- Home

- »

- Advanced Interior Materials

- »

-

Material Handling Equipment Market Size Report, 2022-2030GVR Report cover

![Material Handling Equipment Market Size, Share & Trends Report]()

Material Handling Equipment Market Size, Share & Trends Analysis Report By Product (Cranes & Lifting Equipment, Racking & Storage Equipment), By Application, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-1-68038-357-7

- Number of Pages: 137

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Advanced Materials

Report Overview

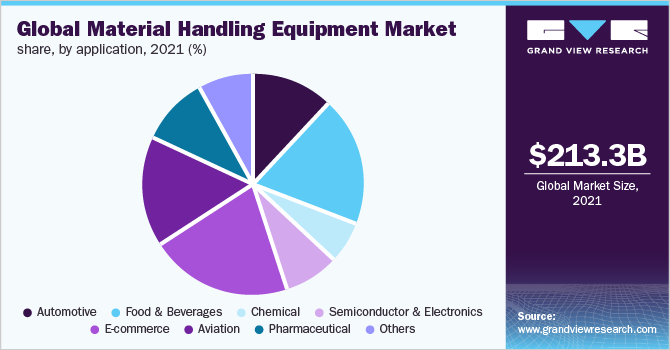

The global material handling equipment market size was valued at USD 213.35 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.7% from 2022 to 2030. Rapid industrialization and increased demand for automation in material handling equipment are expected to fuel market growth over the forecast period. The initial outbreak of the COVID-19 pandemic has had a negative effect on the warehousing industry since the movement of products, especially non-essential items almost came to a complete halt. In addition, the market was severely impacted during the initial phase of the pandemic as sales abruptly declined as a result of labor shortages globally and a sharp decline in demand.

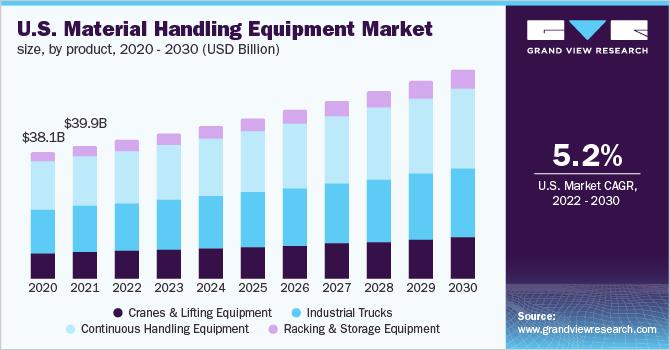

The growth of private investment in industrial equipment and machinery indicates an overall strong U.S. economy, which is expected to encourage activity in the U.S. industry's largest downstream markets such as manufacturing and wholesaling. As a result, an increase in investment in industrial equipment and machinery is likely to correlate to growth in the demand for industry products such as material handling equipment. The market is expected to develop faster due to the increased worker safety awareness, rising requirements for managing bulk materials effectively, and rising industry 4.0 with greater Internet of Things use. The market for this product is expected to be driven by the rising need for reducing downtime and the focus on improving supply chain efficiency.

Growing adoption of automation and ongoing technology breakthroughs in the market has resulted in the establishment of fully automated industrial facilities in developed countries. The ongoing modernization of industrial facilities and infrastructures to improve their production capacity is anticipated to drive the growth of the material handling equipment market. The e-commerce application segment is expected to develop significantly throughout the projection period owing to factors such as increased penetration of online shopping platforms, the existence of large online merchants, and rising logistics infrastructure. This trend is pushing warehouse owners to incorporate efficient material handling equipment into their facilities in order to better manage the supply chain ecosystem.

Product Insights

The cranes and lifting equipment segment dominated the market and accounted for over 35.0% share of the global revenue in 2021. Wide utilization in various end-use industries such as construction, manufacturing, motor vehicle lifts, and lifting accessories is anticipated to drive the market for material handling equipment. Continuous handling equipment assures smooth run picking, sorting, and packaging, whereas traditional handling equipment is prone to picking errors. Another key advantage of continuous handling equipment is that it assists producers in lowering costs and shortening delivery time due to the equipment's streamlined process.

The racking and storage equipment segment is estimated to expand at a CAGR of 6.8% over the forecast period as the equipment help in increasing storage capacity. Furthermore, other advantages can be measured in terms of the money saved by not having to rent additional storage space, the reduced workload, and the increased throughput. Manufacturers prefer industrial trucks as they have practical features like a flat surface or forks that can be inserted under pallets or other kinds of storage platforms. Other trucks require a different piece of machinery to be used for lifting. Another benefit of industrial trucks is that they are capable of powered or manual lifting.

Application Insights

The e-commerce segment led the market and accounted for over 20.0% share of the global revenue in 2021. Factors such as increased penetration of online shopping platforms, the existence of large online merchants, and rising logistics infrastructure are expected to drive the demand for this product in the e-commerce industry. Several grocery stores have evolved into convenience stores that provide fast-food-like services, including frozen food, ready-to-eat meals, and fresh items, which has led to the rise of the food industry. The frozen food industry has radically altered the approach to manufacturing and material handling procedures.

The pharmaceutical segment is estimated to register a CAGR of 6.6% over the forecast period. Pharmaceutical storage and material handling equipment provide a solution to fulfill the growing need for medicines as the prevalence of various diseases increases. These systems are put in place to increase productivity, save time, labor, waste, and overall expenditure, optimize product quality, and maximize safety. A baggage handling system is a form of conveyor system seen in airports. It is used to transport checked-in luggage from ticket counters to a location where it may be loaded onto flights. This system is also responsible for moving bags from the aircraft to the baggage claim area. Thus, the increased use of baggage handling systems is fueling the growth of this product in the aviation industry.

Regional Insights

The Asia Pacific region led the market and accounted for over 35.0% share of the global revenue in 2021. The significant adoption is attributed to the growing food retail sector in Asia Pacific that offers various opportunities to the market owing to their ability to increase the efficiency and speed of the picking and sorting processes. The growth in Europe is anticipated to be aided by integrated solutions based on the implementation of new legislative reforms with regard to safety and quality. Moreover, the material handling equipment demand from manufacturing, ports, and warehousing industries is mostly driven by industrial trucks and automated categories.

The increased adoption of e-commerce technologies created a considerable demand for modern products in warehouses, prompting companies to offer high-quality products. The market expansion is anticipated to be aided by the rising need for automated warehousing operations in North America. Latin America is estimated to register a CAGR of 6.0% over the forecast period. The industry in Latin America is majorly driven by increasing investments in various end-use industries such as automotive and food and beverage.

Key Companies & Market Share Insights

The market for material handling equipment is highly consolidated and characterized by intense competition. As a part of a key growth strategy, vendors aim at adopting organic and inorganic approaches to sustain competition. For instance, in April 2021, Toyota Material Handling launched Mole and Mouse Automated Guided Carts (AGCs). The product is expected to allow customers to automate repetitive operational tasks suitable for assembly lines, distribution centers, warehouses, and manufacturing plants.

Similarly, in July 2020, Vanderlande Industries B.V, one of the logistics process automation providers, introduced HOMEPICK, a goods-to-person (GtP) picking solution. The product complements its automated storage and retrieval system (AS/RS) and facilitates online grocery orders. Some prominent players in the global material handling equipment market include:

-

BEUMER GROUP

-

Daifuku Co., Ltd.

-

Honeywell International, Inc.

-

KION GROUP AG

-

Mecalux, S.A.

-

Murata Manufacturing Co., Ltd.

-

SSI SCHAEFER

-

Swisslog Holding AG

-

TOYOTA INDUSTRIES CORPORATION

-

Vanderlande Industries B.V.

Material Handling Equipment Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 224.42 billion

Revenue forecast in 2030

USD 350.21 billion

Growth rate

CAGR of 5.7% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; Saudi Arabia; South Africa

Key companies profiled

BEUMER GROUP; Daifuku Co., Ltd.; Honeywell International, Inc.; KION GROUP AG; Mecalux; S.A.; Murata Manufacturing Co., Ltd.; SSI SCHAEFER; Swisslog Holding AG; TOYOTA INDUSTRIES CORPORATION, Vanderlande Industries B.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Material Handling Equipment Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global material handling equipment market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Cranes & Lifting Equipment

-

Industrial Trucks

-

Continuous Handling Equipment

-

Racking & Storage Equipment

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Food & Beverages

-

Chemical

-

Semiconductor & Electronics

-

E-commerce

-

Aviation

-

Pharmaceutical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global material handling equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.7% from 2022 to 2030 to reach USD 350.21 billion by 2030

b. The Asia Pacific dominated the material handling equipment market and accounted for a revenue share of 35.7% of the global market in 2021. The growing food retail sector in the Asia Pacific offers various opportunities to the material handling equipment market as this equipment increases the efficiency & speed of the picking & sorting processes

b. Some of the key players operating in the material handling equipment market include BEUMER GROUP, Daifuku Co., Ltd., Honeywell International, Inc., KION GROUP AG, Mecalux, S.A., Murata Manufacturing Co., Ltd., SSI SCHAEFER, Swisslog Holding AG, TOYOTA INDUSTRIES CORPORATION, Vanderlande Industries B.V.

b. Key factors that are driving the material handling equipment market growth include rapid industrialization and increased demand for automation in material handling equipment will drive market growth over the forecast period.

b. The material handling equipment market size was estimated at USD 213.35 billion in 2021 and is expected to be USD 224.42 billion in 2022.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."