- Home

- »

- Medical Devices

- »

-

Liver Cancer Diagnostics Market Size, Industry Report, 2033GVR Report cover

![Liver Cancer Diagnostics Market Size, Share & Trends Report]()

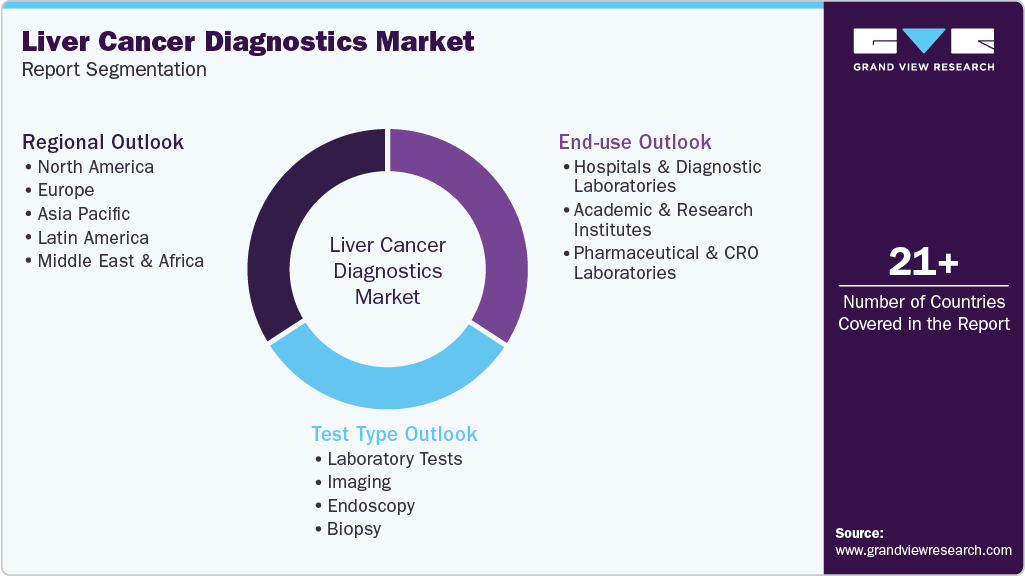

Liver Cancer Diagnostics Market (2025 - 2033) Size, Share & Trends Analysis Report By Test Type (Laboratory Tests, Imaging, Endoscopy, Biopsy), By End-use (Hospitals & Diagnostic Laboratories, Academic & Research Institutes), By Region And Segment Forecasts

- Report ID: GVR-3-68038-012-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Liver Cancer Diagnostics Market Summary

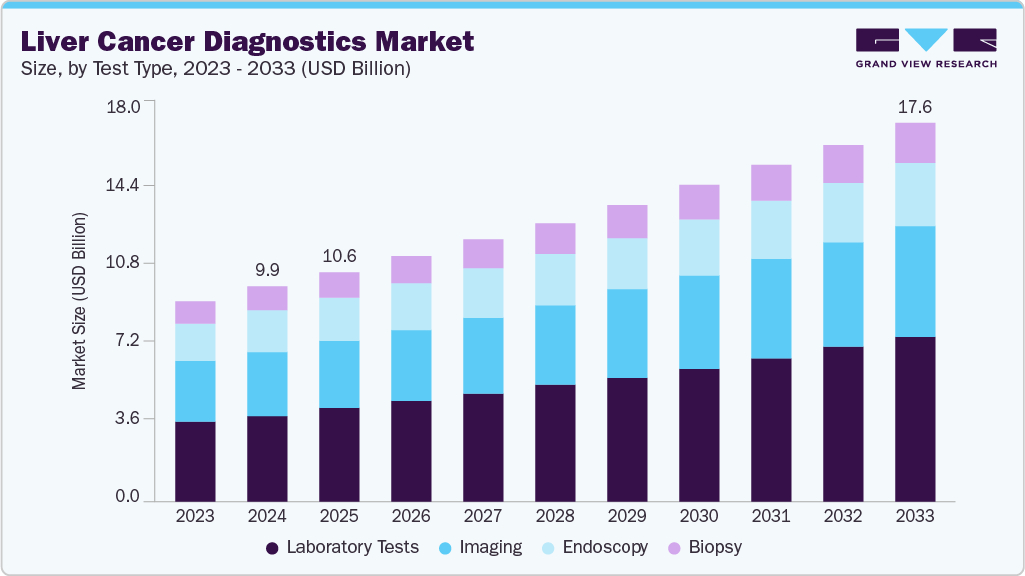

The global liver cancer diagnostics market size was estimated at USD 9.99 billion in 2024 and is projected to reach USD 17.57 billion by 2033, growing at a CAGR of 6.42% from 2025 to 2033. Liver cancer is the leading cause of death amongst all deadly diseases in the globe.

Key Market Trends & Insights

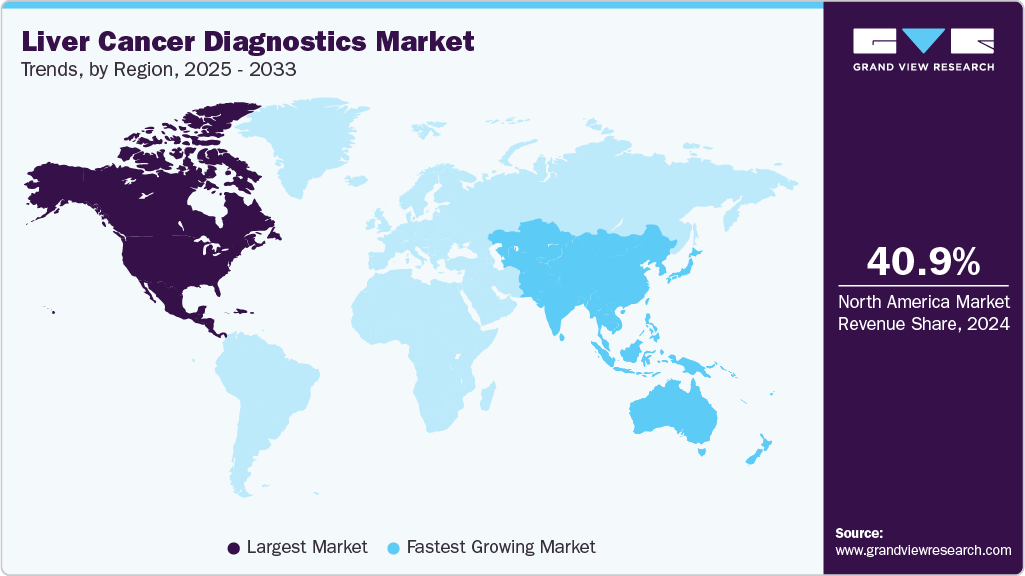

- North America liver cancer diagnostics market dominated the market and accounted for a 40.95% share in 2024.

- The U.S. liver cancer diagnostics market is expected to expand from 2025 to 2033.

- By test type, the laboratory tests for liver cancer diagnostics accounted for the largest revenue share of 40.53% and are among the fastest growing, with a CAGR of 7.52% in 2024.

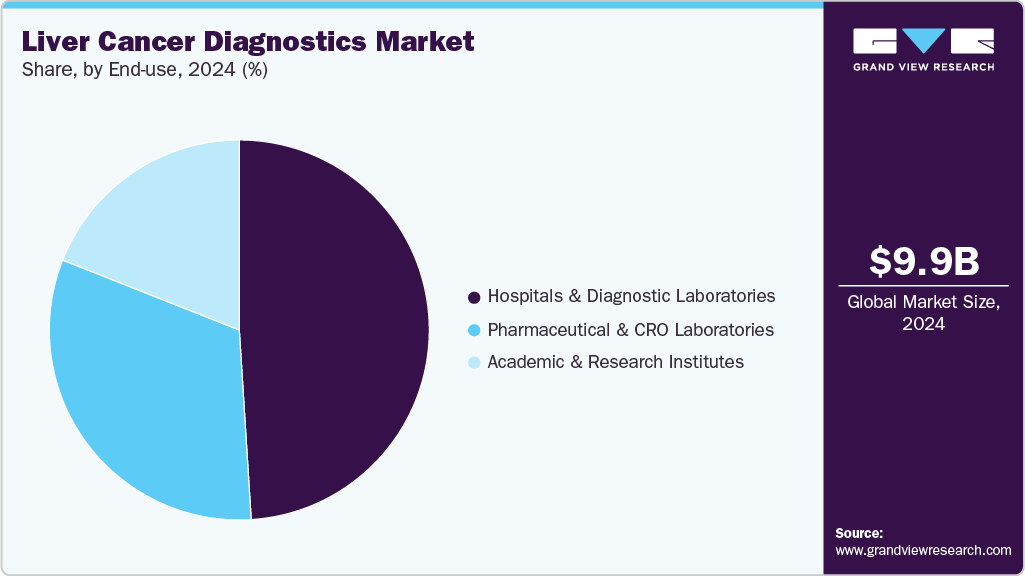

- By end-use, the hospitals & diagnostic laboratories segment held the highest market share of 49.26% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.99 Billion

- 2033 Projected Market Size: USD 17.57 Billion

- CAGR (2025-2033): 6.42%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Since 1980, the rate of incidence of liver cancer has tripled and death rates have doubled during this period. The American Cancer Society estimated that in 2025, about 42,240 new cases are expected, and about 30,090 people will succumb to death. Thus, the global rise in liver cancer prevalence, combined with ongoing exposure to risk factors, will significantly accelerate the growth of the screening and diagnosis market. The rising incidence of liver cancer is increasing the demand for early-stage cancer diagnosis and efforts to reduce associated risk factors. Early detection is crucial in lowering cancer-related deaths, especially through effective screening programs. Overall, diagnosing cancer early can boost patient survival rates by 5 to 10 times compared to later detection.

As the global cases of liver cancer grow, the need for early detection tools and screening methods has intensified. For instance, the National Cancer Institute established the Liver (Hepatocellular) Cancer Screening (PDQ)-health professional version program in April 2025, utilizing techniques like needle aspiration cytology and trans jugular liver biopsy. Programs focused on high-risk groups, such as those with chronic liver conditions, are promoting greater awareness and use of diagnostic tools like ultrasound, CT scans, and blood tests. Early and regular screenings improve detection rates and patient outcomes. This increased emphasis on prevention and early diagnosis is driving innovations in liver cancer diagnostics and accelerating market growth.

Liver cancer screening and treatment are poised for a major shift thanks to cutting-edge early screening technologies currently in advanced development stages. These new innovations are paving the way for growth in the liver diagnostics market. For instance, in April 2025, the FDA granted breakthrough device designation to the EvoLiver biopsy test for monitoring hepatocellular carcinoma (HCC) in patients with high-risk cirrhosis. The test uses a multiomics biomarker signature based on extracellular vesicles (EV) and has shown promising results in detecting early-stage HCC. Data from the MEV01 trial, which involved 464 patient samples, indicated that the EvoLiver test achieved an impressive 86% sensitivity and 88% specificity for early-stage HCC detection. These results significantly surpass current surveillance methods like ultrasound and alpha-fetoprotein testing. This innovative approach has the potential to improve the management of hepatocellular carcinoma in cirrhotic patients greatly.

Emerging biological and informational technologies, such as nanotechnology, big data analytics, AI/machine learning (AI/ML), and genome sequencing, are fueling significant progress in cancer detection and treatment. These advanced technologies improve early detection, customize therapies for individual patients, and enhance overall treatment results.

The global demand for cancer diagnostic tools is rapidly growing, driven by technological progress in cancer detection and diagnosis methods. Advances in imaging technologies, such as high-resolution ultrasound, CT scans, and MRI, have greatly improved the accuracy and early detection of liver tumors, allowing for better monitoring of high-risk populations. Additionally, the creation of non-invasive diagnostic methods, including liquid biopsies and biomarker-based tests, has strengthened the ability to detect liver cancer earlier, when treatments are more effective. AI and machine learning algorithms are also being integrated into diagnostic tools, enhancing the precision of imaging analysis and helping clinicians make better-informed decisions. Moreover, advances in genomic sequencing have made it possible to identify genetic markers linked to liver cancer, supporting personalized treatment plans. As these technologies continue to develop, they are likely to further change the liver cancer diagnostic landscape, resulting in more accurate, timely, and personalized patient care.

Market Opportunities for Liver Cancer Diagnostics in Tissue Diagnostics

Tissue diagnostics is a critical field in healthcare, enabling the identification and characterization of diseases such as cancer, infections, and autoimmune disorders through the microscopic examination of tissue samples. The demand for precision diagnostics, faster turnaround times, and improved accuracy is driving the adoption of digital solutions, with liver cancer diagnostics emerging as a transformative technology within this market.

Liver cancer diagnostics convert glass slides containing tissue samples into high-resolution digital images, facilitating remote access, AI-driven analysis, and enhanced workflow efficiency.

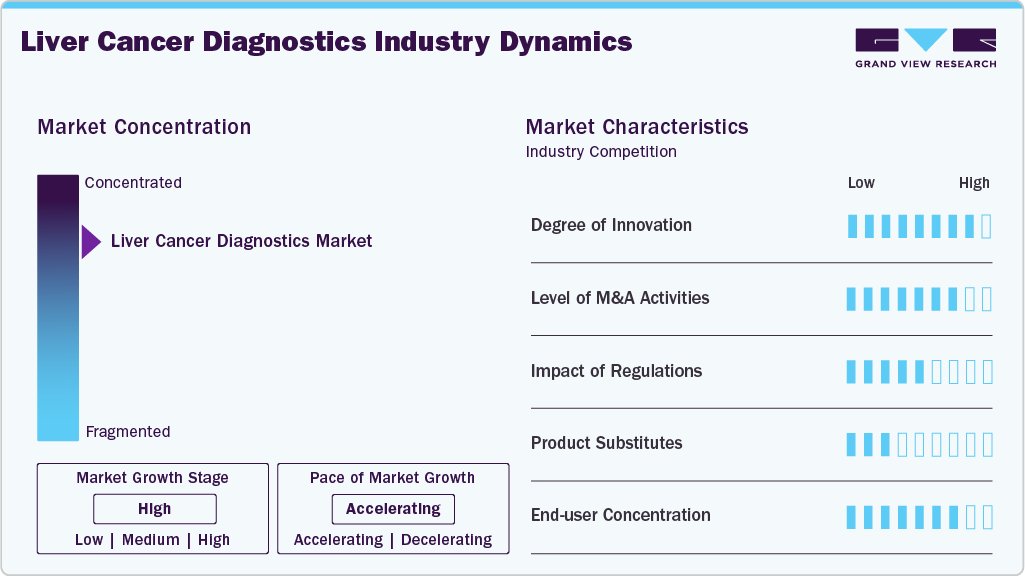

Market Concentration & Characteristics

The degree of innovation in liver cancer diagnostics has significantly increased, driven by advances in technologies such as liquid biopsies, AI-driven imaging, and genomic profiling. These innovations allow for earlier and more accurate detection, improved monitoring of treatment responses, and personalized treatment options. Non-invasive procedures like histotripsy, a focused ultrasound technique, also represent groundbreaking approaches that reduce patient risk and recovery time. As the field evolves, diagnostic tools are becoming more precise, efficient, and accessible, improving outcomes for liver cancer patients.

The liver cancer diagnostics sector has witnessed increased merger and acquisition (M&A) activities in recent years as companies seek to expand their portfolios and strengthen market presence. Major players are acquiring smaller biotech firms and diagnostic companies to integrate innovative technologies like AI, molecular diagnostics, and biomarkers. These acquisitions allow companies to offer more comprehensive diagnostic solutions, enhance R&D capabilities, and improve market penetration. Strategic partnerships are also common, enabling access to new technologies and expanding product offerings for liver cancer detection and management.

Regulation plays a crucial role in the liver cancer diagnostics market, ensuring that products meet safety and efficacy standards. In many countries, diagnostic tools and treatments must undergo rigorous FDA approval or similar regulatory processes before being marketed. This regulatory framework ensures high-quality, reliable products for clinicians and patients. However, the regulatory process can also slow the time to market for innovative diagnostics, which may delay access to new technologies. Compliance with evolving regulations is essential for companies to maintain market access and patient safety.

The liver cancer diagnostics market faces some competition from substitute products and alternative diagnostic methods. Traditional imaging techniques, like CT scans and MRIs, are still widely used but may lack the sensitivity and specificity that newer technologies offer. Non-invasive alternatives, including liquid biopsies and AI-enhanced imaging tools, are emerging as promising substitutes. These alternatives reduce patient discomfort and have the potential for early detection, which may outperform traditional methods. As the technology advances, these substitutes may challenge existing diagnostic tools, driving further innovation.

End user concentration in the liver cancer diagnostics market is high, with hospitals and specialized cancer treatment centers being the primary consumers of diagnostic tools and services. These institutions often have the infrastructure and expertise to use advanced diagnostic technologies like AI-based imaging, liquid biopsies, and genomic profiling. Additionally, research laboratories and healthcare providers involved in oncology and hepatology are also major end users. As personalized medicine and targeted therapies grow in prominence, more healthcare providers, including outpatient clinics, may increasingly adopt liver cancer diagnostic tools.

New Technology and Adoption Landscape of Liver Cancer Diagnostics

-

Non-Invasive Diagnostics: Liquid Biopsy: Liquid biopsy technology has emerged as a transformative tool for the non-invasive detection of liver cancer. By analyzing circulating tumor DNA (ctDNA) or tumor cells from blood samples, it provides insights into tumor characteristics, genetic mutations, and treatment response without the need for traditional tissue biopsies.

-

Artificial Intelligence (AI) and Machine Learning: AI and machine learning algorithms are revolutionizing medical imaging by improving the accuracy of liver cancer detection. These technologies analyze CT scans, MRIs, and ultrasound images to identify small lesions or abnormalities that may be missed by human radiologists.

-

Genomic Profiling and Biomarkers: Next-generation sequencing (NGS) allows for detailed genomic profiling of liver cancer, identifying mutations that can inform targeted therapies. Emerging biomarkers such as Glypican-3 (GPC3) and DKK1 are being explored for their potential in early detection, prognosis, and monitoring treatment responses.

-

Histotripsy: Ultrasound-Based Tumor Ablation: Histotripsy is a novel, FDA-approved procedure that uses focused ultrasound waves to liquefy tumors without the need for surgical incisions. The technology generates high-energy sound waves that create bubbles in the tumor, causing it to collapse and be destroyed while sparing surrounding tissue.

Test Type Insights

The laboratory tests for liver cancer diagnostics accounted for the largest revenue share of 40.53% and are among the fastest growing, with a CAGR of 7.52% in 2024. The rising prevalence of liver cancer is the primary driver of growth in this segment. High-risk liver cancer patients are primarily screened using laboratory tests, which play a critical role in determining treatment options. These tests also help assess the effectiveness of the chosen treatment and its impact on other organs. As laboratory tests are essential for early detection, they enable healthcare providers to identify the tumor's root cause and establish the disease stage. Additionally, these tests are frequently used to monitor treatment progress and detect potential recurrence after therapy. The wide range of applications for laboratory tests in liver cancer contributes to the segment’s rapid expansion.

Various diagnostic tools, including laboratory tests, biomarkers, and imaging technologies, are driving the growth of the liver cancer diagnostics market. Biomarkers play a key role in early detection, offering valuable insights into the presence and progression of liver cancer. Blood tests and pathological biomarkers, combined with advanced imaging techniques like ultrasound, CT, and MRI, enhance diagnostic accuracy. Additionally, endoscopy and biopsy procedures are essential for confirming liver cancer diagnoses, enabling clinicians to assess the tumor's stage and guide treatment decisions. Together, these technologies are advancing liver cancer detection and improving patient outcomes.

An example of innovation in this segment are the MEDRAD Centargo CT Injection System, MAGNETOM Flow MRI, and SOMATOM Pro.Pulse Dual Source CT scanner of Bayer and Siemens Healthineers which launched in April 2025. These three innovative medical imaging systems. The MEDRAD Centargo enhances efficiency in high-volume radiology with its rapid priming and multi-patient capabilities. The MAGNETOM Flow MRI features AI-driven technologies, improving image quality and reducing scan times. The SOMATOM Pro.Pulse offers exceptional temporal resolution for high-quality imaging, further advancing diagnostic precision and patient care in various medical fields.

End-use Insights

The hospitals & diagnostic laboratories labs segment dominated the End Use segments with the largest market share of 49.26% in 2024. Hospitals and diagnostic laboratories play a key role in the liver cancer diagnostics market, driving significant demand for diagnostic tools and technologies. Hospitals, because of their advanced infrastructure and specialized departments, utilize a wide range of diagnostic methods such as imaging, biopsy, blood tests, and biomarker analysis to detect liver cancer early. Diagnostic laboratories, on the other hand, play a crucial role in processing and analyzing patient samples, providing accurate results that guide treatment decisions. As the prevalence of liver cancer rises, both hospitals and diagnostic laboratories are essential in providing timely, accurate diagnoses, thus contributing to better patient outcomes and the overall growth of the liver cancer diagnostics market.

Moreover, the pharmaceutical and CRO laboratories are expected to grow at the fastest rate with a CAGR of 8.08%. Contract Research Organizations (CROs) are expanding rapidly in the market by advancing research and developing innovative diagnostic tools. Their role in clinical trials and the development of precision medicine enables earlier detection and improved treatment strategies. Additionally, CROs contribute to regulatory approvals and validation of diagnostic tests, further enhancing the reliability and adoption of new technologies. The collaboration between these entities is speeding up the progress of liver cancer diagnostics, benefiting both patients and healthcare providers.

The increasing need for remote collaboration, regulatory compliance, and quicker turnaround times has prompted hospitals to adopt remote technologies and seamlessly integrate diagnostic findings. For instance, in February 2025, Agilus Diagnostics and Lucence have partnered to enhance cancer diagnostics in India along with its advancing test LiquidHALLMARK test, a next-generation sequencing liquid biopsy that analyzes circulating tumor DNA (ctDNA) and circulating tumor RNA (ctRNA) for biomarkers associated with various cancers.

Regional Insights

North America liver cancer diagnostics market dominated the market and accounted for a 40.95% share in 2024. The North American liver cancer diagnostics market is expanding, driven by rising cancer prevalence, technological advancements like AI, liquid biopsy, and imaging, and supportive regulatory frameworks. The liver cancer diagnostic market in North America has seen a shift towards non-invasive methods, including imaging techniques like MRI, CT scans, and ultrasound, which provide more accurate and earlier detection of liver tumors. Additionally, advancements in Artificial Intelligence (AI) and Machine Learning (ML) are improving the accuracy and speed of liver cancer diagnosis by assisting radiologists with image analysis and pattern recognition.

U.S. Liver Cancer Diagnostics Market Trends

The U.S. liver cancer diagnostics market is expected to expand from 2025 to 2033. This growth is fueled by the rising incidence of liver cancer, advances in diagnostic technologies such as AI-assisted imaging and liquid biopsy, and the presence of major companies like Abbott Laboratories, Thermo Fisher Scientific, Illumina, and Guardant Health. Additionally, ongoing research focused on creating innovative diagnostic products will open up further profitable opportunities during the forecast period. Developments in non-invasive testing and personalized medicine are improving early detection and treatment accuracy, positioning the U.S. as a leader in the global market.

Europe Liver Cancer Diagnostics Market Trends

The European liver cancer diagnostics market was identified as a lucrative region in this industry. Key drivers include the rising incidence of liver cancer, advancements in diagnostic technologies, and increasing demand for non-invasive testing methods. This market is expected to grow exponentially during the forecast period owing to an increase in the number of approvals by regulatory bodies, intense competition between companies to increase market share, government initiatives, and improving reimbursement scenarios. These advancements are enhancing early detection and personalized treatment approaches, positioning Europe as a hub for liver cancer diagnostics.

The UK liver cancer diagnostics market is experiencing robust growth. This expansion is driven by the increasing incidence of liver cancer, advancements in diagnostic technologies, and a strong emphasis on early detection. Government bodies, like the NHS, are implementing initiatives to increase the accessibility and affordability of these tests, ensuring they are available to all. These efforts aim to save time, reduce complications, and encourage widespread adoption of diagnostic tools. Recent advancements include the development of AI-assisted imaging, liquid biopsy techniques, and non-invasive screening methods, enhancing diagnostic accuracy and patient outcomes.

The Germany liver cancer diagnostics market is experiencing significant growth. This growth is driven by the increasing prevalence of liver cancer, advancements in diagnostic technologies, and supportive government initiatives. Key players such as Siemens Healthineers, Epigenomics AG, and Synlab Group are leading the market with innovative solutions. Recent advancements include AI-assisted imaging, liquid biopsy techniques, and non-invasive screening methods, enhancing diagnostic accuracy and patient outcomes. The German government's efforts to promote early detection and improve healthcare accessibility further contribute to the market's expansion.

Asia Pacific Liver Cancer Diagnostics Market Trends

Asia Pacific liver cancer diagnostics market is anticipated to witness the fastest growth of 10.35% CAGR over the forecast period. The Asia-Pacific liver cancer diagnostics has drawn more attention as a result of demographic shifts brought on by urbanization, a rapidly aging population, and economic expansion. Recent advancements include the development of AI-assisted imaging, liquid biopsy techniques, and non-invasive screening methods, enhancing diagnostic accuracy and patient outcomes. The region's focus on early detection and personalized treatment approaches further contributes to the market's growth

The China liver cancer diagnostics market is witnessing significant growth. The expansion in market is driven by rising liver cancer incidence, government support for research and screening programs, and advancements in diagnostic technologies. Key players include Roche, Abbott Laboratories, Illumina, Thermo Fisher Scientific, and local firms like Berry Oncology, which launched a liquid biopsy test with over 95% sensitivity. Innovations such as AI-enhanced imaging and multi-analyte blood tests are improving early detection and patient outcomes.

The Japan liver cancer diagnostics market is experiencing steady growth is driven by the rising prevalence of liver cancer, advancements in diagnostic technologies, and strong government support for early detection programs. Key players such as Abbott Laboratories, Thermo Fisher Scientific, Roche Holding AG, Fujifilm Holdings Corp, and Siemens Healthineers are leading the market with innovative solutions. Recent advancements include AI-assisted imaging, liquid biopsy techniques, and non-invasive screening methods, enhancing diagnostic accuracy and patient outcomes. The Japanese government's initiatives to promote liver cancer screening and improve healthcare accessibility further contribute to the market's expansion.

Latin America Liver Cancer Diagnostics Market Trends

The Latin America liver cancer diagnostics market has exhibited significant growth in the past few years owing to the increased prevalence of various types of cancer in the region. Several surveys by various government and nonprofit organizations revealed that overall cancer mortality in Latin America is almost twice that of high-income countries. These factors are expected to contribute to market growth during the forecast period. Advancements in diagnostic technologies, such as non-invasive imaging modalities, liquid biopsy techniques, and AI-assisted diagnostics, are improving early detection and patient outcomes.

The Brazil liver cancer diagnostics market is experiencing steady growth, driven by increasing liver cancer prevalence and advancements in diagnostic technologies. Recent advancements include the development of AI-assisted imaging, liquid biopsy techniques, and non-invasive screening methods, enhancing diagnostic accuracy and patient outcomes. Government initiatives and collaborations with private healthcare providers further support the adoption of advanced diagnostic solutions, contributing to the market's expansion.

Middle East and Africa Liver Cancer Diagnostics Market Trends

The Middle East & Africa has immense growth potential, as the majority of the regional market is untapped due to the unavailability of organized cancer screening programs in this region, especially in underdeveloped African economies. This growth is driven by increasing liver cancer prevalence, advancements in diagnostic technologies, and supportive government initiatives. Government efforts to promote early detection and improve healthcare accessibility further contribute to the market's expansion.

The Saudi Arabia liver cancer diagnostics market is growing rapidly, driven by the government's Vision 2030 initiative to modernize healthcare infrastructure. The growth of the country's market can be largely attributed to the growing government involvement and heightened awareness of the advantages of non-invasive diagnostic methods. Moreover, significant advancements in NGS and PCR technologies have enhanced the accuracy of diagnostic procedures over time. Key drivers include increasing liver cancer prevalence, advancements in diagnostic technologies, and supportive government initiatives. The government's focus on early detection and improved healthcare accessibility further contributes to the market's expansion.

Key Liver Cancer Diagnostics Company Insights

Some of the key players operating in the market include Abbott Laboratories, Thermo Fisher Scientific, Inc, F. Hoffmann-La Roche Ltd, Qiagen N.V, Siemens Healthineers, Becton, Dickinson & Company. New product launch, mergers and acquisitions, and collaborations are some of the major strategies adopted by these players to counter the stiff competition.

Key Liver Cancer Diagnostics Companies:

The following are the leading companies in the liver cancer diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott Laboratories

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche Ltd.

- Qiagen N.V.

- Siemens Healthineers

- Becton, Dickinson & Company

- Illumina, Inc.

- Epigenomics AG

- Koninklijke Philips N.V.

- Fujifilm Medical Systems U.S.A., Inc.

Recent Developments

-

In January 2025, FDA has granted breakthrough device designation to the EvoLiver test for monitoring hepatocellular carcinoma (HCC) in patients with high-risk cirrhosis, according to a recent announcement from the test's developer.

-

In May 2023, Lucence Health Inc. introduced LucenceINSIGHT, a blood test for early multicancer detection, marking a significant step in expanding their diagnostic capabilities. This initiative is expected to enhance the company's offerings by providing a more accessible and convenient solution for asymptomatic individuals. By enabling early detection of various cancers, including liver cancer, LucenceINSIGHT aims to improve patient outcomes and contribute to the ongoing evolution of cancer diagnostics.

Liver Cancer Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.63 billion

Revenue forecast in 2033

USD 17.57 billion

Growth rate

CAGR of 6.42% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Abbott Laboratories; Thermo Fisher Scientific, Inc.; F. Hoffmann-La Roche Ltd.; Qiagen N.V.; Siemens Healthineers; Becton, Dickinson & Company; Illumina, Inc.; Epigenomics AG; Koninklijke Philips N.V.; Fujifilm Medical Systems U.S.A., Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Liver Cancer Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global liver cancer diagnostics market report on the basis of test type, end-use, and region:

-

Test type Outlook (Revenue, USD Million, 2021 - 2033)

-

Laboratory Tests

-

Biomarkers

-

Oncofetal and Glycoprotein Antigens

-

Enzymes and Isoenzymes

-

Growth Factors and Receptors

-

Molecular Markers

-

Pathological Biomarkers

-

-

Blood Tests

-

-

Imaging

-

Endoscopy

-

Biopsy

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Diagnostic Laboratories

-

Academic & Research Institutes

-

Pharmaceutical & CRO Laboratories

-

-

Regional Outlook (Revenue in USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Based on test type, laboratory tests accounted for the largest share of 40.53%% in 2024. The high market share can be attributed to increased demand for the effective diagnosis of hepatocellular carcinoma.

b. Some key players operating in the liver cancer diagnostics market include Abbott Laboratories; F. Hoffmann-La Roche Ltd.; Qiagen N.V.; Thermo Fisher Scientific, Inc.; Siemens Healthineers; Becton Dickinson & Company; Illumina, Inc.; Koninklijke Philips N.V.; Epigenomics AG; and Fujifilm Medical Systems U.S.A., Inc.

b. The global liver cancer diagnostics market size was estimated at USD 9,994.06 million in 2024 and is expected to reach USD 10,683.2 million in 2025.

b. The global liver cancer diagnostics market is expected to witness a compound annual growth rate of 6.42% from 2025 to 2033 to reach USD 17.57 billion in 2033.

b. The major factors driving the liver cancer diagnostics market growth are the introduction of innovative diagnostic products and the rising prevalence of liver cancer.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.