- Home

- »

- Medical Devices

- »

-

MEA Hip & Knee Reconstruction Devices Market Report, 2021-2028GVR Report cover

![MEA Hip And Knee Reconstruction Devices Market Size, Share & Trends Report]()

MEA Hip And Knee Reconstruction Devices Market Size, Share & Trends Analysis Report By Joint Type (Hip, Knee), By Technique (Arthrodesis, Joint Replacement, Arthroscopy, Osteotomy, Resurfacing), By Country, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-433-5

- Number of Pages: 114

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Healthcare

Report Overview

The MEA hip and knee reconstruction devices market size was estimated at USD 1.2 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 4.1% from 2021 to 2028. Technological advancements and the growing prevalence of orthopedic conditions resulting in a spike in hip and knee surgeries are anticipated to boost the growth of the market for hip and knee reconstruction devices. Furthermore, an increase in lifestyle disorders and the rising target population is also fueling market growth. Hip and knee reconstruction procedures have been considered non-urgent during the COVID-19 pandemic.

Due to this, all outpatient and elective interventional procedures were limited or interrupted. Specialty centers for orthopedic procedures were also shut down during the pandemic, which further negatively impacted the market for hip and knee reconstruction devices. In addition, due to the risk of infection, patients suffering from acute pain were left untreated, which eventually resulted in chronic pain, increasing the risk of depression as well as other disabilities.

The growing prevalence of orthopedic conditions is driving the number of hip and knee surgeries as well. This is driving the demand for reconstruction devices for these surgeries, hence, impelling market growth. According to the International Journal of Clinical Rheumatology, as of 2018, the prevalence of osteoporosis in Turkey was 15.1% in women and 10.7% in men. It also stated that 18.5% of people in Northern Iran were suffering from osteoporosis. As per the same study, in Saudi Arabia, 27.2% of women were suffering from osteoporosis and 29.8% were suffering from osteopenia.

The industry players are developing new products with better mechanical properties and biocompatibility. For instance, currently, there is a clinical trial being conducted on a ceramic device implant “H1.” This implant is anticipated to shorten the recovery duration when compared to other hip implants. Furthermore, these companies are focusing on technological advancements for improving the efficiency of hip surgeries by adopting robot-assisted surgeries. For instance, in May 2018, DePuy Synthes (Johnson & Johnson) launched its Attune Revision Knee System in the region.

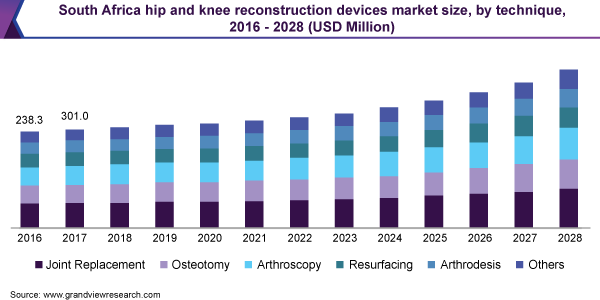

Technique Insights

The joint replacement segment dominated the MEA hip and knee reconstruction devices market and accounted for the largest revenue share of 70.3% in 2020. The segment is expected to maintain its position throughout the forecast period owing to capital-intensive devices and large procedural volume resulting in the highest revenue generation. On the other hand, an increase in demand for minimally invasive surgeries is expected to fuel the growth of the market for hip and knee reconstruction devices. As a result, the segment is anticipated to hold the second-largest revenue share and is expected to expand at a CAGR of 4.0% over the forecast period. The implants sub-segment held the revenue maximum share in the joint replacement segment in 2020.

The joint replacement segment is further divided into implants and bone graft. The bone graft segment is further divided into allograft and synthetic. The implants segment is expected to register a larger market share as compared to the bone graft segment, owing to their high adoption in the region.

Joint Type Insights

The knee segment dominated the market for hip and knee reconstruction devices and accounted for the largest revenue share of 63.4% in 2020. The segment is anticipated to grow well over the forecast period owing to an increasing number of knee surgeries. The increasing prevalence of knee osteoarthritis and availability of a large number of products as well as procedures are expected to boost segment growth. Furthermore, market players are also investing in the segment to launch novel knee reconstruction devices, which is also anticipated to propel segment growth.

The hip segment is expected to witness the fastest CAGR of 4.3% over the forecast period owing to rising number of hip fractures and demand for hip replacement surgeries.

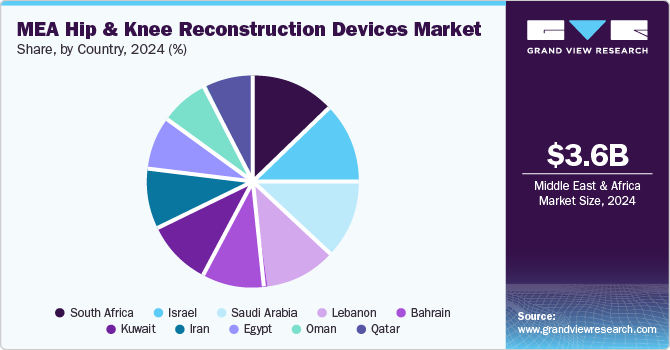

Country Insights

In 2020, South Africa held the largest revenue share of over 28.0%. In South Africa, the prevalence of osteoarthritis accounts for between 29.5% and 82.7% in adults over 65 years of age in rural settings and 55.1% in urban settings. The prevalence of osteoarthritis is high in the country, which is likely to significantly contribute to market growth over the forecast period.

In Israel, the market for hip and knee reconstruction devices is anticipated to witness significant growth over the forecast period. As stated by the Israel National Institute for Health Policy and Health Services Research, in 2018, the country’s obesity rates were increasing, with 62.0% of men and 55.0% of women being overweight, which is likely to contribute to market growth.

Key Companies & Market Share Insights

Vendors are investing in product launches, geographical expansions, collaborative agreements, and acquisitions, to sustain in the market for hip and knee reconstruction devices. The market is expected to become highly competitive as companies are investing to penetrate more in the market.

For instance, in December 2020, DePuy Synthes, a Johnson and Johnson company launched KINCISE Surgical Automated System in Europe and MEA markets. This expanded the company’s offerings and strengthened its market position. Also, in January 2021, Smith+Nephew acquired the extremity orthopedics business from Integra LifeSciences Holdings Corporation for USD 240 million. This supported the company’s strategy to invest in high-growth segments and strengthened its extremities business. Some of the prominent players in the MEA hip and knee reconstruction devices market include:

-

DJO, LLC

-

Smith + Nephew

-

Zimmer Biomet

-

B. Braun Melsungen AG

-

Conmed Corporation

-

DePuy Synthes

-

Meril Life Sciences Pvt. Ltd.

-

Arthrex, Inc.

MEA Hip And Knee Reconstruction Devices Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 1.7 billion

Revenue forecast in 2028

USD 2.3 billion

Growth Rate

CAGR of 4.1% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Technique, joint type, country

Regional Scope

Middle East & Africa

Country Scope

South Africa; Saudi Arabia; Egypt; Oman; Iran; Israel; Kuwait; Bahrain; Lebanon; Qatar; UAE

Key companies profiled

DJO, LLC; Smith + Nephew; Zimmer Biomet; B.Braun Melsungen AG; Conmed Corporation; DePuy Synthes; Meril Life Sciences Pvt Ltd.; Arthrex, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the MEA hip and knee reconstruction devices market report on the basis of technique, joint type, and country:

-

Joint Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Hip

-

Knee

-

-

Technique Outlook (Revenue, USD Million, 2016 - 2028)

-

Joint Replacement

-

Implants

-

Bone Graft

-

Allograft

-

Synthetic

-

-

-

Osteotomy

-

Arthroscopy

-

Resurfacing

-

Arthrodesis

-

Others

-

-

Country Outlook (Revenue, USD Million, 2016 - 2028)

-

South Africa

-

Saudi Arabia

-

Israel

-

Egypt

-

Oman

-

Kuwait

-

Bahrain

-

Lebanon

-

Qatar

-

Iran

-

UAE

-

Frequently Asked Questions About This Report

b. The MEA hip & knee reconstruction devices market size was estimated at USD 1.2 billion in 2020 and is expected to reach USD 1.7 billion in 2021.

b. The MEA hip & knee reconstruction devices market is expected to grow at a compound annual growth rate of 4.1% from 2021 to 2028 to reach USD 2.3 billion by 2028.

b. In 2020, South Africa held the largest revenue share of over 28.0%in the MEA hip & knee reconstruction devices market. This is attributable to the rising prevalence of osteoarthritis.

b. Some key players operating in the MEA hip & knee reconstruction devices market include DJO, LLC, Smith + Nephew, Zimmer Biomet, B.Braun Melsungen AG, Conmed Corporation, DePuy Synthes, Meril Life Sciences Pvt Ltd, and Arthrex, Inc.

b. Key factors driving the MEA hip & knee reconstruction devices market growth include technological advancements, the prevalence of orthopedic conditions, the incidence of lifestyle disorders, and the target population.

b. The knee segment dominated the market for hip and knee reconstruction devices in MEA and accounted for the largest revenue share of 63.4% in 2020.

b. The joint replacement segment dominated the MEA hip & knee reconstruction devices market and accounted for the largest revenue share of 70.3% in 2020.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."