- Home

- »

- Medical Devices

- »

-

Locum Tenens Staffing Market Size And Share Report, 2030GVR Report cover

![Locum Tenens Staffing Market Size, Share & Trends Report]()

Locum Tenens Staffing Market Size, Share & Trends Analysis Report By Type (Physicians, Surgeons, Nurses, Anesthesiologist, Radiologist), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-259-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Locum Tenens Staffing Market Size & Trends

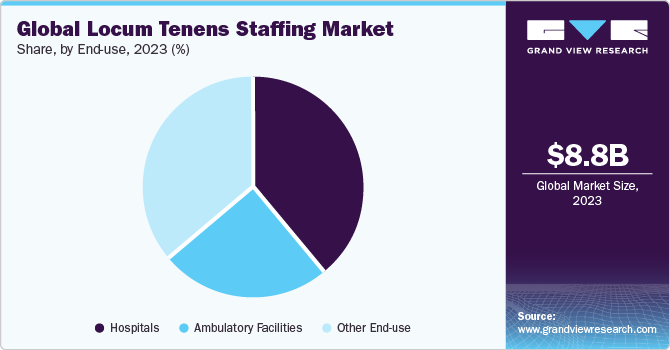

The global locum tenens staffing market size was estimated at USD 8.80 billion in 2023 and is expected to grow at a CAGR of 7.56% from 2024 to 2030. The market is expected to grow significantly, driven by a combination of factors that include the increasing demand for healthcare services and a shortage of healthcare professionals. The aging population and the rise in chronic illnesses are leading to a greater need for medical services, which in turn is exacerbating the shortage of healthcare workers, including primary care physicians and specialists. This shortage is particularly acute in rural areas, where the distribution of physicians and Advanced Practice Providers (APPs) is uneven, leading to staffing shortages.

The locum tenens model offers a solution to these challenges by providing healthcare facilities with temporary staffing to fill gaps, which is particularly useful during peak seasons when permanent physicians are on vacation or sabbatical or when there is a sudden increase in patient demand, such as during the COVID-19 pandemic. This model not only helps maintain patient care levels but also allows healthcare facilities to cut back on the expenses associated with hiring, onboarding, and training new providers.

In addition, locum tenens work offers healthcare professionals the flexibility to choose their working hours and the opportunity to gain experience in various healthcare systems across different locations, making it an attractive career option. This flexibility can also serve as a remedy to burnout, which is a significant issue contributing to high physician turnover rates.

The market growth is further supported by the increasing number of healthcare facilities, including government and non-government hospitals, long-term care centers, and acute care centers. With the projected physician shortage in the US reaching 124,000 by 2034, the demand for locum tenens services is expected to continue rising.

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, and impact of regulations, service substitutes, and geographic expansion. For instance, the locum tenens staffing industry is fragmented, with many small players entering the market and offering new services. The level of partnerships & collaborations activities is medium, and service expansion is high. The impact of regulations on the market is medium, and the regional expansion is medium.

The level of partnerships & collaborations in the market is moderate due to the industry's emphasis on forming alliances and working together to address the growing demand for temporary physician staffing. Moreover, the industry players work together to address staffing shortages, expand services, and meet the evolving needs of the healthcare sector.

Regulations greatly shape the industry by governing licensing, credentialing, and scope of practice. They affect provider flexibility, staffing efficiency, and costs. In addition, reimbursement, tax laws, and quality standards impact pricing, demand, and operational practices. Adapting to regulatory shifts is vital for compliance and maintaining high-quality patient care in this dynamic industry.

Per diem, staffing and travel nurses are substitutes for locum tenens staffing. The high demand for nursing services by healthcare facilities leads to a demand for alternative options for staffing. In addition, benefits such as flexible schedules and better compensation have led to healthcare personnels working as per diem and travel nurses.

The level of regional expansion in the market is moderate due to the rapid expansion of the healthcare sector in regions such as North America and Asia-Pacific, which are experiencing significant market growth.

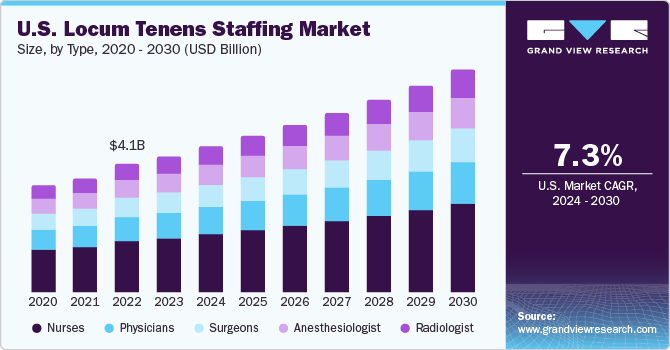

Type Insights

Based on type, the nurses segment led the market with the largest revenue share of 39.10% in 2023. The growth is attributed to well-documented shortage of nurses across medical facilities. Rising demand for registered nurses (RNs), nurse practitioners (NPs), and licensed practical nurses (LPNs) across various healthcare settings, including hospitals, clinics, long-term care facilities, and home healthcare is expected to drive the segment growth during the forecast period.

The physicians segment held the second largest share due to increasing shortages in low-economic countries. This scarcity creates a constant need for temporary staffing solutions, making locum tenens physicians highly sought-after. Locum tenens physicians are considered to be a cost-effective solution for temporary needs or peak seasons, compared to hiring full-time staff. This makes them a fiscally responsible option for managing fluctuating workloads and is expected to boost segment growth.

End-use Insights

Based on End-use, the hospitals segment held the market with the largest revenue share of 39.64% in 2023. Many hospitals are aligning their workforce according to government regulations, which mandate specific nurse-to-patient ratios that must be upheld. Adherence to patient-centered regulations and legislation is driving an increase in the number of staff members within hospitals to accommodate the heightened demand for services. Moreover, the shortage of proficient professionals and nurses in hospitals impacts both patient care and clinical outcomes significantly. According to the U.S. Bureau of Labor Statistics, between 2020 and 2030, there is projected to be a heightened demand for medical staff, with approximately 275,000 additional nurses needed. Employment prospects for nurses are anticipated to grow at a fastest CAGR of 9% compared to all other occupations from 2016 to 2026.

The ambulatory facilities segment is expected to grow at the fastest CAGR during the forecast period. The growing shift of patient care towards ambulatory services has led to a greater need for flexible staffing solutions in these facilities. This has led to increasing adoption of locum tenens staffing in ambulatory centers.

Regional Insights

North America dominate the locum tenens staffing market with the largest revenue share of 51.94% in 2023. This can be attributed to the increase in demand for healthcare professionals, fueled by factors like population growth, aging demographics, and healthcare reform, driving the need for flexible staffing solutions.

U.S. Locum Tenens Staffing Market Trends

The locum tenens staffing market in U.S. held the largest share in 2023, owing to physician shortages in various specialties and geographic regions necessitating the temporary placement of healthcare professionals to maintain patient care standards. The increasing demand for healthcare services, driven by an aging population and rising chronic diseases, further amplifies the need for flexible staffing solutions in the U.S.

Europe Locum Tenens Staffing Market Trends

The locum tenens staffing market in Europe is anticipated to grow at a significant CAGR over the forecast period, due to the aging population with rising healthcare demands creating a significant need for temporary physicians, particularly in countries with a strained healthcare system or geographically underserved areas. Moreover, locum tenens staffing agencies bridge this gap by offering flexible solutions to hospitals facing staffing shortages. In addition, factors like physician migration within Europe and a growing acceptance of the locum tenens model further contribute to market growth.

The Germany locum tenens staffing market held largest share in the Europe region in 2023. Temporary staffing has become an integral part of this country with increasing demand for medical services. The demand for skilled professionals is increasing due to a rise in investment by various healthcare facilities, a lack of skilled physicians & nurses, and an increase in geriatric population.

The locum tenens staffing market in UK is expected to witness at the fastest CAGR over the forecast period. This can be attributed to the growing awareness of the advantages of temporary employment, such as flexibility and diverse work experiences.

Asia Pacific Locum Tenens Staffing Market Trends

The locum tenens staffing market in Asia Pacific is expected to witness at the fastest CAGR over the forecast period. The growing elderly population in the Asia Pacific region is putting a strain on healthcare systems. This creates a surging demand for temporary physicians to manage the increasing need for medical care are favoring the market growth.

The Japan locum tenens staffing market held the largest share in 2023, owing to rise in aging populations, leading to a surge in demand for healthcare services, a growing trend among younger Japanese physicians towards work-life balance, and flexible work arrangements.

The locum tenens staffing market in India has witnessed high demand in the recent years. The growing demand for quality healthcare at affordable costs. The Indian government is recognizing the value of locum tenens staffing as a way to address healthcare access issues which is expected to contribute to the market growth in India.

Latin America Locum Tenens Staffing Market Trends

The locum tenens staffing market in Latin America is anticipated to grow at a significant CAGR during the forecast period, due to uneven distribution of doctors and nurses across the region, and increase in healthcare expenditure which leads to an increase in investment in temporary staffing solutions to address an physician shortages and improve access to care.

The Brazil locum tenens staffing market held the largest share in 2023, owing to the increasing demand for qualified healthcare professionals is driving the market growth in the country. The rising population and growing prevalence of chronic diseases have led to an increased demand for healthcare services in Brazil. This has resulted in healthcare facilities continuously seeking healthcare professionals such as doctors to fulfill this demand.

Middle East & Africa Locum Tenens Staffing Market Trends

The locum tenens staffing market in Middle East & Africa region is anticipated to witness at a significant CAGR during the forecast period, due to the persistent physician shortages, escalating demand for healthcare services, and the need for flexible staffing solutions. With population growth, aging demographics, and increasing prevalence of chronic diseases, locum tenens professionals play a crucial role in filling temporary gaps in staffing, providing specialized expertise, and ensuring continuity of care.

The South Africa locum tenens staffing market held the largest share in 2023. Employer’s cost-effectiveness and physicians demand for locum tenens work are key factors driving the market growth in South Africa. Furthermore, the rising demand for physicians and the increasing number of a large network of clinics in South Africa are also anticipated to drive market growth.

Key Locum Tenens Staffing Company Insights

The market is highly fragmented, with the presence of many country-level players. With the growing aging population and the need for mobile health, a few smaller competitors are entering the industry. Some of the emerging companies are CompHealth, Global Medical Staffing, and Medicus Healthcare Solutions.

Key Locum Tenens Staffing Companies:

The following are the leading companies in the locum tenens staffing market. These companies collectively hold the largest market share and dictate industry trends.

- CHG Management, Inc.

- AMN Healthcare

- ViSTA Staffing Solutions

- LocumTenens.com

- Aya Healthcare, Inc.

- Weatherby Healthcare. A CHG Company.

- The Delta Companies

- Medicus Healthcare Solutions, LLC

- Locumpedia

- Maxim Staffing

Recent Developments

-

In November 2023, AMN Healthcare announced the acquisition of MSDR, which comprises two healthcare staffing organizations such as DRW Healthcare Staffing and Medical Search International, which specializes in advanced practices and locum tenens

-

In August 2023, Caliber Healthcare Solutions unveiled a new brand aimed at aligning with its status as the foremost provider-focused locum tenens staffing choice within the healthcare sector. Formerly recognized as Health Carousel Locum Tenens, Caliber embodies a novel approach to recruiting top-tier physicians and advanced practice providers dedicated to enhancing patient outcomes

-

In August 2023, LocumTenens.com completed the acquisition of Inlightened, a technology-enabled platform that links forward-thinking client firms with a network of carefully screened healthcare professionals (HCPs) offering on-demand consultation and expertise. This acquisition unlocks new opportunities for both companies, greatly enhancing their ability to drive innovation and provide physicians and advanced practice providers with opportunities for non-patient-facing gig work

-

In October 2021, Consilium Staffing announced the formation of a new team that is dedicated to locum tenens placement in surgical and sub-specialties, including pulmonary critical care. Additionally, the focus is on placements in gynecology and obstetrics, an area that has seen steady demand even throughout the past year and a half

Locum Tenens Staffing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.44 billion

Revenue forecast in 2030

USD 14.61 billion

Growth rate

CAGR of 7.56% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, End-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

CHG Management, Inc.; AMN Healthcare; ViSTA Staffing Solutions; LocumTenens.com; Aya Healthcare, Inc.; Weatherby Healthcare. A CHG Company.; The Delta Companies; Medicus Healthcare Solutions; LLC; Locumpedia; Maxim Staffing

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

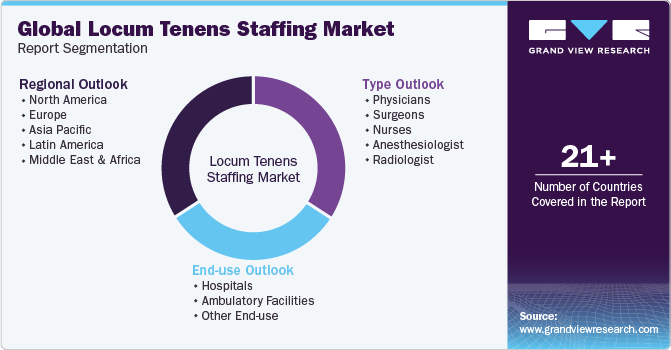

Global Locum Tenens Staffing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the locum tenens staffing market report based on type, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Physicians

-

Surgeons

-

Nurses

-

Anesthesiologist

-

Radiologist

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Facilities

-

Other End-use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global locum tenens staffing market size was estimated at USD 8.80 billion in 2023 and is expected to reach USD 9.44 billion in 2024.

b. The global locum tenens staffing market is expected to grow at a compound annual growth rate of 7.56% from 2024 to 2030 to reach USD 14.61 billion by 2030.

b. North America dominated the locum tenens staffing market with a share of % in 2023. This is attributable to a rise in demand for healthcare professionals, propelled by factors such as population expansion, aging demographics, and healthcare policy changes, underscores the necessity for adaptable staffing solutions.

b. Some key players operating in the locum tenens staffing market include CHG Management, Inc., AMN Healthcare, ViSTA Staffing Solutions, LocumTenens.com, Aya Healthcare, Inc., Weatherby Healthcare. A CHG Company., The Delta Companies, Medicus Healthcare Solutions, LLC, Locumpedia, and Maxim Staffing

b. Key factors that are driving the locum tenens staffing market growth include the rising shortage of medical personnel, improving healthcare infrastructure and increasing investment in public health, and rising demand for temporary nursing staff.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."