- Home

- »

- Consumer F&B

- »

-

Meal Kit Delivery Services Market Size & Share Report, 2033GVR Report cover

![Meal Kit Delivery Services Market Size, Share & Trends Report]()

Meal Kit Delivery Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Offering (Heat & Eat, Cook & Eat), By Service (Single, Multiple), By Platform (Online, Offline), By Meal Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-224-2

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Meal Kit Delivery Services Market Summary

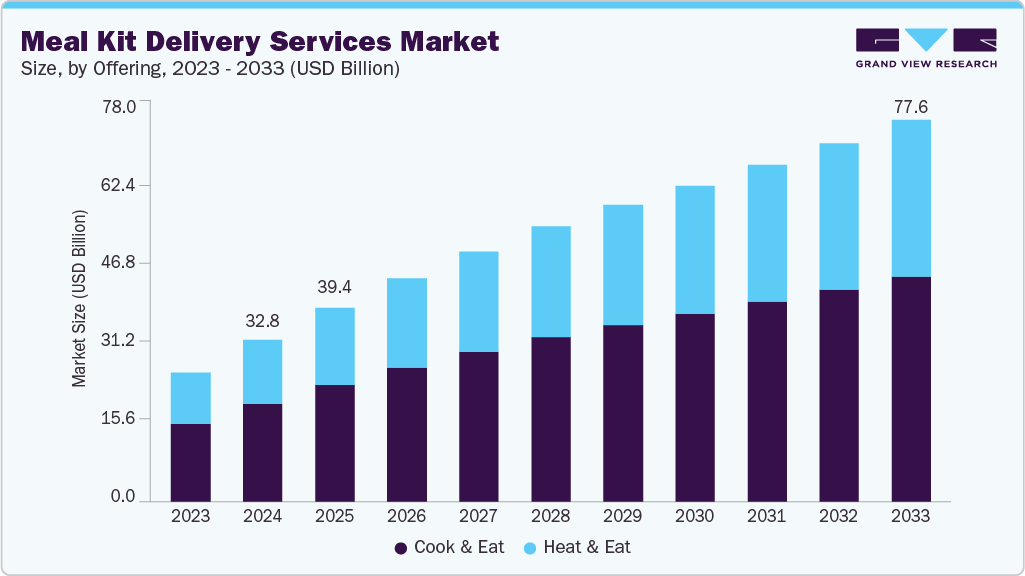

The global meal kit delivery services market size was estimated at USD 32.8 billion in 2024 and is projected to reach USD 77.6 billion by 2033, growing at a CAGR of 8.8% from 2025 to 2033. Increasing preference for home-cooked and chef-cooked food among millennials is a major factor contributing to market growth.

Key Market Trends & Insights

- North America held the largest share of the meal kit delivery services market in 2024, accounting for 45.54%.

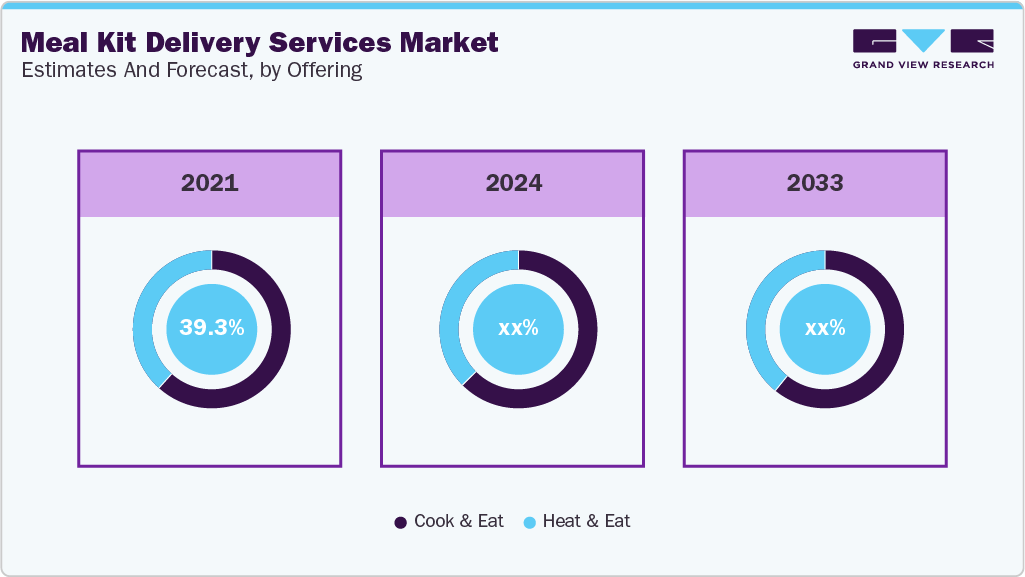

- By offering, cook & eat meal kit delivery service held a larger market share of 60.3% in 2024.

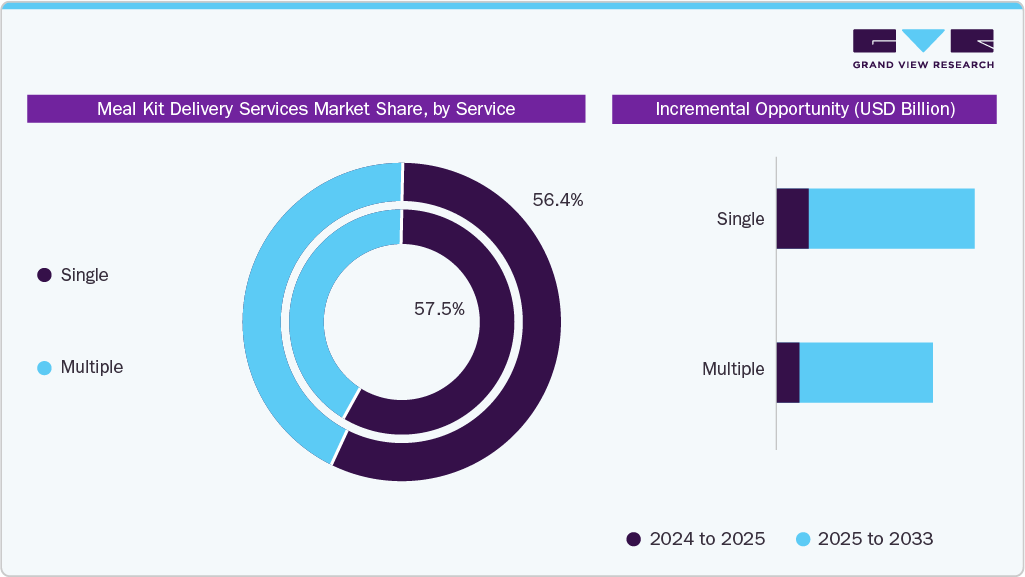

- By service, the single delivery service contributed a share of 57.5% of the global revenue in 2024.

- By platform, the online segment accounted for a share of 62.8% of the global revenue in 2024.

- By meal type, non-vegetarian held the largest market share of 63.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 32.8 Billion

- 2033 Projected Market Size: USD 77.6 Billion

- CAGR (2025-2033): 8.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The market is primarily driven by the increasing consumer preference for convenient yet healthy meal options. Busy lifestyles, long working hours, and urbanization have made consumers seek time-saving food solutions that do not compromise nutrition or taste. Meal kits offer pre-portioned, ready-to-cook ingredients that minimize food waste while ensuring balanced, home-cooked meals. In addition, the growing awareness of healthy eating habits, coupled with rising disposable incomes, encourages consumers to explore diverse cuisines and dietary options, including vegan, keto, and gluten-free kits. According to the Organization for Economic Co-operation and Development (OECD), real household income per capita across OECD countries increased by 1.8% in 2024, showing a marginal improvement compared to the 1.7% growth recorded in 2023. Moreover, the growing focus on portion control, ingredient transparency, and the desire for restaurant-quality culinary experiences at home is further boosting the demand for meal kit delivery services.The rise of digital platforms and subscription-based business models has made it easier for consumers to customize and manage their meal plans based on preferences and dietary goals. Rising internet penetration and smartphone usage further accelerate online meal kit purchases globally. According to the Press Information Bureau (PIB), the total number of internet subscribers increased from 88.1 crore in March 2023 to 95.4 crore in March 2024, reflecting an annual growth rate of 8.3%. This surge represents an addition of 7.3 crore new internet users within a year, highlighting the rapid expansion of digital connectivity across the country. The integration of advanced technologies such as AI and data analytics enables companies to offer personalized meal recommendations, flexible delivery schedules, and dynamic pricing options.

Moreover, the convenience of mobile apps and online payment systems has simplified the ordering process, enhancing user engagement and retention. Social media marketing, influencer collaborations, and interactive cooking content also play a major role in expanding the customer base. In addition, the growing adoption of e-commerce platforms in emerging markets is widening accessibility, making meal kit delivery services available to a broader audience. The rising demand for convenient, time-saving, and nutritious meal solutions is a key factor boosting product demand. The growing urban population, higher disposable incomes, and increasing number of working individuals are further fueling the preference for ready-to-consume or easy-to-prepare food options. In addition, the growing trend of single-person households and the increasing adoption of subscription-based food services further enhance product demand. For instance, in 2024, Blue Apron launched its “Heat & Eat” ready-meal range to cater to busy, on-the-go consumers seeking quick yet wholesome meal alternatives, reflecting the industry’s shift toward accessible, healthy, and chef-crafted dining experiences at home.

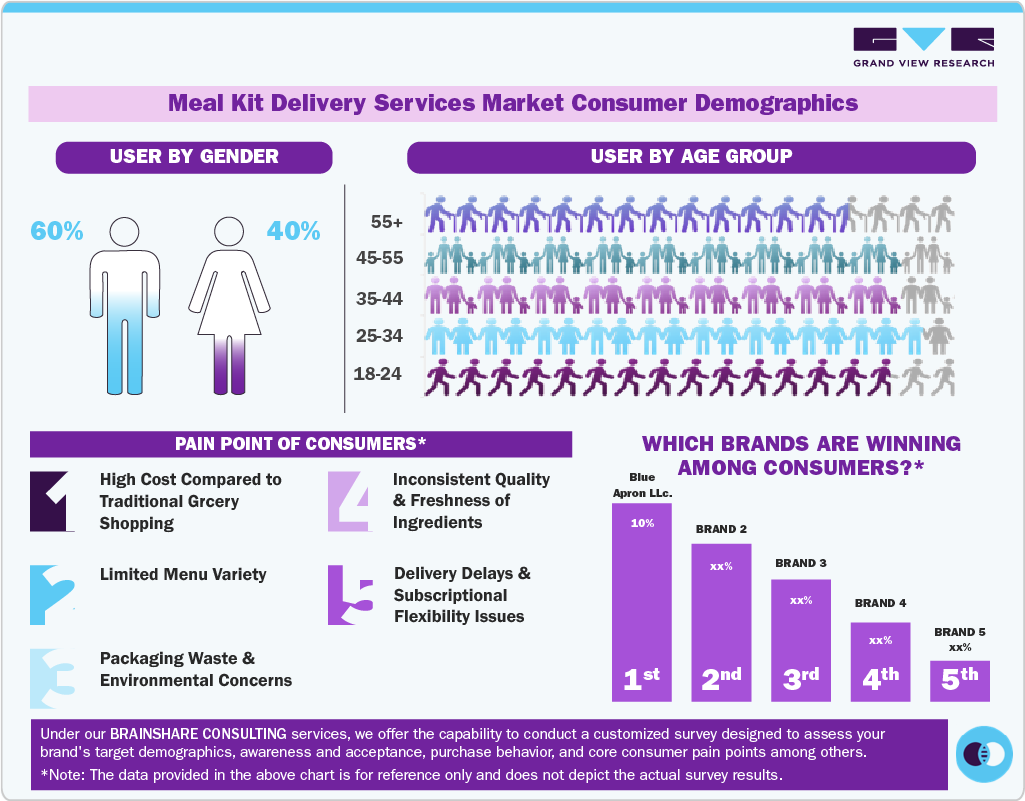

Consumer Insights for Meal Kit Delivery Services

Consumers of meal kit delivery services are increasingly seeking convenient, time-saving, and healthy meal solutions that fit busy lifestyles. They value fresh, high-quality ingredients, portion control, and recipe variety without the hassle of grocery shopping or meal planning. Health-conscious consumers prefer options catering to specific diets such as vegan, keto, or gluten-free. Younger demographics, particularly millennials and Gen Z, drive demand through online subscriptions and mobile apps. In addition, sustainability, eco-friendly packaging, and transparency in ingredient sourcing influence purchasing decisions, while affordability and flexible subscription options enhance retention and attract a broader customer base across global markets.

Offering Insights

The cook & eat market accounted for the largest share of 60.3% of the revenue in 2024. Cook & eat meal kits provide pre-portioned, fresh ingredients along with step-by-step recipes, allowing consumers to prepare home-cooked meals without the hassle of meal planning or grocery shopping. Rising health consciousness, interest in culinary exploration, and demand for freshly prepared, preservative-free meals are major factors boosting product demand. In addition, these kits appeal to busy professionals and families seeking balanced nutrition and restaurant-quality food that can be easily prepared at home.

The heat & eat market is projected to grow at the fastest CAGR of 9.2% from 2025 to 2033. The heat & eat segment includes fully or partially cooked, ready-to-eat meals that require minimal preparation, typically just heating before consumption. The rapid growth is driven by the increasing demand for convenient, time-saving, and nutritious meal solutions among busy professionals and urban households. Furthermore, rising consumer preference for healthy, preservative-free, and freshly prepared meals with longer shelf life is fueling segment expansion. Brands are innovating by offering high-quality, chef-crafted heat-and-eat meal options made from natural ingredients to attract a larger consumer base. For instance, in 2023, Home Chef introduced Tempo, a heat-and-eat meal delivery service offering subscription-based, single-serve microwaveable meals designed to provide convenient and nutritious options for busy consumers.

Service Insights

The single delivery service segment accounted for the largest share of 57.5% of global revenue in 2024, driven by its affordability, flexibility, and suitability for modern consumer lifestyles. These services allow customers to purchase meal kits on demand without long-term commitments, appealing to individuals seeking convenience without subscription obligations. The model also attracts first-time users and occasional buyers who enjoy experimenting with different meal options.

The multiple delivery service segment is expected to register faster growth during the forecast period, with a CAGR of 9.1% from 2025 to 2033. Increasing consumer preference for convenience, consistency, and subscription-based meal solutions is fueling product demand. These services enable customers to receive weekly or monthly meal kits tailored to their dietary needs and taste preferences, eliminating the need for frequent reordering. The model promotes better meal planning, cost savings, and reduced food waste through portion-controlled ingredients. Furthermore, rising digital adoption, flexible subscription options, and the integration of AI-driven personalization are enhancing the overall user experience.

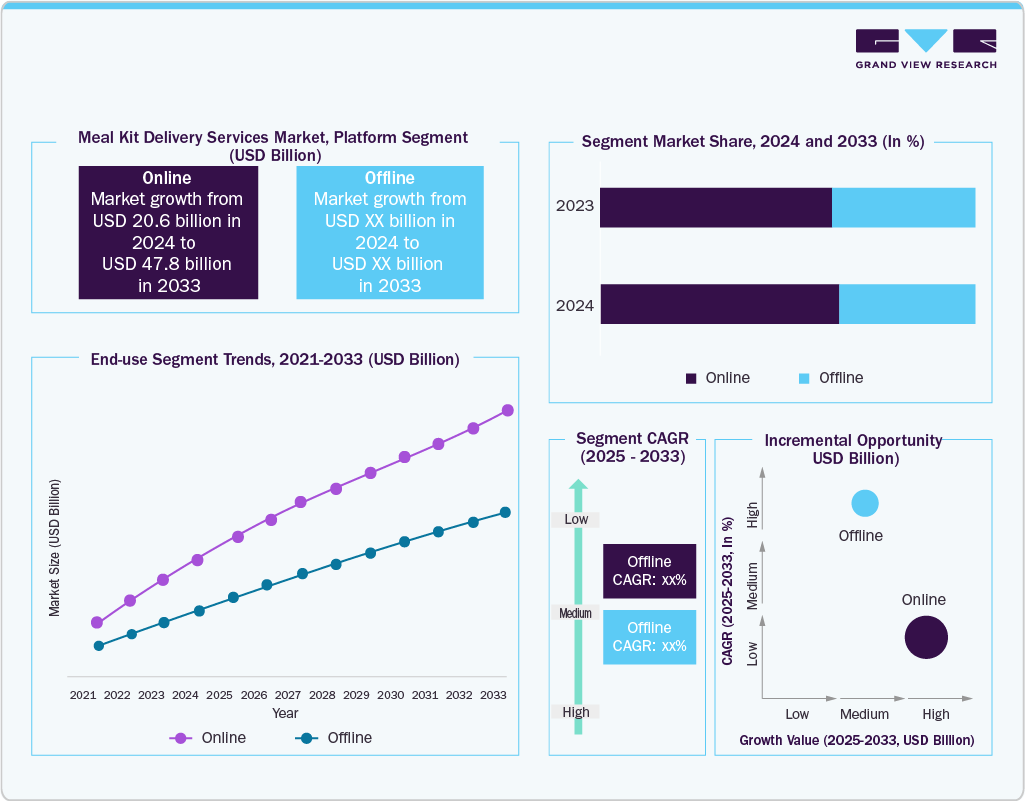

Platform Insights

The online platform accounted for the highest share of 62.8% of the global revenue in 2024, driven by the growing popularity of e-commerce, digital payments, and mobile app-based food delivery services. Consumers increasingly prefer online channels for their convenience, wide product selection, and personalized recommendations. The ability to compare meal options, access subscription discounts, and track deliveries in real time has further enhanced user engagement. In addition, rising internet penetration, increasing smartphone adoption, and improved logistics infrastructure have expanded accessibility, particularly among urban and tech-savvy consumers, thereby solidifying the dominance of online platforms in the market.

The offline distribution channel in the market is projected to grow steadily at a CAGR of 9.2% from 2025 to 2033, driven by the increasing availability of meal kits in supermarkets, hypermarkets, and specialty grocery stores. Many consumers prefer purchasing meal kits in person to evaluate freshness, quality, and portion sizes before buying. In addition, impulse buying behavior and the expanding retail presence in urban areas, particularly in developing countries such as India, Brazil, Vietnam, and Thailand, are further fueling offline channel growth.

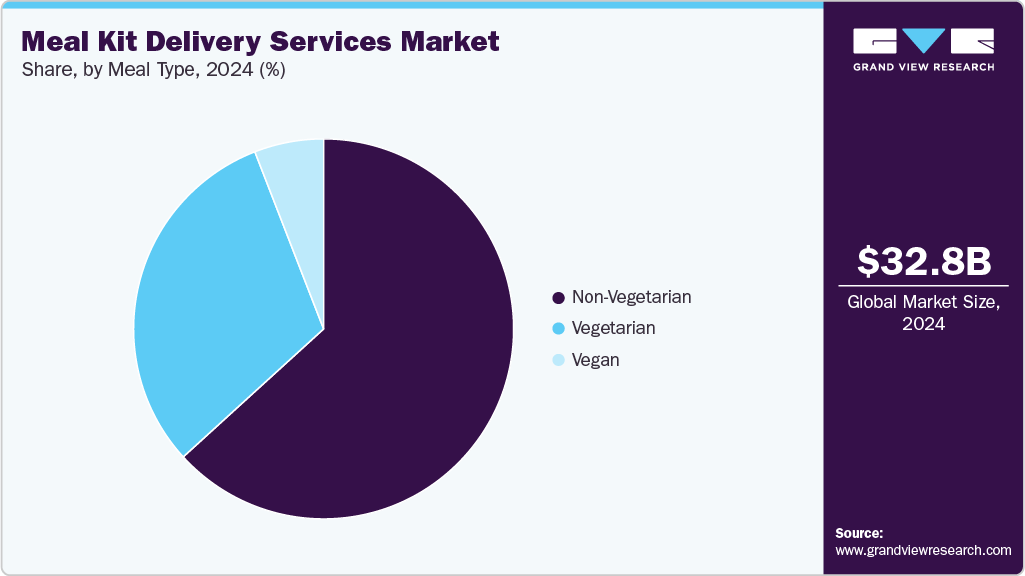

Meal Type Insights

The non-vegetarian meal kit delivery service segment held the largest market share of 63.3% in 2024, driven by the high global consumption of animal-based protein and growing demand for diverse, protein-rich meal options. Consumers increasingly prefer non-vegetarian meal kits featuring chicken, seafood, and red meat for their nutritional value and variety. Moreover, the rising popularity of gourmet-style recipes and global cuisines, combined with improved cold-chain logistics ensuring meat freshness, further boosts the segment's growth.

The vegetarian meal kits segment is expected to grow at a CAGR of 9.0% from 2025 to 2033. The increase in plant-based diets and surging awareness of the health and environmental benefits of reducing meat consumption drive product demand. Growing vegan and flexitarian populations, particularly in North America and Europe, are boosting demand for vegetarian meal kits that offer balanced nutrition and diverse flavor profiles. Furthermore, innovation in plant-based protein alternatives and expanding product availability through online and retail channels are fueling the segment’s steady global growth.

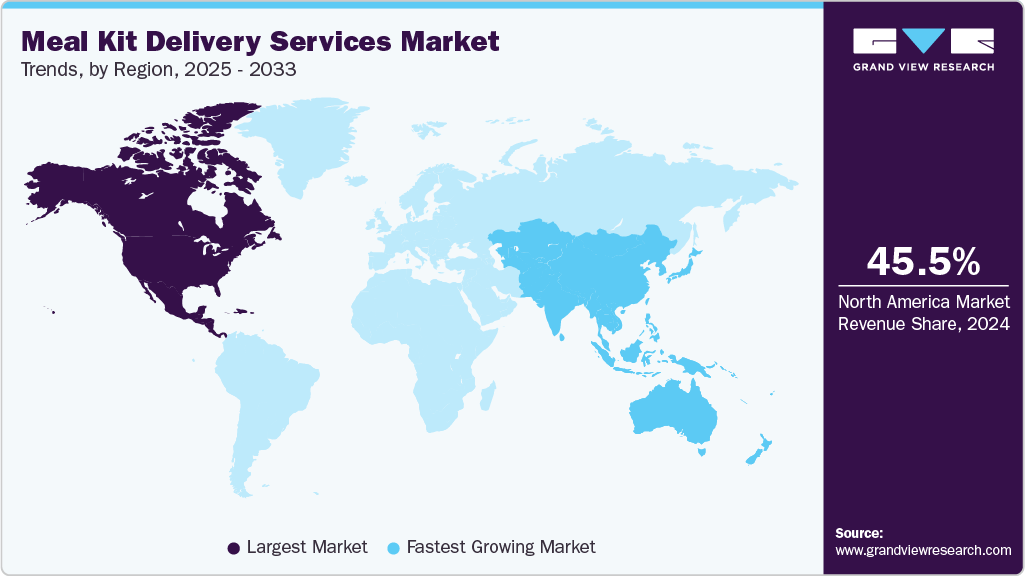

Regional Insights

North America accounted for the largest market share of 45.54% in 2024, driven by high consumer awareness, strong purchasing power, and a growing preference for convenient, healthy, and time-efficient meal solutions. The region’s well-established e-commerce infrastructure and widespread adoption of subscription-based services further support market growth. Increasing health consciousness and the popularity of personalized, diet-specific meal options, such as keto, vegan, and low-carb kits, have strengthened consumer engagement. Furthermore, busy lifestyles, dual-income households, and the increasing number of working professionals are fueling the demand for quick yet nutritious meal options. Rising focus on sustainable packaging, organic ingredients, and restaurant-quality home dining experiences is also enhancing consumer appeal.

U.S. Meal Kit Delivery Services Market Trends

The meal kit delivery services market in the U.S. remains the largest in North America, accounting for 86.0% of the region’s total revenue in 2024. Strong consumer purchasing power, busy lifestyles, and a growing preference for convenient yet healthy food solutions drive the market growth. High adoption of subscription-based meal services, increasing launches of new meal kit offerings, rising awareness of balanced nutrition, and robust digital infrastructure further support market expansion. For instance, in April 2025, Goldbelly launched the “Yes, Chef!” meal kit in collaboration with Martha Stewart and José Andrés. The kit includes ingredients for chef-designed dishes such as Chicken Paella Valenciana and Salted Caramel Chocolate Cake..

Europe Meal Kit Delivery Services Market Trends

The meal kit delivery services market in Europe held a significant market share of 24.49% in the global market. Rising awareness of balanced nutrition and reduced food waste encourages the adoption of meal kits across major economies such as the UK, Germany, and France. Moreover, the increasing popularity of flexitarian and plant-based diets, coupled with strong digital penetration and expanding e-commerce platforms, supports market growth. In addition, growing consumer preference for sustainable packaging, locally sourced ingredients, and premium-quality meal kits tailored to regional tastes further fuels market expansion across the region.

Germany meal kit delivery services market accounted for the largest market share of 19.8% in Europe in 2024, supported by the country’s evolving food culture, high internet penetration, and strong preference for healthy meals. Consumers in Germany are increasingly opting for meal kits that offer convenience without compromising on freshness, quality, or sustainability. The growing trend of remote work and dual-income households has further increased demand for quick, balanced meal options. Moreover, an increasing focus on reducing food waste and supporting local sourcing has made meal kits an attractive solution.

Asia Pacific Meal Kit Delivery Services Market Trends

The meal kit delivery services market in the Asia Pacific is projected to grow at the fastest CAGR of 10.1% from 2025 to 2033, driven by rapid urbanization, rising disposable incomes, and shifting dietary habits in countries such as China, Japan, South Korea, and India. Busy urban lifestyles and an increasing preference for convenient, healthy, and home-cooked meals are fueling demand. The growing influence of Western food trends, expansion of e-commerce platforms, and availability of regionally customized meal kits further support market growth.

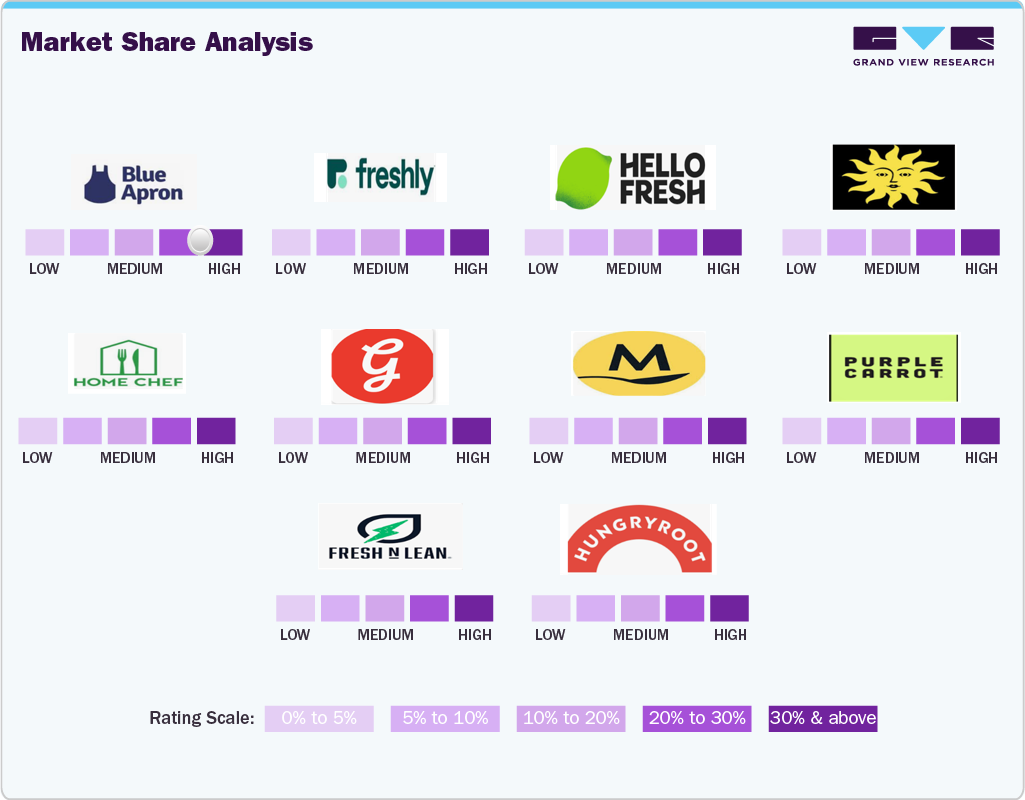

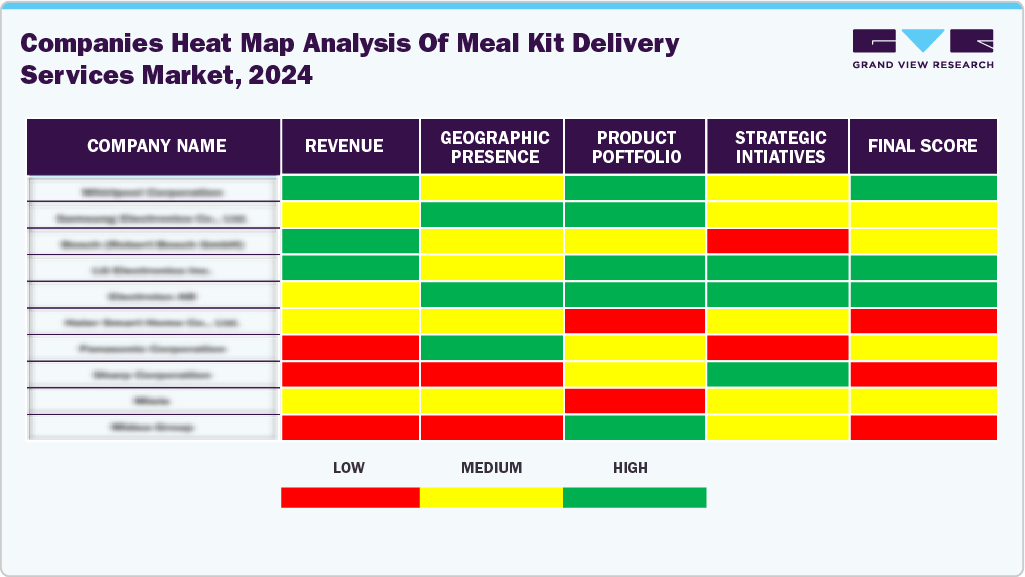

Key Meal Kit Delivery Services Company Insights

Numerous leading brands in the market have recognized significant opportunities within their product portfolios and are actively working to capitalize on these gaps. These companies are focusing on launching innovative designs, expanding customization options, and tailoring their marketing strategies to better align with evolving consumer preferences and cultural trends. By addressing niche segments and emerging consumer demands, these brands aim to increase their market share and strengthen their competitive positioning on a global scale.

Key Meal Kit Delivery Services Companies:

The following are the leading companies in the meal kit delivery services market. These companies collectively hold the largest market share and dictate industry trends.

- Blue Apron, LLC

- Freshly Inc.

- HelloFresh

- Sun Basket

- Relish Labs LLC (Home Chef)

- Gobble

- Marley Spoon Inc.

- Purple Carrot

- Fresh n' Lean

- Hungryroot

Recent Developments

-

In July 2025, Xoom Foods,a U.S.-based company, launched a heat-and-eat meal subscription service that delivers fully cooked meals to consumers across the U.S. The service aims to provide restaurant-quality, ready-to-eat dishes within minutes, catering to the growing demand for convenient yet nutritious meal options.

-

In August 2025, LT Foods, an India-based company, launched the DAAWAT Thai Green Curry Rice Kit, a new “cook and eat” product. The kit combines jasmine rice with pre-mixed coconut milk and spices and contains no artificial colors or preservatives.

Meal Kit Delivery Services Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 39.4 billion

Revenue forecast in 2033

USD 77.6 billion

Growth rate (Revenue)

CAGR of 8.8% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, service, platform, meal type, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Blue Apron, LLC; Freshly Inc.; HelloFresh; Sun Basket; Relish Labs LLC (Home Chef); Gobble; Marley Spoon Inc.; Purple Carrot; Fresh n' Lean; Hungryroot

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Meal Kit Delivery Services Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the meal kit delivery services market report based on offering, service, platform, meal type, and region:

-

Offering Outlook (Revenue, USD Million, 2021 - 2033)

-

Heat & Eat

-

Cook & Eat

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Single

-

Multiple

-

-

Platform Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

Offline

-

-

Meal Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Vegan

-

Vegetarian

-

Non-Vegetarian

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global meal kit delivery services market size was estimated at USD 32.8 billion in 2024 and is expected to reach USD 77.6 billion in 2033.

b. The global meal kit delivery services market is expected to grow at a compound annual growth rate of 8.8% from 2025 to 2033 to reach USD 77.6 billion by 2033.

b. The single delivery service segment accounted for the largest share of 57.5% of global revenue in 2024.

b. The online platform accounted for the largest share of more than 62.8% in 2024, in the global meal kit delivery services market.

b. North America held the largest share of 45.5% in the meal kit delivery services market in 2024.

b. The meal kit delivery services market in the U.K. was valued at USD 1.4 billion in 2024 and is expected to grow at a CAGR of nearly 9.4% during the forecast period to reach a market valuation of nearly USD 3.5 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.