- Home

- »

- Pharmaceuticals

- »

-

Liver Cancer Drug Market Size, Share, Industry Report, 2030GVR Report cover

![Liver Cancer Drug Market Size, Share & Trends Report]()

Liver Cancer Drug Market (And Segment Forecasts 2025 - 2030) Size, Share & Trends Analysis Report By Therapy (Targeted Therapy, Immunotherapy, Chemotherapy), By Type (Hepatocellular Carcinoma), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies), By Region

- Report ID: GVR-2-68038-513-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Liver Cancer Drug Market Summary

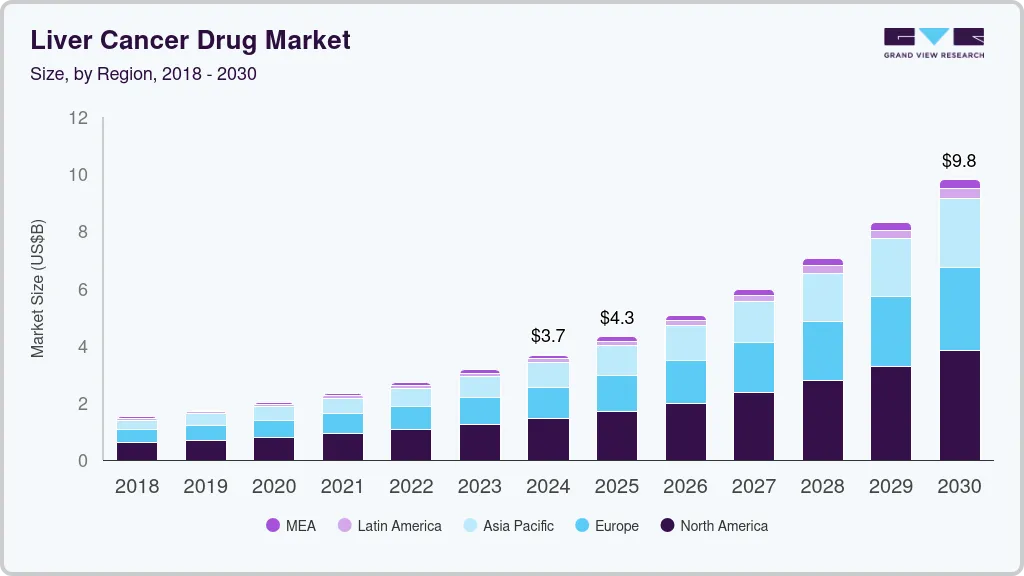

The global liver cancer drug market size was estimated at USD 3,670.0 million in 2024 and is projected to reach USD 9,810.0 million by 2030, growing at a CAGR of 17.9% from 2025 to 2030. The rising prevalence of liver cancer, advancement in treatment options, growing awareness and early diagnosis, rising healthcare expenditure, technological advancement, rising investment in research and development (R&D), government initiatives to increase access to care and promoting research in oncology are some the key drivers propelling the market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Mexico is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, targeted therapy accounted for a revenue of USD 2,285.0 million in 2024.

- Immunotherapy is the most lucrative therapy segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3,670.0 Million

- 2030 Projected Market Size: USD 9,810.0 Million

- CAGR (2025-2030): 17.9%

- North America: Largest market in 2024

A liver cancer drug is a medication used to treat liver cancer by targeting specific cancer cells or pathways. These drugs include chemotherapy agents such as gemcitabine and oxaliplatin, targeted therapies such as sorafenib and lenvatinib, and immunotherapies including atezolizumab. They work by inhibiting cancer growth, inducing cell death, or enhancing the immune response against cancer cells.

According to the American Cancer Society, more than 800,000 people are diagnosed with liver cancer each year, accounting for more than 700,000 deaths each year worldwide. Factors such as alcohol consumption, hepatitis B & C infections, obesity, and fatty liver disease are expected to contribute to a growing incidence rate of liver cancer. The development of novel therapies and treatment options for liver cancer, including targeted therapies, immunotherapies, chemotherapy, and combination therapies, has fuelled the market growth. These advancements have improved survival rates and quality of life for patients. Increased awareness about the importance of early detection and diagnosis of liver cancer has led more patients to seek treatment at an early stage.

The increasing healthcare expenditure globally and government initiatives to improve access to healthcare services have contributed to the market growth. Technological advancements in healthcare are improving the diagnosis process. The rise of precision medicine allows for tailored treatment plans based on a patient’s needs.

Therapy Insights

The targeted therapy segment led the market and held the largest market revenue share of 53.1% in 2024, owing to its precision in targeting specific molecules or pathways involved in the growth and spread of cancer cells. In addition, targeted therapy aims to minimize damage to normal cells, thus reducing side effects and improving patient outcomes. Furthermore, in the case of liver cancer, targeted therapy has been identified as having promising results in inhibiting tumor growth and improving survival rates.

The immunotherapy segment is expected to grow at the fastest CAGR of 23.5% over the forecast period. Immunotherapy has shown promising results in treating liver cancer by harnessing the immune system to target and destroy cancer cells. This approach has demonstrated significant efficacy, increasing adoption and investment in immunotherapy for liver cancer treatment.

Type Insights

Hepatocellular carcinoma (HCC) dominated the global liver cancer drug industry with the highest revenue share of 38.2% in 2024. HCC Is the most common type of primary liver cancer. The high prevalence and mortality rate due to HCC is leading to research and development to find effective drugs and therapies. HCC has been challenging to treat and has limited treatment options, which leads companies to invest in new and effective drugs and therapies. Furthermore, growing awareness and early detection of liver cancer allows timely intervention and treatment, driving the demand for the drug.

The cholangio carcinoma segment is expected to grow at the fastest CAGR of 7.9% over the forecast period, primarily driven by the increasing incidence rates and rising awareness. Furthermore, cholangiocarcinoma's aggressive nature and limited treatment options necessitate more effective therapies, leading to increased research and development. Moreover, collaborations between pharmaceutical companies and healthcare organizations are propelling clinical trials and novel treatments, further boosting market expansion.

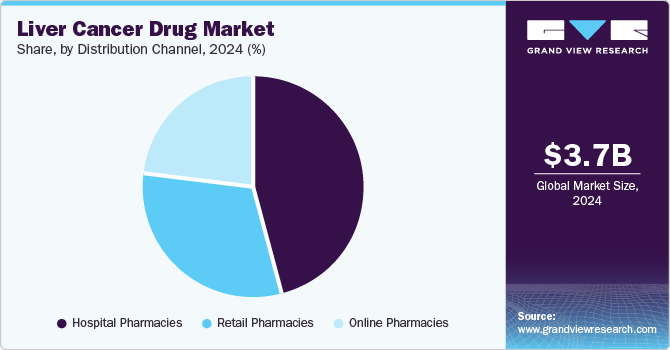

Distribution Channel Insights

Hospital pharmacies held the dominant position in the market and accounted for the largest revenue share of 45.7% in 2024. This growth can be attributed to the increasing prevalence of cancer, and treatments & technologies available in hospital facilities are driving the hospital pharmacy market growth. Hospitals serve as primary diagnosis and treatment centers, offering access to newly approved drugs. Furthermore, this centralized care model enhances patient outcomes and supports the adoption of innovative therapies, making hospital pharmacies a key distribution channel.

Online pharmacies are expected to grow at a CAGR of 20.5% over the forecast period, attributed to convenience and accessibility. Their role in the liver cancer drug market is limited due to the specialized nature of these medications. Online platforms are expanding by offering services such as home delivery and telemedicine, which can improve patient compliance and access to care, though regulatory challenges remain a barrier.

Regional Insights

North America liver cancer drug market dominated the global market and held the largest revenue share of 38.7% in 2024. It can be attributed to increasing awareness, advanced healthcare infrastructure and advanced medical technologies in the region. In addition, the strong regulatory framework ensures safe drugs, boosting patient trust. Key market players and ongoing R&D activities enhance the market. The advanced infrastructure supports the development of innovative treatments, further driving market expansion and improving patient outcomes.

U.S. Liver Cancer Drug Market Trends

The liver cancer drug market in the U.S. dominated the North America market with the largest revenue share in 2024, driven by the increasing investment in pharmaceuticals. The regulatory framework in the U.S. ensures only safe and effective drugs reach the market which increases trust of patients and healthcare providers in the drugs. Furthermore, major players and novel treatment launches contribute to its dominance. Regulatory approvals for innovative drugs support market expansion, making the U.S. a leader in liver cancer treatments. This environment fosters continuous innovation and growth.

Asia Pacific Liver Cancer Drug Market Trends

Asia Pacific liver cancer drug market is expected to grow at the fastest CAGR of 19.6% from 2025 to 2030. This growth is due to the significantly increasing investments in liver cancer drug technologies across the region. In addition, enhanced clinical research and a large target audience create opportunities. Furthermore, countries such as China offer significant potential due to unsatisfied medical needs, making it an attractive market for pharmaceutical companies. This region's diverse healthcare systems also support market expansion.

The liver cancer drug market in China dominated the Asia Pacific market and accounted for the highest share in 2024, primarily driven by its large population and increasing demand for liver cancer treatments. Furthermore, expanding healthcare infrastructure and clinical research activities create favorable conditions for pharmaceutical investments. Moreover, innovative therapies are increasingly sought after to address the rising incidence of liver cancer. Government support for healthcare development further boosts market growth.

Europe Liver Cancer Drug Market Trends

Europe liver cancer drug marketis expected to grow significantly over the forecast period. The market is primarily driven by factors such as the growing elderly population, increasing incidence of liver cancer, advancements in treatment and diagnosis procedures, and the rise in demand for minimally invasive cancer treatment techniques. In addition, increased funding for medicinal products and demand for targeted therapies contribute to growth. Furthermore, the region's strong healthcare systems support the adoption of new treatments, enhancing patient care and outcomes.

The liver cancer drug market in Germany led the European market and held the largest revenue share in 2024, driven by increased funding for cancer research and the adoption of advanced medical technologies. In addition, demand for minimally invasive treatments and targeted therapies supports expansion. Furthermore, the country's strong healthcare system and innovative research environment make it a liver cancer drug development hub. Collaborations between academia and industry further enhance market potential.

Key Liver Cancer Drug Company Insights

Key companies in the liver cancer drug industry include Exelixis, Inc., Merck KGaA, Eisai Co., Ltd., and others. These players implement strategies such as investing in R&D, launching novel drugs, forming strategic partnerships, and expanding distribution networks to enhance their portfolios and expand their market presence. Furthermore, they also focus on regulatory compliance and improving patient access to treatments.

Exelixis operates in the oncology segment, manufacturing drugs such as CABOMETYX (cabozantinib), used for treating liver cancer. The company focuses on developing targeted therapies for various cancers, including liver cancer. Its products are designed to improve patient outcomes by targeting specific pathways involved in cancer growth.

Merck KGaA operates in the pharmaceutical segment, offering a range of oncology treatments. The company collaborates with other firms to develop innovative cancer therapies, including those for liver cancer. Its products and partnerships focus on enhancing cancer care through advanced treatments and technologies.

Key Liver Cancer Drug Companies:

The following are the leading companies in the liver cancer drug market. These companies collectively hold the largest market share and dictate industry trends.

- Exelixis, Inc.

- Merck KGaA

- Eisai Co., Ltd.

- Bristol-Myers Squibb Company

- Thermo Fisher Scientific Inc.

- Pfizer Inc.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Bayer AG

Recent Developments

-

In January 2025, Bristol Myers Squibb received a positive CHMP opinion for Opdivo (nivolumab) plus Yervoy (ipilimumab) as a first-line treatment for non-resectable or advanced hepatocellular carcinoma, a form of liver cancer. This combination, a potential live cancer drug, demonstrated improved complete survival compared to existing treatments. The approval offers new hope for patients with this challenging condition, providing an innovative approach to liver cancer treatment.

-

In March 2024, Bayer AG and Thermo Fisher Scientific Inc. joined forces to enhance patient access to precision cancer medicines, including a potential live cancer drug. The collaboration focused on developing advanced next-generation sequencing companion diagnostics (CDx) to pinpoint individuals who could benefit from Bayer's expanding range of targeted cancer treatments.

Liver Cancer Drug Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.31 billion

Revenue forecast in 2030

USD 9.81 billion

Growth rate

CAGR of 17.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Therapy, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Exelixis, Inc.; Merck KGaA; Eisai Co., Ltd.; Bristol-Myers Squibb Company; Thermo Fisher Scientific Inc.; Pfizer Inc.; Eli Lilly and Company; F. Hoffmann-La Roche Ltd; Novartis AG; Bayer AG.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Liver Cancer Drug Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global liver cancer drug market report based on therapy, type, distribution channel and region:

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Targeted Therapy

-

Immunotherapy

-

Chemotherapy

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hepatocellular Carcinoma

-

Cholangio Carcinoma

-

Hepatoblastoma

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.