- Home

- »

- Consumer F&B

- »

-

Low GI Rice Market Size & Share, Industry Report, 2030GVR Report cover

![Low GI Rice Market Size, Share & Trends Report]()

Low GI Rice Market (2025 - 2030) Size, Share & Trends Analysis Report By Distribution Channel (Hypermarket & Supermarket, Online Retail, Others), By Region ( North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68039-151-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Low GI Rice Market Size & Trends

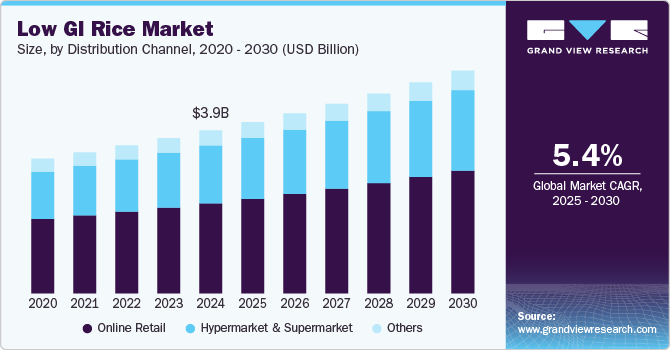

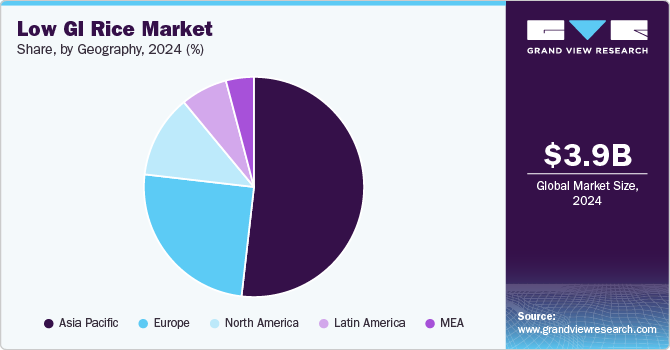

The global low GI rice market size was valued at USD 3.95 billion in 2024 and is projected to grow at a CAGR of 5.4% from 2025 to 2030. Consumers worldwide are becoming more health-conscious, seeking healthier food alternatives that support long-term wellness. Low GI rice is perceived as a suitable choice because it leads to slower digestion and more stable blood sugar levels, making it appealing for people looking to manage their health. Moreover, rising awareness regarding the relationship between high-glycemic foods and chronic diseases such as diabetes, obesity, and heart disease has led to increased demand for foods with a lower glycemic impact, including low GI rice varieties.

Low glycemic index (GI) rice is digested more slowly than its high GI counterpart (white rice), which leads to a gradual rise in blood sugar levels rather than a rapid spike. This helps maintain more stable energy levels throughout the day. Many low GI rice varieties, such as brown rice, retain the bran and germ, which contain fiber. This fiber helps slow glucose absorption, promoting better blood sugar control. As gluten-free diets become more popular, especially among people with celiac disease or gluten sensitivity, rice, including low GI varieties, has become a key staple. Many low GI rice varieties are also associated with sustainable farming practices, such as organic farming or traditional cultivation methods, which register well with environmentally-conscious consumers. Such factors are expected to ensure the promising growth of the low GI rice industry.

Government organizations, particularly in economies such as India and China, have undertaken several initiatives to boost the quality and production of these varieties of rice. For instance, in October 2024, researchers at the Centre for Cellular and Molecular Biology (CCMB) in Hyderabad, India, stated that they were working on new low glycemic index rice varieties. In another example, in August 2024, the Agricultural and Processed Food Products Export Development Authority (APEDA) announced a partnership with the IRRI South Asia Regional Centre (ISARC). The collaboration launched an initiative aimed at enhancing the value of non-basmati rice varieties to accelerate the development of rice-based agri-food systems in the country. At the international level, in August 2024, a research team at the International Rice Research Institute (IRRI) stated that it had identified markers and genes responsible for high protein content and low glycemic index in rice. These rice lines were prepared by intercrossing the amylose extender of IR36 and an inbred Samba Mahsuri variety.

Distribution Channel Insights

The online retail segment accounted for the largest revenue share of 55.3% in the global low GI rice industry in 2024. As the market still has a niche presence, product manufacturers are targeting to improve product visibility by leveraging e-commerce platforms, social media channels, and digital advertisement agencies. Moreover, while there is growing awareness regarding the benefits of low GI rice worldwide, the lack of widespread availability has compelled consumers to use online channels to purchase this product from other regions. These platforms provide easy access to specialty rice varieties and allow consumers to compare their quality, functional benefits, and pricing, enabling them to make informed decisions.

The hypermarket & supermarket segment is expected to grow at the highest CAGR from 2025 to 2030 in the low GI rice industry. These stores attract a large customer base due to the variety of products offered, enabling better product visibility for lesser-known segments such as low GI rice. Furthermore, manufacturers are utilizing appealing packaging methods, as well as offers and discounts, to boost the chances of impulse purchases among consumers. Companies are also deploying in-store specialists and other visual aids to improve awareness regarding the product. Strategic placement near diabetic-friendly offerings and healthy cooking ingredients has helped further push sales of low GI rice through these channels.

Regional Insights

North America low GI rice market accounted for a substantial revenue share in the global market for low GI rice in 2024. The U.S. and Canada have witnessed rising rates of obesity and diabetes, with the Centers for Disease Control and Prevention (CDC) stating that over 38 million Americans are currently living with this condition. Moreover, there has been a steady adoption of ketogenic and other low-carb diets among regional consumers, making low GI rice an attractive option for people following such routines. Regional consumers are increasingly concerned regarding sustainability and the ethical sourcing of food products. Low GI rice varieties that are organic, Fair Trade, or locally sourced are thus becoming more desirable in the North American market.

U.S. Low GI Rice Market Trends

The U.S. low GI rice market accounted for a dominant revenue share in the North American market in 2024. As part of the broader trend towards health and wellness, many consumers in the country are choosing low GI foods to support weight management. Furthermore, the sharp growth in the popularity of global cuisines, especially Asian, Indian, and Mediterranean food, has led to increased rice consumption in various forms in American households. Basmati rice, jasmine rice, and wild rice, including low GI varieties, are extensively used in food preparations. Sales of these products are increasing through major grocery chains, including Whole Foods, Trader Joe's, Walmart, and Costco, which are stocking whole grain and low GI rice options for health-conscious consumers.

Asia Pacific Low GI Rice Market Trends

Asia Pacific low GI rice market accounted for the largest revenue share of 51.8% in 2024 in the global low GI rice industry. The demand for low glycemic index (GI) rice is being driven by a combination of health concerns, evolving dietary patterns, and socio-economic changes in regional economies. Asia is home to the largest consumer base for rice globally, and as such, changes in rice consumption habits in this region substantially impact the demand for low GI rice. According to the International Diabetes Federation (IDF), the region accounts for over 60% of the world’s diabetic population. Since rice is a staple food in many regional countries, there is a growing demand for low GI rice as a healthier alternative that can help manage blood sugar levels among diabetic people.

China low GI rice market accounted for a dominant revenue share in the regional market in 2024, owing to the widespread usage of rice in food preparations and constant efforts to introduce healthy varieties of rice. The prevalence of obesity and metabolic syndrome in China is on the rise, particularly in urban areas. High glycemic foods such as white rice contribute to these health conditions, and their low GI alternatives are increasingly being promoted as a healthier option to help prevent or manage these issues. Brown rice, which possesses a lower glycemic index than white rice, is being marketed for its higher nutritional value, including fiber and essential vitamins. This trend toward whole grains is contributing to the economy’s demand for low GI rice.

Europe Low GI Rice Market Trends

Europe is anticipated to witness the highest CAGR in the market during the forecast period. Economies such as Germany, the UK, and Italy have witnessed a significant rise in the prevalence of conditions such as type 2 diabetes and obesity. As per the IDF, around 61 million people in this region are living with type 2 diabetes, making up about 95% of all diabetic cases among Europeans. Low GI rice is increasingly viewed as an important part of a healthy diet, especially for managing blood sugar levels and preventing insulin resistance, making it an appealing alternative to high-GI rice varieties. Moreover, increasing awareness among regional consumers regarding the benefits of this type of rice over white rice is expected to create positive growth opportunities for the market.

Germany accounted for a significant revenue share in the regional market in 2024, owing to the rising focus on healthier eating habits among citizens in the economy. This includes a growing interest in plant-based diets, low-carb diets, and foods that help manage blood sugar. As part of this trend, low GI rice is increasingly considered a healthier choice than traditional white rice, which has a high glycemic index. Health organizations and public health campaigns in Germany have been promoting nutritional eating habits to combat rising rates of diabetes and obesity. These campaigns often emphasize the importance of low GI foods, resulting in an increased demand for these types of rice among German consumers.

Key Low GI Rice Company Insights

Some major companies involved in the global low GI rice industry include Ricegrowers Limited, Nestiva, and Sugar Watchers Low GI Staples, among others.

-

Ricegrowers Limited, which trades as SunRice, is a major global rice food company and a notable exporter of branded food based in Australia. The company is known for its low GI and healthy rice product portfolio, including long-grain rice, brown rice, jasmine, basmati, medium-grain rice, low GI rice, black rice, and risotto. Under the low GI rice category, the company sells SunRice White Medium Grain Rice, SunRice Low GI White Rice, SunRice Low GI Brown Rice, and SunBrown Calrose Rice, among other offerings.

-

Nestiva, an India-based company created in 2016, develops healthy food products focusing on ethical sourcing, high product procurement standards, and environment-friendly processes. The company offers products through four segments - Health Foods, Edible Oil, Exotic Butter, and Essential Oil. Under the Health Foods segment, Nestiva develops low GI rice and brown rice. The SMART BALANCE RICE developed by the company is a unique polished white rice with a low glycemic index cultivated as per Good Agriculture Practices (GAP) guidelines.

Key Low GI Rice Companies:

The following are the leading companies in the low GI rice market. These companies collectively hold the largest market share and dictate industry trends.

- Ricegrowers Limited

- Nestiva

- Chaman Lal Setia Exports Ltd.

- SDLG Radiant Pvt. Ltd.

- Sugar Watchers Low GI Staples

- First Choice Food Products Pvt Ltd.

- Parish Rice

- The Little Rice Company

- Siam Lotus

- Cahokia

Recent Developments

-

In August 2024, Parish Rice announced the imminent availability of its products across 74 Walmart outlets in Louisiana, the U.S. The agreement further included distribution to 491 Walmart locations across 15 Southern and Midwestern U.S. states. The brand’s rice was created in 2019 by scientists at the LSUAg Center and has a GI value of 41 out of 100, along with 53% more protein content than average rice brands.

-

In August 2023, Sugar Watchers, an India-based health brand specializing in low Glycemic Index (GI) staple food products, announced that it had received funding of over USD 425,000 in a round led by ah! Ventures. Through this funding, the company stated its aim to strengthen its distribution and marketing strategies, expand its footprint in India, and improve exports across the U.S., Singapore, UAE, and Israel, among other countries.

Low GI Rice Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.15 billion

Revenue forecast in 2030

USD 5.40 billion

Growth Rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, Brazil, Argentina, UAE, South Africa

Key companies profiled

Ricegrowers Limited; Nestiva; Chaman Lal Setia Exports Ltd.; SDLG Radiant Pvt. Ltd.; Sugar Watchers Low GI Staples; First Choice Food Products Pvt Ltd.; Parish Rice; The Little Rice Company; Siam Lotus; Cahokia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Low GI Rice Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global low GI rice market report based on distribution channel and region:

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarket & Supermarket

-

Online Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.