- Home

- »

- Conventional Energy

- »

-

Managed Pressure Drilling Services Market Size Report 2030GVR Report cover

![Managed Pressure Drilling Services Market Size, Share & Trends Report]()

Managed Pressure Drilling Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (MCD, CBHP, DGD, RFCD), By Application (Onshore, Offshore), By Region, And Segment Forecasts

- Report ID: 978-1-68038-889-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Managed Pressure Drilling Services Market Summary

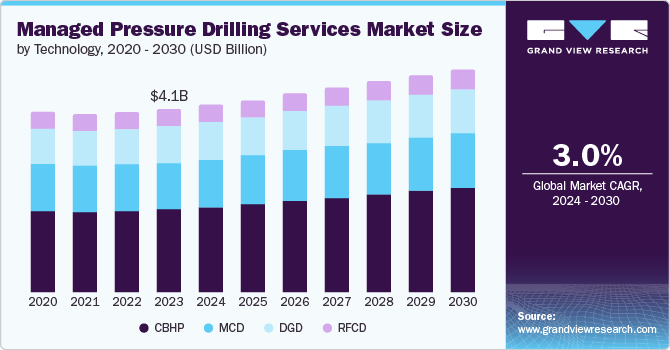

The managed pressure drilling services market size was valued at USD 4.08 billion in 2023 and is projected to reach USD 4.97 billion by 2030, growing at a CAGR of 3.0% from 2024 to 2030. The increasing demand for oil and gas, coupled with the need for optimal extraction, has led to the adoption of technologically advanced drilling techniques, including managed pressure drilling.

Key Market Trends & Insights

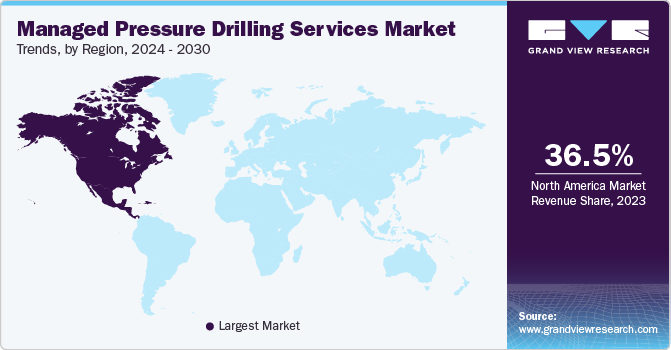

- North America dominated the MPD services market in 2023.

- The U.S. held a 72.2% revenue share of the North American market in 2023.

- By technology, CBHP technology segment accounted for the largest market revenue share of 44.9% in 2023.

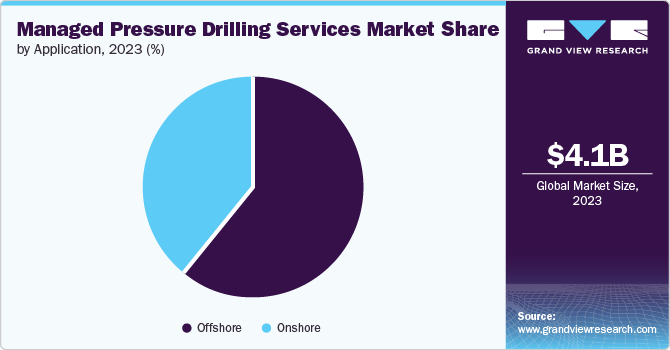

- By application, offshore segment dominated the market and accounted for a share of 60.9% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 4.08 Billion

- 2030 Projected Market Size: USD 4.97 Billion

- CAGR (2024-2030): 3.0%

- North America: Largest market in 2023

Furthermore, the growing exploration activities in unconventional resources and offshore fields have necessitated the use of managed pressure drilling (MPD) services. The need for safer and cost-effective drilling operations is another significant factor contributing to the market growth. The ongoing technological advancements and innovations in drilling services are also expected to propel the market further in the coming years.

The managed pressure drilling services industry is experiencing a significant transformation due to technological advancements. The development of enhanced sensors and real-time data analysis tools has been instrumental in driving the industry forward. These advancements have facilitated the creation of sophisticated well control mechanisms, which are becoming increasingly vital in the face of the growing complexity of drilling operations. In particular, ultra-deepwater and deepwater explorations, which present unique challenges, have greatly benefited from these technological innovations.

Governments worldwide are making substantial investments in the exploration of new oil and gas reserves. These investments have led to the initiation of numerous projects in various regions, thereby increasing the demand for MPD and other drilling equipment. This surge in demand is contributing significantly to the market's growth.

The market is characterized by intense competition, spurred by enhanced R&D activities and the development of advanced MPD solutions. This competitive landscape has led to a wave of collaborations, partnerships, and mergers and acquisitions among companies. These strategic alliances allow companies to adapt to changing market scenarios and gain a competitive edge, thereby shaping the market and driving its growth.

Technology Insights

CBHP technology accounted for the largest market revenue share of 44.9% in 2023 and is also expected to grow at the fastest CAGR over the forecast period. The factors attributed to this growth are the heavy utilization of this technology in the U.S., Gulf of Mexico, and other parts of the world for offshore drilling. This widespread use is a testament to the technology’s effectiveness in maintaining constant Bottom Hole Pressure (BHP) while drilling through varying pore pressure gradients. The ability to maintain constant BHP is crucial in preventing formation damage and ensuring safe drilling operations, especially in complex drilling environments.

MCD technology is anticipated to witness a growth of 2.3% from 2024 to 2030. The driving forces behind this growth are the numerous advantages offered by this technology, including increased drilling depth, faster drilling speed compared to alternatives, and well-controlled drilling. MCD technology, a dual-gradient drilling technique, is particularly effective in drilling operations where conventional methods are ineffective or risky, such as in depleted reservoirs or formations with narrow pressure windows. Furthermore, the ability of MCD technology to reduce drilling costs and hazards has increased its demand, significantly contributing to market growth.

Application Insights

Offshore dominated the market and accounted for a share of 60.9% in 2023. This dominance can be attributed to the increasing exploration and production activities in offshore reserves worldwide. Offshore drilling presents unique challenges, such as high-pressure and high-temperature conditions, which necessitate the use of advanced drilling techniques like MPD. Furthermore, the discovery of new offshore reserves, particularly in regions like the Gulf of Mexico and the North Sea, has led to an increased demand for these services.

Onshore application is expected to grow at a CAGR of 2.5% from 2024 to 2030. Heavy usage of CBHP techniques with heavy usage of shale oil production, and an increasing number of unconventional resources increasing the demand. These are the driving forces growing the market.

Regional Insights

North America dominated the MPD services market in 2023. This growth can be attributed to increasing onshore drilling activities, particularly in unconventional reserves like shale and tar sands. Onshore drilling operations often involve drilling through complex geological formations, which requires the use of MPD techniques to maintain well control and prevent formation damage. Additionally, the push towards energy independence in various countries has led to an increase in onshore drilling activities, thereby driving the growth of this segment.

U.S. Managed Pressure Drilling Services Market Trends

The U.S. held a 72.2% revenue share of the North American market in 2023 owing to the increasing exploration activities, and projects focused on shale gas, which necessitate the use of managed pressure drilling equipment. Shale gas exploration presents unique challenges that require advanced drilling techniques, and MPD services are well-equipped to meet these demands. Furthermore, according to the U.S. Energy Information Administration, shale gas is projected to constitute half of the U.S. domestic gas supply by 2025. This forecast indicates a promising future for the U.S. managed pressure drilling services market, driven by the growing importance of shale gas in the country's energy landscape.

Europe Managed Pressure Drilling Services Market Trends

Europe managed pressure drilling services market was identified as a lucrative region in 2023. This expansion is primarily driven by the increasing focus on onshore drilling activities for oil extraction within the region.

The MPD services market in the UK is anticipated to experience significant growth in the forthcoming years. This upsurge is primarily driven by the demand for enhanced drilling efficiency and safety. Operators in the UK Continental Shelf (UKCS) are increasingly seeking MPD solutions to optimize wellbore stability, improve well control, and mitigate risks associated with conventional drilling methods. This translates to cost reductions and improved project economics, ultimately propelling market expansion.

Asia Pacific Managed Pressure Drilling Services Market Trends

Asia Pacific managed pressure drilling services market is anticipated to witness significant growth. This surge is driven by several key factors, including rising energy demands, supportive government regulations, advancements in drilling technology, and a growing focus on operational safety. These combined elements are creating a robust environment for the adoption of managed pressure drilling services throughout the region.

The managed pressure drilling services market in China held a substantial market share in 2023. This growth can be attributed to favorable market expansion opportunities within China's industrial sector. These opportunities spurred technological advancements and the adoption of cost-effective MPD techniques, ultimately driving market demand and expansion.

Key Managed Pressure Drilling Services Company Insights

Some of the key companies in the global managed pressure drilling services market include Maersk, Aker Solutions, Baker Hughes, and many more. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

Key MPD Services Companies:

The following are the leading companies in the managed pressure drilling services market. These companies collectively hold the largest market share and dictate industry trends.

- Baker Hughes Company

- Halliburton

- SABIC

- SLB

- Weatherford

- NOV

- ADC Services

- Salos Sunesis Limited

- Stena Drilling Ltd

- Aker Solutions

- A.P. Moller - Maersk

- Enhanced Drilling

Recent Developments

-

In April 2024, Halliburton secured a deepwater multi-well construction contract with Rhino Resources Ltd. for exploration and appraisal in Namibia's Orange Basin. This strategic partnership is expected to leverage Halliburton's expertise to maximize asset value for Rhino.

-

In March 2024, Schlumberger (SLB) entered into a definitive agreement to acquire a majority ownership stake in Aker Carbon Capture (ACC). This combined entity is expected to accelerate the commercialization of cost-effective carbon capture solutions, driving progress toward large-scale industrial decarbonization.

Global Managed Pressure Drilling Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.18 billion

Revenue forecast in 2030

USD 4.97 billion

Growth rate

CAGR of 3.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Technology, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Norway, Russia, China, India, Australia, Malaysia, Brazil, Argentina, Saudi Arabia, UAE, Kuwait

Key companies profiled

Baker Hughes Company; Halliburton; SABIC; SLB; Weatherford; NOV; ADC Services; Salos Sunesis Limited; Stena Drilling Ltd; Aker Solutions; A.P. Moller - Maersk; Enhanced Drilling

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Managed Pressure Drilling Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global managed pressure drilling services market report based on technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

MCD

-

CBHP

-

DGD

-

RFCD

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Norway

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Australia

-

Malaysia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.