LNG Bunkering Market Size & Trends

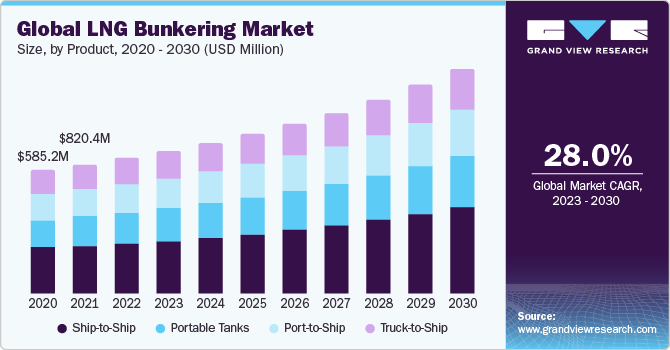

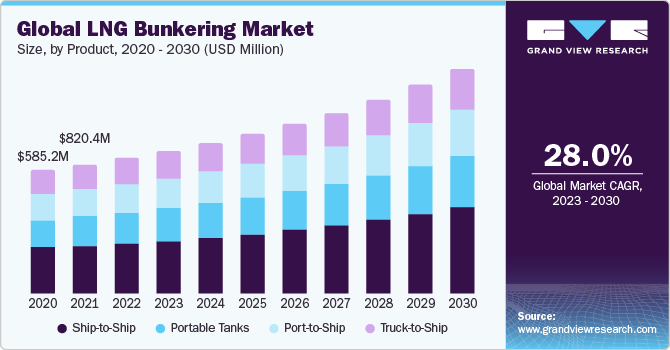

The global LNG bunkering market was valued at USD 1,150.1 million in 2022 and is expected to grow at a CAGR of 28.67% over the forecast period. LNG bunkering involves supplying liquefied natural gas as a fuel source for a vessel's self-use. The primary benefit of using LNG as a fuel lies in its significant reduction of pollutants compared to conventional ship fuels like heavy fuel oil, marine gas oil (MGO), and marine diesel fuel (MDO).

The COVID-19 pandemic had a significant impact on LNG bunkering operations across the maritime industry. One of the most notable effects was the fluctuation in demand for LNG bunkering services. As the pandemic led to a global economic slowdown and a reduction in maritime activities, the need for LNG fuel varied considerably. Some LNG bunkering facilities experienced decreased utilization rates as shipping volumes declined, while others in regions with ongoing shipping activity remained relatively stable.

Operational challenges emerged as COVID-19 safety protocols became a central concern. Quarantine requirements for ship crews and personnel directly involved in bunkering operations disrupted the smooth operation of LNG bunkering facilities and vessels. Delays in crew changes and quarantine measures occasionally hindered the availability of trained personnel for bunkering operations, which impacted the efficiency and scheduling of LNG bunkering activities.

The market has seen advancements in LNG propulsion technology. Shipbuilders have been designing and constructing vessels with LNG-ready or LNG-powered engines to meet the demand for eco-friendly shipping options. This trend is expected to continue as ship-owners seek to update their fleets and comply with stringent emissions regulations.

Product Insights

Based on the product, the market is segmented into portable tanks, port-to-ship, truck-to-ship, and ship-to-ship. The ship-to-ship segment held the largest market share in 2022. Ship-to-ship bunkering entails the direct transfer of LNG between two vessels, typically involving a specialized LNG bunkering vessel and the receiving ship. This method is particularly well-suited for larger vessels and allows for bunkering to occur while both vessels are at sea or anchored.

Shipping costs for LNG spot cargoes from selected regions ($/MMBtu) - July 2023

|

LNGSupplier

|

Destination

|

|

To

From

|

Japan

|

China

|

India

|

UK

|

Spain

|

Argentina

|

Brazil

|

|

SpotLNG

deliveredprice

|

10.87

|

10.87

|

10.47

|

9.25

|

9.52

|

9.87

|

9.50

|

|

Australia

|

0.72

|

0.76

|

0.87

|

2.22

|

2.16

|

1.70

|

1.85

|

|

Cameroon

|

2.15

|

2.13

|

1.42

|

0.93

|

0.86

|

1.00

|

0.66

|

|

NorthAfrica

|

2.10

|

2.09

|

1.18

|

0.61

|

0.54

|

1.40

|

0.99

|

|

Oman

|

1.30

|

1.21

|

0.28

|

1.50

|

1.43

|

1.63

|

1.61

|

|

USA

|

2.14

|

2.36

|

2.28

|

1.00

|

0.98

|

1.34

|

0.81

|

Vessel Type Insights

On the basis of vessel type the market is segmented into ferries, bulk and general cargo fleet, offshore support vessels, cruise-ships, and tanker fleet. Bulk and general cargo fleet is the largest vessel type in 2022. This stems from the escalation of trade agreements and a heightened demand for ship-based cargo transportation. Furthermore, the anticipated growth of the cargo shipping market is bolstered by the increasing number of manufacturing facilities and factories in regions like Asia-Pacific and LAMEA.

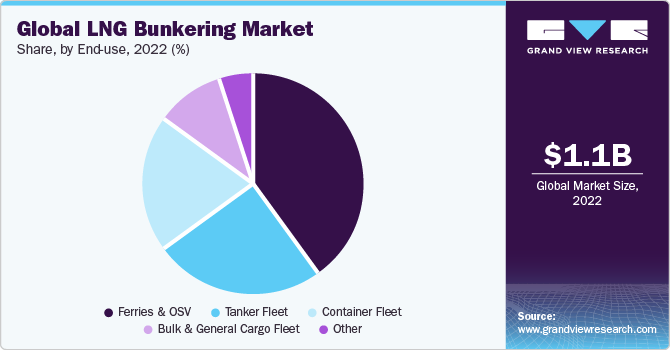

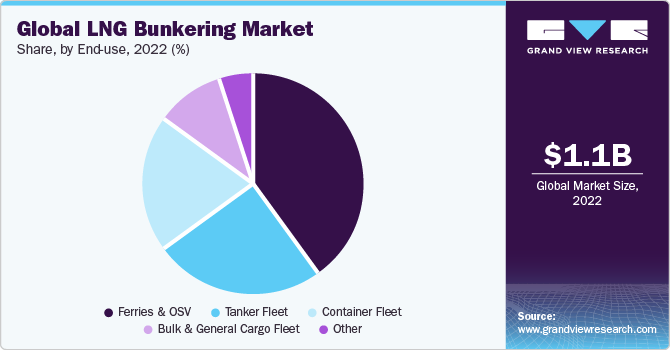

End-Use Insights

Based on end-use, the market is segmented into container fleet, bulk tanker fleet, and general cargo fleet, ferries and offshore support vessels (OSV), and other. Ferries and offshore support vessels (OSV) segment dominated the end-use segmentation in 2022. The Ferries and OSV market often operates in emission control areas and environmentally sensitive coastal zones, where emissions reductions are mandated. LNG stands out as a favorable choice due to its lower emissions profile, aligning perfectly with these regulatory requirements. This compliance with emissions regulations positions LNG bunkering as a compelling solution for vessels seeking to minimize their environmental impact.

Regional Insights

North America dominated the largest market share in 2022. One of the primary drivers of LNG bunkering in North America is the regulatory framework. The implementation of strict emissions regulations, including the International Maritime Organization's (IMO) sulfur emissions limits, has prompted the maritime industry to seek cleaner fuel alternatives. LNG, with its substantially lower sulfur and nitrogen oxide emissions, has gained favor as a solution for compliance. Both the U.S. and Canadian governments have supported the adoption of LNG as a marine fuel through regulatory incentives and initiatives.

Key Companies & Market Share Insights

Key players operating in the market are Shell PLC, TotalEnergies, Gazprom Neft PJSC, Gasum Oy, and BP. Shipping operators like Mitsui O.S.K. Lines (MOL), Carnival Corporation, and NYK Line have also entered the LNG bunkering market. They have a deep understanding of the shipping industry's needs and have invested in LNG-powered vessels while actively participating in the development of LNG bunkering infrastructure. This vertical integration positions them well to offer comprehensive bunkering solutions and drive the adoption of LNG among their peers.

In August 2023, the largest LNG bunkering vessel globally, the Hai Yang Shi You 301 (Offshore Oil 301), has successfully conducted its inaugural ship-to-ship bunkering operation with a very large crude carrier (VLCC) while anchored in Guangzhou Port.

In October 2023, The Gibraltar government, along with the Gibraltar Port Authority, has officially issued a license to Peninsula, a marine energy provider, allowing them to operate as an LNG bunkering operator. Peninsula made headlines with the introduction of their specialized 12,500 cubic meter LNG supply vessel, named Levante LNG, which has arrived in the Strait of Gibraltar. This new vessel positions the company to meet the LNG needs of clients not only in the Strait of Gibraltar but also in various other Mediterranean ports.