- Home

- »

- Homecare & Decor

- »

-

Luxury Fabric Market Size And Share, Industry Report, 2030GVR Report cover

![Luxury Fabric Market Size, Share & Trends Report]()

Luxury Fabric Market (2024 - 2030) Size, Share & Trends Analysis Report By Type [Interior (Curtains, Bed Linen), Exterior (Gazebo Drapes, Outdoor Furniture Upholstery)], By Material (Silk, Velvet), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-160-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Luxury Fabric Market Summary

The global luxury fabric market size was estimated at USD 3,825.5 million in 2023 and is projected to reach USD 9,089.4 million by 2030, growing at a CAGR of 11.6% from 2024 to 2030. Market growth can be attributed to the increasing consumer spending on home improvement and interior decoration, coupled with favorable government initiatives that have resulted in increased residential and commercial construction worldwide.

Key Market Trends & Insights

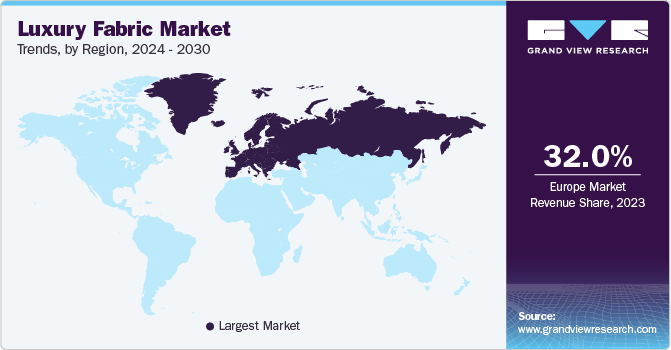

- In terms of region, Europe was the largest revenue generating market in 2023.

- Country-wise, Germany is expected to register the highest CAGR from 2024 to 2030.

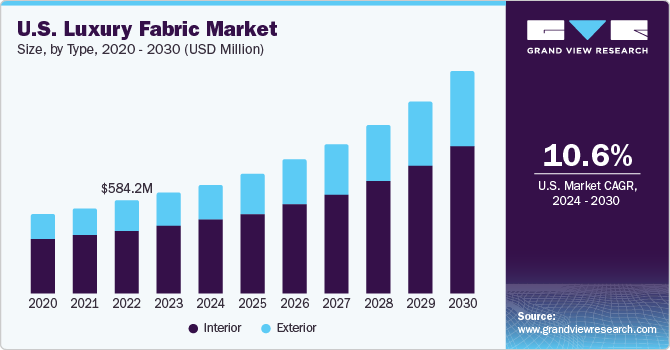

- In terms of segment, interior accounted for a revenue of USD 2,482.8 million in 2023.

- Exterior is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 3,825.5 Million

- 2030 Projected Market Size: USD 9,089.4 Million

- CAGR (2024-2030): 11.6%

- Europe: Largest market in 2023

The primary drivers of home improvement spending have shifted from being economical to increasingly being lifestyle-related. This shift in motivation highlights the growing importance of homes and investments in living spaces. This evolving relationship with homes is driving the demand for luxury fabrics where individuals are seeking to enhance and personalize their living environments.

According to the 2022 U.S. Houzz & Home Study on renovation trends, the median has increased by 50% to USD 15,000 from USD 10,000 over the previous three years. In addition, compared to 53% in 2020 and 54% in 2019 and 2018, more than half of homeowners (55%) underwent renovations in 2021.

Homeowners are increasingly renovating their spaces with a focus on eco-friendly and skin-friendly fabrics. This shift is driven by a desire to create aesthetically pleasing rooms that are also healthy and sustainable, aligning with a growing awareness of environmental and wellness considerations in interior design. Market players like House of Hackney, based in the U.S., are committed to sustainability, offering environmentally friendly and organic fabric options, sourcing eco-friendly raw materials, and adhering to ethical practices. The company offers cotton linens, cool British velvets, and decadent jacquards. Its iconic print fabrics are ideal for curtains, blinds, and furniture upholstery.

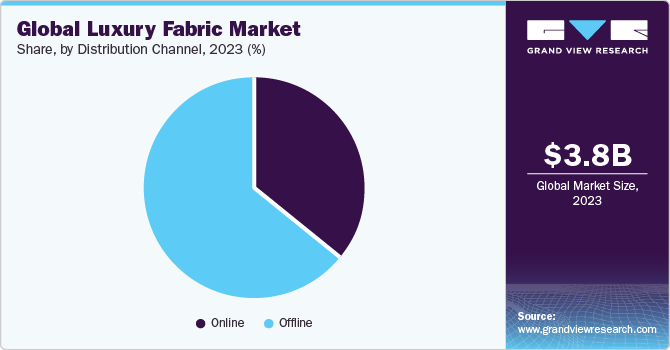

Companies operating in the industry operate through both offline and online distribution channels. When it comes to buying luxury interior fabric, many consumers prefer offline purchasing through specialty and branded stores. Easy availability of fabrics based on their specific preferences and in-store assistance are some of the factors driving the sales of luxury interior fabrics through the offline distribution channel.

A significant shift has been observed among several companies in recent years, with many of them leaning toward the online sales channel. With rising digitization, smartphone penetration, and growing internet access, businesses are gradually shifting from brick-and-mortar stores to e-commerce platforms. To expand product visibility, manufacturers are showcasing their products across online platforms, such as company-owned portals and e-retailing, especially in emerging markets.

Manufacturers are increasingly spending on marketing and advertisements to increase their customer base. Direct-to-customer channels are highly profitable but only for brands with consumer loyalty and do not have to invest heavily in endorsing their products. Manufacturers in the market are operating on a high-profit margin.

Market Characteristics

The global market is characterized by a high degree of innovation by the market players, with new unique products and materials being developed and introduced at regular intervals. Companies are achieving this mainly through collaborations with designers and artisans and acquisitions of established brands or complementary businesses

Players such as Kravet Inc. have been involved in acquisition activities in recent years. Through multiple acquisitions between 2020 and 2023, the company has been able to strategically broaden its portfolios and leverage the expansive distribution & sales networks of the acquirees

Companies are actively investing substantial resources in obtaining certifications, including GOTS and OEKO-TEX Standard 100, to demonstrate their commitment to product safety and environmental sustainability. Governments worldwide have been implementing stricter regulations to ensure sustainable practices across the value chain of the luxury fabrics industry

The impact of substitution is deemed to be low in the luxury fabrics industry, with the market dominated by materials such as silk, cashmere, velvet, linen, jacquard, etc. for interior and exterior applications. These materials have distinct characteristics that cannot be replicated by common or lower-grade materials

Type Insights

Demand for interior fabrics segment dominated the market in 2023 with a revenue share of over 64%. Curtains, upholstery, bed linen, and mattress coverings are the key product types within this category. Interior fabrics are frequently produced from premium natural fibers, such as silk, wool, and linen, which are valued for their enduring quality and aesthetic appeal. Synthetic alternatives like polyester are also used, skillfully designed to mimic the texture and appearance of their natural counterparts.

High costs associated with house prices and mortgage rates have led consumers to invest in home improvement or remodeling projects to revamp their traditional household structures. Moreover, the increasing age of constructed houses also drives the need for interior decoration, which would subsequently drive the demand for new stylized curtains and blinds.

The exterior fabric segment is projected to grow at a CAGR of 12.2% over the forecast period. Luxury fabrics for exterior purposes are specially designed materials that combine style and comfort with durability and resistance to the elements. They are typically used in high-end outdoor furniture upholstery, cushions, pillows, curtains, gazebo drapes, tablecloths and linens, poolside lounging, and other décor items.

Consumer preferences have shifted toward investing in luxury products for their homes. Consequently, spending on home renovations has increased, with particular emphasis on making outdoor spaces, such as balconies, gardens, and patios, more functional and attractive. This shift in consumer priorities has significantly contributed to the growing demand for the exterior luxury fabric category.

Raw Material Insights

Among the key materials used in the industry, silk segment dominated the market in 2023 with a revenue share of over 24% in 2023. Silk is known to embody richness, primarily owing to its substantial production costs, tactile qualities, and elegance. As a result, it enjoys considerable favor in the high-end fashion industry. Silk has a tremendous tensile strength; however, it is typically preferred for its softness.

Silk is widely used as decorative pillows, curtains, as well as wall hangings due to its softness, durability, and lightweight nature. Increased availability of raw silk has prompted luxury silk fabric companies to be more selective while choosing high-quality raw materials. An excess supply of raw silk generates opportunities for product diversification within the luxury silk fabric industry.

Cashmere is ideal for crafting luxurious pillows and cushions and is an excellent choice for furnishing upholstery. Its luxurious texture and lightweight nature ensure comfortable seating, while its durability ensures it withstands regular use without signs of wear and tear. Cashmere can be fashioned into chairs, sofas, ottomans, headboards, and more, combining visual appeal and enhanced aesthetics. Demand for cashmere-based luxury fabrics segment is anticipated to grow at the fastest CAGR of 13.9% over the forecast period.

Distribution Channel Insights

Offline sales segment dominated the market in 2023, with a revenue share of 63%. Some of the prominent offline distribution channels in this market are company retail stores, supermarkets & hypermarkets, specialty stores, and multi-brand stores. Many people prefer offline distribution channels as they give consumers a first-hand look and feel at the fabrics, which helps in the easy inspection of product quality and specifications. With the help of traditional brick-and-mortar stores, brands have been able to create a unique shopping experience for customers. The availability of various brands under one roof also helps in the easy comparison of products in terms of price and specifications.

Online sales of luxury fabrics segment is projected to register the fastest CAGR of 12.3% over the forecast period. Major online channels in the industry include company portals and e-commerce websites. The online segment is expected to witness significant growth in the coming years due to the increasing consumer preference for online shopping over physical stores. Consumers prefer online portals and official websites to purchase luxury fabrics due to the availability of a wide range of products from a variety of domestic and international brands. Moreover, the availability of the latest luxury fabrics at the best deals, discounts, and sales is attracting consumers to opt for these channels.

Regional Insights

Europe dominated the global market in 2023 with a revenue share of nearly 32%. A growing number of hotel reservations across major tourist destinations in Europe is one of the key factors driving the regional market. The resurgence of travel in Europe since the pandemic is pushing hoteliers to renovate rooms and other spaces according to evolving customer needs. The hotel industry in Europe is undergoing a major technological and luxury overhaul to adapt to new and innovative trends. Renovation activities in such spaces will likely drive the demand for luxury interior fabrics for décor and furnishings.

The demand for luxury fabrics in Germany is on the rise due to several factors. A robust economy and increased disposable incomes have bolstered consumer spending on premium and high-quality materials. In addition, there is a growing emphasis on interior design and home aesthetics, prompting a surge in demand for luxury fabrics for curtains, upholstery, and furnishings.

Product demand in Asia Pacific is projected to grow at a CAGR of 13.3% during the forecast period. Asia Pacific’s market growth is influenced by collaborations between upholstery and luxury fabric manufacturers. China, India, and Japan are key markets in Asia Pacific, witnessing a rising demand for luxury fabric due to the increasing household disposable income and the growing trend of home interiors and décor. International brands are entering the Asia-Pacific market to cater to the demand for luxury fabrics, with companies like E.S. Kluft & Company and Frette expanding their presence in Chinese cities like Shanghai and Beijing.

Key Companies & Market Share Insights

The industry is characterized by the presence of global companies and emerging players. The major players in the industry emphasize product innovation & differentiation and unique designs aligned with the changing consumer trends. These players have extensive distribution networks worldwide, which enable them to reach a wide customer base and expand into emerging markets. The emerging companies, on the other hand, are focused on niche markets, specialized product portfolios, and fresh designs to improve their visibility in the market.

Jim Thompson Fabrics is among the largest manufacturers of a complete portfolio of premium textiles for interior decoration, traditional handlooms, advanced precision lower looms, and state-of-the-art equipment. The company possesses silk farms, mills, design studios, and R&D operations and thus integrates all the processes and expertise needed for textile production.

Key Luxury Fabric Companies:

- Jim Thompson Fabrics

- Pierre Frey

- Sanderson Design Group

- The Romo Group

- Kravet Inc.

- Sattler Group (SUN-TEX GmbH)

- Perennials and Sutherland L.L.C.

- LVMH Moët Hennessy Louis Vuitton (Loro Piana)

- Ermenegildo Zegna N.V.

- De Le Cuona

Recent Developments

-

In September 2023, Kravet Inc. expedited its production process by including all its smart fabrics and frames in the Quickship program. This move ensures a 10-day production timeline for customers, aiming to support projects, budgets, and tight timelines. The Kravet Smart collection, featuring over 2,000 fabrics and 150 furniture frames, offers personalization options, and the frames come with a lifetime warranty, aligning with the company's sustainability commitment.

-

In August 2023, Sanderson Design Group collaborated with Disney to create a collection of wallcoverings and fabrics highlighting iconic Disney characters. The Disney Home x Sanderson collection comprised 12 fabrics and 14 wallpapers, with many designs drawing inspiration from the original Sanderson Disney creations that first emerged in the 1930s alongside the debut of the Mickey Mouse comic strip.

-

In April 2023, The Romo Group collaborated with Alice Temperley, founder and creative director of Temperley London, to release a collection of wallpapers, pillows, fabric, and trimmings. The fabric patterns are artfully crafted on textured velvets and smooth printed cotton, each bearing whimsical names such as Fantasia, Euphoria, and Trixie.

-

In February 2023, Pierre Frey introduced the Braquenié Anniversaire 1823-2023 collection to celebrate its 200th anniversary. The collection comprised a carefully curated range of wallcoverings, upholstery, and rug designs chosen from its extensive historical archives.

Luxury Fabric Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.21 billion

Revenue forecast in 2030

USD 9.09 billion

Growth Rate

CAGR of 11.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, raw material, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; China; Japan; India; Brazil; South Africa.

Key companies profiled

Jim Thompson Fabrics; Pierre Frey; Sanderson Design Group; The Romo Group; Kravet Inc.; Sattler Group (SUN-TEX GmbH); Perennials and Sutherland L.L.C.; LVMH Moët Hennessy Louis Vuitton (Loro Piana); Ermenegildo Zegna N.V.; De Le Cuona

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Luxury Fabric Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global luxury fabric market report based on type, raw material, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Interior

-

Curtains

-

Upholstery

-

Bed Linen

-

Mattress Coverings

-

-

Exterior

-

Outdoor Furniture Upholstery

-

Outdoor Pillows and Cushions

-

Cabana and Outdoor Curtains

-

Gazebo Drapes

-

Tablecloths and Linens

-

Poolside Lounging

-

Others

-

-

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Silk

-

Cashmere

-

Cotton

-

Velvet

-

Linen

-

Jacquard

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global luxury fabric market size was estimated at USD 3.83 billion in 2023 and is expected to reach USD 4.21 billion in 2024.

b. The global luxury fabric market is expected to grow at a compound annual growth rate of 11.6% from 2024 to 2030 to reach USD 9.09 billion by 2030.

b. Europe dominated the luxury fabric market with a share of nearly 32.30% in 2023. The growing number of hotel reservations across major tourist destinations in Europe is one of the key factors driving the regional market.

b. Some key players operating in the luxury fabric market include Jim Thompson Fabrics, Pierre Frey, Sanderson Design Group, The Romo Group, Kravet Inc., Sattler Group (SUN-TEX GmbH), Perennials and Sutherland L.L.C., LVMH Moët Hennessy Louis Vuitton (Loro Piana), Ermenegildo Zegna N.V., and De Le Cuona.

b. The growth of the luxury fabric market can be attributed to the increasing consumer spending on home improvement and interior decoration, coupled with favorable government initiatives that have resulted in increased residential and commercial construction worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.