- Home

- »

- Automotive & Transportation

- »

-

Locomotive Market Size And Share, Industry Report, 2030GVR Report cover

![Locomotive Market Size, Share & Trends Report]()

Locomotive Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Diesel, Electric), Technology (IGBT Module, GTO Thyristor), By Component ( Rectifier, Inverter), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-100-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Locomotive Market Summary

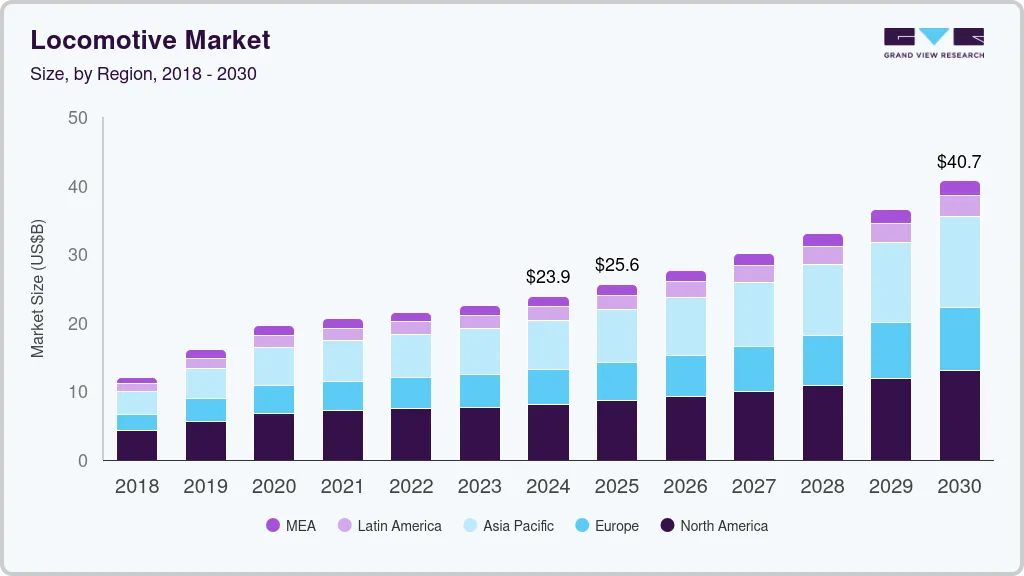

The global locomotive market size was estimated at USD 23.9 billion in 2024 and is projected to reach USD 40.70 billion by 2030, growing at a CAGR of 9.7% from 2025 to 2030.The growth of the locomotive industry is primarily driven by rising investments in rail network infrastructure by both public and private entities.

Key Market Trends & Insights

- North America locomotive market held a substantial market share of 34.0%.

- By technology, the IGBT module segment accounted for the largest share of the global locomotive market in 2024.

- By component, the rectifier segment accounted for the largest share of the global locomotive market in 2024.

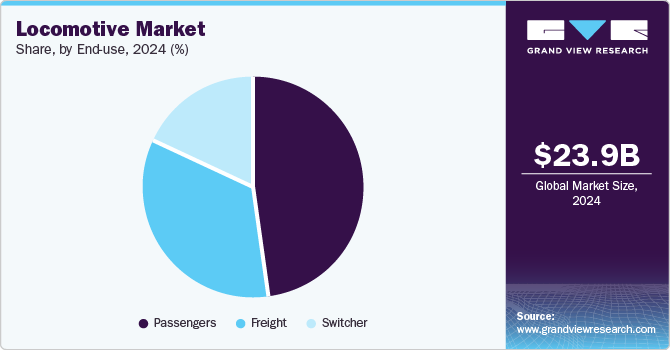

- By end-use, the passenger segment accounted for the largest market share of the global locomotive market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 23.9 Billion

- 2030 Projected Market Size: USD 40.70 Billion

- CAGR (2025-2030): 9.7%

- North America: Largest market in 2024

Additionally, growing developments in the urban and metropolitan areas, owing to the rise in population, are further anticipated to increase the demand for improved rail networks, thereby driving market growth. Moreover, a growing number of government initiatives in improving railway infrastructure and deploying new-age locomotives that travel faster are expected to drive the locomotive industry growth over the forecast period.

The growing focus of government agencies in optimizing the railway infrastructure to ease the travel experience of commuters has been one of the major factors contributing to the market growth. For instance, in November 2021, the U.S. government announced a USD 1.2 trillion infrastructure investment plan, wherein funds will be provided by the Federal Transportation Administration (FTA) over a period of five years.

Also, several locomotive manufacturers are partnering with government agencies to invest and develop advanced locomotives beneficial for economic development. In February 2023, Alstom, a smart and sustainable mobility manufacturer, partnered with the Government of Quebec, Charlevoix Railway, Train de Charlevoix, Harnois Energies, and HTEC to develop a hydrogen-powered passenger demonstration train, the Coradia iLint. Harnois Energies will manufacture the green hydrogen-powered train in Quebec City.

Additionally, investments in advanced locomotive technologies, such as high-speed rail and electric/hybrid locomotives that are poised to reduce carbon emissions and promote sustainable transportation have further contributed immensely to the growth of the locomotive market. For instance, in November 2021, Wabtec Corp entered into a contractual agreement with Egyptian National Railways (ENR) to provide 100 ES30ACI Evolution Series Locomotives and a comprehensive, multi-year service agreement for ongoing fleet maintenance. The locomotive supply contract, financially supported by the European Bank for Development and Reconstruction, underscores their commitment to providing the necessary funding for this substantial project.

Type Insights

Based on type, the electric segment accounted for the largest share of 48.7% of the locomotive market in 2024. The growth of this segment is attributed to the increasing focus of public & private manufacturers on environmental sustainability. Electric locomotives produce lower emissions, reducing air pollution and greenhouse gas emissions. Thus, rising inclination toward electric mobility and the use of renewable resources, the segment is poised to grow considerably over the forecast period. Additionally, the increasing concerns by governments and regulatory bodies to increase the adoption of electric locomotives as part of their efforts to combat climate change are also contributing to the growth of the locomotive industry.

The diesel-type segment is expected to grow at a considerable CAGR over the forecast period. The growth of this segment is due to diesel-powered locomotives’ ability to provide high-power, minimum infrastructure requirements for deployment and performance. The diesel locomotive segment growth is also due to advancements with engine upgrades, emission control systems, and fuel efficiency improvements, contributing to reduced emissions and operating costs for diesel locomotives, contributing to locomotive industry growth.

Technology Insights

By technology, the IGBT module segment accounted for the largest share of the global locomotive market in 2024. The growth of this segment is attributed to the growing demand for efficient and reliable power electronics solutions for traction, propulsion, and control systems in modern rail transportation. The demand for IGBT modules is increasing in long-distance locomotives.

The SiCpower module segment is expected to grow at the highest CAGR over the forecast period. The growth of this segment is owing to the growing demand for lightweight traction converters with high efficiency, smaller sizes, lower thermal loss, and improved power. Moreover, the increasingly stringent emissions and energy efficiency regulations are driving the adoption of advanced technologies in the locomotive industry. SiC power modules contribute to reducing energy consumption and improving efficiency, aligning with these regulatory requirements and environmental concerns.

Component Insights

By component, the rectifier segment accounted for the largest share of the global locomotive market in 2024. The growth of the segment is attributed to the growing demand for electric locomotives to convert AC to DC supply for the DC traction motors. Moreover, the rising demand for more efficient and reliable power conversion solutions helps reduce energy consumption and operating costs for locomotives.

The traction motor segment is expected to grow with the highest CAGR over the forecast period. There is a rising demand for traction motors in locomotives for high efficiency through loss of reduction. Many locomotive manufacturers produce traction motors to fulfill the growing demand in the locomotive industry. For instance, in June 2022, ŠKODA Transportation A.S, a Czech-based engineering company, received a contract from Wabtec Corporation, a rail technology provider, for the production and delivery of an additional 26 locomotives in Kazakhstan. The contract is worth over EUR 12 million (USD 13.36 million) and covers the delivery of 156 mechanical traction drives, including gearboxes, traction motors, and wheelsets.

End-use Insights

By end-use, the passenger segment accounted for the largest market share of the global locomotive market in 2024. The segment growth is attributed to a rising number of vehicles on the road; the public is shifting toward rail transport options for daily and last-mile commutes. In developing countries with a high density of middle-income population, public transport is preferred over private commutes. Moreover, many governments worldwide are investing in expanding and modernizing their railway networks to improve passenger transportation. Governments provide financial support, subsidies, and incentives to promote the development of passenger rail systems, thus boosting market growth.

The freight segment is expected to witness considerable growth over the forecast period. The growth of this segment is due to the rise in the Rectifier industry. The growth of the economy, global trade, energy efficiency, cost savings, capacity and scale advantages, intermodal transportation, infrastructure development, and safety considerations are key driving factors in the locomotive industry. Moreover, the need for efficient, reliable, and cost-effective freight transportation solutions contributes to the growth of the segment.

Regional Insights

North America locomotive market held a substantial market share of 34.0% in terms of revenue due to the growing adoption of electric and autonomous locomotives in countries across the U.S. and Canada. The rising concerns of greenhouse gas emissions led to the growing usage of battery electric power, reducing greenhouse gases and improving local air quality. The government is investing in advanced electric locomotives to reduce greenhouse gas emissions.

For instance, in January 2022, Union Pacific Railroad announced the purchase of 20 battery-electric freight locomotives from Wabtec Corporation, a rail technology provider, and Progress Rail, a subsidiary of Caterpillar. With a valuation exceeding USD 100 million, the contract entails the acquisition of battery-electric locomotives, which will be initially deployed for train carriage sorting activities in rail yards of California and Nebraska. This substantial investment underlines the company's commitment to leveraging environmentally friendly technologies and optimizing operational efficiency within the rail industry. These initiatives are further encouraging locomotive industry growth.

U.S. Locomotive Market Trends

The locomotive market in the U.S. is driven by a combination of regulatory policies, technological advancements, sustainability goals, and economic factors. Government regulations play a significant role in shaping the market, particularly through infrastructure investments and stringent emission standards. The Bipartisan Infrastructure Law has allocated substantial funding for rail improvements, including modernizing aging locomotive fleets. Additionally, the Environmental Protection Agency (EPA) has enforced Tier 4 emission standards, compelling rail operators to adopt cleaner and more fuel-efficient locomotives. These regulatory pressures encourage innovation and drive demand for next-generation locomotive technologies.

Asia Pacific Locomotive Market Trends

The locomotive market in Asia Pacific is driven by various factors, such as the increasing advancement of rail infrastructure, investment by the government in the development of the railway industry, and the widespread use of affordable public transport for daily commuting and last-mile travel.

For instance, in February 2022, the Indian government announced an investment of USD 32.7 billion for the rail sector. The investment includes the development of railway infrastructure and the development of rolling stocks. In addition, about 400 Vande Bharat trains are to be received and 100 new multimodal freights are to be built over the period of three years. This development and advancement in developing countries drive the growth of the locomotive industry.

China locomotive market is driven by Government policies and investments. The Chinese government has prioritized railway expansion through its Five-Year Plans, including the Medium and Long-Term Railway Network Plan, which aims to extend the country’s rail network significantly by 2035. Massive state-backed funding for high-speed and freight rail projects ensures a steady demand for new locomotives. Additionally, the Belt and Road Initiative (BRI) has fueled demand for locomotives in international railway projects, expanding China’s influence in global rail infrastructure.

The locomotive market in India is driven by the growing economy, industrial production, and Rectifier expansion, which increases freight rail demand. Sectors such as coal, cement, steel, automobiles, and agriculture rely heavily on rail transport, boosting locomotive procurement. The Make in India initiative encourages domestic locomotive manufacturing, with major players like Alstom, Siemens, and Wabtec setting up local production facilities. The government is also promoting PPP (Public-Private Partnership) models to enhance freight rail efficiency.

Europe Locomotive Market Trends

The locomotive market in Europe is driven by the adoption of AI-driven predictive maintenance, digital signaling (ETCS), and automation. Rail companies are investing in autonomous train technology, smart sensors, and IoT-based fleet management to improve efficiency and reduce operational costs. The EU’s "Shift2Rail" initiative is supporting research and innovation in digital rail systems, ensuring Europe remains at the forefront of locomotive advancements.

The U.K. has committed to a net-zero railway by 2050, significantly influencing locomotive trends. The government is phasing out diesel locomotives, replacing them with electric and hydrogen-powered alternatives. Network Rail’s Electrification Plan is accelerating the adoption of electric locomotives, particularly for passenger and freight services. Additionally, hydrogen-powered locomotives, such as the HydroFLEX train, are being tested as a viable zero-emission alternative. Battery-powered trains are also gaining traction for short-distance routes where electrification is not yet feasible.

The locomotive market in Germany is expected to grow as the country is one of Europe's largest rail freight markets, with increasing demand for electric freight locomotives to support cross-border trade and intermodal logistics. The modal shift from road to rail, driven by EU sustainability regulations, has led to investments in powerful, energy-efficient freight locomotives. Key projects, such as the Rhine-Alpine freight corridor (a major European trade route), are further driving locomotive demand. Deutsche Bahn Cargo and private freight operators are expanding their fleets with hybrid and electric locomotives to meet rising demand.

Key Locomotive Company Insights

To address the increasing demand for locomotives and sustain growth in a competitive market, companies employ a range of strategic initiatives, including mergers and acquisitions, product innovations, partnerships, and geographic and sectoral expansions. By advancing their technological capabilities, collaborating with key component suppliers, and expanding into emerging markets, locomotive manufacturers and service providers are aligning themselves with the evolving needs of industries such as freight logistics, passenger transportation, energy, and infrastructure. These strategies not only strengthen their market presence but also play a crucial role in modernizing rail networks, enhancing operational efficiency, and supporting sustainability goals, ultimately driving the transformation of the global railway industry.

-

CRRC Corporation Limited, headquartered in Beijing, China, is one of the leaders in the rail transportation industry, specializing in the design and manufacturing of locomotives, high-speed trains, urban transit vehicles, and freight wagons. Formed in 2015 through the merger of China CNR Corporation and China CSR Corporation, CRRC is at the forefront of rail technology innovation, supplying electric locomotives and smart rail solutions worldwide. The company is also heavily invested in sustainable transport solutions, including hydrogen-powered trains and maglev technology while expanding its presence across international markets.

-

Bharat Heavy Electricals Limited (BHEL), an Indian government-owned company under the Ministry of Heavy Industries, plays a crucial role in the railway and locomotive industry. The company manufactures electric locomotives, propulsion systems, and railway electrification equipment, supporting the push for sustainable rail transport. BHEL collaborates with Indian railway operators to develop high-power locomotives and energy-efficient technologies.

Key Locomotive Companies:

The following are the leading companies in the locomotive market. These companies collectively hold the largest market share and dictate industry trends.

- AEG Power Solutions B.V.

- Alstom

- Bharat Heavy Electricals Limited

- CRRC Corporation Limited

- Hitachi, Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Siemens AG

- Strukton

- Toshiba Corporation

- Wabtec Corporation

Recent Developments

-

In October 2024, Siemens AG inaugurated its Train Manufacturing Facility within the Goole Rail Village in East Yorkshire, U.K., following an investment of up to USD 254.3 million (EUR 230 million). Spanning 67 acres, this site will assemble 80% of London's new Piccadilly line trains, which are expected to enter passenger service in 2025.

-

In July 2024, Wabtec Corporation expanded its locomotive services in India with the commencement of operations at the Gooty Maintenance Shed in Andhra Pradesh. This facility enhances Wabtec Corporation's capacity to maintain and service locomotives, supporting the efficiency and reliability of India's rail network.

-

In June 2024, Bharat Heavy Electricals Limited (BHEL) developed India's first state-of-the-art WAG7 Electric Locomotive with regenerative capabilities. This advanced locomotive is designed to enhance energy efficiency by recovering and storing energy during braking, which can then be fed back into the power grid or used for further operation. The WAG7 locomotive is a significant step forward in sustainable rail transport in India, contributing to energy savings, reduced carbon emissions, and improved overall performance for both freight and passenger services. This innovation aligns with India’s broader goals of rail electrification and environmental sustainability.

Locomotive Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 25.59 billion

Revenue forecast in 2030

USD 40.70 billion

Growth Rate

CAGR of 9.7% from 2025 to 2030

Actual Data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, technology, component, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany, China; India; Japan; Australia; New Zealand; Indonesia, Malaysia, Vietnam, Philippines, Thailand, Brazil, Mexico, Argentina

Key companies profiled

AEG Power Solutions B.V.; Alstom; Bharat Heavy Electricals Limited; CRRC Corporation Limited; Hitachi, Ltd.; Mitsubishi Heavy Industries, Ltd.; Siemens AG; Strukton; Toshiba Corporation; Wabtec Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Locomotive Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest component trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global locomotive market report based on type, technology, component, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Diesel

-

Electric

-

Other

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

IGBT Module

-

GTO Thyristor

-

SiC Power Module

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Rectifier

-

Inverter

-

Traction Motor

-

Alternator

-

Auxiliary Power Unit (APU)

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Freight

-

Passengers

-

Switcher

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

New Zealand

-

Indonesia

-

Malaysia

-

Vietnam

-

Philippines

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global locomotive market size was estimated at USD 23.90 billion in 2024 and is expected to reach USD 25.59 billion in 2025.

b. The global locomotive market is expected to grow at a compound annual growth rate of 9.7% from 2025 to 2030 to reach USD 40.70 billion by 2030.

b. The electric segment is estimated to account for the largest share of over 48.7% of the locomotive market in 2024. The growth of this segment is attributed to the increasing focus of public & private manufacturers on environmental sustainability.

b. Some key players operating in the locomotive market include CRRC Corporation Limited, Alstom, Siemens AG, Wabtec Corporation, and Strukton.

b. Key factors driving the locomotive market growth include the increasing investment in the infrastructure of rail networks planned by the public and private players, along with growing developments in the urban and metropolitan areas owing to the rise in population are further anticipated to increase the demand for improved rail networks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.