- Home

- »

- IT Services & Applications

- »

-

Low-Code Application Development Platform Market Report, 2030GVR Report cover

![Low-Code Application Development Platform Market Size, Share & Trends Report]()

Low-Code Application Development Platform Market Size, Share & Trends Analysis Report By Component (Platform, Services), By Application, By Deployment, By Organization Size, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-945-6

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

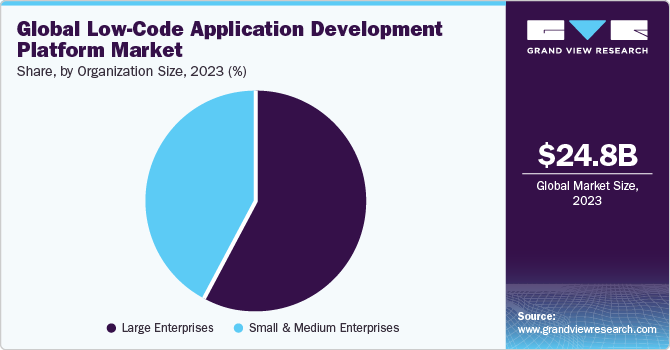

The global low-code application development platform market size was estimated at USD 24.83 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 22.5% from 2024 to 2030. Low-code development platforms are significantly transforming the software development processes compared to conventional development methods. Low-code application development platform facilitates software development with minimal effort, cost, and time, which increases their adoption for creating business processes and workflows. The versatile nature of low-code application development platforms makes software development scalable, agile, and user-friendly. Thus, driving the growth of the market.

The adoption of low-code and no-code development platforms can address the challenge of software development talent shortages as they allow businesses to build systems without hiring large teams of developers. For instance, in October 2023, Kissflow Inc., a SaaS-based company, reported that, low-code platforms help reduce application development time by 90%. Moreover, by 2024, 80% of non-IT professionals are expected to develop IT products and services, with over 65% of the professionals using low-code/no-code tools. Therefore, it’s expected that adoption of low-code application development platforms is expected to grow in the forecasted period.

By using AI-powered low-code application development platforms, businesses can optimize their workflows and maximize return on investment (ROI) by automating operational tasks. For instance, in June 2023, Appian Corporation, an enterprise software provider, announced that BAI Communications Australia (BAI); a company that designs, builds, and operates communications infrastructure; selected Appian Corporation’s AI-powered process platform to digitize and optimize site access management. This initiative helped BAI ensure a broader shift in business processes, optimize operations and maximize ROI with enhanced automation. An AI-based low-code application development platform expedites the processing of site access requests and grants 100% access to eligible applicants. The volume of requests made to the company's network operations center has decreased noticeably. In addition, BAI can now verify that all site visitors understand safety and security protocols owing to the prequalification application, which also offers important metrics and records for businesses’ reporting needs.

Low-code application development platforms provide various key features that are functional in enhancing the software development process. For instance, drag-and-drop is one of the vital features of low-code application development platforms that simplify the development process. It allows users to develop applications with just a click without hand-coding. Moreover, the built-in components in low-code application development platforms make the overall development process comprehensible to users, regardless of their technical knowledge. The visual modeling features empower business users by providing developer abilities, thereby speeding up the process of building software applications. Other features of the low-code application development platform include cross-platform functionality, reusability, and scalability, which collectively drive the growth of the market.

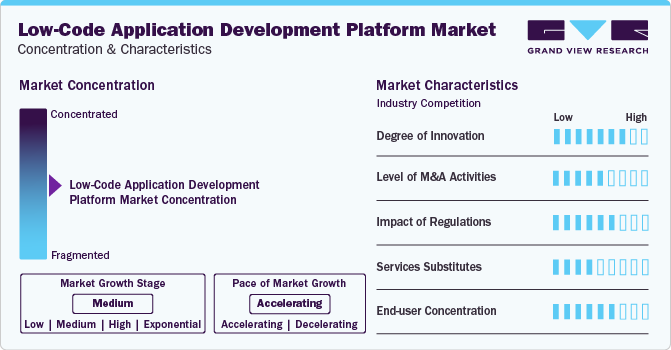

Market Concentration & Characteristics

The growth of the low-code application development platform market is high, and the growth’s pace is accelerating. By using AI-powered low-code application development platforms, businesses can optimize their workflows and maximize return on investment (ROI) by automating operational tasks. For instance, in June 2023, Appian Corporation, an enterprise software provider, announced that BAI Communications Australia (BAI); a company that designs, builds, and operates communications infrastructure; selected Appian Corporation’s AI-powered process platform to digitize and optimize site access management. This initiative helped BAI ensure a broader shift in business processes, optimize operations and maximize ROI with enhanced automation.

The market is also witnessing a high level of merger and acquisition (M&A) activity by key players. For instance, in December 2023, Nintex USA, LLC, a software services provider acquired Skuid, Inc., a low-code application development platform provider, to develop the low-code platform to enhance operational efficiency. Combining Skuid's low-code application development with Nintex's automation and process intelligence facilitates integrated value. The platform would optimize the business operations of end users with domain-specific solutions that are configurable to users’ needs and scalable business platform. Thus, driving the growth of the market.

The low-code application development platforms are required to comply with the data protection and privacy regulations in Europe under the General Data Protection Regulation (GDPR) set by the European Union. Moreover, various other regulatory compliances concerning software development include the Consumer Privacy Act (CCPA), California Canada's Consumer Privacy Protection Act (CPPA), and the New Zealand Privacy Act, among others.

The direct substitutes for low-code application development platforms are no-code or high-code application development platforms However, low-code application development platforms are expected to witness increased adoption in the coming years with the growing consumer demand and advancements in technologies.

Furthermore, end users increasingly prefer low-code application development platforms owing to factors such as minimal coding requirements and reduced IT resources. These solutions are witnessing high demand owing to their sustainability and enhanced efficiency.

Component Insights

Platform component led the market and accounted for a revenue share of more than 71.0% in 2023. Low-code application development platforms enable the quick development and execution of custom applications. Enterprise low-code application development platforms lower the number of tasks undertaken by application developers and offer features that ensure the timely delivery and maintenance of a variety of applications implemented by midsize and large organizations. These features include the availability of technical support and training, disaster recovery, security, Application Programming Interface (API) access to enterprise and third-party cloud services, availability and scalability of applications, and high-performance support. Thus, driving the growth of the platform segment in the low-code application development platform industry.

The service segment is anticipated to witness the highest CAGR from 2024 to 2030 in the market. Low-code application development platform services help developers develop workflows, and mobile apps, or verify application concepts using pre-existing data sets. In addition, these services help users increase their speed to market, gain digital autonomy, and ease the burden on IT resources, creating an environment conducive to innovation. Moreover, low-code application development services empower businesses to achieve configurable business workflows, process optimizations, integrations, and application modernization. Thus, end users are implementing low-code application development platform services to build custom, enterprise-grade software faster and more efficiently.

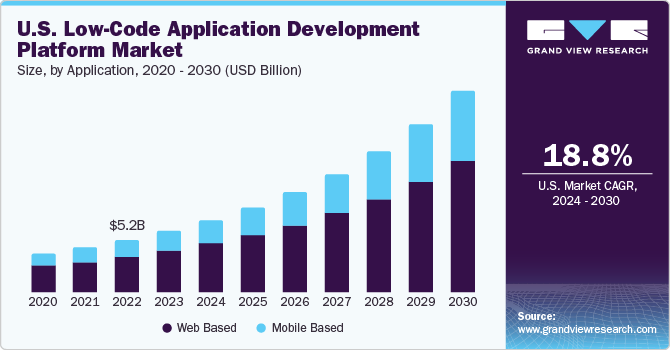

Application Insights

The web-based segment accounted for the largest market revenue share in 2023. Low-code application development platforms for web-based applications offer drag-and-drop interfaces and one-click publishing capabilities, making the development of web apps easier than high-code application development. Furthermore, low-code web applications development platforms provide several other features such as user-defined Progressive Web Applications (PWAs), customizable routine frameworks, and UX improvements. Thus, the aforementioned factors collectively drive the segment’s growth in the market.

The mobile-based segment is expected to register the fastest CAGR during the forecast period. Strong security features offered by low-code mobile application development platforms help safeguard sensitive data and applications. A high level of flexibility can be achieved by utilizing simple platform visuals and drag-and-drop functionality. As a result, users can easily create applications for various operating systems. Thus, driving the growth of the mobile based segment of the market.

Deployment Insights

The on-premises segment accounted for the largest market revenue share in 2023. Businesses such as the ones with large internal infrastructure, banks, and other financial institutions that handle highly sensitive data often favor the on-premises model as it offers better control over resources and data. Furthermore, companies favor on-premises solutions over cloud solutions since they have a lower total cost of ownership in the long run. Concerns about data security are also a major factor driving the increase in the use of on premise software. On-premise software solutions are necessary for businesses located in remote areas with poor internet connectivity. Thus, on-premises segment holds the largest share in the low-code. Thus, driving the growth of the on-premises segment in the market.

The cloud segment is expected to register the fastest CAGR during the forecast period. This can be attributed to the fact that cloud computing enables businesses to monitor their applications and services closely. Cloud-based platforms facilitate better access and monitoring of applications for both developers and users. Cloud platforms also facilitate automated workflows and lower maintenance expenses. Cloud-based low-code application development platforms also offer benefits such as increased scalability, accelerated development, and remote services. Moreover, cloud computing is also used by businesses to streamline business administration processes. Thus, above factors collectively drive the growth of the cloud segment in the market.

Organization Size Insights

Large enterprises accounted for the largest market revenue share in 2023. Low-code application development platforms provide seamless scalability and agility. Moreover, large enterprises can quickly and easily provide each customer with custom apps by using a low-cost app development platform. The solutions developed range from order capture applications to intricate sales tracking apps that link to the business's ERP systems. They also include order track-and-trace, real-time inventory tracking, vendor integration services, planogram apps, and sales learning apps. Thus, large enterprises are increasingly implementing low-code application development platforms, driving market growth.

The small and medium enterprises are projected to witness highest growth rate over the forecast period. Low-code application development platforms help Small and Medium Enterprises lower their application development costs as there is no intricate hand-coding on the platform. As a result, inexperienced professionals can confidently model the user interface and quickly and cheaply develop applications on their own. Furthermore, small and medium enterprises are increasingly investing in computer and mobile applications to enhance their digital presence, which is likely to result in the growth of the segment in the market.

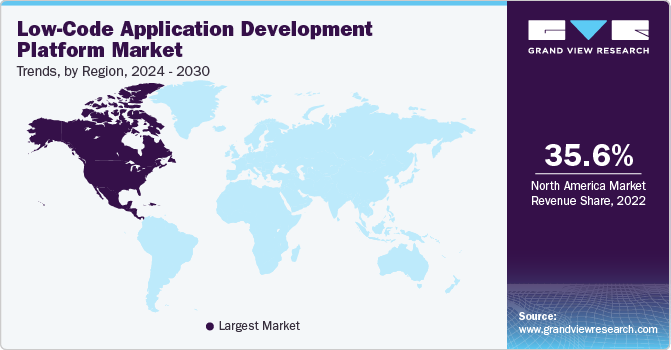

Regional Insights

North America dominated the market in 2023. North America is known for its advanced technology infrastructure, early adoption of sophisticated technologies, and rapid adoption of software applications across the financial, healthcare, retail, and e-commerce, among other industries and industry verticals. Several key market players are looking forward to introducing innovative, agile app development platforms encouraged by these favorable factors.

Asia Pacific is anticipated to witness significant growth in the market. The growth of the Asia Pacific low-code application development platform industry can be attributed to the implementation of advanced technologies, such as AI, ML, and advanced analytics, in business processes across manufacturing, retail, BFSI, and healthcare, among other industries and industry verticals. Low-code application development solutions based on these technologies hold the potential to convert business processes into high-end digital workflows connecting various systems, data, and apps while enhancing the visibility of the processes. Thus, companies across the region are increasingly adopting low-code application development platforms, driving the growth of the segment.

Key Low-Code Application Development Platform Company Insights

Some of the key players operating in the market include Microsoft Corporation; Salesforce.com, Inc.; Pegasystems Inc.; and ServiceNow.

-

Salesforce.com, Inc.’s advanced low-code and no-code solutions are powered by cutting-edge technologies such as artificial intelligence, empowering developers and users to create digital experiences and automate business processes to meet the diverse requirements of organizations.

-

Microsoft Corporation provides low-code solutions through Power Apps and Azure to develop line-of-business applications quickly with minimal coding and at a lower cost. These solutions facilitate the automation of business processes with advanced connectors, drag-and-drop features, and common use cases. Enterprises are widely adopting Microsoft Corporation’s services, such as Azure Functions and Azure API Management, to scale and extend apps and quickly respond to changes.

Betty Blocks, LANSA INC., and Nintex UK Ltd. are some of the emerging market participants in the low-code application development platform industry.

-

Betty Blocks offers a low-code platform that helps organizations develop powerful solutions without the need to depend on advanced infrastructure, technology, and IT resources. Betty Blocks’ offerings bring together ease of use and functionality for enterprise and app development teams with powerful AI capabilities, intuitive visual interface, pre-built components, and user-friendly templates.

-

LANSA INC. offers a range of application development and integration tools, including mobile application development, web application development, cloud development, data and process integration, and application modernization. The low-code solutions offered by the company are built to easily customize, modernize, and empower enterprise-grade applications to meet growing business needs, along with providing a better return on investment.

Key Low-Code Application Development Platform Companies:

The following are the leading companies in the low-code application development platform market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these low-code application development platform companies are analyzed to map the supply network.

- Appian

- Betty Blocks

- Fujitsu

- LANSA INC.

- Mendix Technology BV

- Nintex UK Ltd

- Microsoft Corporation

- Oracle Corporation

- OutSystems

- Pegasystems Inc.

- Salesforce.com, Inc.

- ServiceNow

- TrackVia

- Tyler Technologies

- Zoho Corporation Pvt. Ltd.

Recent Developments

-

In December 2023, Appian, low-code application development platform provider, announced a strategic collaboration with Ernst & Young Global Limited, a technology and strategy consulting company. This collaboration focused on offering AI process automation solutions and services. These solutions would help businesses modernize and simplify their processes using advanced technologies such as low-code, process automation, AI, and data fabric.

-

In October 2023, Mendix Technology BV, low-code application development platform provider, announced a partnership with Red Hat, a provider of enterprise open-source solutions. Through the collaboration, Mendix Technology BV aims to integrate the speed and agility of the Mendix low-code platform with the flexibility and scalability offered by Red Hat OpenShift, empowering businesses to undergo digital transformation with greater ease and confidence.

-

In May 2023, Nintex UK Ltd announced its plan to launch a new regional office in Saudi Arabia. The company has around 80 customers in Saudi Arabia and 300 across the Middle East region. This launch of a new office aimed at contributing to Saudi Arabia’s Vision 2030 initiative, which aims to transform its business.

Low-Code Application Development Platform Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 30.12 billion

Revenue forecast in 2030

USD 101.68 billion

Growth rate

CAGR of 22.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report Updated

January 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, application, deployment, organization size, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Saudi Arabia; UAE; South Africa

Key companies profiled

Appian; Betty Blocks; Fujitsu; LANSA INC.; Mendix Technology BV; Nintex UK Ltd; Microsoft Corporation; Oracle Corporation; OutSystems; Pegasystems Inc.; Salesforce.com, Inc.; ServiceNow; TrackVia; Tyler Technologies; Zoho Corporation Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Low-Code Application Development Platform Market Report SegmentationThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global low-code application development platform market report based on component, application, deployment, organization size, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Platform

-

Services

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Web based

-

Mobile based

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small and Medium Enterprises

-

Large Enterprises

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The key players operating in the low-code application development platform market include Appian, Betty Blocks, Fujitsu, LANSA INC., Mendix Technology BV, Nintex UK Ltd, Microsoft Corporation, Oracle Corporation, OutSystems, Pegasystems Inc., Salesforce.com, Inc., ServiceNow, TrackVia, Tyler Technologies, Zoho Corporation Pvt. Ltd., among others.

b. The global low-code application development platform market size was estimated at USD 24.83 billion in 2023 and is expected to reach USD 30.12 billion in 2030.

b. The global low-code application development platform market is expected to grow at a compound annual growth rate of 22.5% from 2024 to 2030 to reach USD 101.68 billion by 2030.

b. Platform components led the market and accounted for more than 71.0% of the global revenue in 2023. Low-code application development platforms enable the quick development and execution of custom applications. Enterprise low-code application development platforms lower the number of tasks undertaken by application developers and offer features that ensure the timely delivery and maintenance of a variety of applications implemented by midsize and large organizations. These features include the availability of technical support and training, disaster recovery, security, Application Programming Interface (API) access to enterprise and third-party cloud services, availability and scalability of applications, and high-performance support. Thus driving the growth of the platform segment in the low-code application development platform market.

b. Low-code development platforms are significantly transforming the software development processes compared to conventional development methods. Low-code application development platform facilitates software development with minimal effort, cost, and time, which increases their adoption for creating business processes and workflows. The versatile nature of low-code application development platforms makes software development scalable, agile, and user-friendly. Thus driving the growth of the low-code application development platform market demand.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."