- Home

- »

- Homecare & Decor

- »

-

Mattress Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Mattress Market Size, Share & Trends Report]()

Mattress Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Innerspring, Foam, Hybrid), By Size (Single, Double, Queen, King), By End Use, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-942-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mattress Market Summary

The global mattress market size was estimated at USD 46.48 billion in 2024 and is expected to reach USD 67.51 billion by 2030, growing at a CAGR of 6.5% from 2025 to 2030. The growing awareness of the importance of sleep quality has significantly impacted consumer behavior, leading many to prioritize sleep health.

Key Market Trends & Insights

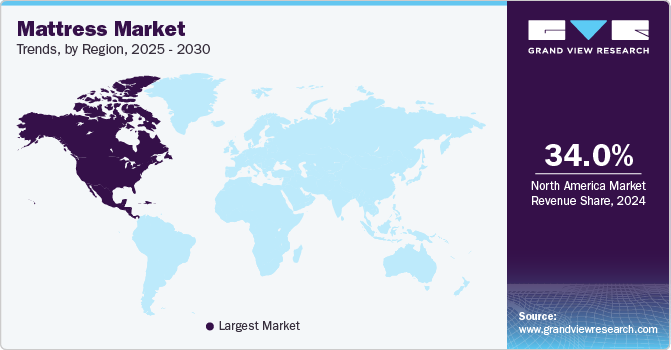

- The North America mattress market is accounted for a market share of around 34% in 2024 in the global market.

- The U.S. mattress market is accounted for a market share of around 75% in 2024.

- By type, foam mattresses segment accounted for a market share of around 45% in 2024.

- By size, queen-size mattresses segment accounted for a share of around 46% in 2024.

- By end-use, household applications segment accounted for a share of around 78% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 46.48 Billion

- 2030 Projected Market Size: USD 67.51 Billion

- CAGR (2025-2030): 6.5%

- North America: Largest market in 2024

Quality sleep is important in overall well-being, affecting physical health, mental clarity, and emotional stability. Consumers are becoming more discerning about sleep environments, favoring market growth. Consequently, this heightened focus on sleep quality drives demand for premium mattresses. It also encourages manufacturers to innovate and improve their offerings, aligning with consumer expectations for products that contribute positively to their health and lifestyle.

Advancements in mattress technology have revolutionized the industry, with innovations such as memory foam, hybrid mattresses, and smart mattresses equipped with sleep-tracking features capturing consumers' attention in search of enhanced comfort and support, likely favoring the market growth. Companies like Tempur-Pedic are well-known for high-quality memory foam mattresses that contour to the body, providing personalized support. Smart mattress companies like Sleep Number and Eight Sleep also incorporate sleep-tracking technology and adjustable firmness settings, enabling users to tailor their sleep environments to individual needs. These technological advancements enhance the overall sleep experience and cater to the growing consumer demand for products promoting health and well-being.

The rise of online shopping has transformed the market by providing consumers with unparalleled access to a wide range of products and information, simplifying the research and purchasing process. E-commerce platforms like Amazon and Wayfair and dedicated mattress retailers such as Casper and Leesa allow shoppers to compare different brands, read customer reviews, and explore various mattress types from their homes. In addition, many online mattress companies offer free trials and hassle-free return policies, further alleviating buyer hesitation and boosting confidence in purchasing decisions. The ability to enjoy home delivery ensures that customers receive their new mattresses without the hassle of transporting bulky items, significantly contributing to the overall growth of market sales in this digital age.

The aging population, alongside the emergence of millennial and Gen Z consumers, is significantly reshaping mattress purchasing patterns and creating new growth opportunities within the market. Older adults often seek mattresses that provide enhanced support and comfort to address age-related issues such as back pain and joint discomfort, driving demand for ergonomic and specialized products tailored to their needs. In contrast, millennials and Gen Z prioritize quality, sustainability, and innovative features, such as smart technology and eco-friendly materials, reflecting lifestyle preferences and values. This generational shift encourages manufacturers to develop diverse product lines that cater to both demographic groups, from premium, health-focused options for seniors to trendy, tech-savvy choices for younger consumers, favoring market growth.

Type Insights

Foam mattresses accounted for a market share of around 45% in 2024. This dominance is primarily driven by foam mattresses' numerous advantages, such as exceptional pressure relief, support, and motion isolation, making them particularly appealing for couples and individuals with varying sleep preferences. The growing awareness of the importance of sleep quality has led consumers to seek out high-quality foam options, including memory foam and latex mattresses, known for their comfort and durability. Furthermore, advancements in foam technology, such as cooling gel-infused layers and breathable designs, have further enhanced their appeal, contributing to the significant market share of foam mattresses in the competitive landscape.

The demand for hybrid mattresses is expected to grow at a CAGR of 6.8% from 2025 to 2030. Hybrid mattresses, which typically blend innerspring coils with layers of foam or latex, provide the best of both worlds: the bounce and support of traditional mattresses and the contouring comfort of foam. As more consumers seek personalized sleep experiences that cater to their unique needs, hybrid mattresses are gaining popularity for their versatility and ability to accommodate different sleeping positions. Moreover, advancements in materials and manufacturing techniques are enhancing the performance of hybrid mattresses, further driving their growth in the competitive market. As awareness of sleep health rises, the hybrid mattress segment is well-positioned for significant expansion in the coming years.

Size Insights

Queen-size mattresses accounted for a share of around 46% in 2024. Queen-size mattresses are the most popular choice among consumers, attributed to the ideal balance of space and comfort, catering to single sleepers and couples alike. The queen size offers ample room for couples while still fitting well in a variety of bedroom sizes, making it a versatile option for many households. As consumer awareness of sleep health and comfort increases, the demand for queen-size mattresses continues to rise, with various brands offering a range of options, including memory foam, innerspring, and hybrid designs. This segment's strong market presence reflects the ongoing trend toward optimizing sleep environments for better rest and overall well-being.

The demand for king size mattresses is expected to grow at a CAGR of 6.7% from 2025 to 2030. Rising preference among consumers for larger sleeping surfaces that offer enhanced comfort and space. This trend is driven by various factors, including the growing number of couples and families seeking larger beds to accommodate sleep needs and an increasing awareness of the benefits of spacious sleeping arrangements for better sleep quality. In addition, the trend towards premium and luxury bedding contributes to the demand for king-size options, as consumers are more willing to invest in high-quality mattresses that improve the overall sleep experience. As lifestyle changes and consumer preferences continue to evolve, the king-size mattress segment is expected to play a significant role in the market growth.

End Use Insights

Household applications accounted for a share of around 78% in 2024. This substantial share reflects the growing awareness of the importance of sleep quality and comfort in enhancing overall well-being. With consumers increasingly investing in high-quality mattresses to improve their sleep experiences, various options, including memory foam, innerspring, and hybrid designs, have gained popularity. Furthermore, e-commerce has made it easier for households to access a wide range of products, increasing sales and competition among manufacturers. As lifestyle changes prioritize health and comfort, the household application segment is expected to remain a critical driver of market growth.

The demand for mattresses in commercial applications is expected to grow at a CAGR of 5.1% from 2025 to 2030. As hotels, resorts, and healthcare facilities increasingly prioritize guest comfort and patient care, the need for high-quality mattresses that enhance sleep quality is becoming more pronounced. This growth is further fueled by the rising trend of wellness-focused accommodations and the incorporation of ergonomically designed products to improve overall health outcomes. Moreover, the growing emphasis on sustainability prompts commercial buyers to seek eco-friendly mattress options, aligning with broader corporate social responsibility goals. As a result, the commercial market is poised for steady expansion, reflecting the evolving priorities of various industries in providing quality sleep solutions.

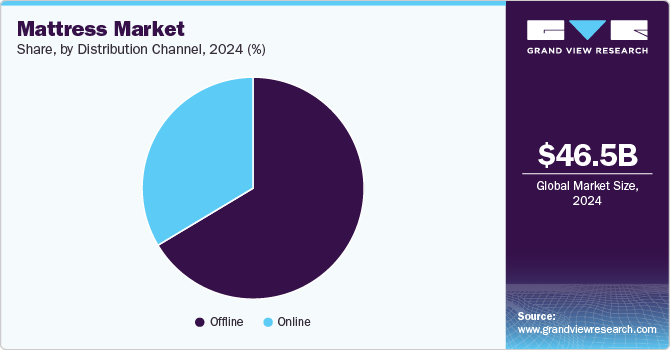

Distribution Channel Insights

The sale of mattresses through offline channels accounted for a market share of around 66% in 2024.Consumers continue to value the opportunity to physically test mattresses before purchase and the personalized service often provided by sales associates in brick-and-mortar stores. Major retailers, including department stores and specialized mattress outlets, remain crucial in driving sales, as they offer a wide range of products and brands, allowing customers to compare options side by side. Despite the growing trend of online shopping, the offline channel's strong market presence reflects the importance of tangible experiences and expert guidance in the mattress purchasing process, ensuring that consumers feel confident in their investment for a good night's sleep.

Online sales is expected to grow at a CAGR of 8.2% from 2025 to 2030. This growth is driven by the increasing preference for the convenience and flexibility that online shopping offers and the expanding presence of direct-to-consumer brands that provide competitive pricing and attractive return policies. Enhanced digital marketing strategies and the proliferation of e-commerce platforms are making it easier for consumers to access a wide variety of mattress options, read reviews, and compare features before purchasing. In addition, innovations in online shopping experiences, such as virtual mattress trials and personalized recommendations, further fuel this trend.

Regional Insights

The North America mattress market is accounted for a market share of around 34% in 2024 in the global market.The market is characterized by various products, including memory foam, innerspring, and hybrid mattresses, catering to various consumer preferences and needs. Key players such as Tempur Sealy, Serta Simmons Bedding, and Purple dominate the landscape, with many companies focusing on innovation and technology to enhance the sleep experience. The rise of direct-to-consumer brands has transformed purchasing behaviors, allowing consumers to access a wide selection of mattresses through online platforms, often with attractive financing options and return policies. Furthermore, sustainability is becoming increasingly important, prompting manufacturers to incorporate eco-friendly materials and practices into their product lines. The market is dynamic, marked by competitive offerings and evolving consumer trends.

U.S. Mattress Market Trends

The U.S. mattress market is accounted for a market share of around 75% in 2024. The market in the U.S. is robust and competitive, driven by consumer demand for comfort, innovation, and customization. Major companies such as Tempur-Pedic, Serta Simmons Bedding, Purple, and Saatva dominate the landscape, offering a diverse range of products that cater to varying sleep preferences and budgets. The market has seen significant growth in direct-to-consumer brands like Casper and Nectar, which leverage e-commerce to provide convenient shopping experiences and competitive pricing. Moreover, sustainability trends influence product development, with manufacturers increasingly incorporating eco-friendly materials and practices. Overall, the U.S. market is characterized by a blend of traditional retailers and innovative online brands striving to meet the evolving needs of consumers.

Europe Mattress Market Trends

The Europe mattress market is accounted for a revenue share of around 20% of global revenue in 2024. This includes increasing consumer awareness of sleep quality, a growing preference for premium and eco-friendly products, and advancements in sleep technology that drive market growth. The demand for personalized sleep solutions has led to innovations in materials and designs, with consumers seeking mattresses that offer better support and comfort. Key players in the European market include Tempur Sealy, Simba Sleep, Emma Mattress, Hypnos, and Dunlopillo, all focusing on sustainability and customization to cater to diverse consumer preferences and enhance sleep experiences.

Asia Pacific Mattress Market Trends

The mattress market in Asia Pacific is expected to grow at a CAGR of 6.9% from 2025 to 2030. The market in the region is driven by rising disposable incomes, urbanization, and a growing awareness of sleep health among consumers. With a diverse consumer base and varying preferences, the market is characterized by a wide range of products, including memory foam, innerspring, and latex mattresses. Countries like China, India, and Japan are leading the charge, with increasing demand for high-quality and technologically advanced mattresses that cater to different sleeping styles and preferences. In addition, the rise of e-commerce platforms has transformed the purchasing landscape, enabling consumers to access a broader selection of brands and products online. As sustainability becomes a key concern, manufacturers are also focusing on eco-friendly materials and practices to meet the evolving demands of environmentally conscious consumers, further shaping the competitive dynamics of the Asia Pacific market.

Key Mattress Company Insights

The competitive landscape in the market is characterized by a diverse array of brands and manufacturers, each vying for market share through innovation, quality, and marketing strategies. Major players like Tempur Sealy International, Inc., Serta Simmons Bedding LLC, and Sleep Number Corp. dominate the industry, leveraging advanced materials and technologies to enhance sleep comfort and support. Sustainability has also become a key focus, with many companies incorporating eco-friendly materials into their products to appeal to environmentally conscious consumers. As e-commerce continues to grow, brands are increasingly investing in online marketing and customer engagement strategies to capture the attention of a diverse consumer base, making the market highly competitive and dynamic.

Key Mattress Companies:

The following are the leading companies in the mattress market. These companies collectively hold the largest market share and dictate industry trends.

- Tempur Sealy International, Inc.

- Serta Simmons Bedding LLC

- Spring Air International

- Sleep Number Corp.

- Kingsdown, Inc.

- Southerland Sleep

- Hästens Ltd

- Casper Sleep Inc.

- Silentnight Group Limited.

- Emma

Recent Developments

-

In July 2023, Serta Simmons Bedding unveiled its latest innovations, expanding its product offerings with the updated Beautyrest Harmony collection and an expansion of the Beautyrest Black line. These new products feature advanced technologies to enhance sleep quality, including sustainable materials and improved support systems. The updated Harmony collection emphasizes eco-friendly practices while delivering superior comfort, while the Beautyrest Black line continues to cater to luxury consumers seeking high-performance mattresses. This launch reflects Serta Simmons Bedding's ongoing commitment to innovation and sustainability in the sleep industry.

-

In January 2023, Tempur-Pedic announced the launch of its all-new Tempur-Breezer mattress, designed to enhance sleep quality with advanced cooling technology. This innovative mattress features a unique combination of materials that regulate temperature and provide personalized comfort. The Tempur-Breezer incorporates a breathable cover and adaptive foam layers, ensuring a cool and supportive sleep environment. This introduction underscores Tempur-Pedic's commitment to improving the sleep experience through cutting-edge design and technology.

Mattress Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 49.24 billion

Revenue forecast in 2030

USD 67.51 billion

Growth rate (Revenue)

CAGR of 6.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, size, end use, distribution channel, region.

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Saudi Arabia; South Africa

Key companies profiled

Tempur Sealy International, Inc.; Serta Simmons Bedding LLC; Spring Air International; Sleep Number Corp.; Kingsdown, Inc.; Southerland Sleep; Hästens Ltd; Casper Sleep Inc.; Silentnight Group Limited.; Emma

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mattress Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mattress market report based on type, size, end use, distribution channel, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Innerspring

-

Foam

-

Hybrid

-

Others

-

-

Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Single

-

Double

-

Queen

-

King

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Household

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global mattress market was estimated at USD 46.48 billion in 2024 and is expected to reach USD 49.24 billion in 2025.

b. The global mattress market is expected to grow at a compound annual growth rate of 6.5% from 2025 to 2030 to reach USD 67.51 billion by 2030.

b. Asia Pacific region dominated the mattress market with a share of 38% in 2024. This is owing to the rising income levels across the region, improving the business environment in countries like India and China.

b. Some key players operating in the mattress market include Tempur Sealy International, Inc., Serta Simmons Bedding LLC, Spring Air International, Sleep Number Corp., Kingsdown, Inc., Southerland Sleep, Hästens Ltd, Casper Sleep Inc., Silentnight Group Limited.,and Emma

b. Key factors driving the mattress market growth include increasing cases of back problems associated with uncomfortable sleeping surfaces.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.