- Home

- »

- Advanced Interior Materials

- »

-

Luxury Furniture Market Size & Share, Industry Report, 2030GVR Report cover

![Luxury Furniture Market Size, Share & Trends Report]()

Luxury Furniture Market Size, Share & Trends Analysis Report By Material (Wood, Metal, Glass, Leather, Plastic), By End-use (Domestic, Commercial), By Region (Nort America, Europe, APAC, Latin America, MEA), And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-646-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Luxury Furniture Market Size & Trends

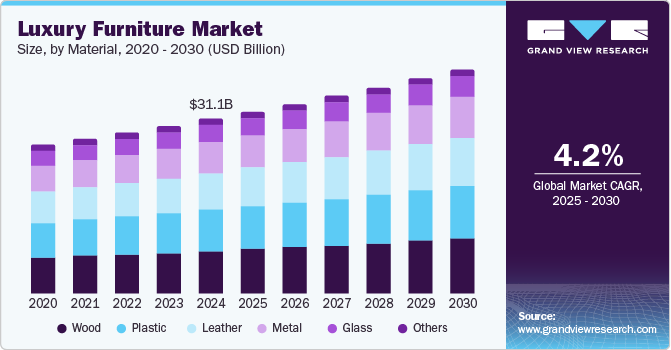

The global luxury furniture market size was valued at USD 31.06 billion in 2024 and is expected to grow at a CAGR of 4.2% from 2025 to 2030. The market is attributed to the growing income and increasing number of stores of luxury furniture brands in developing economies. Furthermore, the growing global economy is propelling the accumulation of wealth, particularly among the affluent, who are investing in high-end furniture. Additionally, rising urbanization is pushing individuals to purchase custom furniture to adorn their homes, workplaces, and other spaces are expected to drive market growth.

The influence of social media platforms such as Instagram and Pinterest and home renovation shows has also aroused curiosity in interior design projects, driving demand for unique and luxurious furniture. Furthermore, there is a growing interest in products that reflect individualistic style and vibe, pushing the demand for luxury furniture that provides exclusivity and uniqueness. The surging demand for convenience & comfort is propelling the market, as consumers seek premium furniture to elevate their living experience. Moreover, the increasing awareness of global brands and trends in emerging economies is favoring the market, with consumers keen on investing in high-quality craftsmanship and innovative designs.

Material Insights

Wood dominated the market with the largest revenue share of 24.5% in 2024. Wood is a timeless and versatile material, highly valued for its aesthetic appeal and durability. It offers a sense of warmth and natural beauty often sought in luxury furniture. The ability to craft intricate designs and unique pieces from various types of wood, such as oak, walnut, and mahogany, further enhances its popularity. Wood's sustainability and eco-friendliness have become significant selling points, as consumers increasingly prioritize environmentally responsible products. The high quality and craftsmanship associated with wooden furniture contribute to its enduring demand in the luxury furniture industry.

The metal segment is expected to grow at the fastest CAGR of 5.0% over the forecast period. Metal furniture is popular for its durability, strength, and modern aesthetic, making it an ideal choice for luxury settings. The versatility of metal allows for a wide range of innovative and intricate designs, which appeal to consumers looking for unique and contemporary pieces. Additionally, advancements in manufacturing techniques have enabled the production of high-quality metal furniture that can withstand wear and tear while maintaining a sophisticated appearance. The growing trend towards industrial and minimalist interior designs has also boosted the demand for metal furniture.

End-use Insights

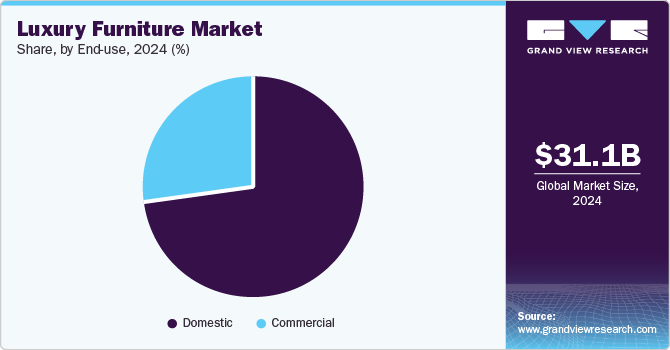

Domestic dominated the market with the largest revenue share in 2024 owing to the rising demand for high-quality, bespoke furniture that enhances home interiors. Consumers are increasingly investing in luxury furniture to create personalized and stylish living spaces that reflect their individual tastes and preferences. The growing trend of home renovation and interior design projects has further boosted the demand for domestic luxury furniture. Additionally, the availability of a wide range of customization options, allowing consumers to select materials, finishes, and designs that align with their aesthetic preferences, has contributed to this segment's growth. Social media and home décor influencers have also played a significant role in driving consumer interest and spending on luxury furniture for domestic use.

Commercial is expected to grow significantly over the forecast period owing to the increasing demand for high-quality furniture in hospitality, office spaces, and retail environments. Businesses are investing in luxury furniture to create sophisticated and comfortable spaces that enhance customer experience and employee satisfaction. The rise of co-working spaces and luxury hotels also contributes to this trend, as these establishments seek to provide premium amenities and aesthetics. Additionally, the growing emphasis on corporate branding and the desire to create unique, memorable environments further fuel the demand for luxury commercial furniture.

Regional Insights

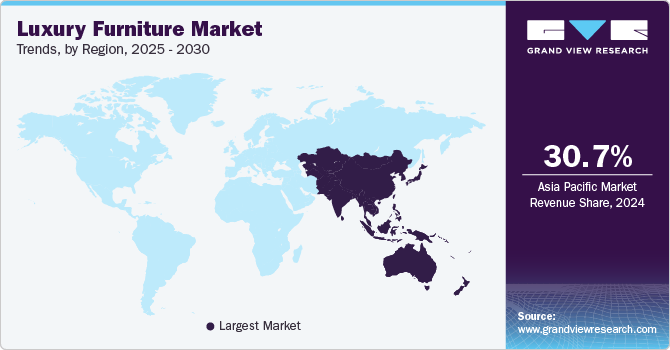

Asia Pacific luxury furniture market dominated the global market with the largest revenue share of 30.7% in 2024. This dominance is attributed to the region's burgeoning middle class and rising disposable incomes, which has led to an increased demand for high-end, luxury furnishings. Urbanization and the development of modern living spaces have further fueled the market, as consumers seek stylish and sophisticated furniture to enhance their homes and offices. Additionally, the influence of international design trends and a growing appreciation for unique, high-quality craftsmanship have boosted the luxury furniture sector in Asia Pacific. The expansion of e-commerce and improved logistics have also made luxury furniture more accessible to a wider audience in the region.

Europe Luxury Furniture Market Trends

Europe's luxury furniture industry was identified as a lucrative region in 2024. Consumers in Europe are allocating a larger portion of their disposable income to high-end furniture, driven by urbanization, real estate growth, and economic stability. The market is also seeing a rise in e-commerce, transforming the traditional dynamics of the luxury furniture industry

North America Luxury Furniture Market Trends

North America luxury furniture market is expected to grow significantly with a CAGR of 4.3% over the forecast period. The region's economic growth and rising real estate sector are key drivers of this market. Consumers are leaning towards environmentally friendly furniture, and online sales are becoming increasingly popular due to their convenience and variety. The market is segmented by material, with wood being the most popular choice for its natural aesthetic appeal.

U.S. Luxury Furniture Market Trends

The U.S. luxury furniture market is expected to grow significantly over the forecast period owing to the rising consumer spending power and a growing demand for high-quality, eco-friendly furniture. Consumers are increasingly seeking handcrafted, authentic pieces that add a unique touch to their homes. The market is also witnessing a trend towards multifunctional furniture and using metals such as brass and blackened metals in designs. Online retailing is becoming a significant channel, offering convenience and a wider range of options, which is expected to drive market growth.

Key Luxury Furniture Company Insights

Some key companies in the luxury furniture market include Duresta, Mobelcenter, Valderamobili, Giovanni Visentin, SCAVOLINI S.P.A, and others.

-

Duresta has built a luxury furniture industry name that blends classic English style with contemporary design elements. Their offerings include a wide range of sofas, chairs, and other upholstered furniture, all handmade in Nottinghamshire, England. Duresta's furniture is crafted using premium materials such as velvet, leather, and wool, ensuring both comfort and durability.

-

Mobelcenter is known for its innovative designs and use of premium materials, catering to the tastes of discerning consumers. Mobelcenter's product line includes luxurious sofas, chairs, tables, and cabinets, all designed to enhance the aesthetic appeal of any space.

Key Luxury Furniture Companies:

The following are the leading companies in the luxury furniture market. These companies collectively hold the largest market share and dictate industry trends.

- Duresta

- Mobelcenter

- Valderamobili

- Giovanni Visentin

- SCAVOLINI S.P.A.

- LAURA ASHLEY HOLDINGS PLC

- Iola Modern

- Nella Vetrina

- Henredon

Recent Developments

-

In November 2024, Indian luxury furniture brand DIVIANA inaugurated its first showroom in Milan's prestigious Montenapoleone Fashion District, marking a significant step in its EUR50 Million European expansion. This 3,200-square-foot space showcases DIVIANA's commitment to blending traditional craftsmanship with modern design.

-

In October 2024, Pepperfry, a leading e-commerce platform for furniture and home decor, launched a luxury segment featuring over 650 furniture items and over 1,000 home decor products from renowned brands such as Freedom Tree and Jaipur Rugs.

-

In May 2024, Remax Furnitures celebrated the grand opening of its flagship store, showcasing an exquisite selection of customizable furniture. This milestone event emphasizes the brand's commitment to innovative interior design, offering customers an immersive experience in transforming their living spaces.

-

In April 2024, Luxury Living Group and Bugatti unveiled a remarkable exhibition at Palazzo Chiesa’s gardens in Corso Venezia, showcasing the latest evolution of their design philosophy.

Luxury Furniture Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 32.34 billion

Revenue forecast in 2030

USD 39.79 billion

Growth rate

CAGR of 4.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; South Africa

Key companies profiled

Duresta; Mobelcenter; Valderamobili; Giovanni Visentin; SCAVOLINI S.P.A.; LAURA ASHLEY HOLDINGS PLC; Iola Modern; Nella Vetrina; Henredon

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Luxury Furniture Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global luxury furniture market report based on material, end-use, and region:

-

By Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wood

-

Metal

-

Glass

-

Leather

-

Plastic

-

Others

-

-

By End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Domestic

-

Living & Bedroom

-

Kitchen

-

Lighting

-

Outdoor

-

Bathroom

-

-

Commercial

-

Hospitality

-

Office

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."