- Home

- »

- Beauty & Personal Care

- »

-

Luxury Perfume Market Size, Share & Trends Report, 2030GVR Report cover

![Luxury Perfume Market Size, Share & Trends Report]()

Luxury Perfume Market (2025 - 2030) Size, Share & Trends Analysis Report By End Use (Women, Men, Unisex), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-406-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Luxury Perfume Market Summary

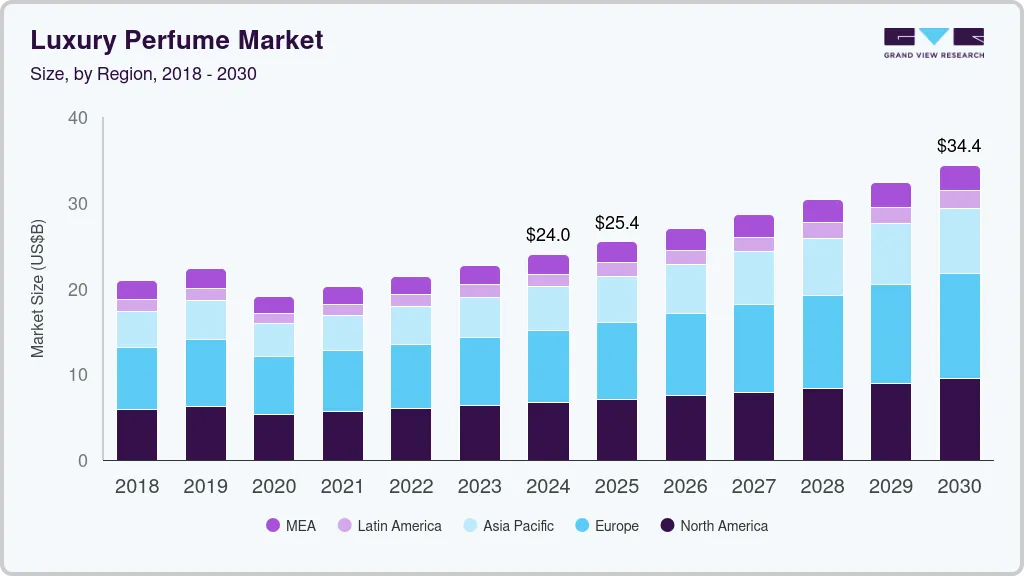

The global luxury perfume market size was estimated at USD 23.99 billion in 2024 and is projected to reach USD 34.39 billion by 2030, growing at a CAGR of 6.2% from 2025 to 2030. The demand for high-end and premium perfumes is experiencing significant growth, driven by a combination of evolving consumer preferences and market dynamics.

Key Market Trends & Insights

- The luxury perfume market in North America accounted for a market share of around 27% in 2023 in the global market.

- The U.S. luxury perfume market accounted for a market share of around 82% in 2023 in the North American market.

- By end use, women segment in luxury perfume market accounted for a share of over 62% in 2023.

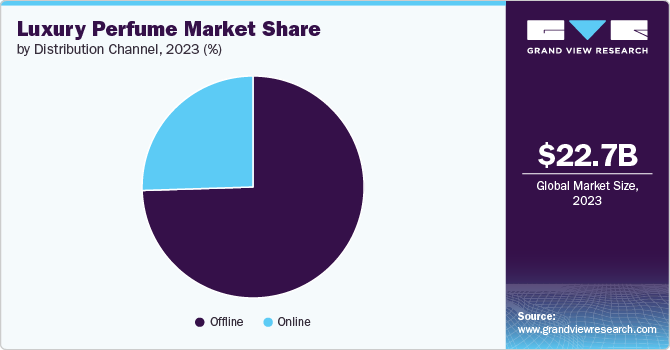

- By distribution channel, Offline channels segment accounted for a market share of 74% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 23.99 Billion

- 2030 Projected Market Size: USD 34.39 Billion

- CAGR (2025-2030): 6.2%

- North America: Largest market in 2023

High-end fragrance sales have surged globally. Brands such as Gucci, Hugo Boss, and Calvin Klein, produced by companies like Coty Inc., have seen a noticeable uptick in sales, reflecting a broader trend where consumers are increasingly viewing perfumes as essential components of their daily self-care routines. The pandemic has played a crucial role in this trend, as consumers sought accessible luxuries to uplift their spirits during lockdowns. Perfumes, unlike high-end handbags, could be enjoyed daily even within the confines of their homes. This behavior has persisted beyond the pandemic, with more shoppers purchasing fragrances as part of their personal-care rituals.Retailers like Sephora have capitalized on this trend, with expectations for their luxury fragrance business to nearly double in the coming years. Furthermore, the potential for growth in markets like China, where only a small fraction of the population currently wears fragrance, presents a significant opportunity for brands to expand their reach and sustain the momentum in high-end perfume demand.In 2023, the market has seen significant activity from major brands, underscoring the sector's attractiveness and potential. Notably, Spanish group Puig acquired a majority stake in Byredo for nearly USD 1 billion, while Kering purchased the fragrance label Creed for USD 3.5 billion. LVMH's fragrance and cosmetics division experienced a 13% growth in the first half of 2023 compared to 2022, surpassing USD 4 billion in sales. This success is largely driven by the high demand for Christian Dior perfumes, including iconic fragrances like J’adore, Miss Dior, and Sauvage—the latter now being the world’s leading fragrance. LVMH's focus on a selective distribution strategy and substantial marketing investments in exclusive retail activations have been key factors behind this impressive performance.

Product launches are significantly driving the market, with fragrance manufacturers heavily investing in high-end scents to introduce novelty and attract diverse demographics. Inter Parfums, for instance, launched nine new fragrances in the first half of 2023, including Kate Spade Chérie, Jimmy Choo Rose Passion, Rochas Girl Life, Coach Love and Green, Moncler Collection, and Mont Blanc Explorer Platinum. These launches have bolstered brand growth by appealing to a broader audience and maintaining consumer interest. By continuously introducing fresh, enticing scents, manufacturers are not only sustaining but also expanding their market presence in the competitive luxury perfume industry.

Consumer behavior for luxury perfumes is increasingly geared towards premiumization and mass adoption of high-end brands, as consumers view fragrances as an accessible entryway to luxury. COTY, a leading beauty conglomerate, observed accelerated consumer demand for prestige fragrances, which grew from high-single-digit to mid-teens growth, driven by structural changes in consumer behavior. This surge is evidenced by rising volumes and values, indicating increased category penetration and consumer usage.

End Use Insights

In the market perfumes for women accounted for a share of over 62% in 2023. Women’s perfumes in the luxury market are prominent due to their association with status, branding, and sophisticated marketing. These high-end scents symbolize affluence and refinement, reflecting personal taste and social standing. Additionally, the allure of renowned fragrance houses, celebrity endorsements, and compelling advertising campaigns enhance their desirability, making them coveted symbols of luxury and aspiration.

The rising demand for women's luxury perfumes is exemplified by Coty's success with Burberry Goddess, a fragrance that has set new sales targets in key markets since its launch in August 2023. This strong performance, highlighted by a notable increase in Coty's sales outlook for 2024, underscores the growing consumer inclination towards high-end fragrances.

Demand for luxury perfumes for men is set to expand at a CAGR of about 6.6% in the forecast period from 2024 to 2030. The demand for luxury perfumes among men is set to rise significantly, driven by Gen Z's increasing interest in high-end fragrances. According to Piper Sandler's teen spending report 2023, male teens have boosted their spending on perfumes by 26% in just one year, favoring sophisticated and extravagant scents from brands like Jean Paul Gaultier, Valentino, and Dior's Sauvage. This trend reflects a shift towards viewing perfumes as an integral part of personal identity and self-expression.

Distribution Channel Insights

The sales of luxury perfume through offline channels accounted for a market share of 74% in 2023.Offline shopping for luxury perfumes is mostly preferred due to the rich sensory experience it offers. Customers can physically sample and smell fragrances, gaining a true sense of each scent's character and how it interacts with their skin. The expert guidance available from trained staff enhances the shopping experience, while the immediate gratification and peace of mind from avoiding shipping issues make in-store purchases especially appealing.

Diptyque is leveraging immersive retail through its new Maison Diptyque concept which opened in May 2024, a 4,300-square-foot store in London that combines shopping with cultural and community experiences. The store features a fragrance library, gallery, workshop space, and a Parisian-style dining experience, creating a holistic brand universe to enhance customer engagement and drive sales.

Online sales of luxury perfume are expected to grow at a CAGR of 6.8% from 2024 to 2030.The global growth of online luxury perfume brands is accelerating, driven by the convenience and accessibility of e-commerce platforms. Brands like EZE Fine Perfumes, launched by Sawai Fragrances, are tapping into this trend by offering high-quality fragrances directly to consumers through online marketplaces like Amazon and Flipkart. This shift is facilitated by sophisticated digital marketing campaigns that resonate with younger audiences, emphasizing individuality and self-expression. As more consumers turn to online shopping for their luxury needs, the demand for premium perfumes through online channels is poised to grow significantly, enhancing the global footprint of these brands.

Regional Insights

The luxury perfume market in North America accounted for a market share of around 27% in 2023 in the global market. The demand for luxury perfumes in North America has surged, evidenced by the stellar performance of prestige fragrance brands. InterParfums, a leading fragrance company, experienced remarkable growth in this sector, with a 50% sales increase in North America in 2022 compared to 2019. Customer preferences for more expensive, highly concentrated fragrances, including parfums and eau de parfums, which increased by three share points in 2023, are in favor of this trend. Additionally, Americans are gravitating towards prestigious brands like Chanel, Dior, and Tom Ford, moving away from the concept of a single "signature scent" to a more diverse aromatic palette that allows for greater self-expression.

U.S. Luxury Perfume Market Trends

The U.S. luxury perfume market accounted for a market share of around 82% in 2023 in the North American market. The fragrance industry's adept storytelling has captivated consumers, leading to increased purchases directly from brands without relying on traditional retail and advertising channels. This direct-to-consumer trend, which gained momentum during the pandemic, has been particularly embraced by indie fragrance brands looking to cultivate a loyal community of fragrance enthusiasts. The post-Covid environment has further fueled this demand, with consumers engaging in pent-up shopping sprees. Wider access to a variety of fragrance products has also played a significant role, providing consumers with more options to explore and indulge in high-end scents.

Asia Pacific Luxury Perfume Market Trends

The luxury perfume market in Asia Pacific is anticipated to rise at a CAGR of about 6.9% from 2024 to 2030. This is due to an increasing preference for "Eastern" scent notes among consumers, particularly in China. The mental health impacts of the COVID-19 pandemic have driven young consumers to seek scented-based remedies, boosting the fragrance market. Local brands like Documents and To Summer are capitalizing on unique oriental ingredients, while international giants like L’Oreal are investing in these homegrown brands to tap into the evolving market. This shift towards niche and culturally resonant fragrances highlights the region's growing "smell economy."

Key Luxury Perfume Company Insights

The market is fragmented. Many brands have identified untapped opportunities within their product lines and are taking steps to address these market gaps. This often involves developing new products, acquiring investments, or making strategic acquisitions to meet consumer needs and preferences better.

In May 2024, for instance, Matière Première, a French niche fragrance brand, secured additional funding with Kering Beauté acquiring a minority stake to enhance its online and e-commerce presence. The brand plans to open 20 standalone stores across the UK, U.S., Germany, France, the Middle East, and China. Known for using ingredients sourced from Guichard’s farm in Grasse, the brand also offers hair perfumes and hand and body creams.

Key Luxury Perfume Companies:

The following are the leading companies in the luxury perfume market. These companies collectively hold the largest market share and dictate industry trends.

- CHANEL

- Coty Inc.

- LVMH Moet Hennessy-Louis Vuitton

- The Estée Lauder Companies

- Puig

- L'Oréal Groupe

- Hermès

- Kering

- Prada Holding S.P.A.

- Ralph Lauren Corporation

Recent Developments

-

In June 2024, CHANELcelebrated over a century of its iconic No. 5 with a limited-edition collectible: the Chanel No. 5 L’Eau Drop. Priced at USD 188, this unique bottle, inspired by Marilyn Monroe’s famed quote about the perfume, features a fresh twist on the classic scent. The L’Eau variant offers a lighter, citrus-infused take on the original fragrance, blending timeless floral notes with a modern touch.

-

In May 2024, Coty Inc. and Marni announced a groundbreaking licensing agreement to create a new line of fragrances and beauty products, with the first launch set for 2026. This long-term partnership aims to merge Marni's artistic fashion sensibility with Coty's expertise in luxury beauty, strengthening Coty’s position in the high-end fragrance market.

-

In February 2024, Hermès launched Oud Alezan, a new addition to its Hermessence collection. The fragrance blends earthy oud with rose water and rose oxide. Priced at USD 371, It offers a unique and luxurious scent profile and is available in three sizes.

Luxury Perfume Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 25.43 billion

Revenue forecast in 2030

USD 34.39 billion

Growth rate

CAGR of 6.2% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End use, distribution channel, regional

Regional scope

North America; Europe; Asia Pacific; Central & South America; & Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

CHANEL; Coty Inc.; LVMH Moet Hennessy-Louis Vuitton; The Estée Lauder Companies; Puig; L'Oréal Groupe; Hermès; Kering; Prada Holding S.P.A.; Ralph Lauren Corporation

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Luxury Perfume Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the luxury perfume market report based on end use, distribution channel, and region.

-

End Use Outlook (Revenue, USD Billion; 2018 - 2030)

-

Women

-

Men

-

Unisex

-

-

Distribution Channel Outlook (Revenue, USD Billion; 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. Key players in the luxury perfume market are CHANEL, Coty Inc., LVMH Moet Hennessy-Louis Vuitton, The Estée Lauder Companies, Puig, L'Oréal Groupe, Hermès, Kering, Prada Holding S.P.A., Ralph Lauren Corporation.

b. Key factors that are driving the luxury perfume market growth include brand prestige, high-quality ingredients, innovative marketing, and the influence of celebrity endorsements.

b. The global luxury perfume market was estimated at USD 22.65 billion in 2023 and is expected to reach USD 23.99 billion in 2024.

b. The global luxury perfume market is expected to grow at a compound annual growth rate of 6.2% from 2023 to 2030 to reach USD 34.39 billion by 2030.

b. Europe dominated the luxury perfume market with a share of around 35% in 2023. This is due to its rich heritage of craftsmanship, high-quality ingredients, and renowned fragrance houses.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.