- Home

- »

- Consumer F&B

- »

-

Maple Syrup Market Size, Share And Growth Report, 2028GVR Report cover

![Maple Syrup Market Size, Share & Trends Report]()

Maple Syrup Market (2022 - 2028) Size, Share & Trends Analysis Report By Source (Red Maple, Black Maple, Sugar Maple), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-938-6

- Number of Report Pages: 78

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Maple Syrup Market Summary

The global maple syrup market size was valued at USD 1.49 billion in 2021 and is expected to reach USD 2.29 billion by 2028, growing at a CAGR of 6.2% from 2022 to 2028. The increasing utilization of maple syrup in the bakery, confectionery, cereal, and dairy industries for topping purposes is accelerating the market growth.

Key Market Trends & Insights

- North America led the global market with a revenue share of over 43% in 2021.

- Asia Pacific is poised to be the fastest-growing market for maple syrup, advancing at a CAGR of 7.5% through 2028.

- By distribution channel, the offline segment contributed a revenue share of over 77% in 2021.

- By source, the sugar maple segment contributed to the largest market share of over 67% in 2021.

Market Size & Forecast

- 2021 Market Size: USD 1.49 Billion

- 2028 Projected Market Size: USD 2.29 Billion

- CAGR (2022-2028): 6.2%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

Moreover, the significant increase in consumption of maple products is likely due to the sophistication, diversity in consumer tastes, and continuously changing consumer behavior. The rising demand for organic and natural products across the globe is expected to propel the market growth during the forecast period. Moreover, the increase in income levels, the improving economic conditions of consumers, and the growing consumption of balanced and nutritious food products across the globe are accelerating the market growth. Furthermore, the rising demand for baking food items such as waffles, cakes, French toast, pancakes, and bread rolls is driving the market growth. In addition to this, maple syrup is also used as a natural sweetener in various food products, which in turn further accelerates market growth.

A syrup derived or obtained from the xylem sap of maple trees is known as maple syrup. The increasing inclination of consumers toward natural and organic sweeteners has resulted in the increasing adoption of the product, which is expected to drive market growth during the forecast period. Moreover, the increasing prevalence of chronic diseases such as diabetes, cardiovascular diseases, and obesity has led to the growing adoption of maple syrup as a substitute for sugar, which is anticipated to further boost the market expansion during the projection years.

The continuous development of innovative products and attractive innovative packaging is a major trend in the market that propels the demand for maple syrup products in emerging economies. Moreover, many independent producers and large-scale food companies use maple syrup to flavor savory dressings, mustards, sauces, and spices among other condiments, thus accelerating the market growth. Additionally, the rising investments by key market players in advertising campaigns, promotional activities, and social media marketing are poised to drive market growth during the forecast period.

The rising health awareness and wellness trends present an opportunity for maple syrup to become the next preferred substitute for sugar during the forecast period. In addition to this, the growing trends of consumption of healthy snacks such as nuts, cereals, or energy bars coupled with health awareness are accelerating the market growth.

Stringent government guidelines in countries such as the U.S., Canada, Germany, the U.K., and France are expected to maintain the quality of these products. The published federal guidelines and rules ensure the quality of products is up to the hygienic standards for consumption. However, the black marketing of maple products and the stringent quota system are factors hindering the overall market growth.

The lockdowns announced during the COVID-19 pandemic had suspended the supply of raw material and disturbed transportation for a short period, as well as causing significant impacts on the supply chain of the maple syrup industry across the globe. The outbreak of COVID-19 is having a major impact on international trade. The pandemic is profoundly impacting the global maple syrup sector, including its production and consumption, due to annual event cancellations and restaurant closures globally.

The rising health consciousness among consumers and the increasing demand for nutritious food to build immunity in the post-COVID-19 pandemic period will create opportunities for the market players. Thus, the market is expected to progress at a healthy growth rate in the upcoming years.

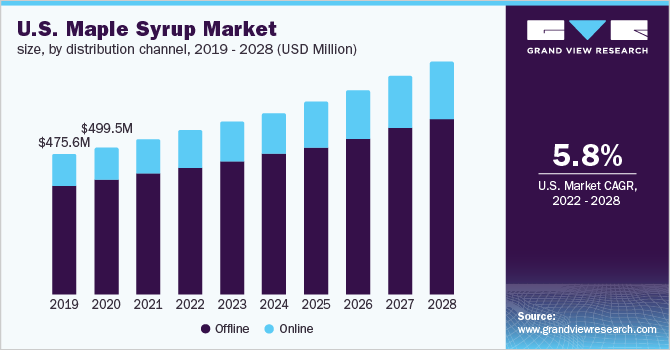

Distribution Channel Insights

The offline channel contributed a revenue share of over 77% in the global maple syrup market in 2021. Consumers prefer the offline mode for purchasing consumer goods, groceries, as well as packaged syrup products, where they can physically verify the product quality. Moreover, easy access and searching for various maple syrup products through stores is likely to drive the segment growth in the coming years.

Additionally, supermarkets, convenience stores, and malls are gaining popularity in recent years owing to the availability of a wide range of consumer goods under a single roof. Furthermore, the rising urbanization and competitive pricing are accelerating the popularity of offline channels in developing economies.

The online segment in the maple syrup industry is anticipated to register the fastest CAGR of 6.9% from 2022 to 2028. A rapid growth in internet penetration has been observed in the last few years, which has led to the significant growth of the e-commerce sector across the globe, thereby driving market demand. Moreover, several manufacturers are offering their products on their own websites as well as on e-commerce platforms, which is expected to drive market growth during the projection period.

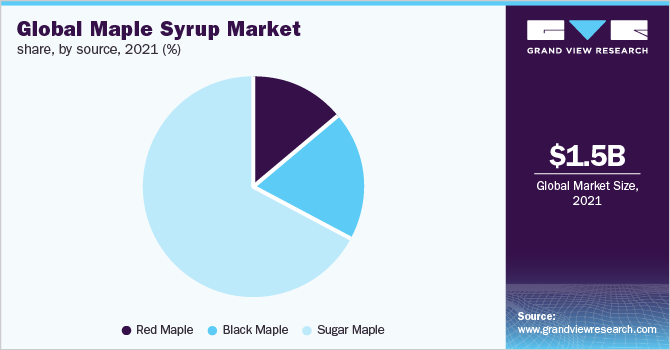

Source Insights

The sugar maple segment contributed to the largest market share of over 67% in 2021 and is expected to expand at a CAGR of 5.7% from 2022 to 2028. The increasing demand and consumption of bakery and confectionery products are accelerating market growth.

Sugar maples are commonly found throughout the North East U.S., South East Canada, and the upper Mid-West U.S. and it is the best tree to produce syrup, which may accelerate the market growth. Moreover, the increasing demand for packaged maple products for home consumption as well as in the food industry will propel the market growth during the forecast period.

The black maple segment contributed a revenue share of around 19% in 2021 and is expected to advance at the fastest growth rate of 7.4% during the forecast period. Black maple is more convenient, healthier, and contains antioxidants, which accelerate the market growth. The increase in income levels, the improving economic conditions of consumers, and the growing consumption of balanced and nutritious food products across the globe are accelerating the market growth.

Additionally, the rising consumer demand for natural and organic products coupled with rapid urbanization across the globe is accelerating market growth. Moreover, the rising trend of e-commerce is expected to drive this segment demand during the next couple of years.

Regional Insights

North America led the global market with a revenue share of over 43% in 2021. The increasing popularity and demand for maple products in this region are propelling the market growth. Moreover, the rising consumption of healthy and nutritious food products is also propelling the regional market growth. Maple products are natural and nutrient-rich with potassium, calcium, and zinc. The increase in consumption of maple products in this region is likely due to the sophistication, diversity in consumer tastes, and continuously changing consumer behavior.

Asia Pacific is poised to be the fastest-growing market for maple syrup, advancing at a CAGR of 7.5% through 2028. Japan, Australia, and South Korea have a huge consumer base for maple products, which will drive the regional demand. Moreover, the region is expected to show an accelerated growth rate during the forecast period, owing to the rising health awareness & wellness trends, and the rising population in the region. However, the high costs associated with the product due to its import from the U.S. and Canada, uncertain pricing, and off-flavored syrups are hindering the market growth.

Europe held the second-largest share in the maple syrup market of over 26% in 2021. Furthermore, the region is expected to grow with the second-fastest CAGR of 6.9% from 2022 to 2028. The regional growth is attributed to the high consumption of maple syrup, coupled with the high purchasing power of the consumers. These factors are expected to contribute to a higher revenue generation.

Key Companies & Market Share Insights

The market consists of various established players such as B&G Foods, Inc., The J.M. Smucker Co., Federation of Quebec Maple Syrup Producers, and Les Industries Bernard et Fils Ltee. Various manufacturers and suppliers are expected to focus on the logistic development and strengthening of the distribution channel to advance their business. Key market players are heavily investing in advertising campaigns, promotional activities, and social media marketing to expand their geographical presence across the globe.

For instance, Coombs Family Farms introduced the first Maple Stream with spray-able maple syrup at the push of a button. Such initiatives are expected to boost the adoption rate of the product among consumers around the globe. The market is further driven by mergers, acquisitions, and innovative packaging designs. Some of the key players operating in the global maple syrup market include

-

B & G Foods, Inc.

-

The J.M. Smucker Co.

-

Federation of Quebec Maple Syrup Producers

-

Les Industries Bernard et Fils Ltee

-

LB Maple Treat

-

Bascom Maple Farms Inc

-

Butternut Mountain Farm

-

Ferguson Farm Vermont Maple Syrup

-

Conagra Brands Inc.

-

Coombs Family Farms

Recent Developments

- In June 2022, Les Industries Bernard et Fils Ltee was acquired by Valeo Foods Group, a distributor in 100+ countries. This will expand Bernard’s existing presence and double their revenue in the coming years.

Maple Syrup Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.58 billion

Revenue forecast in 2028

USD 2.29 billion

Growth rate

CAGR of 6.2% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD million and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; South Korea; Australia; Japan; Brazil; South Africa

Key companies profiled

B&G Foods, Inc.; The J.M. Smucker Co.; Federation of Quebec Maple Syrup Producers; Les Industries Bernard et Fils Ltee; LB Maple Treat; Bascom Maple Farms Inc; Butternut Mountain Farm; Ferguson Farm Vermont Maple Syrup; Conagra Brands Inc.; Coombs Family Farms

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global maple syrup market report on the basis of source, distribution channel, and region

-

Source Outlook (Revenue, USD Million, 2017 - 2028)

-

Red Maple

-

Black Maple

-

Sugar Maple

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2028)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

South Korea

-

Australia

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global maple syrup market size was estimated at USD 1.49 billion in 2021 and is expected to reach USD 1.58 billion in 2022.

b. The global maple syrup market is expected to grow at a compound annual growth rate of 4.8% from 2022 to 2028 to reach USD 2.29 billion by 2027.

b. North America dominated the maple syrup market with a share of 47.0% in 2021. This is attributable to the increasing popularity and demand for maple products coupled with the rising consumption of healthy and nutritious food products.

b. Some key players operating in the maple syrup market include B&G Foods, Inc.; The J.M. Smucker Co.; Federation of Quebec Maple Syrup Producers; Les Industries Bernard et Fils Ltee; LB Maple Treat; Bascom Maple Farms Inc.; Butternut Mountain Farm; Ferguson Farm Vermont Maple Syrup; Conagra Brands Inc.; and Coombs Family Farms.

b. Key factors that are driving the maple syrup market growth include increasing utilization of maple syrup in the bakery, confectionery, cereal, and dairy industries, growing demand for organic and natural products, and growing consumption of balanced and nutritious food products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.