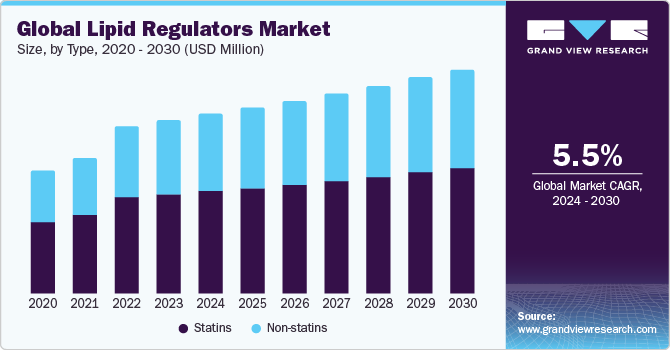

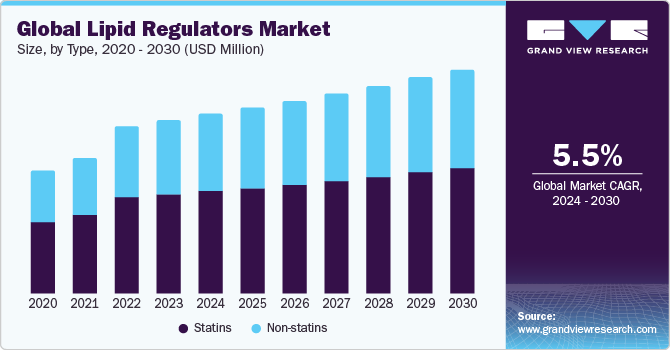

Lipid Regulators Market Size & Trends

The global lipid regulators market size is expected to grow at a compound annual growth rate (CAGR) of 5.5% from 2024 to 2030. This growth is due to the increasing prevalence of lifestyle-related diseases such as hyperlipidemia and cardiovascular disorders, which necessitates the use of lipid-regulating medications. Additionally, growing awareness of the importance of managing cholesterol levels and a rising aging population contribute to the market's expansion. Advancements in drug development and a strong emphasis on preventive healthcare measures further fuel the demand for lipid-regulating medications, driving market growth.

An excess of lipids can have detrimental effects on one's health and body. These lipids play essential roles in cellular functions, produced by various enzymes like lipoxygenases and cyclooxygenases. Lipid-regulating medications, readily available in retail pharmacies, are commonly prescribed as general medicines to manage lipid levels. Additionally, lipid metabolites and fatty acids can activate nuclear peroxisome proliferators operated receptors.

The major factor that drives the market growth is the increasing prevalence of diabetes and cardiac diseases, along with an expanding geriatric population. For instance, the 2022 American Heart Association (AHA) report revealed that approximately 244.1 million people worldwide were affected by ischemic heart disease (IHD). This cardiovascular disease burden is expected to continue to rise due to the prevalence of risk factors like hypertension, obesity, smoking, diabetes, and sedentary lifestyles.

Moreover, the lipid regulators market is anticipated to grow significantly with the increasing elderly population, which is more susceptible to chronic diseases, including cardiovascular conditions. The World Aging Report 2022 projects that the global population aged 65 and above is expected to rise from 10% in 2022 to 16% by 2050. By 2050, the number of individuals aged 65 and over worldwide is expected to surpass twice the number of children under age 5 and approximate the number of children under age 12. This demographic shift underscores the substantial market potential for lipid regulators in addressing the healthcare needs of the aging population.

Type Insights

The branded statins segment held the largest market share in 2023. Branded statins are recognized for their superior effectiveness in reducing LDL-cholesterol concentrations compared to other lipid-regulating drugs. In the market, various statins are available, including atorvastatin, fluvastatin, pravastatin, rosuvastatin, and simvastatin. These branded statins primarily serve as a crucial treatment option for people with dyslipidemia. Dyslipidemia is a medical condition characterized by elevated levels of total cholesterol or low-density lipoprotein cholesterol, or low levels of high-density lipoprotein cholesterol, which significantly increases the risk of coronary heart disease and stroke.

Regional Insights

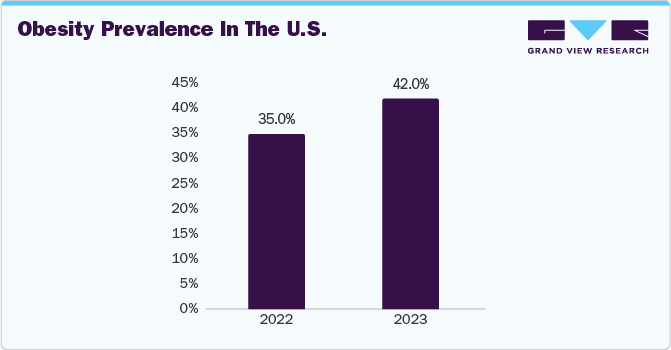

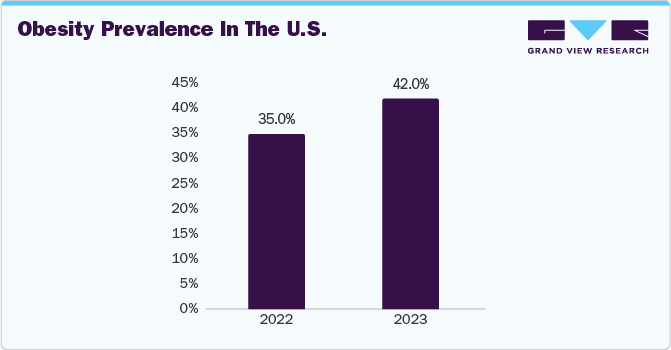

North America dominated the market in 2023. This growth is due to the rise in obesity and diabetes rates and the strategic product launches by industry leaders. For instance, according to OECD data released in May 2021, the North American countries had the highest incidence rate of obesity and diabetes on a global scale. Particularly, being overweight or obese significantly elevates the risk of developing the most prevalent form of diabetes, type 2 diabetes. This heightened prevalence of diabetes also directly increases the likelihood of dyslipidemia, consequently driving the demand for lipid-regulating medications in the foreseeable future.

The data from the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) as of December 2021 revealed that more than 34.2 million individuals were affected by diabetes, accounting for 10.5% of the U.S. population. Furthermore, approximately 26.9 million people of all age groups had received an official diabetes diagnosis, representing 8.2% of the U.S. population. Within this group, 210,000 were children and adolescents under the age of 20, including 187,000 diagnosed with type 1 diabetes.

Product launches, the concentration of market players and manufacturers, key acquisitions and partnerships among industry leaders, and the escalating prevalence of obesity are some of the other drivers of the lipid regulators market. As per the CDC data updated in May 2022, a staggering 41.9% of Americans were classified as obese, marking a noticeable increase from 30.5% to 41.9% over a specified period. Moreover, severe obesity has surged from 4.7% to 9.2% during this timeframe. It is essential to acknowledge that the CDC has designated obesity as the primary cause of preventable fatalities in the U.S., and it remains one of the leading triggers of chronic illnesses both nationally and globally. As the prevalence of obesity continues to rise, the importance of effective cholesterol management becomes paramount, and lipid regulators are poised to play a pivotal role in propelling market growth throughout the forecast period.

Key Companies & Market Share Insights

Key players operating in the market are AstraZeneca, Teva Pharmaceuticals, Abbott Laboratories, Abbott Laboratories, Novartis, AbbVie Inc., and Amgen. The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives:

-

In August 2023, Novartis presented at the ESC Congress 2023 new extended trial results, showing that Leqvio, when used with statin therapy, consistently lowers LDL-C in patients with cardiovascular disease and elevated risk for more than six years. This data pertains to the ORION-8 study, which is an extension of several previous ORION trials.

-

In May 2022, Sun Pharmaceutical Industries introduced the first-of-its-kind oral medication, Bempedoic Acid, in India, marketed as Brillo, to address LDL cholesterol reduction in the lipid regulators market.