- Home

- »

- Homecare & Decor

- »

-

Luxury Candle Market Size And Share, Industry Report, 2030GVR Report cover

![Luxury Candle Market Size, Share & Trends Report]()

Luxury Candle Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Scented, Non-Scented/Decorative), By Fragrance (Floral, Fruity & Citrus), By Product, By Wax, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-054-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Luxury Candle Market Summary

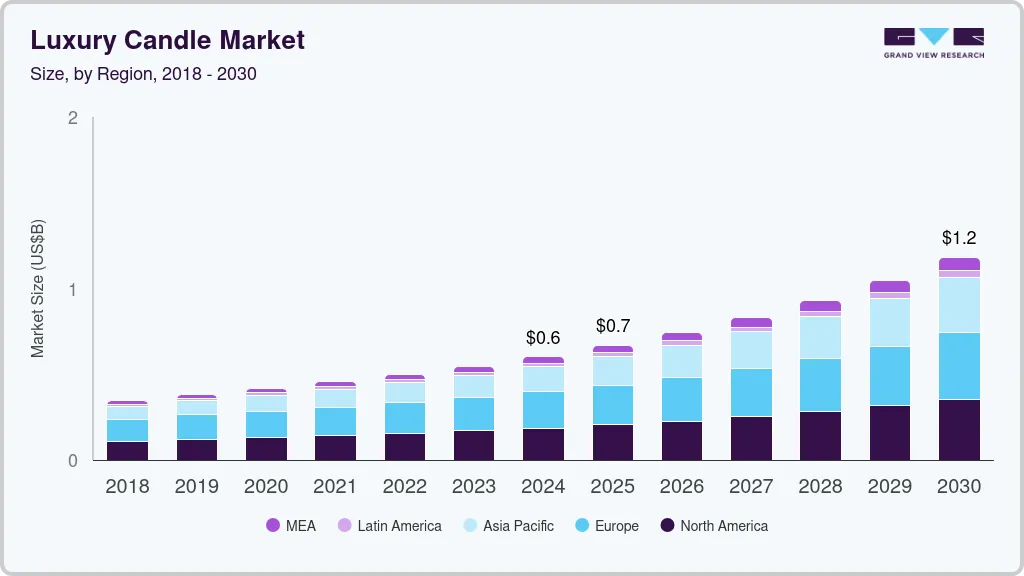

The global luxury candle market size was estimated at USD 603.1 million in 2024 and is projected to reach USD 1,181.9 million by 2030, growing at a CAGR of 12.1% from 2025 to 2030. The industry is growing due to rising consumer interest in home fragrances, self-care, and wellness.

Key Market Trends & Insights

- The luxury candle industry in North America accounted for a revenue share of 30.8% in 2024.

- The luxury candle industry in the U.S. is expected to grow at a CAGR of 11.5% from 2025 to 2030.

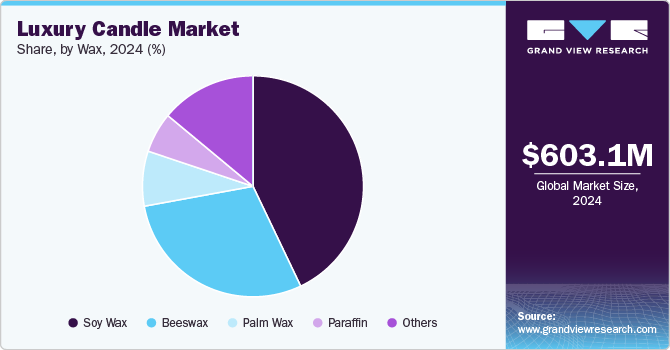

- By wax, soy wax candles held a market share of 42.91% in 2024.

- By fragrance, luxury candles with floral fragrances accounted for a market share of 26.8% in 2024.

- By type, luxury scented candles accounted for a market revenue share of 89.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 603.1 Million

- 2030 Projected Market Size: USD 1,181.9 Million

- CAGR (2025-2030): 12.1%

- North America: Largest market in 2024

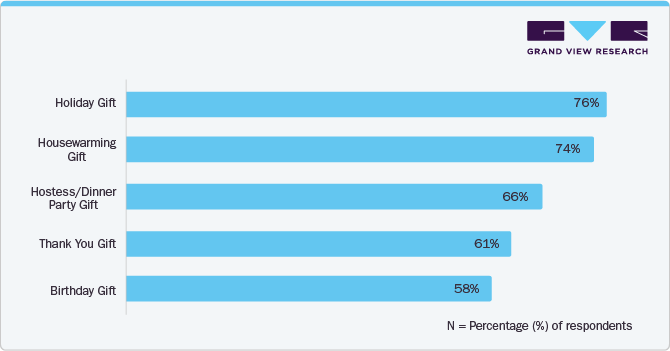

Scented candles have become essential for relaxation, enhancing mood, and creating a calming atmosphere. In addition, gifting and seasonal demand are key drivers, with premium candles being a popular choice for corporate and personal gifting.

Growing consumer interest in home fragrances and self-care rituals is a notable driver for the global candle industry. Candles have evolved from simple lighting sources to integral components of personal wellness routines. Many people now use scented candles to create calming atmospheres that enhance relaxation and emotional well-being. This trend is fueled by a growing awareness of the psychological benefits associated with certain fragrances, which can help reduce stress and improve mood. With more people investing in self-care at home, the demand for quality candles and sophisticated fragrance blends has expanded.

Travel-friendly candles are also on the rise, allowing consumers to bring the comforts of home fragrance on vacations and work trips. These products cater to the demand for compact, versatile candles that provide familiar scents and a sense of relaxation in any setting. As people incorporate home fragrances into their lifestyles, the candle industry continues to benefit from this shift toward wellness-focused spending. Global brands are responding with an array of scent options and high-quality products to meet diverse preferences, supporting sustained growth in the market.

Consumer Survey & Insights

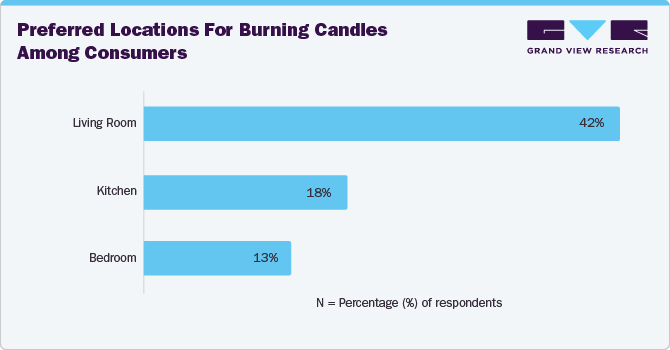

Consumer preferences are closely tied to ambiance creation, relaxation, and home aesthetics, which explains why the living room (42%), kitchen (18%), and bedroom (13%) are the most common spaces for candle usage, as per the National Candle Association. High-end candles are often designed to enhance mood and atmosphere, making them a natural fit for living rooms, where consumers entertain guests and seek a welcoming ambiance. With growing consumer interest in home wellness and sensory indulgence, luxury candle brands position their products as essential elements of curated interior spaces, blending fragrance, décor, and lifestyle appeal.

In the luxury candle industry, consumer preferences are increasingly driven by the perception of candles as both an indulgence and a sophisticated gifting option. The National Candle Association's findings-where 76% of purchasers see candles as a suitable holiday gift, 74% for housewarming, and 66% for hostess gifts-align with the broader trend of premium candles being positioned as status symbols and lifestyle-enhancing products. Luxury brands like Diptyque, Jo Malone, and Trudon have elevated candle gifting through artisanal craftsmanship, unique scent compositions, and high-end packaging, making them ideal for special occasions.

Type Insights

Luxury scented candles accounted for a market revenue share of 89.7% in 2024. Demand for these is rising due to increasing wellness and self-care trends, with consumers seeking relaxation and ambiance-enhancing products. Aromatherapy's popularity fuels interest in mood-boosting scents, while home décor enthusiasts invest in candles for aesthetics. Premium gifting culture, rising disposable incomes, and eco-consciousness drive purchases alongside product innovations and social media influence.

Demand for non-scented/decorative candles is expected to grow at a CAGR of 10.5% from 2025 to 2030. This is due to rising demand for aesthetic home décor, premium gifting, and eco-friendly options. Consumers seek statement pieces that enhance ambiance without overpowering scents, driving market expansion.

Fragrance Insights

Luxury candles with floral fragrances accounted for a market share of 26.8% in 2024. Floral fragrances are popular due to their ability to evoke happiness, relaxation, and calmness while reducing stress and anxiety. With aromatherapy benefits, scents like lavender and jasmine promote better sleep and tranquility. Their versatility offers a range of fragrances catering to various preferences.

Demand for luxury candles with blended fragrances is expected to increase at a CAGR of 13.8% from 2025 to 2030. This is due to their customizable, complex scent profiles, enhanced ambiance, and versatility. Blended candles combine multiple scents-such as florals, spices, woods, fruits, and herbs-creating a more layered and dynamic fragrance experience. Several key factors drive this growing preference, including the desire for personalization, emotional connection, and an elevated home ambiance.

Product Insights

Luxury container candles held a market share of 52.1% in 2024. These candles offer safety and convenience and can enhance ambiance with scent and light. Glass jars protect the flame, ensuring safer use while also allowing for better scent diffusion. Container candles offer long burn times, reusability, and a variety of sophisticated scents and designs, making them a stylish, functional, and indulgent addition to any space.

Demand for luxury votive candles is projected to increase at a CAGR of 12.9% from 2025 to 2030. These provide a stylish way to enhance ambiance, offer premium scents in smaller sizes, and are popular for gifting and décor. In addition, votive candles are frequently used for events such as weddings, parties, and celebrations, where consumers desire elegant yet subtle lighting. As per the Business Standard article, in 2023, the event planning and management industry recorded a remarkable USD 57.38 billion in earnings, marking a 26.4% increase compared to the previous year. The increase in event planning services, home hosting, and personalized gatherings has further propelled the demand for votive luxury candles.

Wax Insights

Soy wax candles held a market share of 42.91% in 2024. Soy wax is the preferred choice for luxury candles due to its natural, renewable, and clean-burning properties. It offers a longer burn time, a stronger scent throw, and minimal soot production, enhancing indoor air quality. Its eco-friendly nature aligns with sustainability trends, while its lower melting point ensures even burning.

Beeswax luxury candle sales are expected to rise at a CAGR of 13.1% from 2025 to 2030. Its eco-friendly, hypoallergenic nature and air-purifying benefits make it a premium, sustainable choice. Furthermore, beeswax luxury candles are often sought after for their unique ability to release negative ions when burned. These ions help neutralize airborne pollutants, such as dust, allergens, and toxins, creating a cleaner and fresher indoor environment. This natural air-purifying property makes beeswax candles particularly attractive to health-conscious consumers and those seeking a holistic approach to home care.

Regional Insights

The luxury candle industry in North America accounted for a revenue share of 30.8% in 2024. driven by evolving consumer preferences and increasing demand from both residential and commercial sectors. In the residential market, luxury candles are increasingly seen as essential elements of home décor and wellness. Consumers are more focused on creating personalized, relaxing environments in their homes, and candles serve as a key component of this trend. The rising interest in self-care, mindfulness, and stress-relief practices has made luxury candles a popular choice for consumers looking to create a calming ambiance.

U.S. Luxury Candle Market Trends

The luxury candle industry in the U.S. is expected to grow at a CAGR of 11.5% from 2025 to 2030. Rising disposable incomes have enabled consumers to invest in premium home decor products, while the increasing focus on mental wellness makes therapeutic fragrances and the calming ambiance of candles particularly appealing. Eco-friendly and sustainable practices are also fueling demand for luxury candles as consumers seek organic waxes and non-toxic fragrances.

Europe Luxury Candle Market Trends

The luxury candle market in Europe held a market share over the forcast period. Luxury candles are in high demand in Europe due to evolving consumer preferences, affordability, and wellness trends. The pandemic heightened interest in home ambiance, with scent transforming spaces and evoking memories. Consumers are now more knowledgeable, seeking premium, nature-inspired fragrances like oud and cedar wood. Sustainability and craftsmanship further drive demand, while customization and gifting potential make luxury candles a desirable lifestyle product across all demographics.

Asia Pacific Luxury Candle Market Trends

The Asia Pacific luxury candle industry is expected to grow at a CAGR of 13.9% from 2025 to 2030. The rising disposable income changing lifestyle in countries such as China, India, and Southeast Asia, coupled with increasing urbanization, is driving demand for luxury products, including candles. With disposable incomes growing, consumers are investing more in home décor and personal indulgences, positioning luxury candles as both decorative and functional items. Urban consumers, in particular, are drawn to scented and artisanal luxury candles that enhance their living spaces and create a relaxing ambiance.

Key Luxury Candle Company Insights

The market is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some key companies in the luxury candle industry areBridgewater Candle Company, Diptyque S.A.S., Loewe, Penhaligon’s Ltd., L'Artisan Parfumeur, Céline, Byredo, and others.

-

Jo Malone London is a British luxury fragrance brand renowned for its elegant and understated scents across various products, including perfumes, home fragrances, and body care items. Jo Malone offers an array of meticulously crafted candles, such as the 'Pomegranate Noir,' 'Lime Basil & Mandarin,' and 'English Pear & Freesia' scented candles. These candles are available in multiple sizes, including travel, home, deluxe, and four-wick luxury editions, each designed to infuse spaces with their signature fragrances.

-

Bridgewater Candle Company is renowned for its premium home fragrance products, with the 'Sweet Grace' collection standing out as a customer favorite. This collection encompasses a variety of items, including candles, flower diffusers, laundry care products, and personal care items, all infused with the signature 'Sweet Grace' scent. Current trends emphasize natural and sustainable practices, such as the use of soy, coconut, and beeswax for cleaner burning, along with eco-friendly packaging and natural wicks.

Key Luxury Candle Companies:

The following are the leading companies in the luxury candle market. These companies collectively hold the largest market share and dictate industry trends.

- Bridgewater Candle Company

- Jo Malone London

- L'Artisan Parfumeur

- Céline

- Loewe

- Le Labo

- Diptyque S.A.S.

- Byredo

- Penhaligon’s Ltd.

- L'OBJET

Recent Developments

-

In March 2025,Tarvos Boutique expanded its luxury collection with new premium candles, perfumes, and skincare products designed for sensitive skin. The boutique emphasizes sustainability, offering carbon-neutral shipping and supporting eco-friendly brands like Cereria Molla, Baobab Collection, and Carriere Freres.

-

In January 2025,L’OBJET partnered with South African artist Ruan Hoffmann for a luxury home décor and fragrance collection. The range includes candles with bold designs, like the Burning Desire and Mask candles, as well as diffusers.

-

In November 2024,Jacquemus teamed up with Trudon to create a special candle for the Winter Retreat collection featuring the Abd El Kader fragrance. This collaboration merges Jacquemus' minimalist aesthetic with Trudon's craftsmanship, offering a fresh scent of mint, ginger, and blackcurrant.

Luxury Candle Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 667.9 million

Revenue forecast in 2030

USD 1,181.9 million

Growth Rate (Revenue)

CAGR of 12.1% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, fragrance, product, wax, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa; UAE

Key companies profiled

Bridgewater Candle Company; Jo Malone London; L'Artisan Parfumeur; Céline; Loewe; L'OBJET; Le Labo; Diptyque S.A.S.; Byredo; Penhaligon’s Ltd.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Luxury Candle Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global luxury candle market report based on type, fragrance, product, wax, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Scented

-

Non-Scented/Decorative

-

-

Fragrance Outlook (Revenue, USD Million, 2018 - 2030)

-

Floral

-

Fruity & Citrus

-

Woody & Earthy

-

Gourmand

-

Spicy & Warm

-

Herbal & Green

-

Blended

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Votive

-

Container

-

Pillars

-

Tapers

-

Others

-

-

Wax Outlook (Revenue, USD Million, 2018 - 2030)

-

Paraffin

-

Soy Wax

-

Beeswax

-

Palm Wax

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global luxury candle market was estimated at USD 603.1 million in 2024 and is expected to reach USD 667.9 billion in 2025.

b. The global luxury candle market is expected to grow at a compound annual growth rate of 12.1% from 2025 to 2030 to reach USD 1,181.9 million by 2030.

b. Luxury candle market in Europe held a market share of 35.05% in 2024. Luxury candles are in high demand in Europe due to evolving consumer preferences, affordability, and wellness trends.

b. Some prominent companies in the luxury candle industry are Bridgewater Candle Company, Diptyque S.A.S., Loewe, Penhaligon’s Ltd., L'Artisan Parfumeur, Céline, Byredo, and others.

b. The luxury candle market is growing due to rising consumer interest in home fragrances, self-care, and wellness. Scented candles have become essential for relaxation, enhancing mood, and creating a calming atmosphere.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.