers due to sedentary lifestyles and health problems have increased demand for the segment. People are also increasingly realizing the importance of using the appropriate type of shoes for sports activities to prevent muscle injuries, leg injuries, knee pain, hip pain, and back pain. As a result, the demand for sports footwear is expected to register a sharp rise during the coming years.

Distribution Channel Insights

Based on the distribution channel, the licensed sports merchandise market has been bifurcated into offline and online channels. The offline segment accounted for a revenue share of 70.6% in 2022. Physical display of the products and the ability to check product features have been major factors driving the popularity of offline sales and distribution channels. Consumers in the U.S. have reported a preference for offline purchases, mainly from mass merchants, followed by retail, department, and specialty stores. In Asian countries, on the other hand, retail purchases witness the highest traction due to easy availability.

However, e-commerce platforms have been gaining popularity as distribution channels. The rise in the adoption of smartphones and penetration of the internet is boosting the demand for licensed sports merchandise through online channels. It’s easy to use online websites and compares product prices. It frequently gives customers a variety of offers. Due to this, consumers are continuing to switch from using traditional retailing channels to online platforms that provide a wide range of premium products at reasonable costs.

Regional Insights

Based on geography, the global market has been segmented into North America, Europe, Asia Pacific, Central & South America, and the Middle East. Asia Pacific is poised to exhibit the fastest growth during the forecast period, registering a 5.3% CAGR from 2023 to 2030, due to a rise in the popularity of several international sports among teenagers and the increase in adoption of the cross-cultural fashion trends.

North America emerged as the largest market in 2022 and is estimated to account for close to 52.01% share of the global market by 2030. Market dominance can be attributed to the increased participation in sports like baseball, basketball, and soccer, particularly among college and university students, active lifestyles among the general public, and an increase in the adoption of health and fitness activities which are likely to create new growth opportunities for the market players in the North American licensed sports merchandise industry.

Moreover, the major league by Major League Baseball (MLB) and National Basketball Association (NBA) etc. which has huge popularity in the region is expected to fuel the market growth.

Key Companies & Market Share Insights

The major players in the licensed sports merchandise market focus on diversifying and expanding the range of their product offerings. Mergers & acquisitions are the prominent strategies adopted by the key players. Manufacturers are providing robust services to gain a competitive advantage over others.

-

In September 2022, Nike.Inc signed a six-year partnership with South Africa Rugby Union (SARU). The deal covers the 2023 and 2027 men’s Rugby World Cups, with Nike’s first new set of Springboks jerseys set to be revealed in July 2023

-

In June 2022, Puma SE launched its first dedicated app in India. As demand for branded footwear and fitness wear expands in India, Puma aimed to capitalize on this and launched its app in India before any other country.

Some of the key companies in the global licensed sports merchandise market include:

-

VF Corporation

-

Nike, Inc.

-

Adidas AG

-

Puma SE

-

Under Armour, Inc.

-

Hanesbrands Inc.

-

DICK’S Sporting Goods Inc.

-

Sports Direct International plc,

-

G-III Apparel Group, Ltd.

-

Fanatics Inc.

Licensed Sports Merchandise Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 34.87 billion

Revenue forecast in 2030

USD 49.0 billion

Growth rate (Revenue)

CAGR of 4.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; China; Japan; South Africa; Brazil

Key companies profiled

VF Corporation; Nike Inc.; Adidas AG; Puma SE; Under Armour, Inc.; Hanes brands Inc.; DICK’S Sporting Goods Inc.; Sports Direct International plc; G-III Apparel Group, Ltd.; Fanatics Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Licensed Sports Merchandise Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels along with provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global licensed sports merchandise market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Sports Apparel

-

T-Shirts And Tops

-

Collegiate Sports Apparel

-

Non-Collegiate Sports Apparel

-

-

Sweatshirts And Hoodies

-

Collegiate Sports Apparel

-

Non-Collegiate Sports Apparel

-

-

Jackets

-

Collegiate Sports Apparel

-

Non-Collegiate Sports Apparel

-

-

Bottom wear

-

Collegiate Sports Apparel

-

Non-Collegiate Sports Apparel

-

-

Others (caps, hats, etc.)

-

Collegiate Sports Apparel

-

Non-Collegiate Sports Apparel

-

-

-

Sports Footwear

-

Toys and Games

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global licensed sports merchandise market size was estimated at USD 33.48 billion in 2022 and is expected to reach USD 34.87 billion in 2023

b. The global licensed sports merchandise market is expected to grow at a compound annual growth rate of 4.9% from 2023 to 2030 to reach USD 49.0 billion by 2030.

b. The North America emerged as the largest market in 2022 and is estimated to account for close to 51.6% of the global market by 2030. Market dominance can be attributed to the Increased participation in sports like baseball, basketball, and soccer, particularly among college and university students, active lifestyles among the general public, and an increase in the adoption of health and fitness activities are likely to create new growth opportunities for market players in the North American licenced sports merchandise industry.

b. Some of the major players operating in the global market are VF Corporation, Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Hanesbrands Inc., DICK’S Sporting Goods Inc., Sports Direct International plc, G-III Apparel Group, Ltd., Fanatics Inc.

b. Key factors that are driving the licensed sports merchandise market growth include the growing population of sports enthusiasts, together with increased urbanisation and the expansion of the online retail industry. The growth of the market is also being aided by a notable rise in the number of regional and worldwide sports leagues.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."