- Home

- »

- Next Generation Technologies

- »

-

Manufacturing Operations Management Software Market Report, 2030GVR Report cover

![Manufacturing Operations Management Software Market Size, Share & Trends Report]()

Manufacturing Operations Management Software Market Size, Share & Trends Analysis Report By Component, By Deployment, By Enterprise Size, By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-031-5

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Report Overview

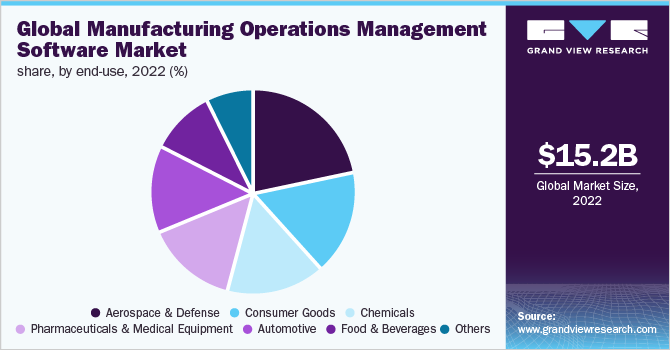

The global manufacturing operations management software market size was evaluated at USD 15.24 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 12.9% from 2023 to 2030. The market growth can be attributed to the rising demand for tracking and monitoring manufacturing operations in real-time networks and the growing demand for industry 4.0 is offering exponential growth opportunities for all business sizes across the globe. The COVID-19 pandemic has affected the global supply chain with strict lockdown and social distancing regulations. During COVID-19 When the whole traditional manufacturing operations management systems became ineffective technology played a big role in streamlining the whole process of manufacturing operations by integrating real-time data along with superior technological tools such as advanced analytics, machine learning, AI, cloud technologies, and others. Thus, it promotes automation and digitization of processes, and manufacturing operations, and increases organizational efficiency.

Industry 4.0 focuses on automation, machine learning, real-time data, and the interconnectivity of networks. The 4.0 technology is transforming manufacturing capabilities by integrating digital technologies along with data, helping organizations in creating connected enterprises network to bring intelligent outcomes in the physical world. For instance, on April 2021, AVEVA, a leading industrial software, and manufacturing operations management software company, partnered strategically with PlanetTogether, a leading advanced planning & scheduling platform provider.

PlanetTogether helps organizations expand, optimize, and digitally transform manufacturing processes and deliver sustainable solutions across their operation cycle. The partnership aims to bring robust capabilities to AVEVA’s Manufacturing Execution System (MES), such as visual planning and scheduling, and multi-plant production planning and schedule optimization. Further, it is also expected to expand AVEVA’s portfolio in the industry of 4.0 manufacturing and solutions. Thus, the rising adoption of industry 4.0 is expected to drive the MOM software market during the forecast period.

Governments across the world are launching industry 4.0 initiatives to promote technological advancements in the industrial manufacturing processes. For instance, the European Union and the German government launched strategic initiatives named industry 4.0 to support digital technologies and promote R&D activities in SMEs and traditional manufacturing industries. Thus, the growing government initiative towards smart manufacturing operations processes and industry 4.0 is likely to accelerate the market’s growth.

The growing implementation of advanced technological solutions across the manufacturing processes helps organizations in improving production efficiency, streamline processes, and increase time to market. Organizations are taking strategic partnership, merger, and acquisition decisions for expanding their capabilities of offering robust manufacturing operations management software to customers. For instance, in September 2021, Rockwell Automation, Inc. acquired Plex Systems, a leading cloud-based smart manufacturing platform.

Plex Systems helps organizations to track, connect, analyze, and automate operations across the supply chain it offers advanced manufacturing execution systems and supply chain management capabilities to the organizations. The acquisition of Rockwell Automation, Inc. and Plex Systems aims to strengthen Rockwell Automation’s existing strategies by bringing connected enterprises to life and navigating faster time to value its customers relying on cloud offerings. Thus, the following factor is expected to drive the demand for manufacturing operations management software across the region.

Manufacturing operations management software promotes ease of operations using data, advanced tools, and human intelligence, driving meaningful insights and supporting decision-making in organizations. Keeping this critical data confidential is becoming a challenge for organizations as growing technological and human interactions are also causing threats in terms of rising data theft, cyber-attacks, and privacy concerns can become a restraining factor for the market’s growth.

Organizations across the world are involved in launching advanced solutions with the latest technologies to minimize the risk of growing data safety concerns. For instance, in 2021, AVEVA announced the offering of its first SaaS solution with leading PI System operations. AVEVA’s Data Hub is a secure cloud-based hub for managing, combining, and sharing operations information securely within and outside the organizations to gain meaningful insights and strengthen operating performance.

Component Insights

The software segment accounted for the largest revenue share of 71.9% in 2022, attributable to the simplified decision-making process by enabling one single view of the whole process, the software removes the need of switching applications for gathering data. The software is more reliable and offers higher security, fast decision-making, reduces operational costs, and improves efficiency by managing all information on a single platform along with all necessary applications. All these factors are increasing the demand for the segment over the forecast period.

The services segment is anticipated to grow at a CAGR of 14.0% during the forecast period. Software as a Service (SaaS) offers the easier and simplified distribution of applications to customers over the internet. It offers greater flexibility in terms of usage and costs of applications as the user only needs to pay for the availed applications. The deployment and installation of SaaS are easier and take less time compared to the traditional deployment of software. These benefits of services will supplement the growth of the segment during the forecast period.

Deployment Insights

The on-premise segment accounted for a revenue share of 52.9% in 2022. The on-premise software offers greater security and data protection as the software is installed in the customer’s premises it also provides greater control over the applications and allows access to applications and data even when the internet disrupts. With regular updates and management of on-premise software, the safety and privacy of data are managed and it saves organizations from potential threats. These related benefits associated with on-premise deployment are expected to drive the growth of the segment over the forecast period.

The cloud segment is anticipated to grow at a CAGR of 14.6% during the forecast period as cloud-based manufacturing operations management software offers greater flexibility to organizations as it does not require any installations on users’ premises and these high-end applications can be avail based on a subscription model. It offers greater scalability, cost-effectiveness, and ease of access to the customers as these licenses can be extended based on the user’s requirements. These benefits offered by cloud deployment would further drive the segment growth during the forecast period.

Enterprise size Insights

The large enterprise segment accounted for the market share of 62.6% in 2022. Manufacturing operations management solutions have greater significance for large enterprises. The manufacturing operations management (MOM) software offers supply chain management, quality control, production management, unified operations management, etc. helps in increasing efficiency and ease of operations for large enterprises along with this it provides end-to-end tracking and monitoring of real-time data, analysis, and implementation of gathered results in the large enterprises for taking timely actions and potential decision making. Thus, the growing significance of MOM software in large enterprises is expected to drive the segment’s growth.

The Small & Medium Enterprises (SMEs) segment is expected to grow at the highest CAGR of 15.1%, during the forecast period, attributed to the rising implementation of manufacturing operations management software in the SMEs. MOM software helps SMEs in achieving growth and expanding capabilities with digitization and automation of manufacturing processes, streamlining operations, reducing lead time, meeting production deadlines, ensuring quality, and optimizing manufacturing capacity. The following benefits are strengthening the demand for MOM software in small & medium enterprises.

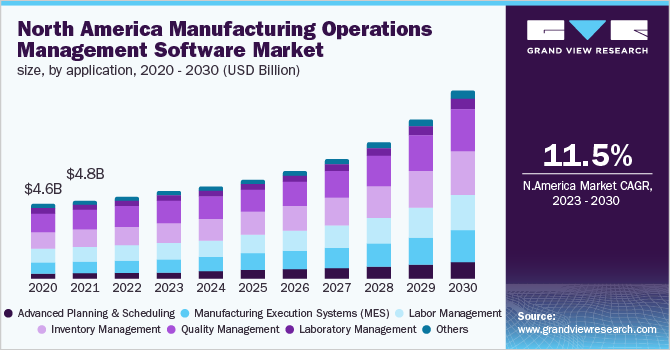

Application Insights

The quality management segment holds the largest market share of 25.0% in 2022. Efficient quality management solutions offer greater quality products, reduce wastage, and increase customer satisfaction. The manufacturing operations management software supports advanced planning, monitoring, and control processes and quality within the organizations. Thus, ensures continuous improvement, offers operational excellence and increases organizational efficiency. The following factor related to quality management is expected to lead the MOM software market during the forecast period.

The manufacturing execution system (MES) segment is anticipated to grow at a significant CAGR of 14.4% over the forecast period. The manufacturing execution system seamlines the production processes and tracks the entire product life cycle from raw material to finished goods. It evaluates the process and ensures the optimum utilization of applied resources. It standardizes processes and activities and offers higher product quality, increases profits, and reduces waste thus increasing the overall efficiency within the organization.

End-use Insights

The aerospace and defense segment accounted for the largest market share of over 21.9% in 2022. The aerospace and defense industry is involved in building cutting-edge platforms and systems with high-end performance goals. The advanced manufacturing operations management software helps the aerospace and defense industry in the continuous planning and execution of processes by integrating technical support, costs, and schedules in a fully planned and systematic manner and it is feasible for both commercial and government manufacturers of all sizes. Thus, these factors are expected to supplement the growth of the segment during the forecast period.

The automotive segment is anticipated to grow at a significant CAGR of 14.6% during the forecast period. Organizations are involved in building smart automotive manufacturing facilities by connecting people, technology, systems, and machines. For instance, in August 2022, Siemens made a strategic partnership with Nissan for installing a new production line for manufacturing an all-electric car segment named Nissan Ariya.

The company was already using the digital software portfolio offered by Siemens. The collaboration with bring technological advancement, zero-emission, automated, and digitalized production lines. Thus, the growing demand for digitization and automation of manufacturing and production line across the automotive industry is expected to drive segment growth during the forecast period.

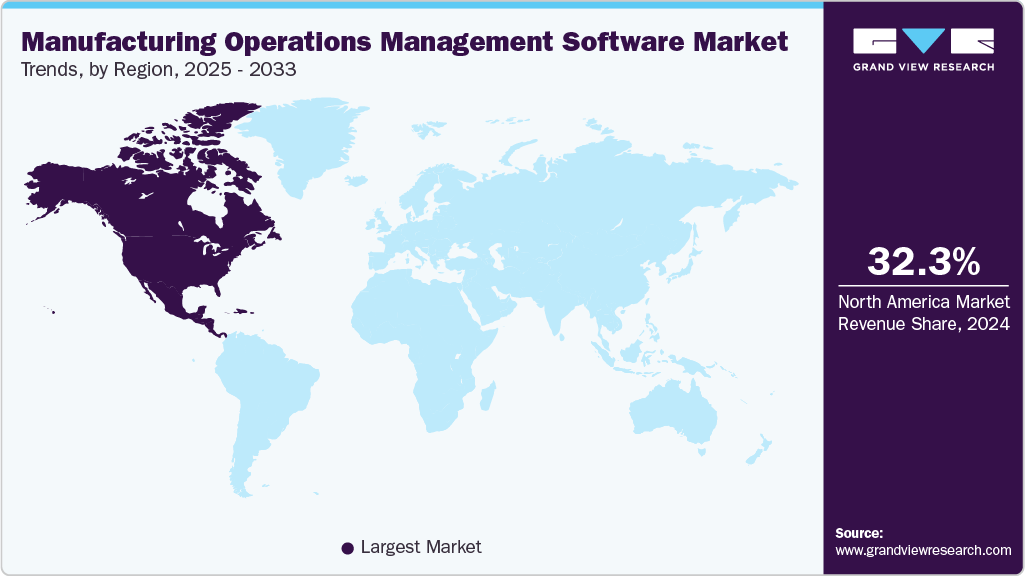

Regional Insights

North America held a major revenue share of 33.3% in 2022, owing to the presence of key manufacturers in the region offering advanced planning & scheduling, manufacturing execution systems, labor management, inventory management, quality management, performance analysis, and manufacturing intelligence, among others. North America has a high potential in programming and software solutions, attributable to automation and advancements in manufacturing operations across the region. Thus, it is positively leading the regional market growth.

The Asia Pacific is anticipated to rise as the fastest developing regional market at a CAGR of 14.8% during the forecast period, due to the rapid growth of the industrial sector in the region owing to the lower cost of operations, availability of resources, and the rising government support for establishing smart manufacturing facilities and industry 4.0 initiative is increasing the demand for manufacturing operations management software.

For instance, Smart Udyog Bharat 4.0 under the department of Heavy Industry & Public Enterprises is an initiative taken by the Indian government to promote digitization and automation in the manufacturing industry to create and facilitate an advanced technological ecosystem for Indian manufacturing units by the year 2025. Thus, the following factors are expected to fuel the development of the MOM software market during the forecast period.

Key Companies & Market Share Insights

The key players operating in the market include ABB Ltd.; AVEVA Group plc; Dassault Systèmes; Schneider Electric; SAP SE; Rockwell Automation, Inc.; and Siemens AG. Market players are observed to invest resources in research & development activities to support growth and enhance their internal business operations.

Companies can be seen engaging in mergers & acquisitions and partnerships to further upgrade their products and gain a competitive advantage. They are effectively working on new product development, and enhancement of existing products to acquire new customers and capture more market shares.

For instance, in October 2022, Siemens partnered with Hilscher for providing customers with a range of solutions for communication and exchanging data between machine and plant to bring efficiency and faster time to market with IOT enabled digitalized and technological advancements. Some prominent players in the global manufacturing operations management software market include:

-

ABB Ltd.

-

AVEVA Group plc

-

Dassault Systèmes

-

Epicor Software Corporation

-

GE DIGITAL

-

Honeywell International Inc

-

Rockwell Automation, Inc.

-

SAP SE

-

Schneider Electric

-

Siemens AG

Manufacturing Operations Management Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 16.25 billion

Revenue forecast in 2030

USD 37.94 billion

Growth Rate

CAGR of 12.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; China; India; Japan; Australia; Brazil; Mexico; UAE; Saudi Arabia

Key companies profiled

ABB Ltd.; AVEVA Group plc; Dassault Systèmes; Epicor Software Corporation; GE DIGITAL; Honeywell International Inc; Rockwell Automation, Inc.; SAP SE; Schneider Electric; Siemens AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Manufacturing Operations Management Software Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global manufacturing operations management software market report based on component, deployment, enterprise size, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprise

-

Small & Medium Enterprise

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Advanced Planning & Scheduling

-

Manufacturing Execution Systems (MES)

-

Labor Management

-

Inventory Management

-

Quality management

-

Laboratory Management

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Automotive

-

Pharmaceuticals & Medical Equipment

-

Chemicals

-

Food & Beverages

-

Consumer Goods

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global manufacturing operations management software market size was estimated at USD 15,249.4 million in 2022 and is expected to reach USD 16.25 billion in 2023.

b. The global manufacturing operations management software market is expected to witness a compound annual growth rate of 12.9% from 2023 to 2030 to reach USD 37.94 billion by 2030.

b. North America dominated the manufacturing operations management (MOM) software market with a share of around 33.0% in 2022. This is attributable to the shifting various manufacturing industries focus towards smart factory and presence of key market players offering extensive MOM software portfolio.

b. Some key players operating in the manufacturing operations management software market include ABB Ltd.: AVEVA Group plc,: Dassault Systèmes; Schneider Electric; SAP SE; Epicor Software Corporation; GE Digital; Rockwell Automation, Inc.; and Siemens AG.

b. The market growth can be attributed to the rising demand for tracking and monitoring manufacturing operations in real-time networks and the growing demand for industry 4.0 is offering exponential growth opportunities for all business sizes across the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."