- Home

- »

- Plastics, Polymers & Resins

- »

-

Marine Adhesive Market Size, Share & Growth Report, 2030GVR Report cover

![Marine Adhesive Market Size, Share & Trends Report]()

Marine Adhesive Market (2023 - 2030) Size, Share & Trends Analysis Report, By Resin Type, By Substrate (Metals, Plastics), By Application, By End-use (Cargo Ships, Boats), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-052-6

- Number of Report Pages: 112

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Marine Adhesive Market Size & Trends

The global marine adhesive market size was valued at USD 495.04 million in 2022 and is anticipated to grow at a CAGR of 4.5 % from 2023 to 2030. The growth for the product market is attributed to the factors such as flourishing shipbuilding industry and growing leisure marine and recreational boating industry worldwide. According to the OEC, passenger and cargo ships were the fortieth-most traded products in the world witnessing trade activities worth USD 65.0 billion in 2020 that accounted for a share of 0.39% of the overall global trade in the same year. China, Japan, South Korea, Germany, and Italy were the major exporters of these ships with exports accounting for USD 13.5 billion, USD 11.0 billion, USD 17.3 billion, USD 4.5 billion, and USD 2.8 billion respectively in 2020. Thus, the flourishing shipbuilding industry in Asia Pacific and Europe is fueling the global demand for the marine adhesives, thereby leading to the growth of the market.

Moreover, the increasing marine leisure activities, including recreational marine activities, leisure boatbuilding, etc. in North America and Europe, are expected to surge demand for the marine adhesives as they are used during manufacturing of the boats, as well as during their after-sales servicing. Thus, these activities make an important macroeconomic contribution to the growth of countries such as the U.S., the UK, and Germany.

For instance, according to the Centre for Economics and Business Research, the marine leisure industry in the UK accounted for a turnover of USD 7.00 billion and contributed approximately USD 3.02 billion to the gross value added of the country by creating approximately 28,500 jobs. Thus, contributing to the growth of product market.

According to the United Nations Conference on Trade and Development, maritime transportation volumes declined more than the estimated volumes. The impact of the COVID-19 in the first half of 2020 led to a 3.8% contraction in the industry. However, with the relaxing of restrictions, the industry recovered in 2021 witnessing a growth of approximately 4.3% in the same year.

This rebound was also due to the increasing spending of the consumers on goods and the flourishing e-commerce sector, especially in the U.S. With the normalization of maritime transportation in 2021, global demand for the product market also surged, thereby leading to growth of the market, worldwide.

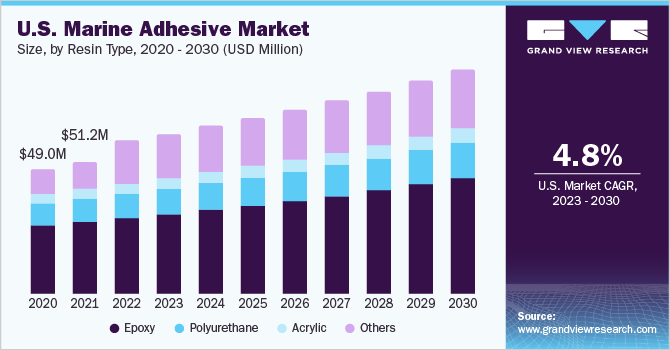

The U.S. is the largest consumer of the product in North America with a revenue share of 69.9% in 2022. This is attributed to the fact that U.S. is one of the most prominent and major shipbuilding countries in the world owing to its increasing tourism and a large number of ports. Moreover, the product market is driven by the exponentially increasing export and import activities due to the rising manufacturing industries.

As per the Bureau of Economic Analysis, the U.S. marine economy accounted for 1.7% of its GDP in 2020 and 1.7% of its dollar gross output. In addition to this, there are around 154 private shipyards spread across 29 states and U.S. Virgin Island which are classified as active ship builders. Thus, all these factors are driving demand for the product in the country.

Substrate Insights

Metal in substrate segment dominated the market with a revenue share of 68.2% in 2022. This growth is attributed to the fact that metals are one of the most important elements used in shipbuilding. Metals are used to construct a large portion of a ship. Steel is the most commonly used metal in the shipbuilding industry due to its excellent mechanical properties, structural integrity, and low cost.

Composites are another segment witnessing fastest growth during the forecast period. This growth owed to their exceptional properties. Composites are made up of two or more different materials that combine to improve strength, durability, and load distribution. Ferro cement is a shipbuilding technique that uses composites to build shell roofs, hulls, and barges. Composite structures constructed using ferro cement have the advantages of being lightweight, long-lasting (due to metal reinforcements), and are inexpensive to maintain.

Application Insights

Deck systems in the application segment dominated the global market with a revenue share of 39.1% in 2022. A deck is a covering over the hull or the compartment of a ship. It is the uppermost horizontal structure over the hull and provides strength to it. Moreover, it serves as the primary working surface of the ship. The deck of a boat is constructed using various adhesives such as epoxy, polyurethane, or acrylic. The deck is not made from a single piece of substrate, but rather from several substrates that are joined together.

Panel bonding is another segment witnessing the fastest growth during the forecast period. Panel bonding includes the bonding of quarter panels, roof skins, box sides, van sides, utility vehicle sides, and door skins. They are used wherever a long-lasting bond between outer body panels is required.

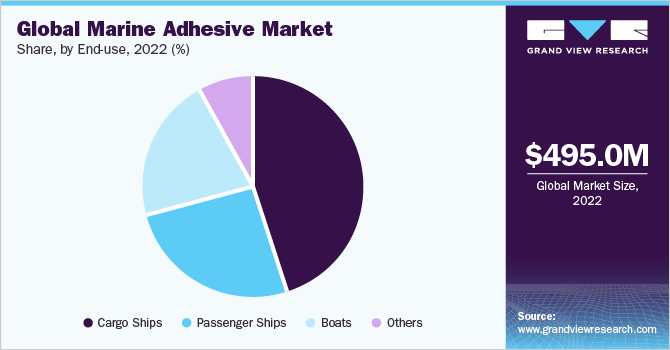

End-use Insights

Cargo based in the end-use segment dominated the global market with a revenue share of 45.5% in 2022. Cargo ships are container or merchant ships that are used to transport goods and materials from one port to another. As per the International Chamber of Shipping, over 50,000 merchant ships are trading internationally every year, transporting all types of cargo. Thus, the increasing usage of these ships is propelling demand for the product during the forecast period.

Boats are another segment witnessing growth throughout the forecast period. In naval terms, a boat is a small vessel that is carried aboard by ship and it comes in a variety of sizes and shapes. It is smaller than a ship, and is distinguished by its shape, size, and cargo or passenger capacity. Small boats are commonly found in protected coastal areas or inland waterways such as lakes and rivers. Some boats, such as the whaleboat, are designed for use in an offshore environment.

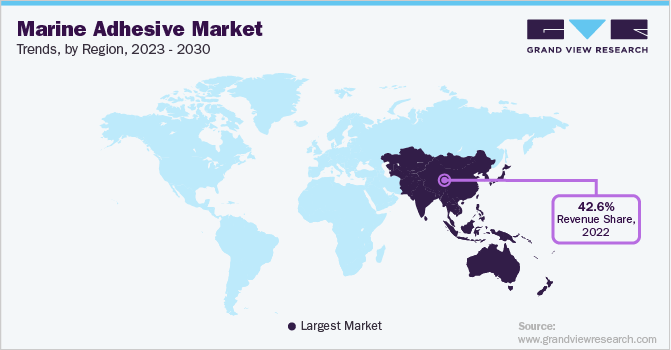

Regional Insights

Asia Pacific emerged as the dominating region with a revenue share of 42.6% in 2022. This growth is attributed to the fact that strong economic development coupled with population expansion in countries such as China and India are expected to increase marine spending in Asia Pacific during the next seven years. Furthermore, according to Oxford Economics, the volume of marine output is predicted to grow by 85.0% and reach USD 17.5 trillion by 2030, with China and India being the major economies driving the marine industry in the region.

Europe is another region witnessing the growth during the forecasted period. This is attributed to the fact that around 40.0% of the world’s shipping fleet is controlled by European ship owners. Europe has an extensive network of inland waterways, especially in the Central European countries such as France, Germany, Russia, and Belgium. Further development of inland waterways and their growing importance for trade and passenger travel is expected to drive demand for the marine adhesives.

Key Companies & Market Share Insights

The market for marine adhesive is highly competitive with the presence of a large number of independent small-scale and large-scale suppliers and manufacturers. Players are entering into mergers and partnerships so as to establish their position in the market. For instance, in January 2022, H.B. Fuller announced the acquisition of Apollo, a UK-based manufacturer of coatings, liquid adhesives, and primers for industrial, construction, engineering, and roofing applications. This acquisition is expected to help H.B. Fuller in strengthening its engineering adhesive transportation product line, which comprises adhesives for use in motor homes, furniture, textiles, marine vessels, and aircraft seats. Some of the prominent players in the global marine adhesive market include:

-

Henkel

-

3M

-

Sika

-

Huntsman International

-

Ashland Inc.

-

AVERY DENNISON CORPORATION

-

Dow

-

Exxon Mobil Corporation

-

H.B. Fuller

-

Scott Bader Company Ltd.

Marine Adhesive Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 516.3 million

Revenue forecast in 2030

USD 703.21 million

Growth rate

CAGR of 4.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, volume in tons, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resin type, substrate, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Henkel; 3M; Sika; Huntsman International; Ashland Inc.; AVERY DENNISON CORPORATION; Dow; Exxon Mobil Corporation; H.B. Fuller; Scott Bader Company Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Marine Adhesive Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels in addition to provides an analysis on the latest industry trendsand opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global marine adhesive market report based on the resin type, substrate, application, end-use, and region:

-

Resin Type Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Epoxy

-

Polyurethane

-

Acrylic

-

Others

-

-

Substrate Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Composites

-

Metal

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Deck Systems

-

Glazing

-

Panel Bonding

-

Others

-

-

End-use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Cargo Ships

-

Passenger Ships

-

Boats

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global marine adhesive market size was estimated at USD 495.04 million in 2022 and is expected to reach USD 516.3 million in 2023.

b. The global marine adhesive market is expected to witness a compound annual growth rate of 4.5% from 2023 to 2030 to reach USD 703.21 million by 2030.

b. Metal in substrate segment dominated the market with a revenue share of 68.2% in 2022.This growth is attributed to the fact that metals are one of the most important elements used in shipbuilding.

b. Some of the prominent players in the market include Henkel, 3M, Sika, Huntsman International, Ashland Inc., AVERY DENNISON CORPORATION, Dow, Exxon Mobil Corporation, H.B. Fuller, and Scott Bader Company Ltd.

b. The growth of Marine Adhesive market is attributed to the factors such as flourishing shipbuilding industry and growing leisure marine and recreational boating industry worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.