- Home

- »

- Pharmaceuticals

- »

-

Malignant Glioma Therapeutics Market Size Report, 2030GVR Report cover

![Malignant Glioma Therapeutics Market Size, Share & Trends Report]()

Malignant Glioma Therapeutics Market Size, Share & Trends Analysis Report, By Type Of Disease (Glioblastoma Multiforme, Anaplastic Astrocytoma), By Therapy, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-170-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

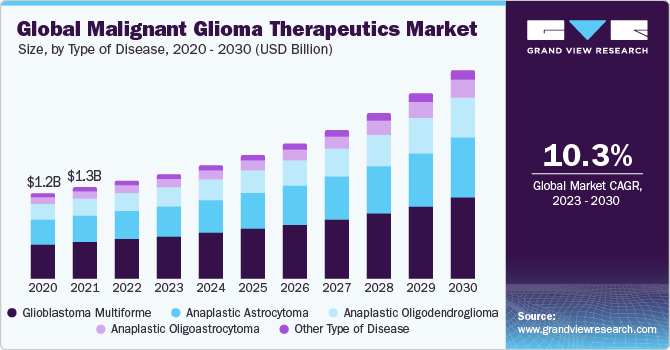

The global malignant glioma therapeutics market size was valued at USD 1.40 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 10.26% from 2023 to 2030. This is attributed to the rising incidence of brain tumor, the increasing number of research & development in the oncology fields, and growing advancements in medical technology such as radiosurgery & minimally invasive surgical techniques. Moreover, the increasing healthcare expenditures and growing collaborations among research institutes are anticipated to further fuel the growth of the market from 2023 to 2030.

According to the 2022 article from the Canadian Cancer Society, an estimated 3,200 Canadians were projected to receive diagnoses of brain and spinal cord cancer in 2022. Similarly, according to the 2022 report from the Australian Institute of Health and Welfare, the age-specific frequency rate for brain cancer in 2022 was estimated to be 6.4 cases per 100,000 individuals, with rates of 4.8 for females and 8.1 for males.

The increasing number of investments for research and growing engagements of government organizations are further expected to fuel the growth of the market. In October 2022, the Australian Government allocated over USD 5.4 million in funding for brain cancer research, sourced from the Medical Research Future Fund (MRFF). Furthermore, in September 2021, the Glioblastoma Therapeutics Network (GTN), funded by the National Cancer Institute (NCI), indicated active collaboration in the pursuit of advancing novel treatments for malignant gliomas. Thus, anticipated to propel the expansion of the market.

Type of Disease Insights

Based on the type of disease, the market is segmented into anaplastic astrocytoma, glioblastoma multiforme, anaplastic oligodendroglioma, and other types of disease. The glioblastoma multiforme segment held the largest market share in 2022. The prevalence and incidence of glioblastoma multiforme is a primary factor contributing to the market growth.

Anaplastic astrocytoma is projected to grow at the fastest CAGR from 2023 to 2030. The growing advancements in understanding the molecular and genetic foundations of anaplastic astrocytoma have impelled the improvement of targeted therapies, thus holding promising outcomes for the patient.

Therapy Insights

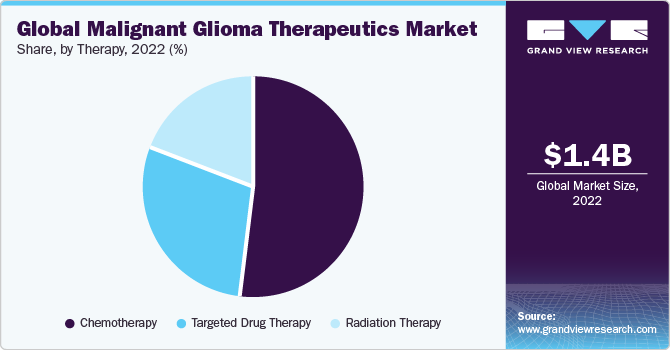

Based on therapy, the malignant glioma therapeutics market is segmented into chemotherapy, targeted drug therapy, and radiation therapy. The chemotherapy segment held the largest market share in 2022. The segment is further segmented into temozolomide, bevacizumab, carmustine, and other types of chemotherapy. Chemotherapy is a widely utilized treatment option for malignant gliomas, including glioblastoma multiforme and anaplastic astrocytoma. Chemotherapeutic agents, often directed orally or intravenously, which is used to inhibit the rapid growth of cancer cells by interfering with their division and replication processes. Temozolomide, an oral chemotherapy drug, has been one of the important drugs in the treatment of glioblastoma.

Regional Insights

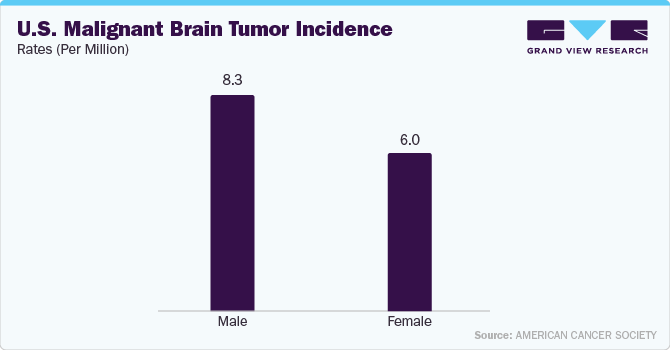

North America dominated the market in 2022 owing to the high prevalence of malignant glioma, the presence of significant funding & increased healthcare expenditure, the presence of well-established healthcare infrastructure, and the increasing number of research related to brain tumor. According to the January 2023 article by the American Cancer Society (ACS), it is estimated that approximately 24.8 thousand novel cases of brain and spinal cord tumors will be reported in the U.S., encompassing both adults and children, that is, nearly 14,280 cases in males and 10,530 cases in females. In addition, among these tumors, the most common and malignant ones rising from glial cells are glioblastomas (GBM). Furthermore, according to the 2022 data by the Brain Tumour Registry of Canada, an incidence rate of 4 cases of glioblastoma (GB) per 100,000 people in Canada is being reported. On the other hand, Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period. This is due to the increasing healthcare expenditure, a rising prevalence of brain tumor, and increasing adoption of advanced technology in healthcare facilities.

Key Companies & Market Share Insights

Key players operating in the market are F. Hoffmann-La Roche Ltd, Bio-Rad Laboratories, Merck & Co. Inc., Bristol-Myers Squibb Company, and Azurity Pharmaceuticals, Inc. The market participants are constantly working towards new product development, R&D activities, and other strategic alliances to gain new market avenues.

The following are some instances of strategic initiatives:

-

In January 2023, Stanford University entered into a collaboration with an investment firm, The Invus Group, to work together on advancing treatments for glioblastoma. This partnership is expected to facilitate the research and development of medications designed for treating glioblastoma.

-

In March 2022, The Ivy Brain Tumor Center, a U.S.-based Barrow Neurological Institute, initiated a clinical trial evaluating AstraZeneca’s AZD1390 in patients with frequent grade IV glioma.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."