- Home

- »

- Pharmaceuticals

- »

-

Liver Disease Therapeutics Market Size, Share Report, 2033GVR Report cover

![Liver Disease Therapeutics Market Size, Share & Trends Report]()

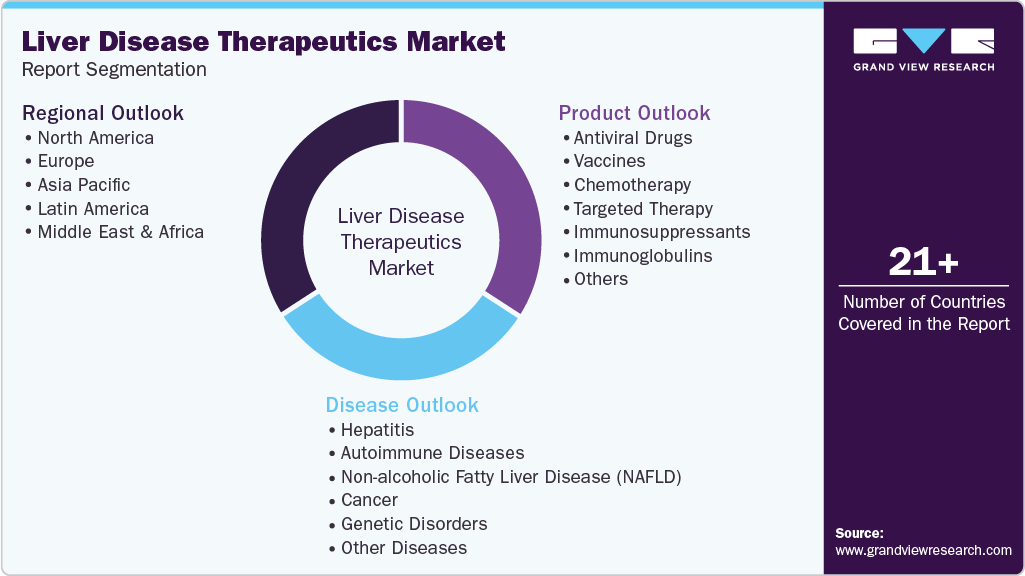

Liver Disease Therapeutics Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Antiviral Drugs, Vaccines, Chemotherapy), By Disease (Hepatitis, Autoimmune Diseases), By Region, And Segment Forecasts

- Report ID: 978-1-68038-540-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Liver Disease Therapeutics Market Summary

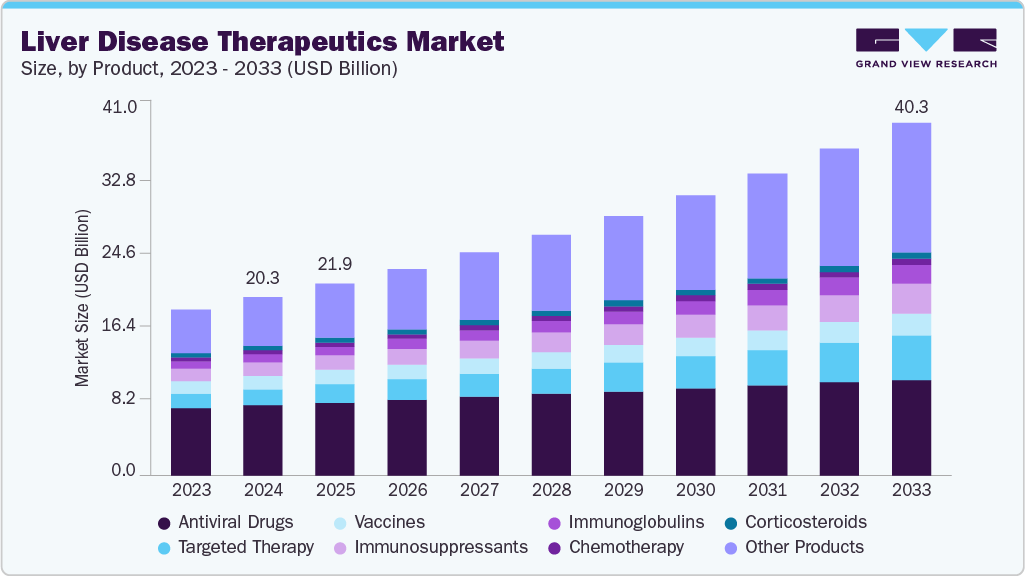

The global liver disease therapeutics market size was estimated at USD 20.31 billion in 2024 and is projected to reach USD 40.29 billion by 2033, growing at a CAGR of 7.9% from 2025 to 2033. Rising cases of NAFLD, hepatitis, and alcohol-related liver conditions, advancements in drug development, and increasing obesity and diabetes prevalence drive this growth.

Key Market Trends & Insights

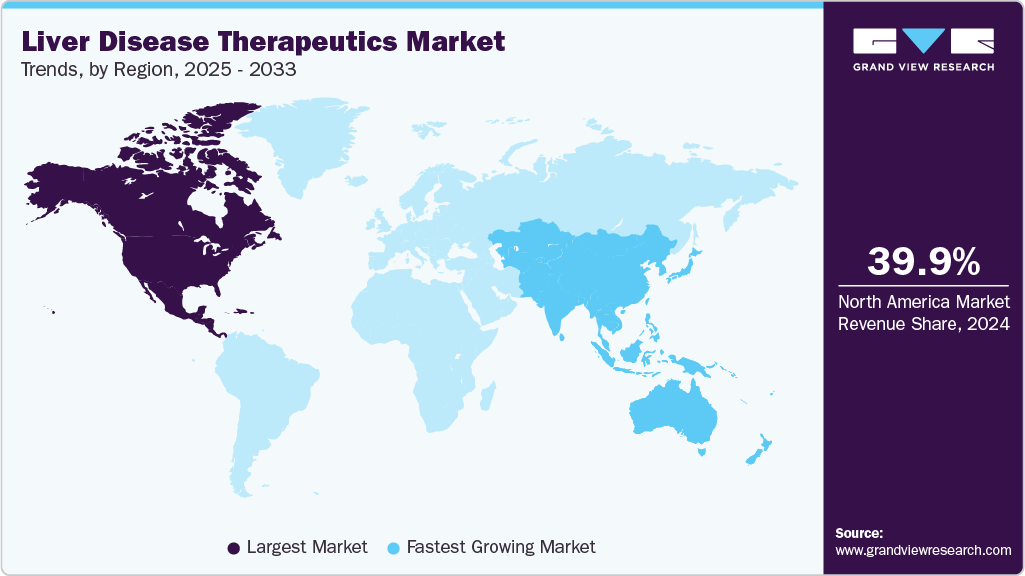

- North America liver disease therapeutics market held the largest share of 39.87% of the global market in 2024.

- The liver disease therapeutics market in Asia Pacific is projected to grow at the fastest CAGR of 9.19% over the forecast period.

- The liver disease therapeutics industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the antiviral drugs segment held the highest market share of 39.84% in 2024.

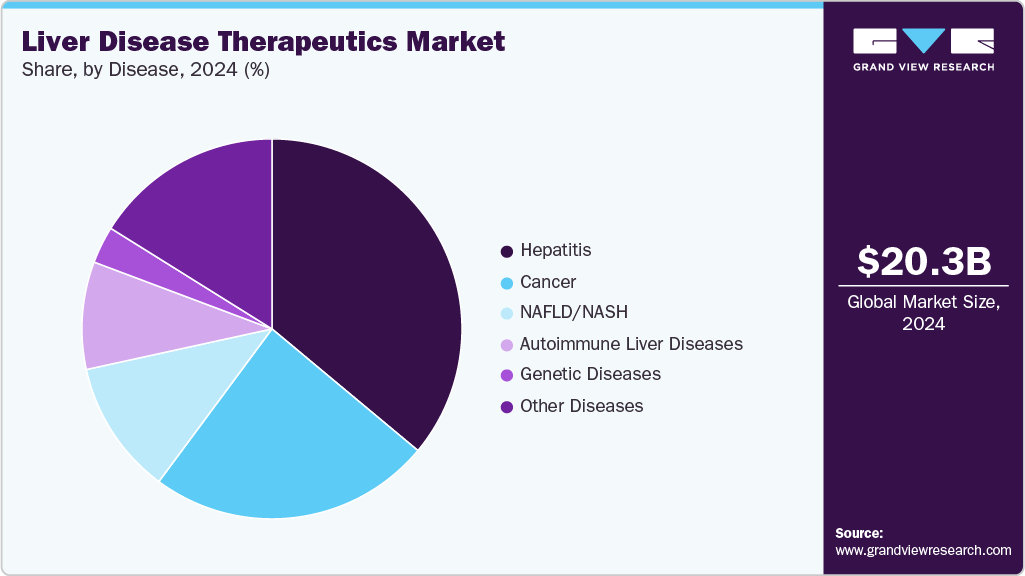

- By disease, the hepatitis segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 20.31 Billion

- 2033 Projected Market Size: USD 40.29 Billion

- CAGR (2025-2033): 7.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

The rising prevalence of liver diseases globally is a primary driver fueling market growth. Recent epidemiological trends underscore a sustained and alarming increase in both chronic and acute liver conditions, including viral hepatitis (HBV, HCV), non-alcoholic fatty liver disease (NAFLD), alcohol-related liver disease (ALD), and hepatocellular carcinoma (HCC). This trend translates into heightened clinical demand for therapeutics across all stages of liver pathology-from early-stage antiviral management to advanced cancer-targeted therapies.

According to the World Health Organization (WHO, 2024), an estimated 296 million people worldwide are living with chronic hepatitis B, while 58 million are infected with chronic hepatitis C, with many unaware of their infection status until advanced liver complications develop. These chronic viral infections contribute to more than 1.1 million deaths annually, primarily due to cirrhosis and liver cancer, highlighting a substantial public health burden and an unmet need for therapeutic intervention.

Table 1 Global Burden of Key Liver Diseases

Disease Area

Estimated Global Prevalence

Key Insights

Hepatitis B (HBV)

296 million

Often asymptomatic; major cause of cirrhosis and HCC; linked to vertical transmission.

Hepatitis C (HCV)

58 million

High-risk in injectable drug users; chronic infection can lead to end-stage liver disease.

Non-Alcoholic Fatty Liver Disease (NAFLD)

~25% of global population

Closely linked with obesity and diabetes, driving a rise in NASH-related liver failure.

Alcohol-Related Liver Disease (ALD)

Rising globally (no unified estimate)

Post-pandemic spike observed; increasing hospitalizations and liver transplants.

Hepatocellular Carcinoma (HCC)

4th most common cause of cancer death globally

Often, a downstream result of chronic HBV/HCV or NASH is an increasing focus on targeted therapies.

Sources: WHO, 2024; Journal of Hepatology, 2023; PMC10026948, 2023

In addition, advancements in therapeutic innovations are a significant market driver, propelled by breakthroughs in mRNA-based platforms, antiviral development, and immune-modulating strategies. These innovations aim to overcome the limitations of conventional protein drugs and DNA therapies, thereby expanding treatment options for complex and chronic liver diseases.

According to a study published in MDPI 2022, mRNA-based approaches are gaining attention due to their ability to produce sustained therapeutic protein expression without integrating into the host genome, reducing the risk of insertional mutagenesis. mRNA's cytoplasmic activity avoids the need for nuclear entry, allowing efficient translation into proteins in hepatocytes, which are ideal targets for metabolic and viral liver disorders.

Moreover, non-viral etiologies are emerging as major contributors to the disease burden. In a 2023 study published in the Journal of Hepatology, it was noted that non-alcoholic fatty liver disease (NAFLD) affects approximately 25% of the global population. Its more severe form, non-alcoholic steatohepatitis (NASH), is rapidly progressing to become the leading cause of liver transplantation in Western countries (Younossi et al., 2023). This demographic shift is particularly driven by rising obesity, insulin resistance, and sedentary lifestyles, contributing to the systemic metabolic dysfunction observed in NAFLD/NASH populations.

Innovations in liver disease therapeutics

Focus Area

Technology

Clinical Development

Source

CMV-induced liver inflammation

mRNA-1647 vaccine

Phase 3 (NCT05085366)

Cureus (2023)

Chronic Hepatitis B

mRNA immunotherapy

Preclinical; aims to induce cellular immunity

Cells 2022, 11, 3328

Liver cancer

mRNA cancer vaccines

No approved vaccine yet; preclinical development ongoing

Cells 2022, 11, 3328

Pediatric liver disorders

mRNA for enzyme replacement

Multiple preclinical programs

Cells 2022, 11, 3328

Market Concentration & Characteristics

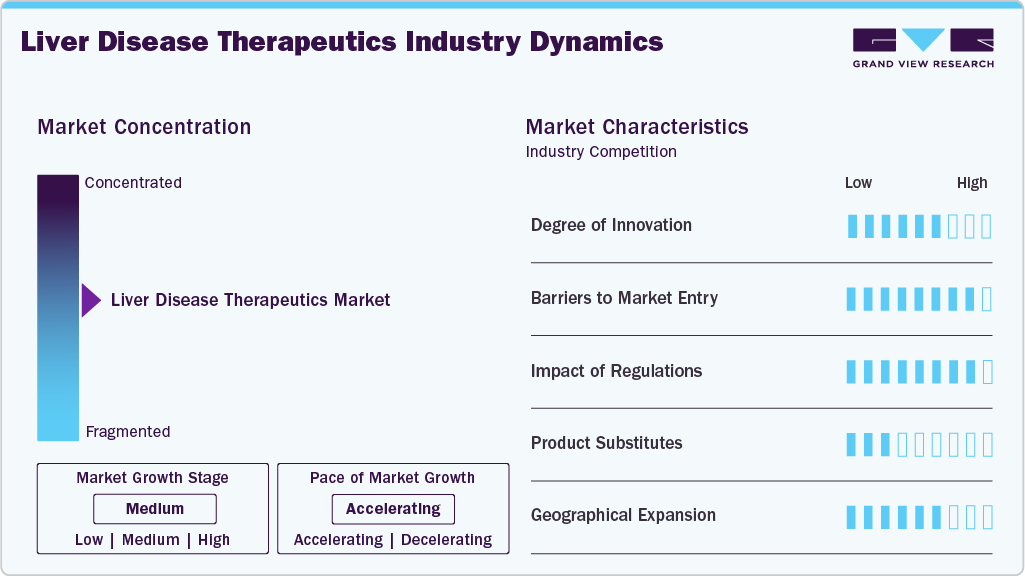

The liver disease therapeutics industry is marked by a moderate to high degree of innovation, with major players like Gilead, AbbVie, and Roche investing in novel antiviral agents and targeted therapies. Unmet clinical needs in NAFLD, autoimmune liver conditions, and liver cancer largely drive innovation. Advancements in biologics, gene editing, and RNA-based technologies are shaping next-generation treatments. However, R&D's high cost and time requirements for R&D limit participation to well-funded companies. Strategic collaborations and licensing deals further accelerate innovation cycles.

Barriers to entry in this market are high due to complex regulatory pathways, substantial capital investment, and the need for extensive clinical validation. The dominance of established players like Pfizer and Merck makes market penetration difficult for smaller firms. Intellectual property protection and strong brand loyalty to existing therapeutics add to these challenges. In addition, the necessity for long-term safety data and pharmacovigilance programs increases entry costs. New entrants often rely on niche indications or partnerships to gain a foothold.

Regulatory frameworks have a significant impact, especially concerning drug approvals for hepatitis treatments and biologics. Stringent protocols from agencies like the FDA and EMA ensure safety and efficacy, but often extend time to market. Post-approval surveillance and pricing regulations also influence product launch strategies. However, accelerated approval programs and orphan drug incentives benefit developers targeting rare liver conditions. Regional disparities in reimbursement policies can affect commercial success across different markets.

While therapeutic substitutes exist, such as liver transplantation and supportive care, pharmacological alternatives remain limited for many liver diseases. Vaccines and antivirals dominate hepatitis treatment, but conditions like NAFLD lack widely accepted drug therapies, reducing substitution risks. Herbal remedies and nutritional supplements pose minimal threat due to limited clinical validation. However, lifestyle interventions and early detection strategies are increasingly integrated alongside pharmaceutical regimens. Continued innovation reduces reliance on non-pharmacological substitutes.

Geographical expansion is a key strategy for major companies aiming to tap emerging markets in Asia Pacific, Latin America, and the Middle East. The rising prevalence of liver diseases and improving healthcare access in countries like China, India, and Brazil are opening new commercial opportunities. Multinational firms leverage regional partnerships, local manufacturing, and market-specific regulatory strategies. Nonetheless, infrastructure disparities and pricing sensitivities can hinder smooth expansion. Tailored drug portfolios for local epidemiology are increasingly important for success.

Product Insights

The antiviral drugs segment dominated the market with the largest revenue share of 39.84% in 2024 due to the high global prevalence of chronic viral hepatitis, long treatment durations for HBV, and premium pricing for HCV DAAs.Antiviral drugs have become central to liver disease management. These therapies, including tenofovir, entecavir, and direct-acting antivirals like sofosbuvir and glecaprevir, effectively suppress HBV and cure HCV. Their broad application across patient groups, high efficacy rates, and oral administration have made them widely adopted globally. WHO's 2030 elimination target is accelerating access to generics and diagnostics, while new therapies such as siRNA and immune-based treatments show promise for a functional HBV cure. The antiviral drug segment is expected to grow strongly, supported by policy momentum, clinical innovation, and expanding treatment infrastructure across regions.

The targeted therapy segment is projected to grow at the fastest CAGR of 11.87% over the forecast period, fueled by rising demand for personalized and mechanism-specific interventions.Targeted therapies transform liver disease treatment across indications like HCC, HBV, HDV, MASH/NASH, and PBC. In HCC, multikinase inhibitors such as sorafenib and lenvatinib and combinations like atezolizumab plus bevacizumab have significantly extended survival outcomes. For HBV and HDV, new agents, including RNAi therapies (JNJ-3989, AB-729) and entry inhibitors (bulevirtide), are moving treatment closer to a functional cure. In MASH/NASH, advanced candidates like efruxifermin and resmetirom show promise in reducing liver fat and fibrosis, with resmetirom progressing into Phase III. GLP-1 receptor agonists and fibrosis-specific agents such as seladelpar and elafibranor are expanding the precision treatment landscape, reshaping standards of care, and driving clinical innovation.

Disease Insights

The hepatitis segment dominated the market with the largest revenue share of 40.44% in 2024, attributed to the widespread burden of chronic hepatitis and the clinical success of antiviral treatments, the hepatitis segment remains a major market driver. Over 300 million people globally live with chronic hepatitis, approximately 254 million with HBV and 50 million with HCV, making it a significant public health concern. Long-term HBV therapies like tenofovir and entecavir, alongside curative HCV DAAs such as sofosbuvir and glecaprevir, have improved clinical outcomes. Vaccines for hepatitis A and B, along with new approvals like bulevirtide for HDV, are expanding preventive and therapeutic options. Regulatory support, policy efforts toward elimination, and improved diagnostics continue to enhance access, although early diagnosis and affordability challenges persist, particularly in underserved populations.

The NAFLD/NASH segment is projected to grow at the fastest CAGR of 20.19% over the forecast period due to the growing prevalence of NAFLD and limited early detection.The disease poses a significant global health challenge, with only 10-20% of cases diagnosed in the early stages. NAFLD affects millions and can progress to NASH, fibrosis, cirrhosis, or HCC. The 2024 FDA approval of Rezdiffra (resmetirom)-a thyroid hormone receptor-β agonist-marked a major milestone, showing NASH resolution and fibrosis improvement in up to 30% of patients. In late-stage trials, other agents like obeticholic acid and elafibranor have demonstrated 20-30% fibrosis reduction. However, patient adherence to lifestyle interventions remains low, with 30-40% dropout rates. As pipeline drugs mature and diagnostic tools expand, the segment is expected to grow rapidly through 2026, transforming NASH management into a targeted therapeutic domain.

Regional Insights

North America held the largest share of the liver disease therapeutics market in 2024, accounting for 39.87% of global revenue, driven by the rising prevalence of liver disease, aging populations, and breakthrough therapies. Over 4.5 million U.S. adults are affected, with similar trends in Canada and Mexico, driven by hepatitis B and C, NAFLD, ALD, and liver cancer. FDA-approved DAAs cure hepatitis C in at least eight weeks with over 95% success rates. Recent advances in NASH treatment, including GLP-1 agonists and FXR modulators, are nearing approval. Regulatory agencies such as the FDA, Health Canada, and COFEPRIS have accelerated review timelines, enhancing access to critical drugs. While reimbursement systems differ across the region, robust R&D, industry innovation, and regulatory flexibility continue to fuel sustained regional market growth.

U.S. Liver Disease Therapeutics Market Trends

The liver disease therapeutics market in the U.S. led the North American market in 2024, holding a significant revenue share due to its large patient population, advanced healthcare infrastructure, and rapid adoption of innovative therapies. The country faces a high prevalence of hepatitis B, hepatitis C, NAFLD, and liver cancer, with over 4.5 million adults affected by liver disease. A pivotal advancement occurred on March 14, 2024, when the FDA approved Rezdiffra (resmetirom) as the first treatment for noncirrhotic NASH with moderate to advanced fibrosis, addressing a major unmet need for the estimated 6-8 million Americans affected. Based on 12-month biopsy data from a 54-month trial, this milestone has fueled R&D momentum and heightened investor interest. Major pharmaceutical players and dual reimbursement systems further solidify the U.S. as the regional market leader.

Europe Liver Disease Therapeutics Market Trends

The liver disease therapeutics market in Europe held a substantial share in 2024, driven by the rising burden of hepatitis, NAFLD, and liver cancer, coupled with widespread alcohol consumption and aging populations. The region has seen increased early diagnosis rates due to national screening initiatives and greater public health awareness. Access to advanced treatments, including DAAs and novel targeted therapies, is improving through centralized healthcare systems and expanded reimbursement coverage. The EMA's support for fast-track drug approvals, as seen with bulevirtide for hepatitis D and elafibranor (Iqirvo) for PBC, reflects regulatory momentum. Ongoing clinical trials across Germany, France, and the UK are accelerating innovation, while growing adoption of non-invasive diagnostics such as FibroScan supports earlier interventions and better treatment outcomes.

The UK liver disease therapeutics marketcontributed significantly to the European market in 2024, driven by a rising prevalence of NAFLD, alcohol-related liver disease, and hepatitis infections. The NHS has implemented expanded screening and early detection programs, particularly for high-risk populations, which have improved diagnosis rates. NICE recommendations and national reimbursement schemes support access to innovative therapies, including DAAs for HCV and Rezdiffra for NASH. Research institutions across London, Cambridge, and Oxford are actively involved in liver disease clinical trials, advancing therapeutic options. Public health initiatives focusing on alcohol consumption and obesity management are also positively impacting disease outcomes, while increased investments in precision medicine and digital health tools are further transforming liver care across the UK.

The liver disease therapeutics market in Germany held a strong position in 2024, supported by its comprehensive healthcare infrastructure, robust diagnostic networks, and early adoption of advanced treatments. The country reported high rates of chronic hepatitis B and C, NAFLD, and alcohol-induced liver conditions, which have driven demand for antiviral drugs, targeted therapies, and supportive care. Germany’s statutory health insurance system ensures broad patient access to innovative drugs, including DAAs, GLP-1 agonists, and the recently approved Rezdiffra for NASH. Leading academic hospitals in cities such as Berlin, Munich, and Heidelberg are central to clinical trial activity and translational research.

France liver disease therapeutics market maintained a notable share in 2024, driven by a high burden of liver-related conditions, widespread screening programs, and access to innovative therapies. Rising cases of chronic hepatitis B and C, NAFLD, and alcoholic liver disease contributed to increased demand for antiviral drugs and emerging NASH treatments. The French healthcare system provides universal coverage, ensuring patient access to advanced drugs such as DAAs, FXR agonists, and GLP-1 receptor agonists. France is also actively involved in liver disease research, with institutions like INSERM and AP-HP leading clinical trials and biomarker studies.

Asia Pacific Liver Disease Therapeutics Market Trends

The liver disease therapeutics market in Asia Pacific is projected to grow at the fastest CAGR of 9.19% over the forecast period, fueled by the high prevalence of hepatitis B and C, rising NAFLD cases, and improving healthcare infrastructure. Countries such as China, India, and Japan are witnessing a growing disease burden due to aging populations, sedentary lifestyles, and urban dietary habits. Government-led screening initiatives and vaccination programs, particularly for hepatitis B, are expanding early diagnosis and treatment access. Increased pharmaceutical investments, local clinical trials, and accelerated regulatory pathways are boosting the availability of novel therapeutics, including DAAs, siRNA therapies, and GLP-1 receptor agonists.

Japan liver disease therapeutics market is expanding rapidly, driven by an aging population, high prevalence of hepatitis C, and increasing NAFLD/NASH cases. The country’s universal health insurance system ensures broad patient access. The government’s proactive screening for viral hepatitis and NASH in older adults has improved early diagnosis rates. Local biopharma and academic institutions in Tokyo, Osaka, and Kyoto actively participate in pivotal clinical trials for DAAs, siRNA agents, and fibrosis-targeting therapies. The 2024 inclusion of novel treatments like Resmetirom under public reimbursement reflects strong regulatory support.

The liver disease therapeutics market in China is growing steadily, fueled by its exceptionally high prevalence of hepatitis B, an estimated 70 million chronic carriers, alongside rising cases of NAFLD and alcohol-related liver conditions. The government’s national hepatitis B vaccination and screening programs have enhanced early detection and treatment access. China’s robust pharmaceutical sector, bolstered by increasing local clinical trial activity and accelerated regulatory approvals through the NMPA, facilitates faster market entry for innovative therapies such as DAAs, NASH agents, and siRNA treatments.

Latin America Liver Disease Therapeutics Market Trends

The liver disease therapeutics market in Latin America is developing steadily, driven by the growing burden of hepatitis B and C, non-alcoholic fatty liver disease (NAFLD), and alcohol-related liver conditions. Rising obesity rates and increased alcohol consumption have intensified the prevalence of liver disorders across countries like Brazil, Mexico, and Argentina. Public health initiatives, such as expanded hepatitis vaccination campaigns and awareness programs, enhance early diagnosis and treatment. Access to direct-acting antivirals (DAAs) and generic formulations has improved affordability, particularly through regional partnerships and government-subsidized programs.

Brazil liver disease therapeutics market holds a significant share of the Latin American market, driven by a high prevalence of hepatitis B, hepatitis C, non-alcoholic fatty liver disease (NAFLD), and alcohol-related liver conditions. The growing incidence of lifestyle-related disorders and liver complications has increased the demand for effective therapeutic options. Brazil's public health system plays a key role by ensuring access to essential medicines and running national programs for hepatitis prevention, early diagnosis, and treatment. Regulatory support from ANVISA accelerates drug approvals and facilitates reimbursement for advanced therapies.

Middle East & Africa Liver Disease Therapeutics Market Trends

The liver disease therapeutics market in the Middle East & Africa is growing steadily, driven by rising cases of hepatitis, NAFLD, and liver cancer linked to obesity, diabetes, and alcohol use. Increased awareness, vaccination efforts, and improved diagnostic initiatives promote early detection and treatment. Access to newer therapies such as direct-acting antivirals and anti-fibrotic drugs is expanding, especially in more developed Gulf nations. Governments are investing in specialized liver care and clinical research.

Saudi Arabia liver disease therapeutics market is expanding, fueled by the increasing prevalence of non-alcoholic fatty liver disease (NAFLD) and its progressive form, non-alcoholic steatohepatitis (NASH), largely due to rising obesity and diabetes rates. The country has seen a shift in liver disease burden from viral hepatitis to metabolic-related liver disorders. Public health initiatives focused on lifestyle modification, early screening, and vaccination programs contribute to improved disease detection and management. The government’s investment in healthcare infrastructure and access to advanced treatments enhances patient outcomes.

Key Liver Disease Therapeutics Company Insights

The market is led by major pharmaceutical companies such as Gilead Sciences, Inc., AbbVie Inc., and Bristol-Myers Squibb Company, which maintain a strong presence through innovative antiviral and immunomodulatory therapies. These companies benefit from extensive clinical research pipelines, established regulatory approvals, and robust global commercialization strategies. Other key players, including F. Hoffmann-La Roche Ltd, Takeda Pharmaceutical Company Limited, and Johnson & Johnson Services, Inc., are expanding their liver disease portfolios through acquisitions, partnerships, and targeted drug development. Merck & Co., Inc., Novartis AG, and Pfizer Inc. also contribute to market competitiveness by advancing combination therapies and leveraging precision medicine approaches.

Key Liver Disease Therapeutics Companies:

The following are the leading companies in the liver disease Ttherapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- Gilead Sciences, Inc.

- AbbVie Inc.

- Bristol-Myers Squibb Company

- F. Hoffmann-La Roche Ltd

- Takeda Pharmaceutical Company Limited.

- Johnson & Johnson Services, Inc.

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi

- GSK plc

Recent Developments

-

In April 2025, Gilead Sciences, Inc. announced it would present over 40 abstracts at the AASLD Liver Meeting, highlighting advancements in viral hepatitis and primary biliary cholangitis (PBC). Key data included results from the RESPONSE and ASSURE studies on seladelpar, and the MYR301 study on bulevirtide for HDV. Additional presentations covered Epclusa’s safety in pregnancy, real-world SVR10K HCV data, and new HBV combination therapies.

-

In March 2025, Takeda Pharmaceutical Company Limited received approval from Japan's Ministry of Health, Labour and Welfare for Livmarli (maralixibat) Oral Solution. The drug is indicated for treating Alagille syndrome and progressive familial intrahepatic cholestasis (PFIC). This approval supports Takeda’s focus on addressing rare pediatric liver diseases with high unmet needs.

-

In August 2024, the U.S. FDA approved Gilead’s liver disease drug seladelpar (Pivlaz) for treating primary biliary cholangitis. The approval followed positive Phase 3 ENHANCE trial results showing significant efficacy. Gilead gained the drug through its USD 4.3 billion acquisition of CymaBay Therapeutics earlier in the year.

Liver Disease Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.87 billion

Revenue forecast in 2033

USD 40.29 billion

Growth rate

CAGR of 7.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, disease, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Gilead Sciences, Inc.; AbbVie Inc.; Bristol-Myers Squibb Company; F. Hoffmann-La Roche Ltd; Takeda Pharmaceutical Company Limited; Johnson & Johnson Services, Inc.; Merck & Co., Inc.; Novartis AG; Pfizer Inc.; Sanofi; GSK plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Liver Disease Therapeutics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global liver disease therapeutics market report based on product, disease, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Antiviral Drugs

-

Vaccines

-

Chemotherapy

-

Targeted Therapy

-

Immunosuppressants

-

Immunoglobulins

-

Corticosteroids

-

Other Products

-

-

Disease Outlook (Revenue, USD Million, 2021 - 2033)

-

Hepatitis

-

Autoimmune Diseases

-

Non-alcoholic Fatty Liver Disease (NAFLD)

-

Cancer

-

Genetic Disorders

-

Other Diseases

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global liver disease therapeutics market size was estimated at USD 20.31 billion in 2024 and is expected to reach USD 21.87 billion in 2025.

b. The global liver disease therapeutics market is projected to grow at a CAGR of 7.94% from 2025 to 2033 to reach USD 40.29 billion by 2033.

b. Based on product, antiviral drugs segment dominated the market with the largest revenue share of 39.84% in 2024 due to the high global prevalence of chronic viral hepatitis, long treatment durations for HBV, and premium pricing for HCV DAAs, antiviral drugs have become central to liver disease management.

b. Some key players operating in the liver diseases therapeutics market include Abbott Laboratories, Astellas Pharma Inc., Bristol-Mayers Squibb, Gilead Sciences, GlaxoSmithKline plc, F. Hoffmann-La Roche Ltd., Merck & Co., Inc., Novartis AG, Sanofi S.A., Pfizer Inc., Takeda Pharmaceuticals, Valeant Pharmaceuticals, and Watson Pharmaceuticals.

b. The liver disease therapeutics market is driven by rising prevalence of chronic liver conditions (e.g., hepatitis, cirrhosis, NAFLD), increasing alcohol and drug-related liver damage, growing awareness, improved diagnostics, and advancements in targeted therapies, including antiviral agents, immunotherapies, and regenerative treatments addressing unmet clinical needs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.